The research encompassed various vital activities to determine the current market size of the Attack Surface Management market. Extensive secondary research was conducted to gather information on the industry. Subsequently, primary research involving industry experts across the value chain validated these findings, assumptions, and estimations. The total market size was estimated using different methodologies, including top-down and bottom-up approaches. Following this, market segmentation and data triangulation techniques were applied to ascertain the size of individual segments and subsegments within the Attack Surface management market.

Secondary Research

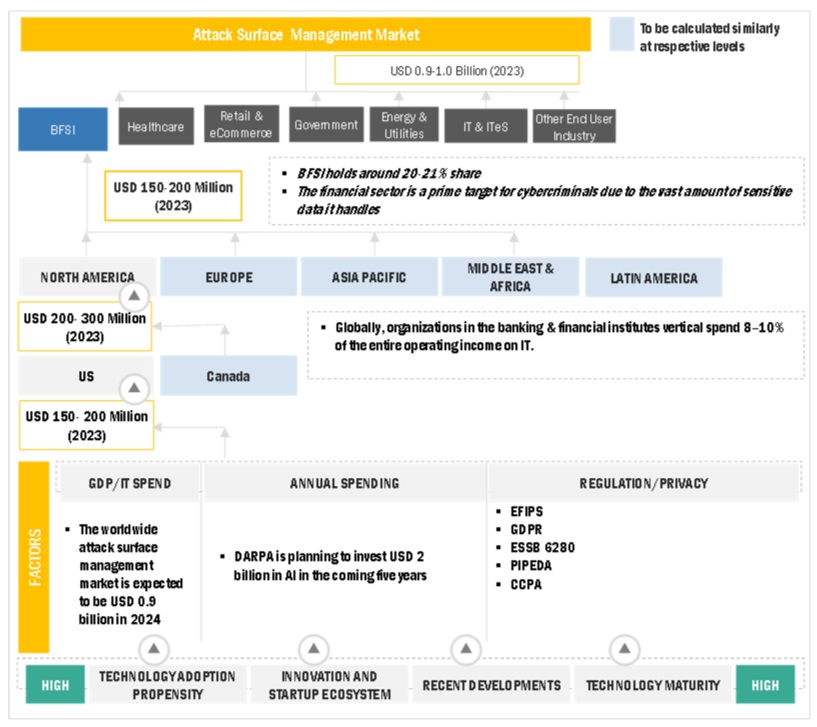

During the secondary research phase, various sources were consulted to identify and gather pertinent information for the study. These secondary sources encompassed annual reports, press releases, investor presentations from Attack surface management software and service vendors, online forums, accredited publications, and white papers. This secondary research served as a foundation for acquiring crucial insights into the industry's supply chain, key players, market categorization, segmentation based on prevailing trends down to granular levels, regional markets, and noteworthy developments from both market and technological perspectives. These findings were subsequently corroborated and validated through primary sources. Factors considered in estimating regional market sizes included governmental and technological initiatives, Gross Domestic Product (GDP) growth rates, Information and Communication Technology (ICT) expenditure, recent market

developments, and a comprehensive analysis of significant Attack Surface Management solution providers' market standings.

Primary Research

The comprehensive market engineering process employed a combination of top-down and bottom-up approaches, complemented by various data triangulation methods, to accurately estimate and forecast market trends for overall market segments and subsegments outlined in the report. The report systematically compiled and presented vital insights and information through meticulous qualitative and quantitative analyses conducted throughout the market engineering process.

After completing the market engineering process, which encompassed calculations for market statistics, segmentation breakdowns, market size estimations, forecasts, and data triangulation, thorough primary research was undertaken. This primary research gathered, verified, and validated critical numerical data and identified segmentation types, industry trends, and the competitive landscape within the Attack Surface Management market. Moreover, primary research was instrumental in elucidating fundamental market dynamics, including drivers, restraints, opportunities, challenges, industry trends, and strategic initiatives market players adopt.

