The global light vehicle parc is expected to grow from 1.37 billion units in 2024 to 1.62 billion units by 2030. This growth is primarily driven by sustained population growth and urbanization trends worldwide, which have increased demand for personal and commercial mobility solutions. Emerging economies in Asia and Latin America are witnessing a surge in first-time vehicle ownership as rising incomes enable broader access to affordable models. Advancements in manufacturing and supply chain efficiencies have lowered production costs, making light vehicles more attainable amid fluctuating raw material prices.

This projected growth in the global light vehicle parc highlights the pivotal role of auto parts aftermarket distributors and retailers, as an expanding fleet increases demand for replacement parts, maintenance supplies, and accessories to keep vehicles operational over extended lifespan. In North America and Europe, where mature markets prioritize sustainability and efficiency, distributors serve as critical intermediaries by optimizing supply chain, ensuring timely access to high-quality components amid urbanization-driven wear and tear on vehicles.

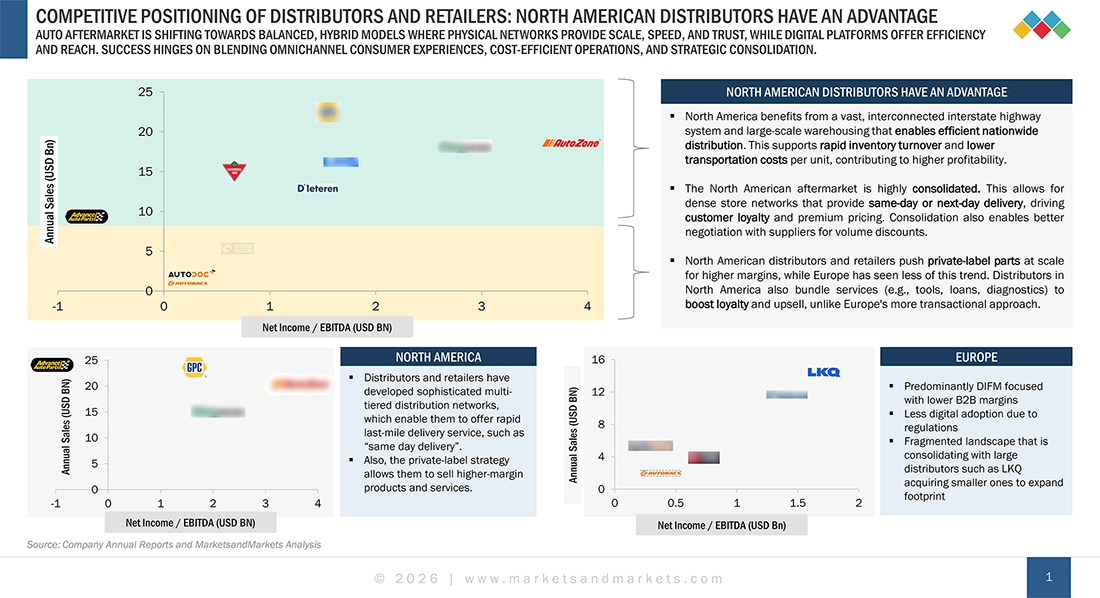

Strategic Competitive Edge: North American Aftermarket Distributors and Retailers Hold a Clear Advantage

Leading auto parts aftermarket distributors and retailers in North America, such as NAPA, AutoZone, O’Reilly, and Advance Auto Parts, are focused to develop large automated mega-hubs and high-velocity distribution centres that can provide same- or next-day availability and enhance fill rates for DIY and professional customers. They are consolidating inventory from a larger number of stores into a few, big, highly automated facilities so that they can reduce costs, improve supply chains, and facilitate the steady expansion of stores all over the U.S., further into Mexico, and selectively into Canada and Brazil.

