The research study involved four major activities in estimating the size of the phishing protection market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

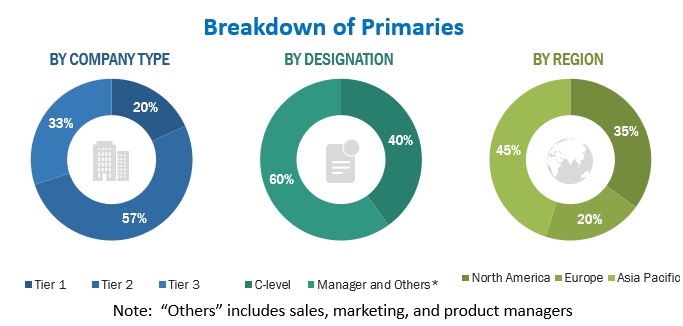

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the phishing protection market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

Market Size Estimation

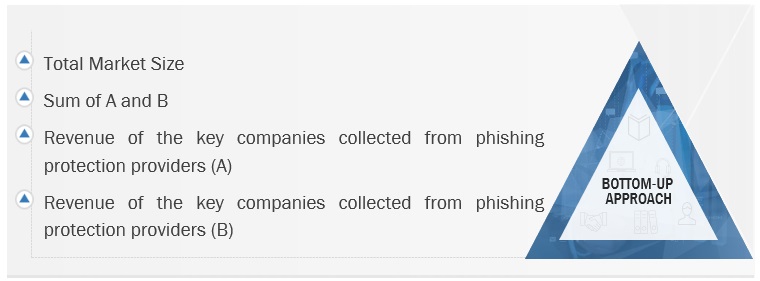

Multiple approaches were adopted to estimate and forecast the phishing protection market. The first approach involved estimating the market size by summating companies’ revenue generated through phishing protection solutions.

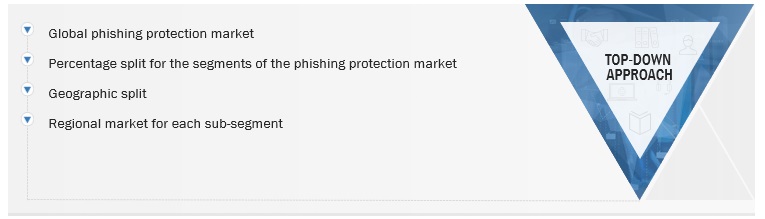

Both top-down and bottom-up approaches were used to estimate and validate the total size of the phishing protection market. The research methodology used to estimate the market size includes the following:

-

Key players in the market have been identified through extensive secondary research.

-

Regarding value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation Methodology-top-down approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The phishing protection market refers to the comprehensive ecosystem of cybersecurity solutions and services designed to detect, prevent, and mitigate phishing attacks. Phishing attacks involve deceptive tactics, often through fraudulent emails, messages, or websites, aiming to trick individuals or organizations into disclosing sensitive information, such as login credentials or financial details. The market encompasses a spectrum of protective measures, including advanced threat detection technologies, email filtering solutions, user awareness training, and incident response mechanisms. As organizations globally grapple with the evolving sophistication of phishing threats, the phishing protection market plays a pivotal role in fortifying digital ecosystems, safeguarding critical data, and ensuring the integrity of communication channels against deceptive and malicious cyber activities.

Key Stakeholders

-

Chief technology and data officers

-

Software and solution developers

-

Integration and deployment service providers

-

Business analysts

-

Information Technology (IT) professionals

-

Investors and venture capitalists

-

Third-party providers

-

Consultants/consultancies/advisory firms

-

Cyber-security firms

The main objectives of this study are as follows:

-

To define, describe, and forecast the phishing protection market based on segment offerings, sub-types, organization sizes, deployment modes, and verticals with regions covered.

-

To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

-

To provide detailed information on the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

-

To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global market.

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global phishing protection market.

-

To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, product offerings, and business strategies; and illustrate the market’s competitive landscape.

-

To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Phishing Protection Market