The study involved four major activities in estimating the current size of the autonomous driving software market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, International Organization of Motor Vehicle Manufacturers (OICA), National Highway Traffic Safety Administration (NHTSA), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global autonomous driving software market.

Primary Research

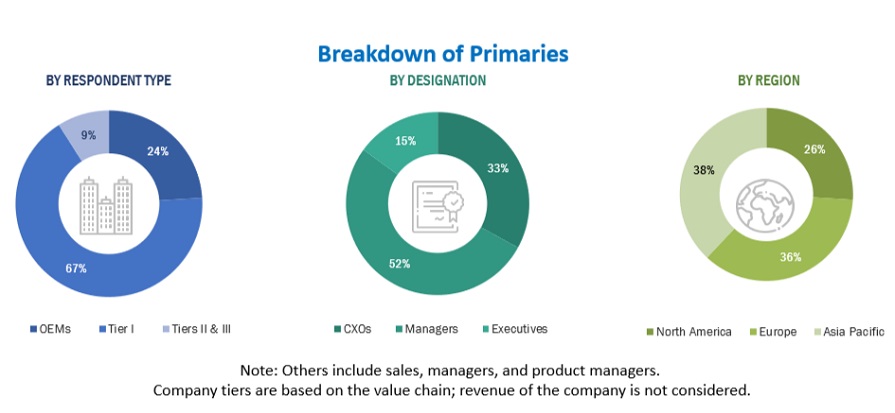

Extensive primary research was conducted after understanding the scenario of the autonomous driving software market through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs) and supply (hardware providers, software providers, autonomous driving platform/OS providers, and other component manufacturers) across three major regions: North America, Europe and Asia Pacific. Approximately 52% and 48% of primary interviews were conducted from the demand and supply sides. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in this report. After interacting with industry experts, brief sessions with highly experienced independent consultants were also conducted to reinforce the findings from primaries. This and the in-house subject-matter experts’ opinions led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the autonomous driving software market. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and markets have been identified through extensive secondary research.

-

The industry’s supply chain and market size, in terms of volume, have been determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Validation

The top-down approach was used to determine the size of the autonomous driving software market for the propulsion segment. The market size breakdown by propulsion type in value (USD million) was derived using the top-down approach. For instance, the autonomous driving software market for the propulsion segment was derived using the top-down approach to estimate its subsegments. Mapping was carried out at the regional level to understand the contribution by propulsion type. The market size was derived at the regional level in terms of value.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Autonomous driving software is a set of computer programs and algorithms that allow a vehicle to operate autonomously, without the intervention of a human driver. This program observes, determines, and controls the vehicle's path by utilizing environmental data from sensors, cameras, and other sources. These technologies allow a vehicle to recognize things, determine pathways, and manage motion while moving on a roadway, avoiding impediments and obeying traffic laws safely and efficiently.

List of Key Stakeholders

-

ADAS Integrators

-

ADAS Solution Suppliers

-

Associations, forums, and alliances related to autonomous vehicles

-

Automotive Component Manufacturers

-

Automotive sensor manufacturers

-

Automotive SoC and ECU Manufacturers

-

Automotive Software and Platform Providers

-

Autonomous Driving Platform Providers

-

Autonomous vehicle manufacturers

-

Connectivity Service Providers

-

Country-specific Automotive Associations

-

Designing & Testing Companies

-

European Automobile Manufacturers’ Association (ACEA)

-

National Highway Traffic Safety Administration (NHTSA)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

-

Autonomous driving software market, by Software Subscription, at regional level

-

Autonomous driving software market, by Propulsion, at country level

-

Profiling of additional market players (up to 3)

Growth opportunities and latent adjacency in Autonomous Driving Software Market