The study involved four major activities in estimating the arc-based plasma lighting market size. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the arc-based plasma lighting market. The secondary sources included the Global Lighting Association, American Lighting Association (ALA), Illuminating Engineering Society (IES), The International Commission on Illumination (CIE), National Electrical Manufacturers Association (NEMA), annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the arc-based plasma lighting market has been obtained from the secondary data available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry's supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends and key developments undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information about the market across four main regions-Asia Pacific, North America, Europe, and the Rest of the World (the Middle East & Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and other related key executives from major companies and organizations operating in the arc-based plasma lighting market or related markets.

After completing market engineering, primary research was conducted to gather information and verify and validate critical numbers from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most primary interviews have been conducted with the market's supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

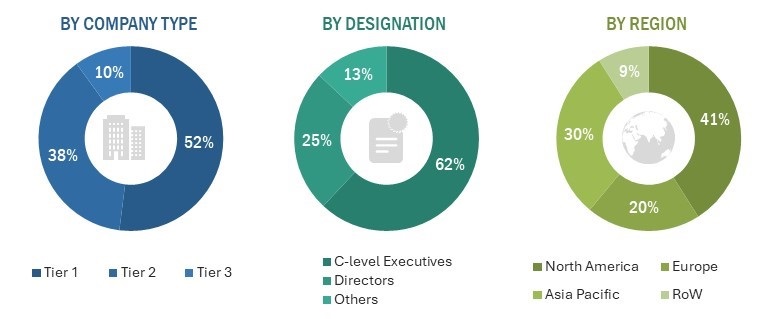

The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches and several data triangulation methods have been used to estimate and validate the size of the overall arc-based plasma lighting market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market positions in the respective geographies have been determined through both primary and secondary research. This entire procedure includes studying top market players’ annual and financial reports and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights (qualitative and quantitative).

All percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

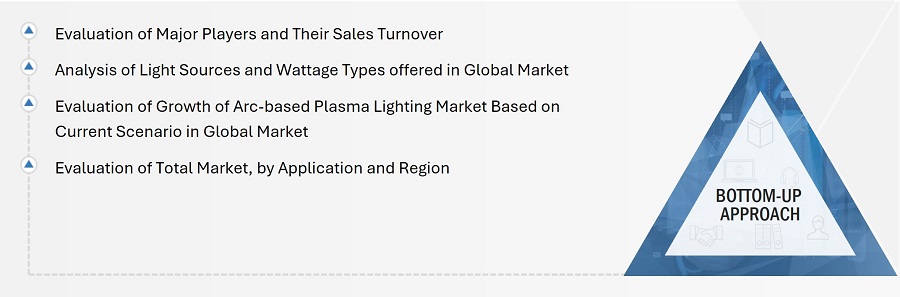

Global Arc-based plasma lighting Market Size: Bottom-Up Approach

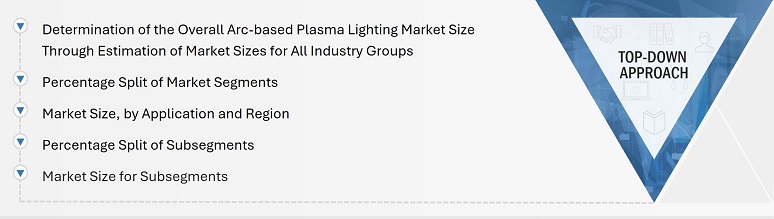

Global Arc-based plasma lighting Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. Data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Arc-based plasma lighting is a lighting technology that operates by creating a high-intensity electric arc within a sealed quartz bulb or other transparent enclosure filled with a noble gas or a mixture of gases. This arc generates a plasma, which is a highly ionized gas consisting of charged particles such as ions and free electrons. The plasma emits light across a broad spectrum, ranging from ultraviolet (UV) to visible and infrared (IR) wavelengths, depending on the specific gas mixture and operating conditions. The arc is typically initiated and maintained by an electrical discharge between two electrodes, which may be made of tungsten, molybdenum, or other refractory materials. As the arc current passes through the gas, it ionizes the gas molecules, causing them to emit photons of light. This process produces an intense and uniform illumination characterized by high brightness and excellent color rendering properties.

Key Stakeholders

-

Raw material suppliers

-

Research organizations

-

Original equipment manufacturers (OEMs)

-

Technology investors

-

Analysts and strategic business planners

-

Government bodies, venture capitalists, and private equity firms

-

End users

Report Objectives

-

To define and forecast the arc-based plasma lighting market based on light source, wattage type, and application, in terms of value

-

To forecast the market size of various segments with respect to four main regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

-

To understand and analyze the impact of evolving technologies on the arc-based plasma lighting value chain and upcoming trends in the ecosystem

-

To highlight the impact of Porter’s five forces on the arc-based plasma lighting ecosystem and analyze the underlying market opportunities

-

To analyze the associated use cases in the arc-based plasma lighting business and their impact on the business strategies adopted by key players

-

To provide key industry trends and associated important regulations impacting the global market

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

-

To strategically profile key players and comprehensively analyze their market share and core competencies, along with detailing the competitive landscape for market leaders

-

To analyze competitive developments such as agreements, partnerships, acquisitions, and product launches in the arc-based plasma lighting market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5 players) based on various blocks of the supply chain

Growth opportunities and latent adjacency in Arc-based Plasma Lighting Market