This research study conducted on the small caliber ammunition market involved extensive use of secondary sources, directories, and databases such as D&B Hoovers, the Global Firepower, the Small Arms Survey, UN COMTRADE, and Factiva to identify and collect information relevant to the market. Details regarding the procurement and consumption patterns of military and homeland security applications in terms of contracts, supply agreements, and joint ventures, among others, were also available only for a limited set of countries.

Thus, manufacturer websites and annual reports, published news articles, defense blogs, government publications of different countries, and documents published by RAND Corporation (US), among others, were also referred to and used as a part of secondary research during the course of the study.

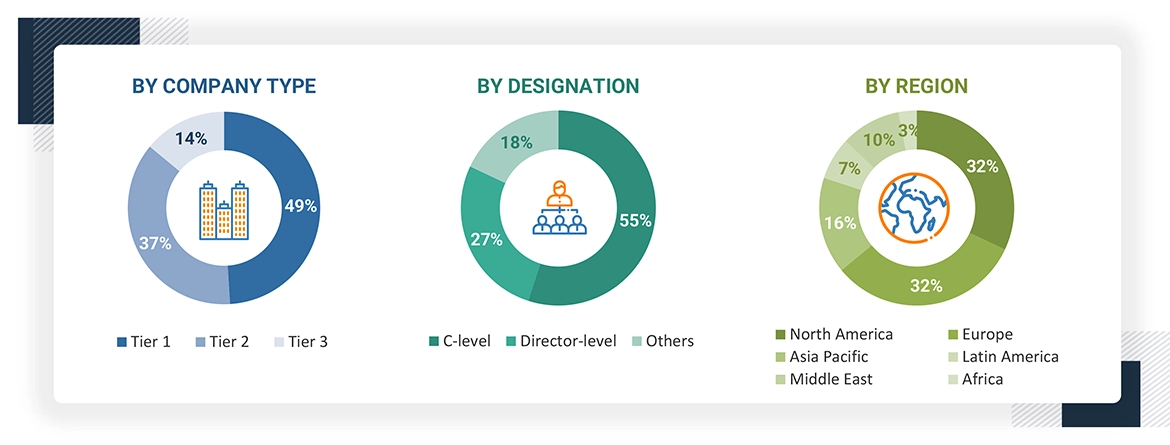

Primary sources considered included industry experts from the concerned market as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. Small Caliber Ammunition is a sensitive topic, and therefore, several challenges were faced while conducting primary research.

Secondary Research

Secondary sources that were referred to for this research study on the small caliber ammunition market included government sources such as the US Department of Defense (DoD); defense budgets; military modernization program documents; corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the small caliber ammunition market, which was further validated by primary respondents.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as chief X officers (CXOs), vice presidents (VPs), directors, regional managers, and business development and product development teams, distributors, and vendors.

Extensive primary research was conducted after obtaining information about the current scenario of the ammunition market through secondary research. Several primary interviews were conducted with market experts from both demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

