Long Duration Energy Storage Market: Growth, Size, Share, and Trends

Long Duration Energy Storage Market by Technology (Mechanical Storage, Thermal Storage, Electrochemical Storage), Duration (8 to 24, >24 to 36, >36), Capacity (Upto 50 MW, 50-100 MW, More Than 100 MW), Application, End User, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The long duration energy storage market is forecasted to reach USD 10.43 billion by 2030 from an estimated USD 4.85 million in 2024, at a CAGR of 13.6% during the forecast period (2024-2030). The major factors driving the market growth of the long duration energy storage market include various driving factors such as it involves growing requirements of grid stability and resilience as it increases its renewable energy sources.

KEY TAKEAWAYS

-

BY REGIONThe North America long duration energy storage market is estimated to dominate with a share of 44.5% in 2024.

-

BY CAPACITYBy Capacity, the Upto 50 MW segment is anticipated to record a CAGR of 15.1% between 2024 and 2030.

-

BY TECHNOLOGYBy Technology, the Mechanical Storage segment is the largest market in 2024.

-

BY DURATIONBy Duration, the 8 to 24 hrs segment is expected to register the highest growth in the forecasted period

-

BY APPLICATIONBy application, the Backup power segment is expected to register the highest CAGR of 15.1% in the forescasted period.

-

BY END USERBy End User, Utilities Segment is to be the largest market in 2030

-

COMPETITIVE LANDSCAPEMAN Energy Solutions, Sumitomo Electric Industries, Ltd., ESS Tech, Inc., Energy Vault, Inc., and Invinity Energy Systems (England) have been identified as the star leaders in the long duration energy storage market, backed by their robust technology portfolios, strong global presence, and accelerating their adoption among utilities, industries, and large-scale renewable projects.

-

COMPETITIVE LANDSCAPEENERGY DOME S.p.A., Malta Inc., Form Energy, and Hydrostor have distinguished themselves among SMEs and Startups due to their strong product portfolio and business strategy.

The long duration energy storage market is expanding rapidly as power systems increasingly rely on renewable energy and require enhanced grid stability and resilience. As solar and wind penetration rises, utilities and operators are turning to advanced storage technologies such as flow batteries, compressed air systems, and thermal storage to manage intermittent generation and maintain reliable power supply. Ongoing efforts to decarbonize electricity are driving higher demand for flexible, long-duration solutions that can support load shifting, ensure energy security, and optimize system performance. At the same time, supportive government policies, favorable incentives, and continuous technology improvements are reducing costs and strengthening the economic feasibility of long-duration storage, further accelerating its adoption as a critical enabler of global net-zero and energy transition goals.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Growing demand for stabilizing power systems with high renewable penetration is expected to drive the long-duration energy storage market. Furthermore, the increasing adoption of long-duration storage technologies to support decarbonization goals and address grid reliability challenges is projected to create lucrative growth opportunities in this sector.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing use of renewable energy sources for power generation

-

Rising need to ensure grid resilience

Level

-

Lack of commercial readiness and scalability of emerging technologies

-

Substantial capital expenditure for development and installation of LDES technology

Level

-

Favorable government initiatives boosting LDES adoption

-

Rising number of low-emission hydrogen production projects

Level

-

Lack of standardization in LDES systems

-

Integration of LDES into existing power system

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing use of renewable energy sources for power generation

The increasing use of renewable energy for power generation is a major driver of the long-duration energy storage (LDES) market, supported by government policies and regulations aimed at reducing greenhouse gas emissions. Since over 40% of energy-related carbon dioxide emissions come from burning fossil fuels, many countries are turning to renewables for electricity and other applications such as heating, desalination, water purification, and clean cooking. According to the International Energy Agency (IEA), renewable energy accounted for 29.5% of global electricity generation in 2022 and is expected to reach 42% by 2028, creating a growing need for LDES to manage fluctuating renewable output. Governments worldwide are setting ambitious renewable targets to address climate change and improve energy security, with regions like the European Union aiming for 32% renewable energy by 2030 and countries such as the US and China offering strong incentives for solar and wind projects. Financial support—including tax credits, subsidies, and feed-in tariffs—is further encouraging investment in large-scale and distributed renewable energy projects, boosting the adoption of renewable technologies globally

