The study involved four major activities in estimating the current size of the Space Debris Removal Market. Exhaustive secondary research was done to collect information on the space debris removal market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the space debris removal market.

Secondary Research

The market ranking of companies was determined using secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies the performance on the basis of the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study included financial statements of companies offering space debris removal products and services and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the space debris removal market, which was validated by primary respondents.

Primary Research

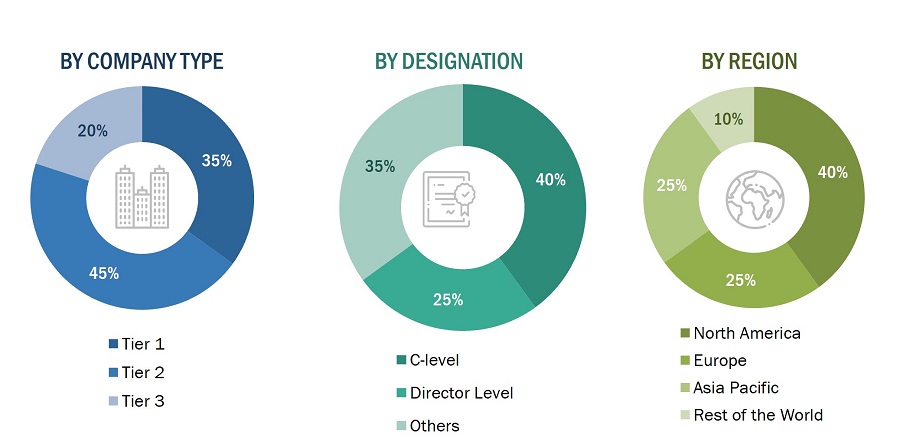

Extensive primary research was conducted after acquiring information regarding the space debris removal market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, ROW which includes the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

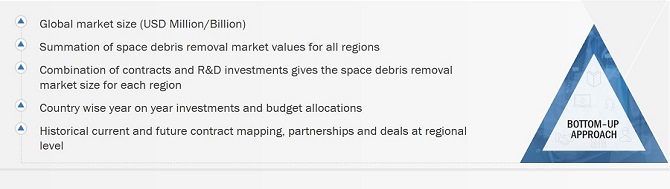

The market sizing of the market was undertaken from the demand side. The market was upsized at a regional level based on procurements and missions planned by the country. Such procurements provide information on each application demand aspects of space debris removal.

Note: An analysis of technological, funding, year-on-year investments, and operational cost was carried out to arrive at the CAGR and understand the market dynamics of all regions in the report. The market share for all technique, orbit, operation, and end user was based on the recent and upcoming planned missions of space debris removal in every region from 2023 to 2028.

Space Debris Removal Market Size: Bottom-up Approach

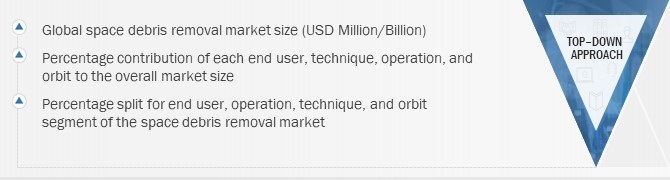

Space Debris Removal Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure that was implemented in the market engineering process to make this report on the space debris removal market.

Market Definition

Space debris removal refers to the strategic process of eliminating defunct satellites, spent rocket stages, and fragments from space orbits and the techniques to safely deorbit the satellites or spacecrafts after their mission. This burgeoning industry aims to mitigate orbital congestion, safeguard operational satellites, and ensure sustainable space exploration. By deploying innovative technologies and retrieval strategies, companies engage in the retrieval, capture, and disposal of space debris, fostering a cleaner orbital environment for continued commercial satellite launches and enhancing the long-term viability of space activities.

Key Stakeholders

-

Manufacturers of space debris removal systems and solutions

-

System Integrators

-

Original Equipment Manufacturers (OEM)

-

Space Organizations

-

Regulatory Authorities

Report Objectives

-

To define and describe the Space Debris Removal market based on debris size, orbit, operation, technique, end user, and region.

-

To indicate the size of the various segments of the Space Debris Removal market based on four regions—North America, Europe, Asia Pacific, Rest of the world—along with key countries in each of these regions.

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market.

-

To determine industry trends, market trends, and technology trends prevailing in the market

-

To analyze micro markets concerning individual technological trends, prospects, and their contribution to the overall market

-

To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market.

-

To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

-

To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

-

Additional country-level analysis of the Space Debris Removal Market

-

Profiling of other market players (up to 5)

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the Space Debris Removal Market.

Growth opportunities and latent adjacency in Space Debris Removal Market