The study involved major activities in estimating the current size of the industrial steam generation outlook. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation techniques were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the industrial steam generation outlook involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect valuable information for a technical, market-oriented, and commercial study of the global smart port market. Other secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

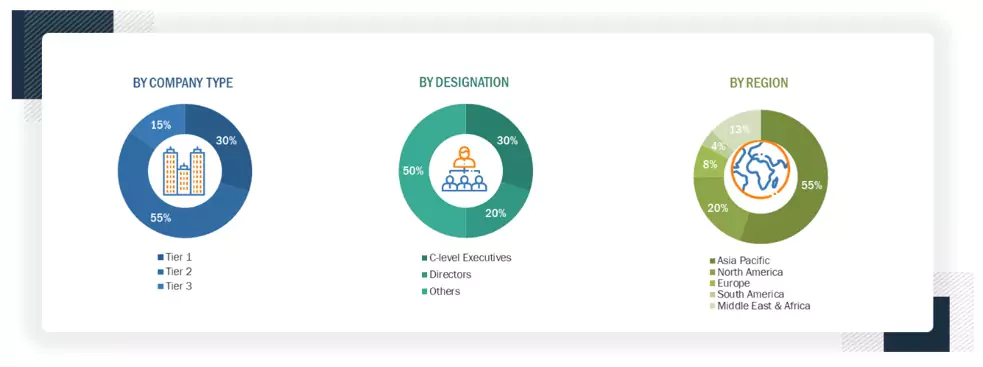

Industrial steam generation outlook comprises stakeholders such as steam generation technology providers, infrastructure developers, and support service providers in the supply chain. The demand side of this market is characterized by the rising demand for industrial steam solutions in nations due to the increasing need for efficiency, real-time data analytics, and predictive operations in aging infrastructure and expanding global energy volumes. The supply side is characterized by rising demand for smart infrastructure contracts from industrial authorities and operators, and mergers and acquisitions among major industry players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion,

Tier 2: USD 500 million–1 billion, and Tier 3:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the industrial steam generation outlook and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes studying the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives.

Industrial Steam Generation Outlook : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown processes were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both the top-down and bottom-up approaches.

Market Definition

The study evaluates the global steam and vapor activities, focusing on the generation, recovery, and utilization of process steam and vapor across industrial sectors. The study emphasizes steam and vapor generation within the temperature range of 100°C to 250°C and the pressure range of 1 to 15 bara. The study is conducted across five key global regions: North America, Latin America, Europe, the Middle East & Africa, and Asia Pacific. It comprehensively analyzes steam and vapor generation across various applications and operating conditions, such as pressure and temperature.

Stakeholders

-

Research and consulting companies in the energy sector

-

Industrial equipment manufacturers

-

Technology providers

-

Government organizations

-

Investors/shareholders

Report Objectives

-

To define, describe, segment, and forecast the industrial steam generation outlook based on pressure, temperature, end-use industry, and region, in terms of volume

-

To describe and forecast the industrial steam generation outlook for various segments with respect to five main regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, in terms of volume

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth

-

To provide a detailed overview of the industrial steam generation value chain analysis, use case analysis, key stakeholders and buying criteria, patent analysis.

-

To analyze opportunities in the market for various stakeholders by identifying high-growth segments

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

-

Further breakdown of the smart port, by country

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Industrial Steam Generation Outlook by Pressure (1