The study involved four major activities in estimating the size of the cellular modem market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Revenues of companies offering cellular modems worldwide have been obtained based on the secondary data accessed through paid and unpaid sources. They have also been derived by analyzing the product portfolios of key companies, rated according to the performance and quality of their products.

In the secondary research process, various secondary sources have been referred to for identifying and collecting information related to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases. Secondary research has been mainly carried out to obtain key information about the supply chain of the cellular modem ecosystem, the value chain of the market, the total pool of the key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both markets- and technology-oriented perspectives.

Primary Research

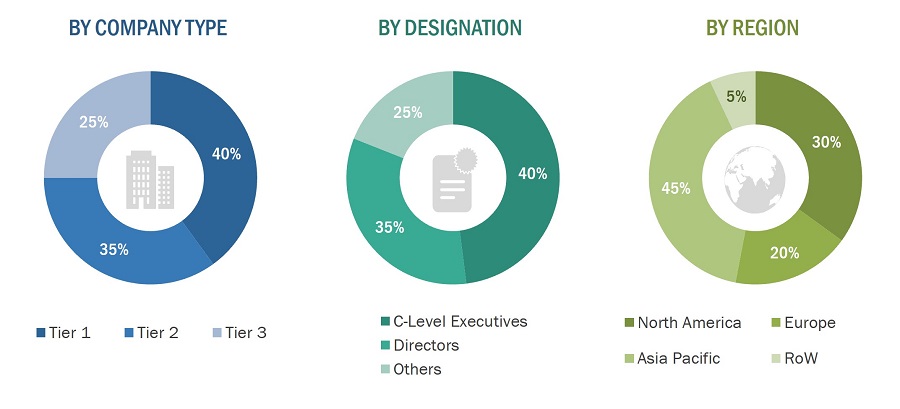

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information important for this report. Primary sources from the supply side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related executives from various key companies and organizations operating in the cellular modem market. After the complete market engineering (including calculations for the market statistics, market breakdown, data triangulation, market estimation, and market forecasting), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained.

Primary research was also conducted to identify the segmentation, industry trends, key players and to analyze the competitive landscape and key market dynamics such as drivers, restraints, opportunities, challenges, and Porter’s five forces analysis, as well as growth strategies adopted by various key market players. Approximately 45% and 55% of primary interviews were conducted for the demand and supply sides.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the cellular modem market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

-

Identifying verticals that are either using or are expected to use cellular modem products and solutions.

-

Tracking leading companies and system integrators operating across various verticals.

-

Deriving the size of the cellular modem market through the data sanity method, analyzing revenues of more than 25 key providers through their annual reports and press releases, and summing them up to estimate the overall market size.

-

Carrying out the market trend analysis to obtain the CAGR of the cellular modem market by understanding the penetration rate and analyzing the demand and supply of cellular modem products and solutions in different verticals.

-

Assigning a percentage to the overall revenue or, in a few cases, to segmental revenues of each company to derive their revenues from the sales of cellular modem products and solutions. This percentage for each company has been assigned based on their product portfolios and the range of their cellular modem offerings.

-

Verifying and crosschecking estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operation managers, and with domain experts at MarketsandMarkets.

-

Studying various paid and unpaid information sources such as annual reports, press releases, white papers, and databases.

-

Tracking companies' ongoing and upcoming cellular modem implementation projects and forecasting the market size based on these developments and other critical parameters.

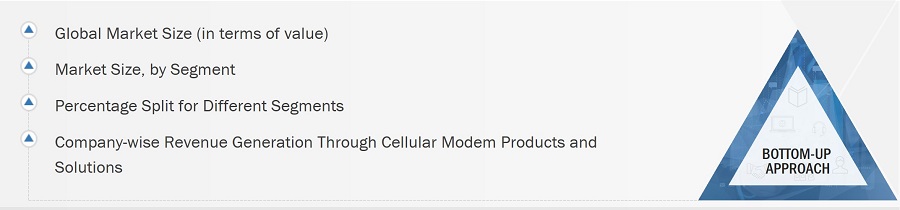

Market Size Estimation Methodology-Bottom-up Approach

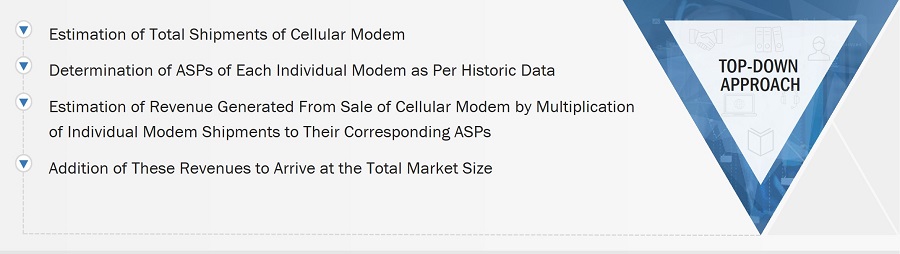

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Cellular modems are devices that connect to the internet network through SIM cards or Ethernet cables, extending network capabilities to devices like laptops and desktops. Cellular modems play a crucial role in providing internet connectivity in areas where wired broadband connections are not feasible or available. It relies on 2G, 3G, 4G, 5G, and LPWAN technologies, such as LTE-M and NB-IoT, for the transmission and reception of data. The 3rd Generation Partnership Project (3GPP) maintains the standards for cellular network technology which is responsible for developing the protocols for each next-generation cellular network. These modems have become essential in modern applications, providing reliable connectivity and enabling efficient data management.

Key Stakeholders

-

Semiconductor component manufacturers and distributors

-

Cellular modem and chipset manufacturers

-

Networking component providers

-

Companies providing wired and wireless connectivity services

-

Software platform providers

-

Original equipment manufacturers (OEMs)

-

Research organizations and consulting companies

-

Government bodies such as regulating authorities and policymakers

-

Venture capitalists and private equity firms

-

Associations, organizations, and alliances related to the cellular modem ecosystem

-

End users of cellular modem devices and solutions across various verticals, such as agriculture, automotive & transportation, building automation, consumer electronics, energy & utility, healthcare, industrial/manufacturing, retail, and smart cities.

Research Objectives

-

To define and forecast the cellular modem market based on type, technology, vertical, and region in terms of volume and value

-

To describe and forecast the cellular modem market based on four key regions, namely, North America, Europe, Asia Pacific, and RoW, along with their respective countries

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

-

To study the complete value chain of the cellular modem market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the cellular modem ecosystem

-

To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2, and provide a detailed competitive landscape

-

To analyze competitive developments, such as product launches and developments, acquisitions, collaborations, agreements, and partnerships, in the cellular modem market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

-

Further breakdown of the market in different regions at the country-level

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Cellular Modem Market