This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

Existing sources were extensively used to gather information for this market study, including business publications, directories, and databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers). Reports such as white papers, annual reports, investor presentations, and company SEC filings were also examined, along with publications from government organizations [such as the National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), and the Global Burden of Disease Study]. This method allowed for the finding and gathering of crucial data. Important details about leading companies, the market's specific organization according to industry developments and significant changes in the market and technology were also learned from these sources. Furthermore, using secondary research made it possible to put together a list of the main companies in the industry.

Primary Research

For the primary research process, interviews were conducted with various people involved in both the supply and demand sides to gather different kinds of qualitative and quantitative information for this report. The main people interviewed on the supply side included experts in the field, such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other important leaders from key companies and organizations in the Brazil advanced wound dressings market. On the demand side, the main people interviewed included those from pharmaceutical companies, biotechnology companies, contract research organizations (CROs), pharmacies, medical device companies, and academic researchers and universities. This initial research was done to confirm how the market is divided, find out who the main companies in the market are, and get a better understanding of the important trends and forces that drive this market.

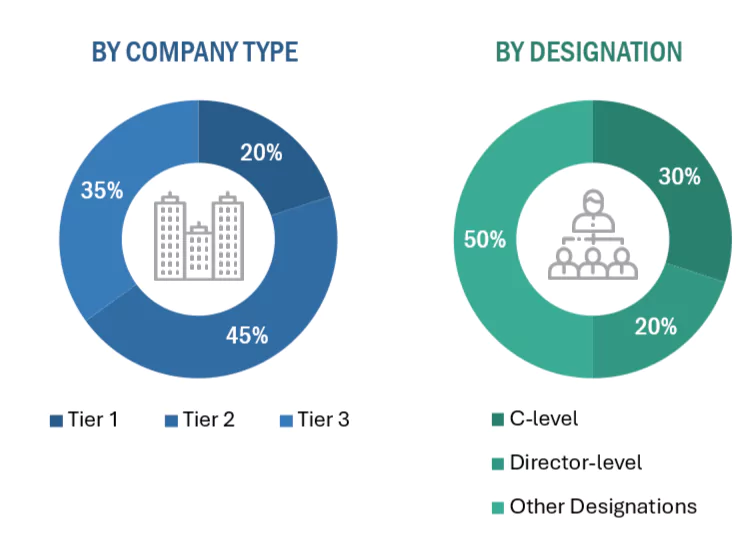

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To determine the total value of the Brazil advanced wound dressings market, yearly earnings were calculated by looking at the revenue of the main companies that make and sell these products in Brazil. All the important service providers in the country were identified. The major companies' revenue was tracked for the different types of products they offer. The Brazilian market was also broken down into different parts based on:

-

A list of the main companies selling these products in Brazil.

-

Providers in Brazil offer product mapping of advanced wound dressings.

-

The major listed companies make yearly income from advanced wound dressings (or the closest related business area).

-

Using the revenue of these major companies to estimate the total market value for each product type.

-

Adding up the market value of all these different product types to get the total value of the advanced wound dressings market in Brazil.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom-up approach and Top-down approach)

Data Triangulation

After arriving at the overall size of the Brazil advanced wound dressings market through the methodology mentioned above, this market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Advanced wound dressings utilize foam dressings, hydrocolloid dressings, film dressings, and alginate dressings to facilitate the rapid healing and management of chronic ulcers, diabetic foot ulcers, burns, traumatic wounds, and surgical wounds. The adoption of advanced wound care provides early and smooth healing and efficient treatment to end users.

Stakeholders

-

Manufacturers & distributors of advanced wound dressings

-

Hospitals & clinics

-

Ambulatory surgery centers (ASCs)

-

Research & development companies

-

Clinical research organizations

-

Research laboratories and academic institutes

-

Brazil advanced wound dressing service providers

-

Government associations

-

Venture capitalists & investors

Report Objectives

-

To provide a clear definition and description of the Brazil advanced wound dressings market, categorizing it by product, wound type, and end user and forecasting its future growth

-

To offer comprehensive details about the primary factors influencing the market's growth trajectory, such as growth drivers, limitations, opportunities, and prevailing trends

-

To look at the market opportunities for those involved and provide details about how the main companies compete

-

To create profiles of the key companies and carefully analyze what products they offer, where they stand in the market, and what their main strengths are

-

To compare the companies in this market using a special framework that looks at different aspects of their business and how good their products are

Growth opportunities and latent adjacency in Brazil Advanced Wound Dressings Market