Restraints: Lack of commercial readiness and scalability of emerging technologies

One of the primary restraints to the growth of the LDES market is technological immaturity. Most of the newly developed technologies lack commercial readiness and economies of scale. Chemical energy storage, especially flow batteries, has been of much interest because of the involvement of high-profile companies such as Sumitomo Electric Industries, Honeywell, and Lockheed Martin. However, this technology is associated with high costs and material availability. The most mature flow battery technology, vanadium redox flow batteries (VRFBs), suffer from the high cost of vanadium pentoxide and supply security concerns. Other alternative electrolyte chemistries, such as organic electrolytes, are under development and are still far from large-scale commercialization. Metal air batteries are inefficient due to the nature of the cathode reaction rate and issues such as anode degradation from dendrite formation. These batteries are also less feasible due to the high cost of catalysts, which are made of precious metals such as platinum and gold. Though metal air batteries are capable of discharging for longer periods and can be used as backup applications for renewables, their technological barriers prevent them from achieving cost-effectiveness and scalability

Opportunities: Favorable government initiatives boosting LDES adoption

The implementation of favorable government policies is helping market players to overcome the financial, regulatory, and technological hurdles, which is driving the deployment of long duration energy storage systems. Governments around the world are realizing the importance of LDES for grid stability and the integration of renewable energy. These measures include direct incentives, such as subsidies and low-interest loans, tax credits, and grants. Under its Energy Earthshots initiative, the US Department of Energy presented the Long Duration Storage Shot, which aims at reducing the cost of an LDES to USD 0.05/kWh by 2030, rendering it more affordable. China, Germany, and other countries are also making investments in research and development and pilot projects on advanced energy storage technologies with a focus on flow batteries and compressed air energy storage. Some governments consider energy storage in their long-term energy transition strategies, which encourage the large-scale adoption of energy storage through legislative mandates and market mechanisms. These government initiatives create a favorable environment for market players to further technological innovation, increase adoption, and expand the market for long duration energy storage systems

Challenges: Lack of standardization in LDES systems

The lack of standardization has prevented the broad adoption of long duration energy storage systems. Standardization of these systems will enable interoperability, optimize cost structures, and ensure quality consistency and compliance. However, LDES is a relatively nascent market and is characterized by the adoption of various technologies, such as flow batteries, CAES, thermal energy storage, gravitational energy storage, and hydrogen-based systems. All these technologies function on different principles. This makes it difficult to have common standards and protocols. One of the major problems associated with the absence of standardization is the difficulty with which LDES technology can seamlessly be integrated into the already existing infrastructure of the grid. The lack of standardized performance metrics, safety protocols, and system design causes problems in evaluating and integrating such systems among grid operators. For instance, the technical requirements to maintain and operate VRFBs are very different from those of CAES and, thus, have been implemented in varied manners. It also creates issues related to scalability, delay in implementation, and the formation of barriers to mass acceptance across geographical areas. Reducing this gap will be crucial to fast-track global LDES system deployments

LONG DURATION ENERGY STORAGE MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Engie, Equans, and Jan De Nul collaborated to deploy an industrial-scale solar + long-duration storage project at JDN’s headquarters. The objective was to demonstrate how on-site renewable generation paired with LDES can support decarbonization goals and maximize self-consumption. The project required a durable and reliable system capable of operating continuously in an urban industrial environment. Vanadium flow batteries (VFBs) were selected for their long life, safety, and ability to provide unlimited daily cycles over more than 20 years. Invinity Energy Systems supplied the VS3 battery units, with Equans overseeing EPC activities. | The LDES installation enabled efficient solar-energy shifting, storing excess daytime generation and discharging after sunset to maintain operations on clean energy. It also supported existing EV-charging infrastructure, helping integrate renewable electricity into JDN’s broader energy system. The compact double-stack installation optimized use of available space. Commissioned in 2023 and inaugurated in 2024, the system demonstrated reliable long-duration performance, improved energy resilience, and reduced reliance on grid electricity—establishing a replicable model for urban industrial sites adopting LDES. |

