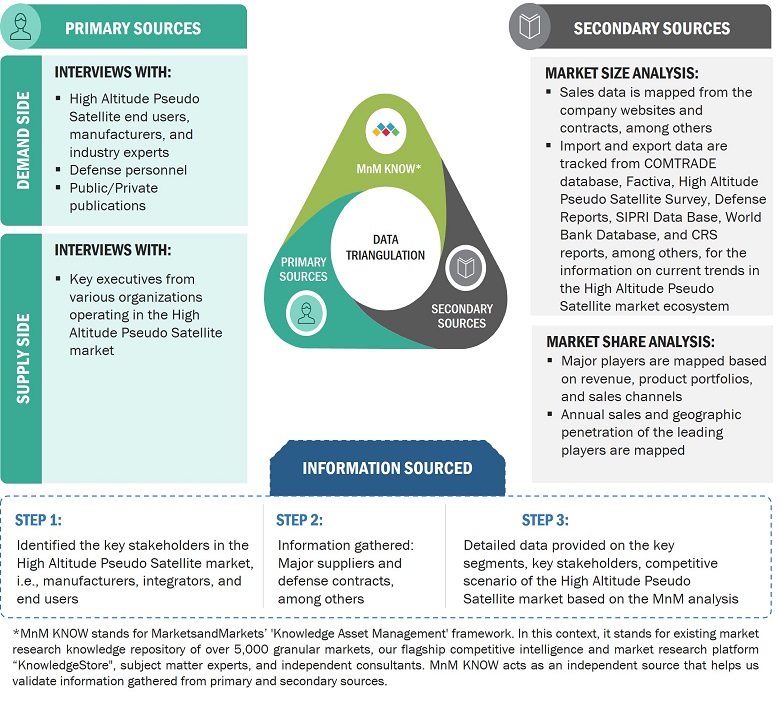

The research study conducted on high altitude pseudo satellite market involved extensive use of secondary sources, including directories, databases of articles, journals on high altitude pseudo satellite, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented study of the high altitude pseudo satellite market. Primary sources include industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of high altitude pseudo satellite market.

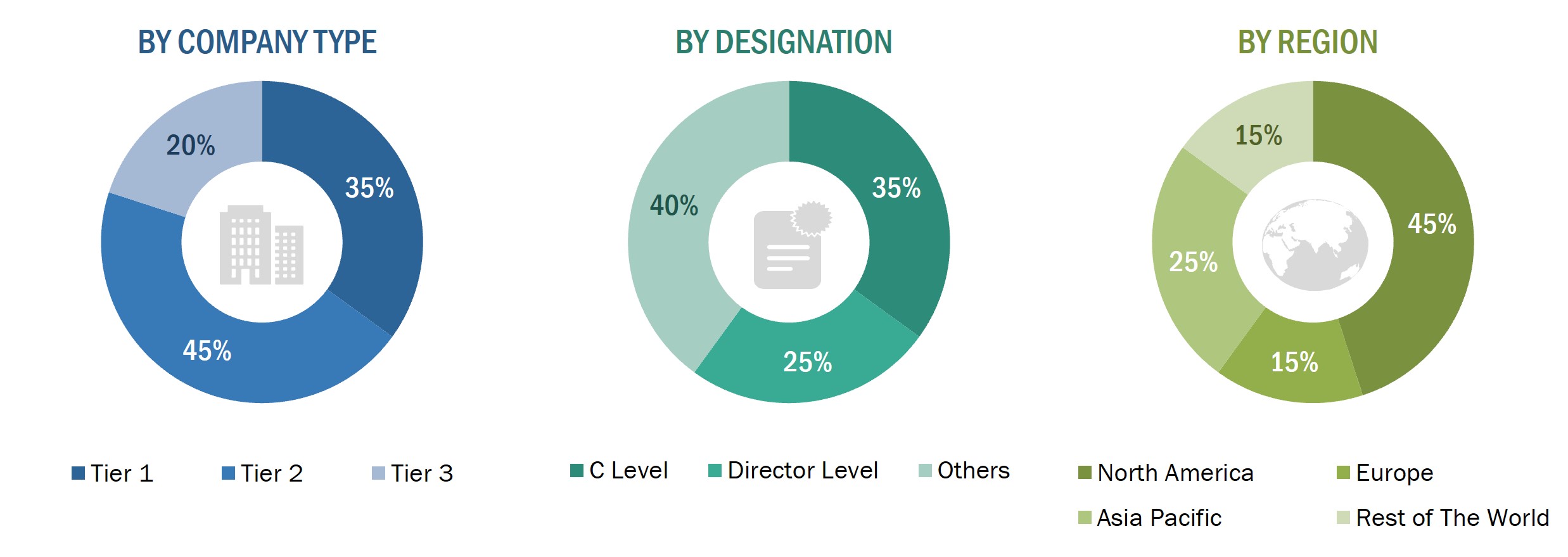

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess future market prospects.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the service portfolios of major companies. These companies were rated on the basis of performance and quality of their products. Primary sources further validated these data points.

Secondary sources referred to for this research study include financial statements of companies offering high-altitude pseudo satellites and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the High-Altitude Pseudo-Satellite market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the High-Altitude pseudo-satellite market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across regions: North America, Europe, Asia Pacific, and the Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews.

