The study involved four major activities in estimating the current size of the racing simulator market. Exhaustive secondary research was done to collect information on the market and its sub-segments. The next step was to validate these findings and assumptions and size them with industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. After that, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been used to identify and collect information useful for an extensive commercial study of the racing simulator market. The secondary sources referred to in this research study include investor presentations and annual reports of Key market players, Racing Simulator Component Manufacturer Associations, Corporate Filings (such as annual reports, investor presentations, and financial statements), Trade, Business, and related Associations, Racing Simulator Manufacturers’ white papers/research papers, Racing Simulator Blogs/Articles/Magazines, Sim Racing Expo, Virtual Motorsports Racing League (VMRL), The National Training & Simulation Association (NTSA), International Sim Racing Association (ISRA), International Sim Racing Association (ISRA), Sim Racing Association Singapore, Driving Simulation Association (DSA). Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

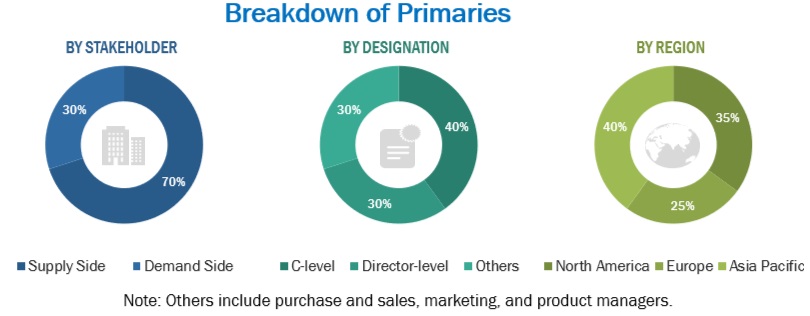

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as market penetration of racing simulators by simulator type at the country level, by component, by offering, by vehicle type, by sales channel, and by application at the regional level. Data triangulation was then done with the information gathered from secondary research. Stakeholders from the demand and supply side have been interviewed to understand their views on the points mentioned above.

Primary interviews have been conducted with market experts from the demand and supply side across four major regions: North America, Europe, Asia Pacific, and the Rest of the World. Primary data has been collected through questionnaires, emails, and telephonic interviews. In canvassing primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the conclusions described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

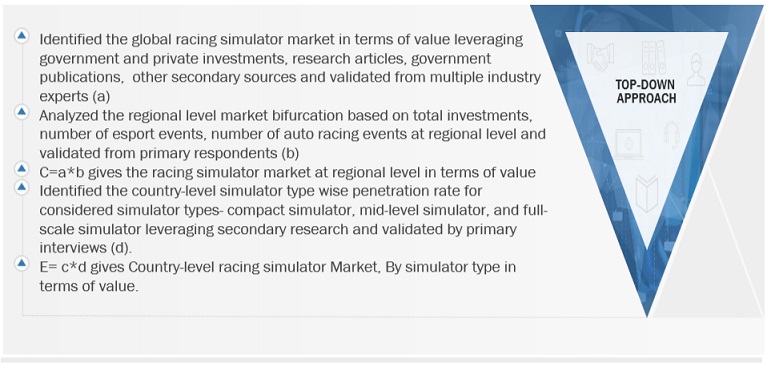

A detailed market estimation approach was followed to estimate and validate the value of the racing simulator market and other dependent submarkets, as mentioned below:

-

Key players in the racing simulator market were identified through secondary research, and their global market shares were determined through primary and secondary research.

-

The research methodology included studying annual and quarterly financial reports, regulatory filings of major market players (public), and interviews with industry experts for detailed market insights.

-

All industry-level penetration rates, percentage shares, splits, and breakdowns for the racing simulator were determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

-

Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been considered while calculating and forecasting the market size.

Racing Simulator Market: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and sub-segments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics of each market segment and sub-segment. The data was triangulated by studying several factors and trends.

Market Definition:

Racing Simulator, often called sim racing, is a form of virtual motorsport where participants use realistic racing simulators to simulate the experience of driving real-world vehicles in a simulated environment. Sim racing involves using dedicated hardware, such as steering wheels, pedals, and sometimes motion platforms, and sophisticated simulation software replicating the physics, dynamics, and visuals of actual race cars and tracks. In the virtual world, participants can compete in various racing disciplines, including Formula 1, NASCAR, endurance racing, and more. Sim racing is valued for providing a realistic and immersive driving experience, allowing enthusiasts and professional drivers alike to hone their skills, compete in virtual championships, and experience the thrill of motorsports without the physical risks associated with real-world racing.

Key Stakeholders:

-

Sales Head

-

Marketing Head

-

Design Manager

-

R&D Head

Report Objectives

-

To define, segment, analyze, and forecast (2024–2030) the racing simulator market size in terms of value (USD million) based on:

-

By Simulator Type (Compact/Entry-level Simulator, Medium-level Simulator, and Full-Scale Simulator)

-

By Offering Type (Hardware and Software)

-

By Vehicle Type (Passenger car and Commercial Vehicle)

-

By Component Type (Steering Wheel, Gearbox Shifters, Seat, Pedal Sets, Monitor Stand, Cockpits, and Others )

-

By Sales Channel (Online and Offline)

-

By Application Type (Home/Personal use and Commercial)

-

By Region (North America, Europe, Asia Pacific, and the Rest of the World (RoW))

-

To analyze the recession's impact on the racing simulator market

-

To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the racing simulator market

-

To study the following concerning the market

-

Supply Chain Analysis

-

Market Ecosystem

-

Technology Analysis

-

Trade Analysis

-

Case Study Analysis

-

Patent Analysis

-

Buying Criteria

-

To estimate the following with respect to the market

-

Average Price Analysis

-

Market Share Analysis

-

To analyze the competitive landscape and prepare a competitive evaluation quadrant for the global racing simulator market players.

-

To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities conducted by key racing simulator market industry participants.

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

The following customization options are available for the report:

-

Racing Simulator Market, By Offerings, By Country

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

Europe Others

-

North America

-

Rest of the World

-

Brazil

-

Argentina

-

UAE

-

Rest of the World Others

Growth opportunities and latent adjacency in Racing Simulator Market