|

CAISO needed to manage the challenges created by the increasing use of solar and wind power in California. These resources vary throughout the day, causing supply–demand imbalances and affecting grid stability. To address this, CAISO looked for ways to include energy storage in its programs so the grid could have reliable support during peak hours and when renewable output drops. | By adding energy storage to the Resource Adequacy and Ancillary Services programs, CAISO ensured the grid had dependable capacity and access to fast-response services like frequency regulation. The 4-hour duration requirement encouraged the use of longer-duration storage systems. These steps helped the grid handle more renewable energy, improved flexibility, and supported more stable operations. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The long duration energy storage (LDES) market ecosystem includes raw material suppliers, technology manufacturers, system integrators, and end users working together to support long-term energy storage needs. Raw material providers such as Albemarle (US), Bushveld Minerals (South Africa), and Glencore (Switzerland) supply materials like lithium, vanadium, zinc, and thermal salts used in flow batteries, thermal storage, and compressed-air systems. Technology developers such as Form Energy (US), Energy Dome (Italy), and Hydrostor (Canada) manufacture LDES technologies for grid and industrial applications. Integrators such as Fluence (US), Wärtsilä (Finland), and Tesla Energy (US) support project deployment and system integration. End users including Dominion Energy (US), Pacific Gas and Electric (US), and NextEra Energy (US) use LDES to manage renewable variability, improve grid flexibility, and meet operational needs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Long Duration Energy Storage market, By Application

Grid management by application is projected to be the largest segment in the long-duration energy storage market during the forecast period. The rising penetration of renewable energy sources is creating a strong need for advanced storage technologies that can manage fluctuations in power supply and demand, positioning grid management as the leading application segment. In LDES systems, functions such as frequency regulation, voltage stabilization, and peak load management are critical for maintaining grid efficiency and reliability. The growth of decentralized power generation and increasing integration of solar and wind energy are further accelerating the demand for grid management solutions. In addition, supportive government policies, investments in grid modernization, and continuous improvements in storage technologies are strengthening this segment’s role as a foundational component of future energy transition strategies

Long Duration Energy Storage market, By End User

The Utilities segment, by end user, is expected to be the largest in the long-duration energy storage market during the forecast period. Market growth is driven by the need for enhanced grid stability and the rising share of renewable energy in power systems. Utilities rely on long-duration storage solutions to manage peak demand, support frequency regulation, and address the variability of renewable power generation. With increasing electricity demand and ambitious decarbonization targets, utilities are being pushed toward widespread LDES adoption. Government incentives, supportive regulatory frameworks, and declining technology costs further accelerate uptake. As a result, utilities view long-duration energy storage as a critical asset for strengthening grid resilience and achieving long-term carbon neutrality goals.

Long Duration Energy Storage market, By Capacity

As large-scale renewable energy projects, such as solar and wind farms, grow, a strong energy storage system becomes necessary to stabilize the otherwise intermittent power generation. The 50-100 MW capacity range is ideal for such projects as it makes it seamless to integrate renewable energy by storing excess energy when generation is high and then releasing it during times of high demand. Power grids are also exposed to the volatility of renewable resources and the growing demand for electricity. Therefore, storage systems with capacities of 50-100 MW play a crucial role in the stabilization of the grid, reducing congestion, maintaining the stability of frequency and voltage, and thus guaranteeing reliable operation of the grid. As such, this capacity range is key in guaranteeing the reliable operation of the grid while supporting global modernization of grids in developed and developing energy systems

Long Duration Energy Storage market, By Duration

The >24-36 hours segment by duration, The renewable energy sources like solar and wind power need storage facilities. Storage systems that could power for 24-36 hours will store the excess in peak generation and then emit it when the output from the renewable sources is low. Hence, it will ensure a stable grid and efficient use of the energy. Furthermore, increased frequency of extreme weather events such as storms and heatwaves may cut off the supply of energy for longer periods. The systems in the 24-36 hour range of LDES provide reliable backup power supply, improve resilience of the grid, and ensure uninterruptible energy access in locations with weather-driven outages

