The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, restraints, challenges, and key player strategies. To track company developments such as acquisitions, product launches, expansions, agreements, and partnerships of the leading players, the competitive landscape of the breathing circuits market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

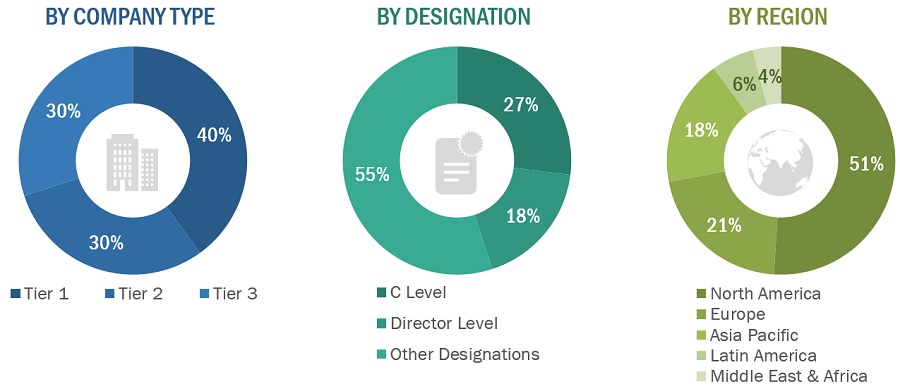

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2022/2023, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME

|

DESIGNATION

|

|

GE Healthcare

|

General Manager

|

|

ICU Medical, Inc.

|

Area Sales Manager

|

Market Size Estimation

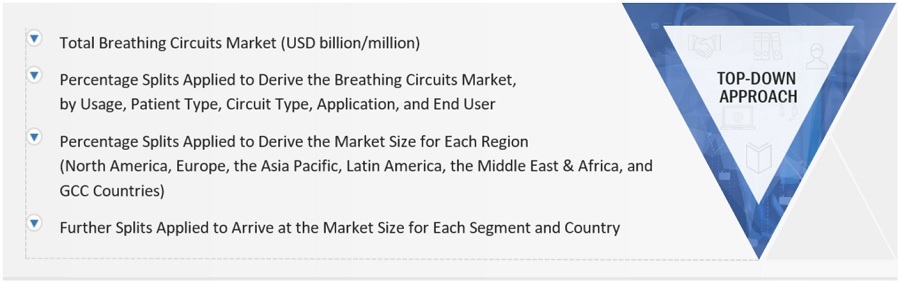

Both top-down and bottom-up approaches were used to estimate and validate the breathing circuits market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry have been identified through extensive secondary research

-

The revenues generated by leading players operating in the breathing circuits market have been determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Breathing Circuits Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Breathing Circuits Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Breathing circuits, also known as respiratory circuits or ventilator circuits, are medical devices used to deliver a mixture of gases, including oxygen and anesthetic agents, to a patient's respiratory system. These circuits play a crucial role in facilitating artificial ventilation, assisting or controlling a patient's breathing, and providing necessary gases during medical procedures or when a patient is unable to breathe adequately on their own.

Key Stakeholders

-

Senior Management

-

End User

-

Finance/Procurement Department

-

R&D Department

Report Objectives

-

To define, describe, segment, and forecast the global breathing circuits market, by usage, patient type, circuit type, application, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall breathing circuits market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To forecast the size of the market segments with respect to six regions, namely, North America, Europe, the Asia Pacific, Middle East & Africa, Latin America, and GCC countries

-

To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

-

To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

-

To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product excellence

Available Customizations

MarketsandMarkets offers the following customizations for this market report.

Country Information

-

Additional country-level analysis of the breathing circuits market

Company profiles

-

Additional five company profiles of players operating in the breathing circuits market.

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the breathing circuits market

Growth opportunities and latent adjacency in Breathing Circuits Market