On the other hand, European distributors and retailers such as LKQ Europe, Inter Cars, Autodoc, and D’Ieteren are operating in a more fragmented, DIFM-oriented market that have thousands of small wholesalers and only a few large networks. To stay competitive, the top distributors in Europe such as LKQ are implementing a strategy of rapid buy-and-build roll-ups, where they acquire regional distributors such as Euro Car Parts, Stahlgruber, Rhiag to quickly expand their scale and geographical reach.

Both regions are making investments towards warehouse automation, AI-driven inventory management, omnichannel platforms, and greener logistics to deliver faster, lower costs, and improve resilience. While North America is concentrating on distribution standardization and store growth in selected areas, Europe is putting more emphasis on consolidation as well as digital and supply-chain modernization initiatives to raise margins and gain share in the professional segments. In the end, both approaches have the same goal of competing in terms of speed, cost efficiency, scale, and service quality in an increasingly complex global aftermarket.

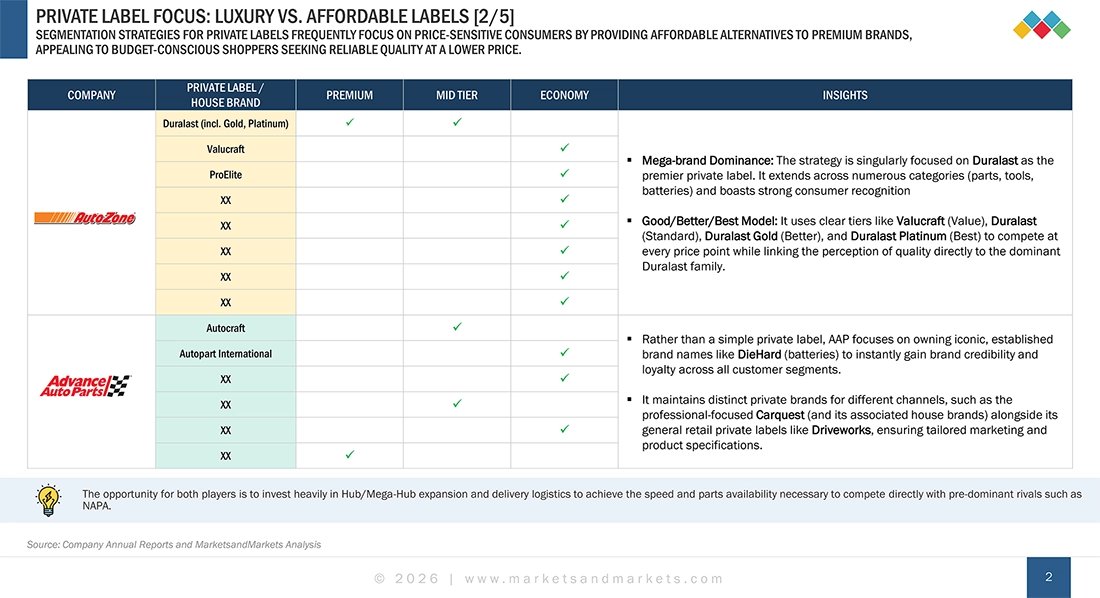

Private Label Strategies: Driving Margins and Differentiation in North American and European Aftermarket

Private label brands are now a key competitive edge in the aftermarket for both North America and Europe. They deliver tiered options that blend quality, value, and robust warranties, helping leaders improve margins, reduce reliance on national brands, and foster customer loyalty. In the consolidated North American market, private labels frequently dominate sales, whereas in Europe's fragmented environment, they help capture price-sensitive segments. With increasing vehicle complexity and ongoing economic challenges, sustained focus on private label expansion backed by supply chain integration and smart assortment strategies will boost profitability, differentiation, and long-term resilience across the industry.

In both Europe and North America, private-label (house-brand) parts have become a central lever for leading distributors to strengthen profitability and stand out in a price-competitive aftermarket. In Europe, players such as LKQ (via brands like Platinum Plus, Finish Master, and Euro Car Parts’ Triple QX), D’Ieteren (through PHE brands), and Autodoc (Ridex, Stark Professional) are rapidly increasing the share of private-label products from the traditional 15–25% to 35–45% of total sales. These labels typically generate 8–12 percentage points higher margins than branded parts while maintaining equivalent quality through strict certification processes and sourcing partnerships with Tier-2 manufacturers in Asia and Eastern Europe.