In the primary research process, various sources were interviewed to obtain qualitative and quantitative information on the market. Sources from the supply side included various industry experts, such as chief X officers (CXOs), vice presidents (VPs), and directors from business development, marketing, and product development/innovation teams; related key executives from the market participants, such as independent consultants; manufacturers; parts manufacturers of High-Altitude pseudo-Satellite, and key opinion leaders.

These interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. It also helped analyze the platform, solution, application, and range,

Stakeholders from the demand side, such as CXOs, production managers, and maintenance engineers, were interviewed to understand the perspective of buyers on product suppliers and service providers, along with their current usage. It also helped in understanding the future outlook of their businesses, which will affect the overall High Altitude Pseudo Satellite market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

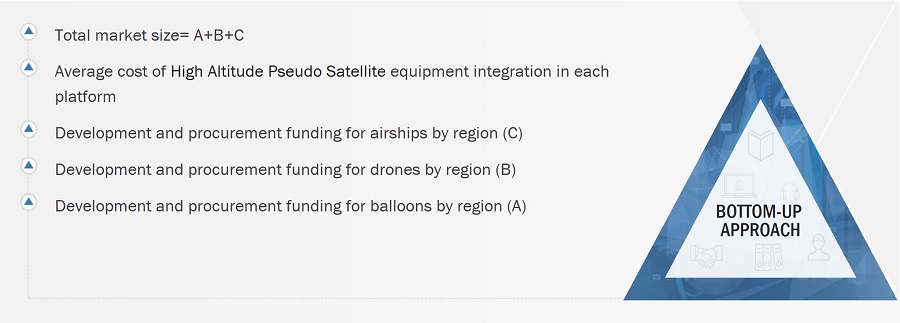

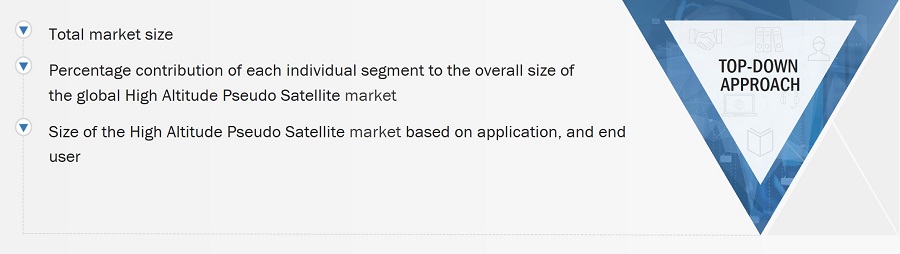

The top-down and bottom-up approaches were used to estimate and validate the size of the high-altitude pseudo satellite market. The figure in the below section is a representation of the overall market size estimation process employed for the purpose of this study.

The research methodology used to estimate the market size includes the following details.

-

Key players in the markets were identified through secondary research, and their market shares were determined through primary and secondary research. This included an extensive study of top market players' annual and financial reports and interviews with CEOs, directors, and marketing executives.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

High Altitude Pseudo Satellite Market Size: Bottom-Up Approach

High Altitude pseudo satellite market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation and market breakdown procedures explained below were implemented wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used in this report.

Market Defination

High-altitude pseudo satellite is a solar-powered high altitude long endurance unmanned aerial vehicle (UAV), watching over earth from the stratosphere. The term "Pseudo-Satellite” is used because of its capability to stay above an area for a very long period like a satellite. The flying altitude of high-altitude pseudo satellite is just above the commercial aircraft and drones but operates like a satellite. The best working altitude is 20km, 8-10km above commercial airlines where the wind speed is sufficient for high altitude pseudo satellite to hold the position for long period. It can remain in its position for weeks or months. Technologically the main advantage of this altitude is very less meteorological events with light winds. At an altitude of 20 km despite the curvature of the earth, it can cover an area of radius 200km. The potential to stay above an area of a radius of 200km for months, makes it the best-suited platform for real-time monitoring/surveillance, communication, earth observation and complementing the existing Air-born and Space born platforms.

Key Stakeholders

-

High Altitude Pseudo Satellite Manufacturers

-

Component Manufacturers

-

Defence Contractors

-

Government and Defence Organizations

-

Commercial Organizations

-

Payload & Warhead Suppliers

-

Technologists

-

R&D Staff

Report Objectives

-

To define, describe, and forecast the size of the high altitude pseudo satellite market based on platform, application, end user and region

-

To forecast the size of the various segments of the high altitude pseudo satellite market based on six regions: North America, Europe, Asia Pacific, and Rest of the World, along with key countries in each of these regions

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To identify industry trends, market trends, and technology trends prevailing in the market

-

To analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

-

To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as new product developments, contracts, partnerships, joint ventures, agreements, and collaborations adopted by key players in the market

-

To identify the detailed financial position, key products, unique selling points, and key developments of leading companies in the market

-

To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies

1 Micromarkets refer to further segments and subsegments of High-altitude pseudo satellite market included in the report.

2 Companies' Core competencies were captured in terms of their key developments and key strategies they adopted to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the market segments at country-level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in High Altitude Pseudo-Satellite Market