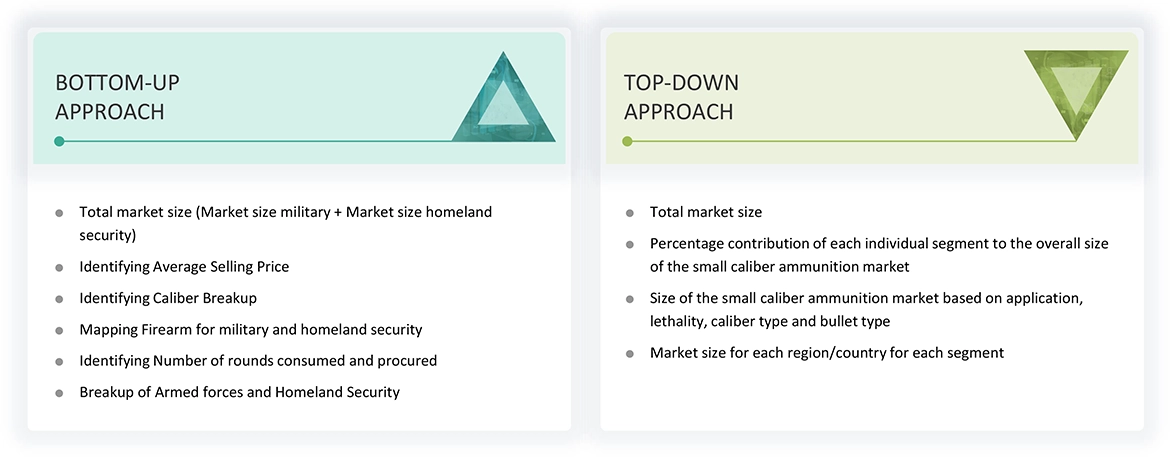

Both top-down and bottom-up approaches were used to estimate and validate the size of the small caliber ammunition market. The research methodology used to estimate the market size included the following details:

-

Key players in the small caliber ammunition market were identified through secondary research, and their market share was determined through primary and secondary research. This included the study of annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the ammunition market.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the small caliber ammunition market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall size of the small caliber ammunition market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented wherever applicable to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments.

The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches. The following figure indicates the market breakdown structure and data triangulation procedure that was implemented in the market engineering process to make this report on the small caliber ammunition market.

Market Definition

Ammunition (informally known as ‘ammo’) is the material fired, scattered, dropped, or detonated from a weapon. Small arms ammunition is primarily cartridge-based. Described in military terms as a 'round' of ammunition, it comprises a cartridge case, bullet, propellant, and primer. Ammunition is available in a range of sizes and types and is often designed to work only in specific weapon systems. Small caliber ammunition is ammunition of .50 caliber and below and varies in size or caliber. Contemporary military ammunition follows standards originally set by NATO or the former Warsaw Pact. This study focuses on small caliber ammunition such as 4.6x30mm, 9x19mm Parabellum, 5.56x45mm, 7.62x51mm, 12.7x99mm, .223 Remington, .300 Winchester Magnum, .308 Winchester, .338 Lapua Magnum, .338 Norma Magnum, and .50 BMG.

Small caliber ammunition refers to rounds that are typically used in handheld small arms and light weapons including diameters up to 14.5mm. This category includes various types such as rimfire and centerfire cartridges, which are used in a wide array of applications from civilian sport shooting and hunting to military and law enforcement operations. The market includes the production, distribution, and technological development of the small caliber ammunition types, focusing on advancements in bullet design, accuracy, and materials to meet specific user requirements while adhering to regulatory standards

Key Stakeholders

-

Armed Forces

-

Defense Regulatory Bodies

-

Law Enforcement Agencies

-

Home Ministries/Ministries of Interior

-

Ammunition Manufacturers

-

Component Manufacturers

-

Distributors and Suppliers

-

Research Organizations, Forums, Alliances, and Associations

Report Objectives

-

To define, describe, segment, and forecast the size of the small caliber ammunition market based on application, caliber type, bullet type, lethality, and region

-

To forecast the size of different segments of the market with respect to various regions, including North America, Europe, Asia Pacific, Middle East, Latin America and Africa along with key countries in each of these regions

-

To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

-

To identify technology trends that are currently prevailing in the small caliber ammunition market

-

To provide an overview of the regulatory landscape with respect to ammunition regulations across regions

-

To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

-

To analyze opportunities in the market for stakeholders by identifying key market trends

-

To profile key market players and comprehensively analyze their market share and core competencies2

-

To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, new service launches, contracts, and partnerships, adopted by leading market players

-

To identify detailed financial positions, key products, and unique selling points of leading companies in the market

-

To provide a detailed competitive landscape of the small caliber ammunition market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the market segments at country-level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Small Caliber Ammunition Market