Long Duration Energy Storage market, By Technology

The mechanical storage segment is estimated to account for the largest share of the overall long duration energy storage market during the forecast period. This is attributed to their scalability and high efficiencies that support energy storage at a large scale. Pumped hydro storage, compressed air energy storage (CAES), and flywheels have become top contenders in the energy storage market due to their long operating durations and grid stability retention. These energy storage systems experience minimal deterioration from extended exposure to harsh outdoor environments. Moreover, improvements in CAES technology and innovations in gravitational storage have enhanced the cost-effectiveness and feasibility of mechanical storage solutions. Governments worldwide are investing in these technologies, offering subsidies, and implementing policies that promote the achievement of energy transition goals.

REGION

North America is the largest region in the long duration energy storage market

North America is the largest region in the long duration energy storage market. This dominance is supported by the region’s extensive integration of renewable energy sources, particularly solar and wind, which drives the need for efficient long-duration storage solutions to ensure grid reliability. Ambitious decarbonization targets, along with supportive government policies such as tax incentives and storage mandates, further accelerate market adoption. Additionally, significant investments in modernizing aging grid infrastructure are increasing the demand for long-duration technologies to enhance grid stability. The presence of leading market players and continued advancements in flow batteries, thermal storage, and other emerging solutions strengthen the region’s position. Rising energy consumption and a strong focus on energy security continue to propel North America’s growth momentum in the long-duration energy storage market.

LONG DURATION ENERGY STORAGE MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

MAN Energy Solutions (Everllence) is an active participant in the long duration energy storage (LDES) market, leveraging its expertise in turbomachinery, compression systems, and power-to-X technologies to support large-scale, long-duration storage projects. The company provides solutions for thermal energy storage, and hydrogen-based storage systems, enabling reliable, flexible, and efficient long-term energy supply. MAN’s focus on system efficiency, modular design, and durable equipment supports multi-hour to multi-day storage needs essential for grid stability and renewable integration. Strategic collaborations with utilities, project developers, and technology partners strengthen its role in advancing large projects, particularly in regions pursuing deep decarbonization. With growing demand for long-duration storage to balance variable renewable energy, MAN Energy Solutions’ technology portfolio and sector partnerships position it as an important contributor to emerging LDES infrastructure worldwide

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Sumitomo Electric Industries, Ltd. (Japan)

- ESS Tech, Inc. (US)

- Eos Energy Enterprises (US)

- Invinity Energy Systems (England)

- Energy Vault, Inc. (Switzerland)

- MAN Energy Solutions (Germany)

- Highview Power (UK)

- Primus Power (US)

- CMBlu Energy AG (Germany)

- Malta Inc. (US)

- RheEnergise Limited (UK)

- QuantumScape Battery, Inc. (US)

- Form Energy (US)

- SFW (Finland)

- GKN Hydrogen (Italy)

- Alsym Energy Inc. (US)

- Ambri Incorporated (UK)

- VFlowTech Pte Ltd. (Singapore)

- VoltStorage (Germany)

- MGA Thermal Pty Ltd (Australia)

- Rondo Energy, Inc. (US)

- Lina Energy Ltd. (UK)

- e-Zinc Inc. (UK)

- Storelectric LTD. (UK)

- 1414 DEGREES AUSTRALIA (Australia)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.85 Billion |

| Market Forecast in 2030 (Value) | USD 10.43 Billion |

| Growth Rate | CAGR of 13.6% from 2024-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America and Middle East & Africa |

WHAT IS IN IT FOR YOU: LONG DURATION ENERGY STORAGE MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- May 2024 : ESS Tech, Inc. (US) and Burbank Water and Power (US) celebrated the commissioning of BWP's first long-duration energy storage (LDES) system, a 75 kW/500 kWh ESS Energy Warehouse iron flow battery. The system has been installed at BWP's EcoCampus and connected to a 265 kW solar array, powering around 300 homes, thereby playing an important role in a decarbonized grid through iron flow technology. This project supports California's goal of achieving zero-emission electricity by 2045 and shows the significance of LDES for integrating renewable energy.

