The study involved major activities in estimating the current size of the canned motor pumps market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments. ndents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information, as well as assess the prospects.

Secondary Research

This research study on the canned motor pumps market involved the use of extensive secondary sources, directories, and databases, such as Hoover's, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the canned motor pumps market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The canned motor pumps market comprises several stakeholders, such as equipment providers, service providers, and technical providers in the supply chain. The rising demand for canned motor pumps of various types, such as standard basic pumps, reverse circulation pumps, high temperature pumps, and self-priming pumps, characterizes this market's demand side. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

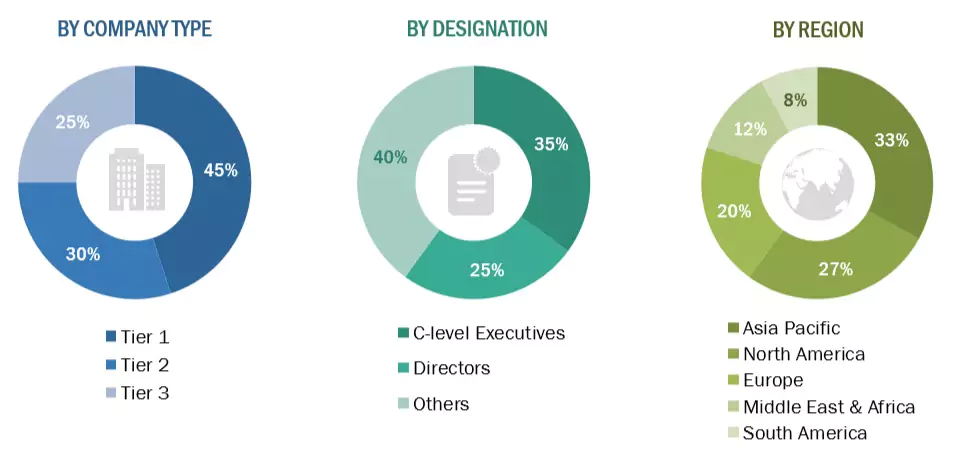

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the canned motor pumps market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following.

Canned Motor Pumps Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A canned motor pump is a type of centrifugal pump in which the pump and a hermetically sealed electric motor are mounted on a single shaft, eliminating the need for mechanical seals or other sealing components. The entire rotating assembly is submerged in the liquid being pumped, while the motor's stator and rotor are protected from the fluid by a corrosion-resistant, non-magnetic liner and sleeve. A portion of the pumped liquid is diverted through the motor to provide cooling and bearing lubrication.

Stakeholders

-

Technology providers

-

Spare parts suppliers & logistics

-

Pump manufacturer associations

-

Oilfield service players

-

Public and private water supply and pumping station operators

-

Government and research organizations

-

Pump raw material providers

-

Consulting companies

-

Industrial users

-

Private or investor-owned utilities

-

State and national regulatory authorities

-

Investors/shareholders

Report Objectives

-

To define, describe, and forecast the canned motor pumps market, based on type, end user, capacity, installation type, motor type, and pump design

-

To provide detailed information on the major factors influencing the growth of the canned motor pumps market (drivers, restraints, opportunities, and industry-specific challenges)

-

To strategically analyze the canned motor pumps market with respect to individual growth trends, prospects, and contribution of each segment to the market

-

To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

-

To forecast the growth of the canned motor pumps market with respect to the major regions (Asia Pacific, Europe, North America, South America, the Middle East, & Africa)

-

To strategically profile key players and comprehensively analyze their market share and core competencies

-

To track and analyze competitive developments, such as new product launches, contracts & agreements, investments & expansions, and mergers & acquisitions, in the canned motor pumps market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

-

Further breakdown of the canned motor pumps market, by country

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Canned Motor Pumps Market