In North America, companies such as NAPA with its private-label portfolio, LKQ with its Keystone and NTP brands, Advance Auto Parts with DieHard and Carquest, and O’Reilly with its growing in-house lines are driving private-label penetration beyond 50% in several categories. Their approach blends low-cost global sourcing, exclusive distribution rights, and aggressive marketing, ensuring stronger retailer control over the DIFM customer base and sustained value for both garages and e-commerce channels.

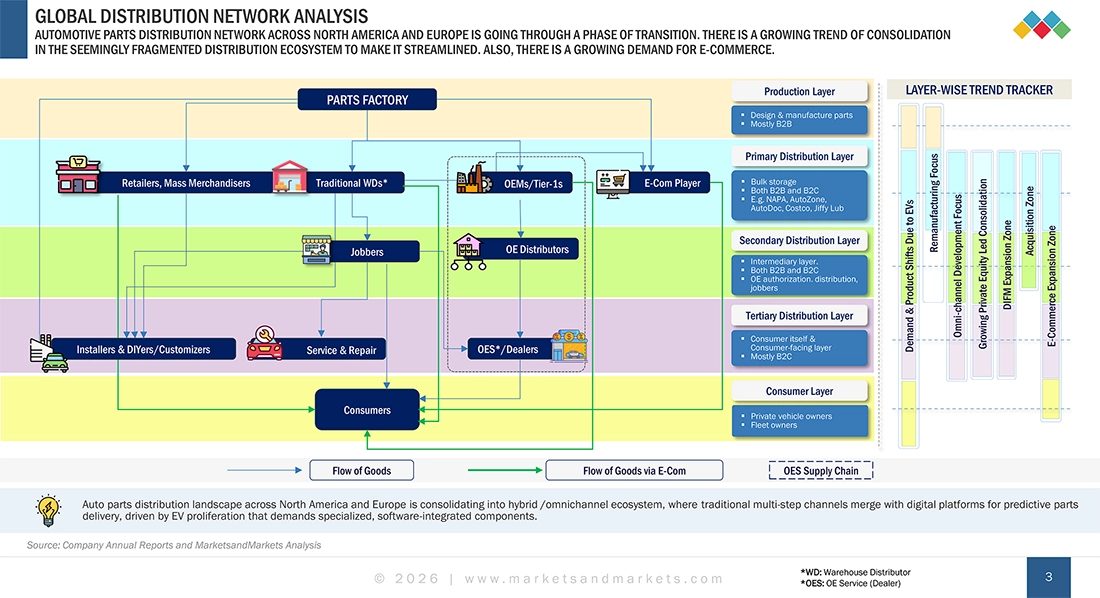

Distribution Channels in the Automotive Aftermarket: From Traditional Multi-Step to Integrated Omnichannel Models

In the auto parts aftermarket, distribution channels range from traditional 3-step (supplier → distributor → jobber → retailer/installer) for broad coverage but lower margins, to streamlined 2-step (supplier → large distributor → retailer/installer) for efficiency and faster turns.

Auto parts retailers such as AutoZone often integrate vertically, sourcing directly to serve DIY/DIFM end-users with promotions and private labels. Mass merchandisers (e.g., Walmart) use hybrid models via distributors, focusing on low-cost impulse items for casual DIYers. The OEM channel links suppliers directly or via 2-step to OES i.e. OE service or dealerships, emphasizing premium branded parts for warranty work. Suppliers employ multi-channel strategies, tailoring products (value for mass merchandisers, premium for OES) and investing in digital tools for logistics, forecasting, and optimized penetration amid consolidation.