- January 2024 : Energy Vault Holdings, Inc. (US) entered into a licensing and royalty agreement with Gravitricity (UK) and a South African consortium for deploying its patented gravity energy storage technology and the VaultOS platform in the SADC region. The consortium comprised WBHO, iX Engineers, and Sizana Solutions and focused on storage projects, from utilities to mining and industrial applications, along with microgrids. This partnership is anticipated to generate massive revenues through EPC projects and royalty streams that bank on regional markets that have the potential of crossing 125 GWh by 2035.

- March 2023 : Sumitomo Electric Industries, Ltd. (Japan) launched sEMSA, a cloud-based solution for energy management of grid storage batteries. sEMSA optimizes charging/discharge schedules to maximize profits while ensuring support for applications such as supply-demand balancing and power trading. The system consists of sEMSA servers dedicated to plan optimization and terminal units for on-site control of the battery. sEMSA is designed to stabilize the power grid and enable VPP functionalities, support various battery types, and allow renewable energy integration, which also opens new revenue streams for energy operators.

- January 2021 : EnerSmart Storage LLC, based in the US, invested USD 20 million in Eos Energy Enterprises (US) for the building of ten energy storage facilities in the San Diego region. Each facility is to be powered by a 3-megawatt zinc battery storage system and will feed carbon-free power into California's electric grid, supporting about 2,000 homes per site. It will further the goals set by California for the state's capacity in renewable energy, increase resilience in its grid, and take full advantage of Eos's safe, scalable, and sustainable energy storage technology

Table of Contents

Methodology

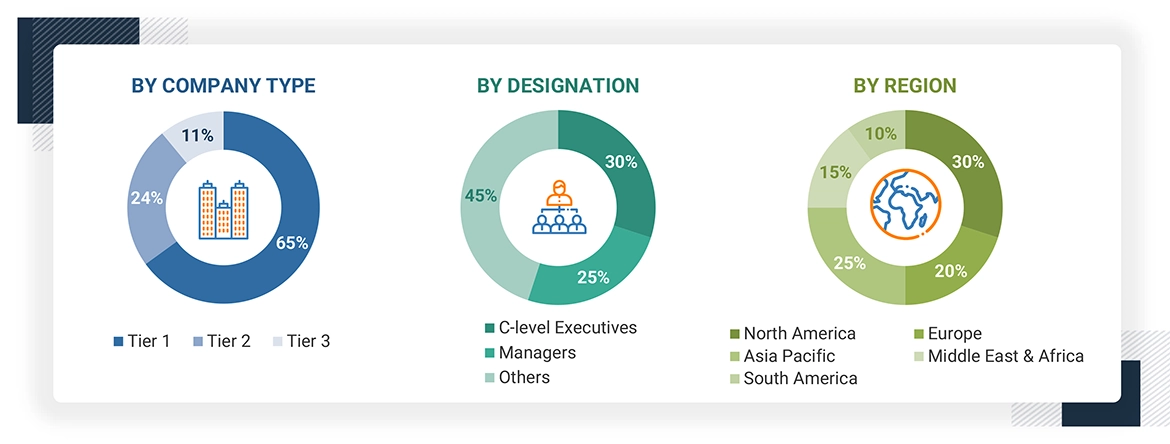

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global long duration energy storage market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

The secondary sources for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases of various companies and associations. Secondary research was mainly used to obtain key information about the supply chain and identify the key players offering long duration energy storage, market classification, and segmentation according to the offerings of the leading players, along with the industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the long duration energy storage market.

