The research study involved four major activities in estimating the size of the SiC-on-Insulator (SiCOI) film market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the SiC-on-Insulator (SiCOI) film report, the top-down as well as bottom-up approaches have been used for the estimation of the global market size, along with several other dependent submarkets. The major players in the market were identified with the help of extensive secondary research and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

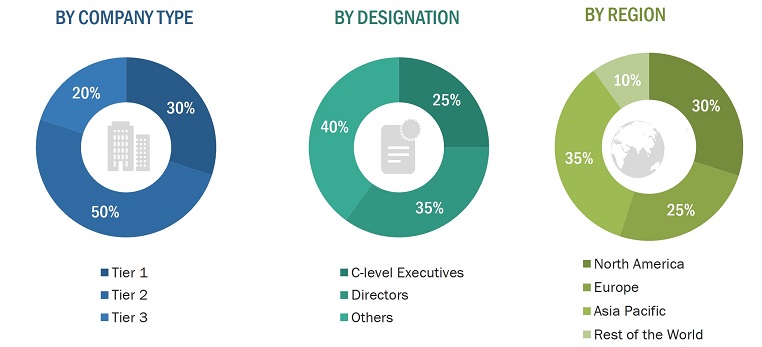

In primary research, various sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the SiC-on-Insulator (SiCOI) film market ecosystem.

Extensive primary research has been conducted after analyzing the SiC-on-Insulator (SiCOI) film market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand and supply side vendors across three regions: North America, Europe, and Asia Pacific. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

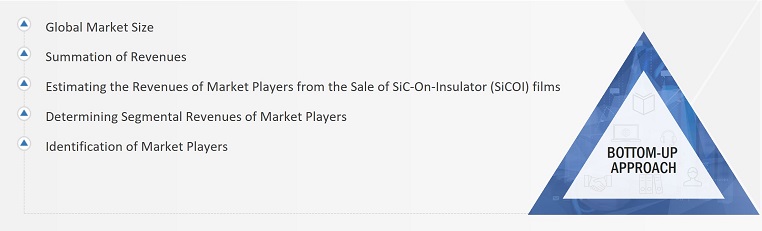

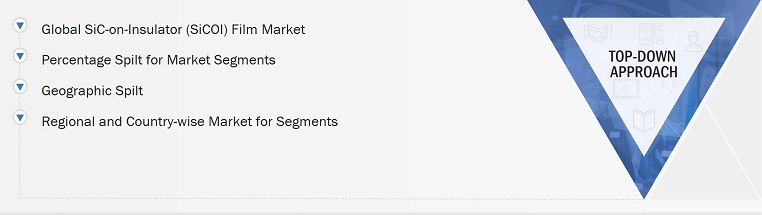

In the market engineering process, both top-down and bottom-up approaches along with data triangulation methods have been used to estimate and validate the size of the SiC-on-Insulator (SiCOI) film market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

-

Identifying different stakeholders in the SiC-on-Insulator (SiCOI) film market that influence the entire market, along with participants across the value chain.

-

Analyzing major manufacturers of SiC-on-Insulator (SiCOI) film and studying their product portfolios

-

Analyzing trends related to the adoption of SiC-on-Insulator (SiCOI) films.

-

Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, collaborations, acquisitions, agreements, contracts, cooperations, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

-

Carrying out multiple discussions with key opinion leaders to identify the adoption trends of S SiC-on-Insulator (SiCOI) films.

-

Segmenting the overall market into various other market segments

-

Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-down Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall SiC-on-Insulator (SiCOI) market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

The SiC-on-Insulator (SiCOI) film market encompasses the commercialization of SiC-based semiconductor materials that are fabricated on insulating substrates. This combination of SiC's unique properties with the benefits of an insulating layer results in films with superior electrical, thermal, and power handling capabilities, making them well-suited for a wide range of applications. These SiCOI films find extensive use in power electronics, radio frequency (RF) and microwave devices, optoelectronics, and high-temperature electronics. They cater to industries such as electric vehicles, renewable energy, communications, and industrial automation. The growing demand for energy-efficient, high-performance, and reliable power electronics, coupled with the increasing adoption of wide-bandgap semiconductor technologies, is driving the global SiC-on-Insulator (SiCOI) film market.

Key Stakeholders

-

Raw material suppliers

-

Design tool and fabrication equipment vendors

-

SiC wafer manufacturers

-

Wafer equipment manufacturers

-

Integrated device manufacturers (IDMs)

-

Pure-play foundry vendors

-

Non-pure-play (IDM) foundry vendors

-

Electronic design automation (EDA) vendors

-

Fabrication players

-

Semiconductor intellectual property vendors

-

Original device manufacturers (ODMs) (discrete and chip manufacturers)

-

Original equipment manufacturers (OEMs) (electronic equipment manufacturers)

-

Assembly, testing, and packaging vendors

-

Distributors and Resellers

-

End users

The main objectives of this study are as follows:

-

To define, analyze, and forecast the SiC-on-Insulator (SiCOI) film market size, by substrate material, wafer size, technology route, and region, in terms of value.

-

To estimate the market size for various segments with respect to three main regions, namely, North America, Europe, and Asia Pacific.

-

To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the SiC-on-Insulator (SiCOI) film market

-

To study the complete supply chain and related industry segments for the SiC-on-Insulator (SiCOI) film market

-

To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze the supply chain, market ecosystem; trends/disruptions impacting customer’s business; technology analysis; Porter’s five forces model; trade analysis; patent analysis; key conferences & events; and regulations related to the SiC-on-Insulator (SiCOI) film market.

-

To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market.

-

To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders.

-

To analyze competitive developments such as product launches, partnerships, agreements, collaborations, contracts, acquisitions, cooperations, expansions, and research & development (R&D) activities carried out by players in the SiC-on-Insulator (SiCOI) film market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

-

Country-wise breakdown for North America, Europe, and Asia Pacific

Growth opportunities and latent adjacency in SiC-on-Insulator (SiCOI) Film Market