The study involved analyzing the recent developments, trends, and performance of the players as well as the robotaxi industry from 2025 to 2035. The analysis was based on the vehicle parc of robotaxis on a global and regional level. The study also analyzes the major milestones in the robotaxi industry across citywide expansion strategies, technology advancements, partnerships, and investment strategies with major automotive OEMs and Tier I players. Exhaustive secondary research gathered information on the market, peer, and parent markets. The next step was to validate these findings and assumptions and size them with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the complete forecasting of the fleet size for the regions considered. Thereafter, market breakdown and data triangulation were used to estimate the market size at a regional level.

Secondary Research

The secondary sources referred to for this research study included autonomous vehicle OEMs, Tier I/II technology and component suppliers, and publications from government sources, autonomous mobility associations, and industry databases [such as country-level transportation authorities, the International Transport Forum (ITF), Society of Automotive Engineers (SAE), National Highway Traffic Safety Administration (NHTSA), Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers’ Association (ACEA), and others]; corporate filings (annual reports, investor presentations, and financial statements) of robotaxi operators, technology developers, and infrastructure providers; and trade, business, and autonomous vehicle industry journals. Additional data was sourced from urban mobility think tanks, smart city programs, and pilot project reports from operators such as Waymo, Tesla, Baidu Apollo, WeRide, Zoox, and Pony.ai. This secondary data was collected and analyzed to determine the overall robotaxi fleet size, deployment geography, operating models, and revenue potential, and further validated through primary research with industry experts and stakeholders.

Primary Research

Extensive primary research was conducted after understanding the global robotaxi market landscape through secondary research. Primary research was undertaken to validate findings on current robotaxi deployments, operational performance, regulatory developments, and projected market growth, as well as to assess adoption potential through 2035.

Several primary interviews were conducted with market experts from the demand side (robotaxi fleet operators, ride-hailing platforms, and urban mobility service providers) and the supply side (autonomous vehicle OEMs, technology suppliers, and infrastructure providers). Approximately 75% of the experts interviewed represented the demand side, while 25% were from the industry’s supply side. Primary data was gathered through structured questionnaires, emails, virtual meetings, and telephonic interviews.

These interviews involved stakeholders from diverse organizational functions such as fleet operations, product management, business development, regulatory affairs, and technology integration to ensure a comprehensive perspective in the report.

In addition to engaging with industry participants, focused sessions were held with experienced independent mobility consultants and robotaxi industry experts to reinforce insights obtained from primary interviews. This input, combined with the views of in-house subject matter experts, forms the foundation of the findings presented in the subsequent sections of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

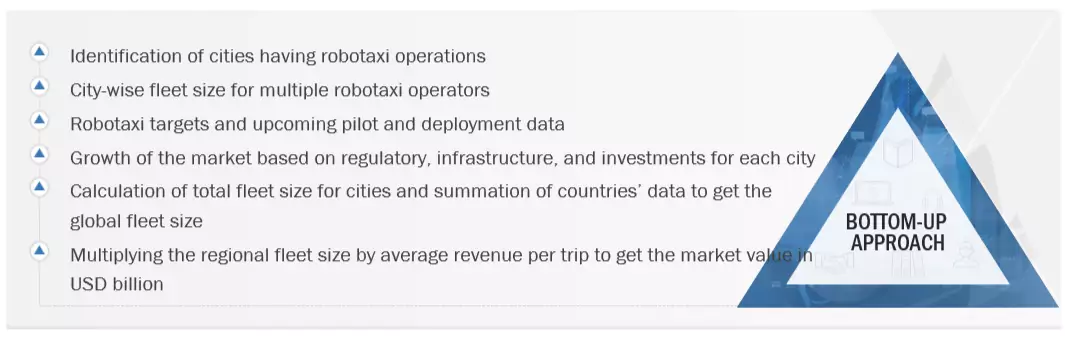

The bottom-up approach was used to estimate and validate the robotaxi fleet growth. This approach was also used to identify the fleet size across cities for each region every year. The research methodology used to estimate the market includes the following:

Global Robotaxi Market : Top-Down and Bottom-Up Approach

Market Definition

The robotaxi market outlook 2035 analyzes the key trends impacting the global robotaxi market. These trends include the rising expansion of robotaxis across major cities, increasing penetration of autonomous tech, and significant funding and alliances between OEMs, tech firms, and mobility operators to enable large-scale commercialization.

Stakeholders

-

Automobile Organizations/Associations

-

Automotive OEMs

-

Automotive System Manufacturers

-

Automotive Electronics Manufacturers

-

Automotive Technology Providers

-

Robotaxi operators

-

Country-specific Automotive Associations

-

Autonomous tech startups

-

Tech giants like Google, Alibaba, and Baidu

-

Automotive Tech Government & Research Organizations

-

Regional Transport Authorities

-

Software Providers

-

Traders, Distributors, and Suppliers of Automotive Components

Report Objectives

-

Assess global and city-level robotaxi fleet deployment patterns and growth trajectories

-

Analyze market trends, technology advancements, and strategic developments in the robotaxi ecosystem

-

Evaluate the role of OEMs, their investments, and partnerships in accelerating market adoption

-

Examine emerging business models

-

Profile and benchmark leading robotaxi operators by scale, capabilities, and performance metrics

-

Conduct cost-revenue analysis to determine pricing strategies and unit economics viability

-

Identify regulatory frameworks and compliance requirements shaping robotaxi market operations

-

Estimate the total addressable market (TAM) for robotaxis across key regions and segments

Growth opportunities and latent adjacency in Global Robotaxi Market