The second life EV battery market is estimated at ~25-30 GWH in 2025 and is projected to reach ~330-350 GWH in 2030 at a CAGR of ~65% during the forecast period. Electric vehicles (EVs) have experienced remarkable growth over the past three to four years, driven by strong demand, particularly in the passenger vehicle segment. As global electric passenger & commercial vehicle sales surge to exceed 33-35 million units by 2030, second life applications for EV batteries are increasingly emerging. With Asia Pacific leading in sales share (~68%), followed by Europe and the US, the rapidly expanding EV fleet sets a solid base for repurposing used batteries beyond their initial automotive use. This growing market spans diverse sectors, including industrial, telecom, public utilities, residential storage, and EV charging infrastructure, and is expected to see significant growth by 2030. The expansion of EVs worldwide thus offers strong momentum for developing and commercializing second life EV battery technologies and applications.

Attractive Opportunities in the Second Life EV Battery Market

The presence of major battery manufacturers like CATL, BYD, LG HEM, Panasonic, and Samsung SDI in the Asia Pacific region will act as a driver for the market if they can enter it during the forecast period.

Cost advantage over new batteries is likely to create an opportunity for the market to propel in emerging markets.

Increasing need for sustainable energy storage is expected to drive the global market as second-life batteries are well-suited for stationary energy storage solutions that stabilize electricity grids and provide backup power.

Improved BMS technology increases the efficiency, safety, and reliability of repurposed batteries, easing concerns about performance and risk.

Second Life EV Battery Market Dynamics

DRIVER: Increased and rising EV sales

The rapid rise in the adoption of battery electric vehicles (BEVs) globally lays a strong foundation for the second life EV battery market. According to IEA statistics, total passenger EV stocks had grown sixfold from 6.8 million in 2020 to 39 million in 2024 at an explosive CAGR of 54.8% from 2020 to 2024. The projected surge in EV stock is expected to exceed 245 million light-duty EVs by 2030, significantly expanding the pool of used EV batteries. Considering 8 years of average life, nearly 4-6 million EVs will reach the end of their first life by 2027-2028, effectively translating to 250-300 GWH of battery capacity available by that time. Further, a continuous increase in EV sales would add up to EV batteries reaching the end-of-life. As light and heavy-duty electric vehicle deployment expands, which is estimated to reach 33-35 million units by 2030, that would further add to the number of EV batteries reaching the end of their life. These batteries would fulfil the desired performance and can be highly deployed for stationary energy storage, telecom backup, and industrial power solutions, which is set to increase. As it can act as a cost-effective catalyst with sustainable energy storage options, addressing both the growing energy demands and circular economy goals, global economies may aggressively electrify their fleets and scale up their battery ecosystem to become major contributors and beneficiaries of this evolving second life EV battery reuse ecosystem.

OPPORTUNITY: Opportunities in energy storage systems (ESS) and backup power solutions

The growing demand for energy storage systems (ESS) and backup power solutions is a significant opportunity for the second life EV battery market. As more renewable energy sources like solar and wind are integrated into power systems, there is a persistent need for affordable, scalable energy storage to balance supply and demand. Second life EV batteries, which retain up to 70–80% of their original capacity after vehicle use, offer a cost-effective alternative to new batteries for stationary storage. These batteries can be repurposed into grid-scale ESS, commercial backup systems, and rural microgrids, providing clean and reliable power at a lower cost. Additionally, applications in telecom, data centers, factories, and off-grid communities expand their utility. For OEMs and battery suppliers, repurposing used batteries into ESS supports circular economy goals and regulatory compliance, unlocking new revenue streams while delaying costly recycling.

CHALLENGE: Falling prices of EV batteries

The rapidly falling prices of new EV batteries will pose a significant challenge to the growth of the second-life EV battery market. According to BloombergNEF, the average cost of lithium-ion battery packs dropped to USD 139/kWh in 2023 from over USD 1,200/kWh in 2010, and is projected to fall below $100/kWh by 2026. As the cost gap between new and second-life batteries reduces, the economic incentive to choose repurposed batteries weakens, especially with major concerns over performance degradation, reduced warranties, and lack of standardization. For many buyers, particularly in grid-scale or commercial applications, new batteries' reliability and longer lifespan will overshadow the marginal cost savings offered by used ones (repurposed batteries). This fall in the prices of new batteries could limit the addressable market for second-life batteries, particularly in regions where battery prices fall faster.

Asia Pacific is expected to offer lucrative opportunities for the second life EV battery installation base by 2032.

The Asia Pacific region is poised to have one of the fastest installation bases. It is likely to capture a substantial share of second-life EV batteries toward the end of the forecast period. This promising trend will be mainly due to its leadership position in EV adoption, supportive regulatory measures, and robust EV manufacturing bases. EVs from prominent Chinese OEMs like BYD, NIO, XPeng, Geely Auto, and Chery, among others, have gained extensive demand and subsequently have a large pool of retired batteries. The supportive government incentives and tax programs will encourage the usage of second-life EV batteries for grid storage and renewable energy integration. Application-wise, grid-scale storage, distributed energy, and commercial & industrial applications would have flourishing demand as the region is already experiencing some of these application-wise demand by the regional players along with major OEMs such as Toyota Motor, BYD, MG Motor, and Nissan Motor Corporation. Additionally, the regional players must develop protocols for battery health diagnostics and standardization to support second-life integration. EV OEMs, utility service providers, and government agencies collaborate across borders to expand pilot projects into large-scale, utility-grade energy storage solutions. By implementing battery passports, traceability systems, and financial incentives, the region is expected to experience a noteworthy growth in second-life EV battery reuse by the end of 2030.