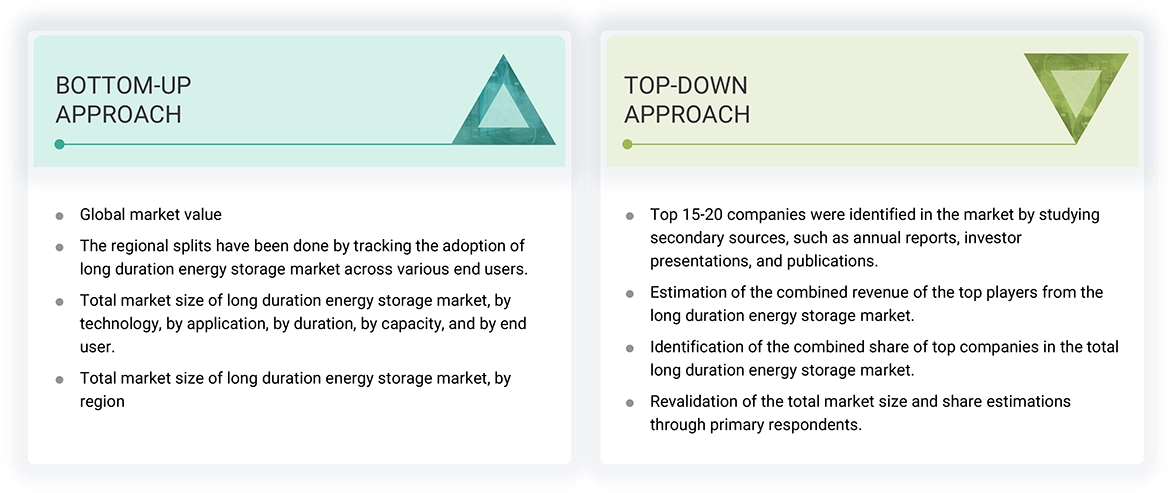

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the market market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes the study of the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the long duration energy storage market.

Long Duration Energy Storage Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—the top-down approach, the bottom-up approach, and expert interviews. When the values arrived at from the three points matched, the data was assumed to be correct.

Market Definition

Long Duration Energy Storage (LDES) refers to energy storage systems capable of storing energy for extended periods, typically over 10 hours. This technology is essential for managing the intermittency of renewable energy sources like solar and wind, allowing for the storage of excess energy generated during peak production times for later use. LDES enhances grid reliability and flexibility, supporting clean energy goals and reducing reliance on fossil fuels. Initiatives from the U.S. Department of Energy aim to significantly reduce LDES costs and promote its development through funding and demonstration projects.

The LDES market is rapidly evolving, driven by government initiatives and private sector investments, with a focus on various technologies such as electrochemical, thermal, and chemical storage. The market for long duration energy storage is defined as the sum of revenues generated by global companies through the sales of their long duration energy storage systems.

Stakeholders

- Long duration energy storage manufacturers

- State and national regulatory authorities

- Organizations, forums, alliances, and associations

- Investors/Shareholders

- Manufacturers’ associations

- Long duration energy storage raw material and component manufacturers

- Long duration energy storage manufacturers, dealers, and suppliers

- Electrical equipment manufacturers’ associations and groups

- Power utilities and other end-user companies

- Consulting companies in the energy and power domain

Report Objectives

- To define, describe, segment, and forecast the long duration energy storage market by technology, by duration, capacity, application, end user, and region, in terms of value.

- To forecast the market sizes for four major regions, namely, North America, Europe, Asia Pacific, South America, and Middle East & Africa, along with their key countries.

- To forecast the long duration energy storage market by region and technology, in terms of volume.

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide the supply chain analysis, trends/disruptions impacting customers’ businesses, market map, ecosystem analysis, tariffs and regulations, pricing analysis, patent analysis, case study analysis, technology analysis, key conferences and events, trade analysis, Porter’s five forces analysis, key stakeholders and buying criteria, and regulatory analysis of the long duration energy storage market

- To analyze opportunities for stakeholders in the long duration energy storage market and draw a competitive landscape of the market

- To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players for the market share, product specifications, and applications.

- To strategically profile key players and comprehensively analyze their market ranking and core competencies.

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, new product launches, partnerships, joint ventures & collaborations, in the long duration energy storage market.

Note: 1. Micromarkets are defined as the further segments and subsegments of the long duration energy storage market included in the report.

2. Core competencies of companies are captured in terms of their key developments and product portfolios, as well as key strategies adopted to sustain their position in the long duration energy storage market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the long duration energy storage market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Long Duration Energy Storage Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Long Duration Energy Storage Market