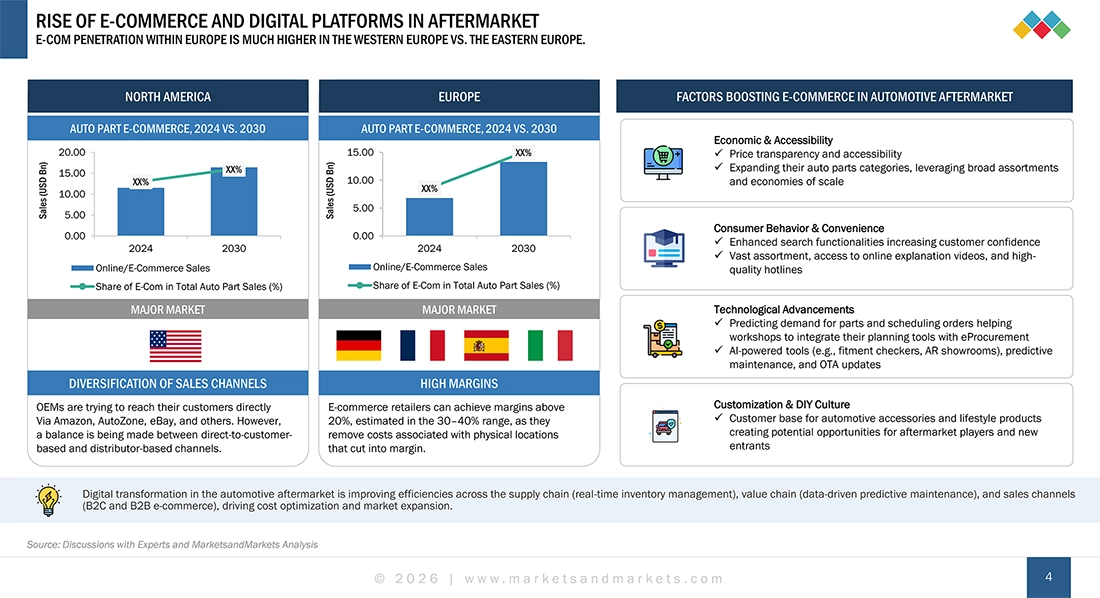

Emerging Trends Shaping the Automotive Aftermarket Digital Transformation, Connectivity, and Logistics Innovation Drive Future Growth

The auto parts aftermarket is rapidly evolving through digital transformation, with e-commerce and online platforms surging via AI personalization, AR part-fitting tools, and seamless repair scheduling for DIY and professional users. Autonomous and connected vehicles are shifting demand towards ADAS sensors, software updates, and predictive maintenance using IoT/telematics, while reducing mechanical repairs with rising EV adoption. Advanced last-mile delivery, through logistics partnerships and same-day services, minimizes downtime and enhances convenience for an aging vehicle fleet.

Overall, these trends mark a shift to a tech-driven aftermarket, where e-commerce, connectivity, and efficient logistics integrate into hybrid models blending digital and physical networks. This boosts customer convenience and efficiency, positioning the industry for growth amid vehicle complexity, EV growth, and sustainability needs. Success depends on agile adaptation, partnerships, and data-driven strategies in a connected ecosystem.

Conclusion: Competitive Benchmarking of Key Aftermarket Distributors and Retailers in North America and Europe

Auto parts distribution landscape across North America and Europe is consolidating into a hybrid /omnichannel ecosystem, where traditional multi-step channels merge with digital platforms for predictive parts delivery, driven by EV proliferation that demands specialized, software-integrated components.

Major distributors across both regions, such as NAPA, AutoZone, LKQ, and the D’Ieteren Group, are creating more well-knit distribution networks to cater to the DIFM segment, which is forecast to consistently grow due to increasing complexity in vehicles.

Distributors are offering OE-comparable parts under their private label program with appropriate price segmentation. The growing popularity of private-label products is driving distributors to offer cost-effective, branded alternatives that builds loyalty and competes with OE service channel.

Personalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Request A Free Customisation

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Competitive Benchmarking of Key Aftermarket

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Customized Workshop Request

Growth opportunities and latent adjacency in Competitive Benchmarking of Key Aftermarket