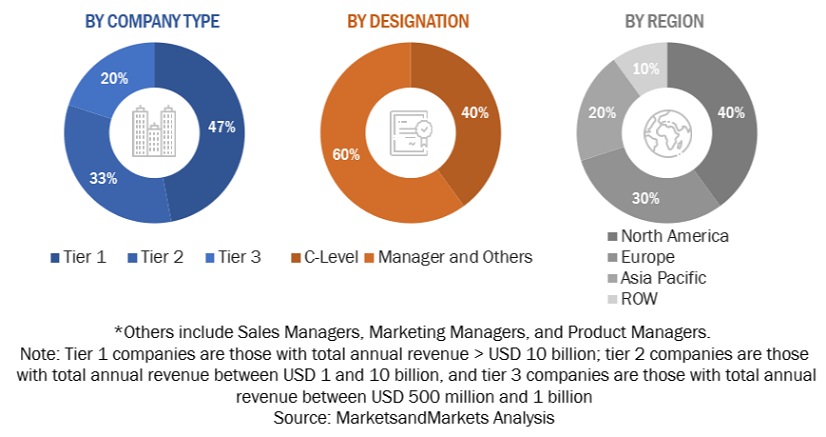

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

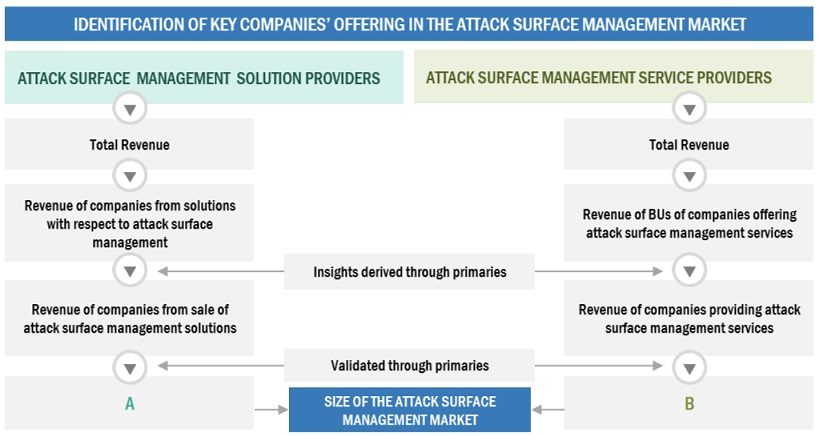

Both top-down and bottom-up approaches were employed to accurately estimate and validate the size of the global Attack Surface Management market and determine the sizes of various dependent subsegments within the overarching Attack Surface Management market. The research methodology utilized for estimating market size involved several key steps: Initially, the identification of key players in the market was conducted through comprehensive secondary research. Subsequently, their revenue contributions within respective regions were assessed through a combination of primary and secondary research methods. This process entailed thoroughly examining leading market players' annual and financial reports, supplemented by extensive interviews with industry leaders, including CEOs, VPs, directors, and marketing executives, to gain valuable insights. All percentage splits and segment breakdowns were derived from secondary sources and cross-validated through primary sources to ensure accuracy and reliability.

To know about the assumptions considered for the study, Request for Free Sample Report

Infographic Depicting Bottom-Up And Top-Down Approaches

Data Triangulation

Following the determination of the overall market size using the market above size estimation methodologies, the market

was segmented into distinct segments and subsegments. Data triangulation and market segmentation procedures were utilized, as needed, to complete the comprehensive market engineering process and ascertain the precise statistics for each market segment and subsegment. Data triangulation was achieved by analyzing various factors and trends from both the demand and supply sides.

Market Definition

Attack Surface Management (ASM) is the continuous monitoring, remediation, and reduction of all security risks within an organization's attack surface. The ultimate objective of ASM is to keep the attack surface minimal to reduce the number of options hackers have to breach a network perimeter.

According to Palo Alto Networks, Attack Surface Management (ASM) continuously identifies, monitors, and manages all internal and external internet-connected assets for potential attack vectors and exposures.

Report Objectives

-

To define, describe, and forecast the Attack Surface Management market based on offering, organization size, deployment mode, vertical, and region.

-

To forecast the market size of five central regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America.

-

To analyze the market subsegments concerning individual growth trends, prospects, and contributions to the overall market.

-

To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the attack surface management market.

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the attack surface management market.

-

To profile the key players of the attack surface management market and comprehensively analyze their market size and core competencies.

-

Track and analyze competitive developments, such as new product launches, mergers and acquisitions, partnerships, agreements, and collaborations in the global attack surface management market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

-

Further breakup of the Asia Pacific market into significant countries.

-

Further breakup of the North American market into significant countries.

-

Further breakup of the Latin American market into significant countries.

-

Further breakup of the Middle East African market into significant countries

-

Further breakup of the European market into major countries.

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Attack Surface Management Market