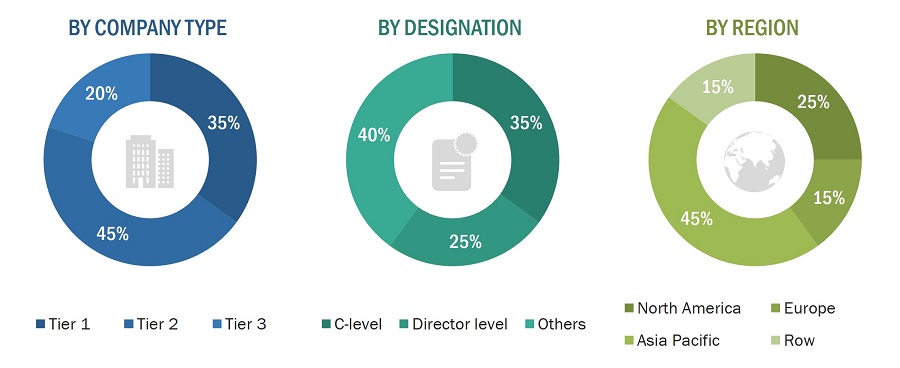

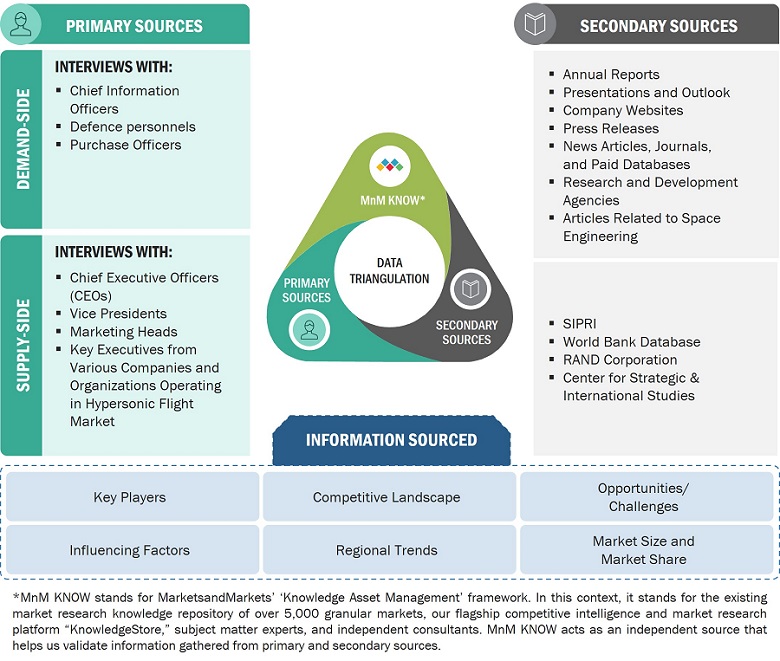

The research study conducted on the hypersonic flight market involved extensive use of secondary sources, including directories, databases of articles, journals on hypersonic flight, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented study of the hypersonic flight market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the hypersonic flight market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the hypersonic flight market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the hypersonic flight industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the hypersonic flight market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Primary sources from the supply side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the hypersonic flight market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the hypersonic flight market. The following figure represents the overall market size estimation process employed for this study on the market.

The research methodology used to estimate the market size included the following details:

-

Secondary research identified key players in the hypersonic flight market, and their market share was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the market.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the rocket and missile market.

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

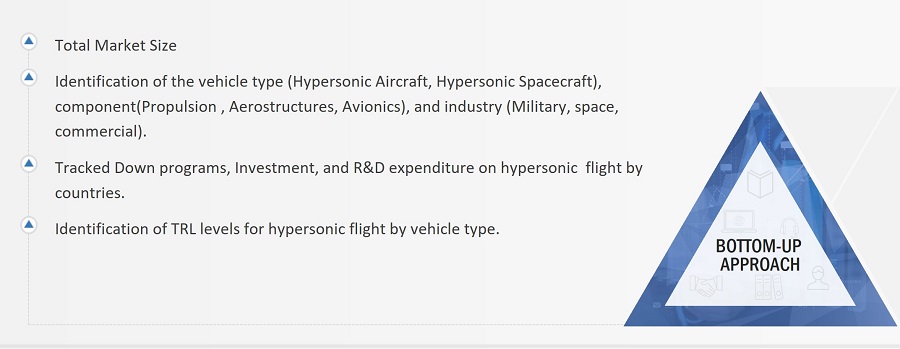

Bottom-Up Approach

The study analyzed the hypersonic flight programs of multiple countries to understand various schemes and funding allocations for hypersonic flight. After this, each program and its spending on procurement were tracked.

For Instance Hermeus (US) received an investment worth USD 60 million for development of hypersonic aircraft.

The above data was further refined by tracking various developments, such as contracts related to the upgradation of existing fleets, procurement of new platforms, and product development issued by the various defense departments. The data sources considered for the market estimation and forecasting include the US DoD budget hypersonic development and integration, defense program publications, defense insights and data by Stockholm International Peace Research Institute (SIPRI), defense expenditure of countries, and conflicts & geopolitical factors were considered.

Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the hypersonic flight market from the revenues of key players and their shares in the market. Calculations based on the revenues of key players identified in the market led to the overall market size. The bottom-up approach was also implemented for data extracted from secondary research to validate the market segment revenues obtained. The market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the overall parent market size and each individual market size were determined and confirmed in this study.

Market size estimation

The bottom-up approach, employed to determine the overall size of the hypersonic weapons market, is delineated below.

-

Identified top countries based on hypersonic flight program and budget spending.

-

Identified hypersonic flight investment for top countries.

-

Identified whether hypersonic flight considered in the scope is used or not for the top countries

-

Identified the use of hypersonic flight by various industries.

-

Selected the top countries based on their TRL levels of hypersonic flight technology.

-

Countries were clubbed based on an overall rating synergy for correlation analysis.

-

After calculating the market size for the selected top countries, the data was added to the matrix.

-

A relation of the derived market size was established with the program spending and development of the respective countries to arrive

-

Validate the data with the supply-side analysis by identifying the product revenue during the last five years. For instance, in December 2022 the US Department of Defense awarded a contract worth USD 334 million to develop both hypersonic missile and hypersonic bomber aircraft.

Market Size Estimation Methodology: Bottom-Up Approach

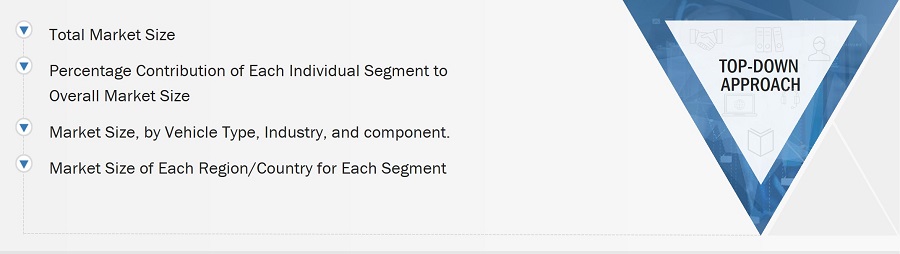

Top-Down Approach

In the top-down approach, the overall size of the hypersonic flight market was used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

The size of the most appropriate, immediate parent market was used to implement the top-down approach to calculate the sizes of specific market segments. The approach was also implemented to validate the revenues obtained for various market segments.

Market share was estimated for each company to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and data validation through primaries, this study determined and confirmed the overall size of the parent market and each market segment. The following figure shows the overall market size estimation process employed for this study.

Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall size of the hypersonic flight market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

The figure above demonstrates the core data triangulation procedure used in this report for every market, submarket, and subsegment. The percentage splits of various market segments, including vehicle type, component, were used to determine the size of hypersonic flight market.

Market Definition

-

Hypersonic flight is an aerospace technology characterized by the rapid movement of objects, vehicles, or aircraft at extremely high speeds, typically exceeding Mach 5, or five times the speed of sound. At these velocities, hypersonic vehicles travel at least 3,836 miles per hour (6,174 kilometers per hour) or faster, making them significantly faster than supersonic and subsonic counterparts. The term "Mach" is used to denote the ratio of an object's speed to the speed of sound, with Mach 1 being the speed of sound in each medium.

-

Hypersonic flight is a field that encompasses both atmospheric and space environments. Hypersonic aircraft and spacecraft navigate through the Earth's atmosphere at these extraordinary speeds, encountering a unique set of challenges due to the extreme conditions they face. These challenges include intense aerodynamic heating, shockwaves, and the need for advanced materials to withstand the extreme temperatures and stresses.

-

The primary distinction between hypersonic flight and other forms of high-speed travel, such as supersonic flight (where speeds exceed Mach 1 but are generally less than Mach 3) or subsonic flight, lies in the velocity and the aerodynamic characteristics involved. Hypersonic vehicles often rely on advanced propulsion systems, like scramjets, which efficiently compress and ignite air to produce thrust at hypersonic speeds.

Key Stakeholders

-

Aerospace & Defense Companies

-

Space Industry Players

-

Research Institutions and Universities

-

Testing and Certification Organizations

-

Material and Technology Providers

-

Investors and Financial Institutions

-

Regulatory Bodies

Report Objectives

-

To define, describe, and forecast the size of the hypersonic flight market based on Industry, Vehicle type, component, and region from 2023 to 2030

-

To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific and the rest of the world

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the hypersonic flight market across the globe

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the hypersonic flight market

-

To analyze opportunities for stakeholders in the market by identifying key market trends

-

To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, new product launches, and Research & Development (R&D) activities in the hypersonic flight market

-

To provide a detailed competitive landscape of the market, in addition to an analysis of business and corporate strategies adopted by leading market players

To strategically profile key market players and comprehensively analyze their core competencies2

1. Micro markets refer to further segments and subsegments of the hypersonic flight market included in the report.

2. Core competencies of the companies were captured in terms of their key developments and strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the market segments at the country level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Hypersonic Flight Market