The study involved four major activities in estimating the current size of the photoacoustic imaging market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial photoacoustic imaging market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the photoacoustic imaging market. The primary sources from the demand side include hospitals and imaging centers, research institutes and academia, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

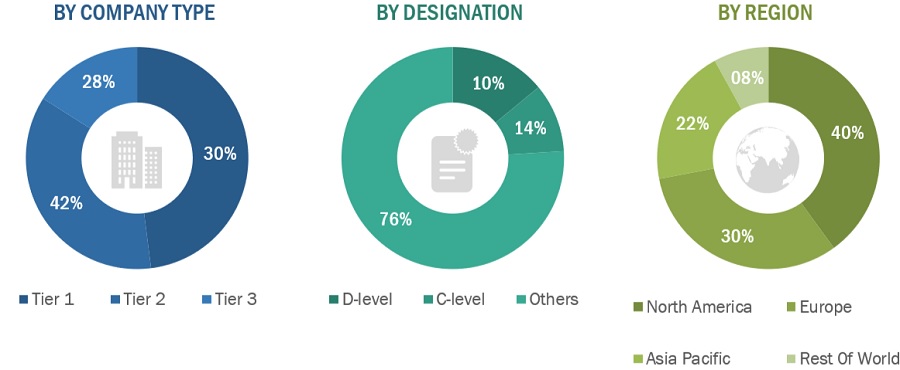

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

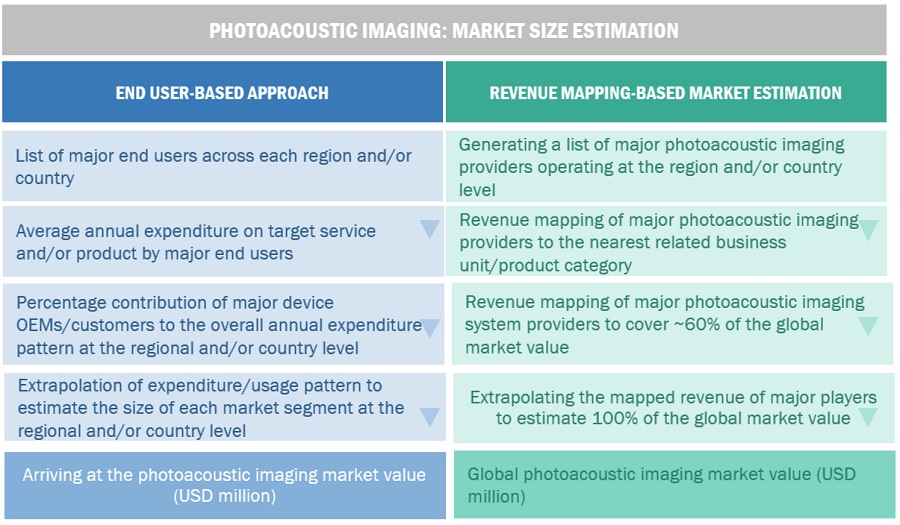

In this report, the global photoacoustic imaging market's size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the photoacoustic imaging business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

-

A list of major players operating in the photoacoustic imaging market at the regional/country level

-

Product mapping of various manufacturers for each type of photoacoustic imaging product at the regional/country level

-

Mapping of annual revenue generated by listed major players from photoacoustic imaging products segments (or the nearest reported business unit/product category)

-

Revenue mapping of major players to cover at least ~60% of the global market share as of 2023

-

Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

-

Summation of the market value of all segments/subsegments to arrive at the global photoacoustic imaging market

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the photoacoustic imaging market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the photoacoustic imaging market was validated using both top-down and bottom-up approaches.

Market Definition

The photoacoustic imaging market refers to the industry segment focused on the development, production, and commercialization of imaging devices and technologies that utilize photoacoustic principles. Photoacoustic imaging combines the advantages of optical and ultrasound imaging techniques, allowing for high-resolution imaging of biological tissues with deep penetration depths. This market encompasses various stakeholders, including manufacturers of photoacoustic imaging systems, research institutions, healthcare providers, and regulatory bodies.

Key Stakeholders

-

Photoacoustic imaging manufacturers, suppliers, and providers

-

Hospitals and imaging firms

-

Contract research organizations (CROs)

-

Academic & private research institutions

-

Research & development (R&D) companies

-

Academic institutions & private research institutions

-

Regulatory agencies

-

Quality control & assurance companies

-

Contract manufacturing organizations (CMOs)

-

Environmental & safety regulatory bodies

Objectives of the Study

-

To define, describe, and forecast the photoacoustic imaging market based on product, technology, type, application, end-user, and region

-

To provide detailed information regarding the major factors influencing the growth potential of the photoacoustic imaging market (drivers, restraints, opportunities, challenges, and trends)

-

To analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the photoacoustic imaging market

-

To analyze key growth opportunities in the photoacoustic imaging market for key stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK,and the RoE), Asia Pacific (Japan, China, India, and the RoAPAC), Rest of world.

-

To profile the key players in the global photoacoustic imaging market and comprehensively analyze their market shares and core competencies

-

To track and analyze the competitive developments undertaken in the global photoacoustic imaging market, such as product launches; agreements; expansions; and mergers & acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present photoacoustic imaging market report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

-

Further breakdown of the Rest of Europe photoacoustic imaging into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

-

Further breakdown of the Rest of Asia Pacific photoacoustic imaging into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

Growth opportunities and latent adjacency in Photoacoustic Imaging Market