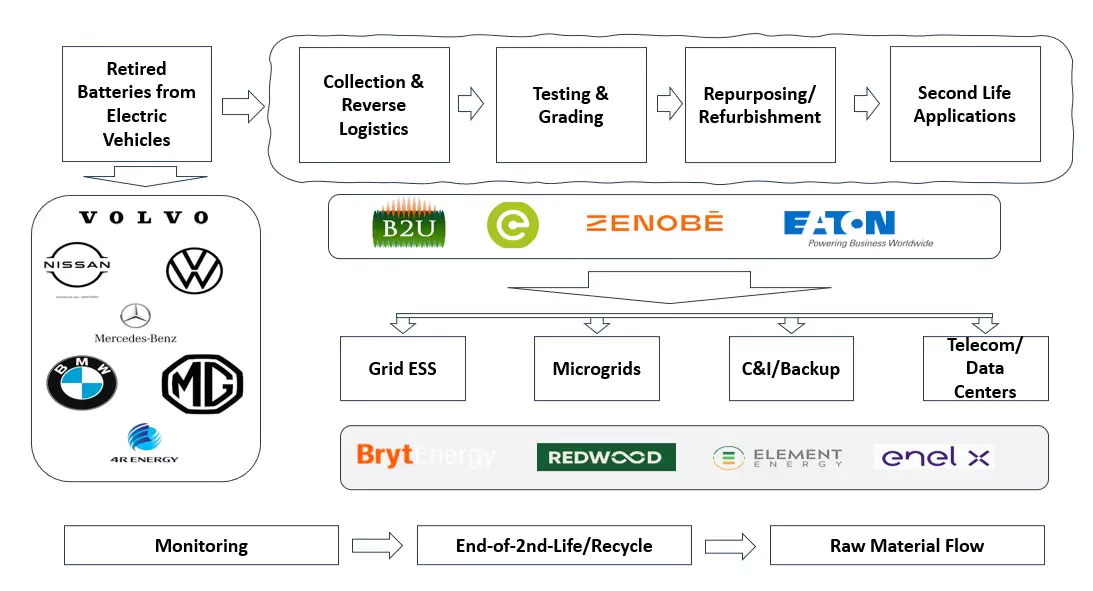

Second Life EV Battery Market Ecosystem

An integrated ecosystem for second-life EV batteries is built on a circular value chain that transitions batteries from automotive use into diverse stationary energy storage applications before final recycling. After their automotive life, when the state of health falls below 80%, batteries are collected, tested, and repurposed for new applications, such as residential backup, commercial storage, and grid-scale energy systems. Policies like Extended Producer Responsibility (EPR) and deposit-refund schemes incentivize manufacturers and consumers to return batteries for certified assessment and refurbishment, ensuring safe and efficient reuse.

Recent Developments of Second Life EV Battery Market

-

In November 2023, Toyota Motor Corporation collaborated with Redwood to source recycled cathode active material (CAM) and anode copper foil for future battery manufacturing in North Carolina. Through this collaboration, Toyota will expand collection, recycling, and repurposing efforts for end-of-life batteries.

-

In October 2022, Toyota Motor Corporation and JERA Co., Inc. (Japan) began working on a joint project to build a commercial-scale stationary energy storage system using second-life Toyota vehicle batteries.

-

In March 2025, Volkswagen Group and Huayou Recycling (China) launched a cascade mobile energy storage system using retired Volkswagen EV batteries. The first deployment of the mobile energy storage system is at Huayou’s industrial park, and further expansion is planned for Volkswagen’s China production bases.

-

In January 2025, BMW Group Malaysia announced new initiatives to develop and expand the ecosystem for EV and PHEV battery recycling and second-life applications. This included partnerships with local charge point operators and holistic circularity projects.

Key Market Players

List of Top Second Life EV Battery Market Companies

The Web Content Management (WCM) Market is dominated by a few major players that have a wide regional presence. The major players in the Second Life EV Battery Market are

Key Questions Addressed by the Report

The major players include Tesla, Volvo, Toyota Motor Corporation, BMW Group, Nissan Motor Corporation, Connected Energy, B2U Storage Solutions, and Rejoule.

Rapid expansion of electric vehicles & EV stocks

Increasing need for sustainable energy storage

Cost advantage over new batteries

Defining precise end-of-life criteria

Battery health assessment and testing methods

Supply chain and sourcing challenges

Asia Pacific is the largest second life EV battery market due to the region's higher sales of EVs.

The current size for actual installations of second life batteries is around 3-5 GWH.

Personalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Request A Free Customisation

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Second Life EV Battery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Customized Workshop Request

Growth opportunities and latent adjacency in Second Life EV Battery Market