The study involved four major activities in estimating the current size of the surgical suction instruments market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the surgical suction instruments market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the surgical suction instruments market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

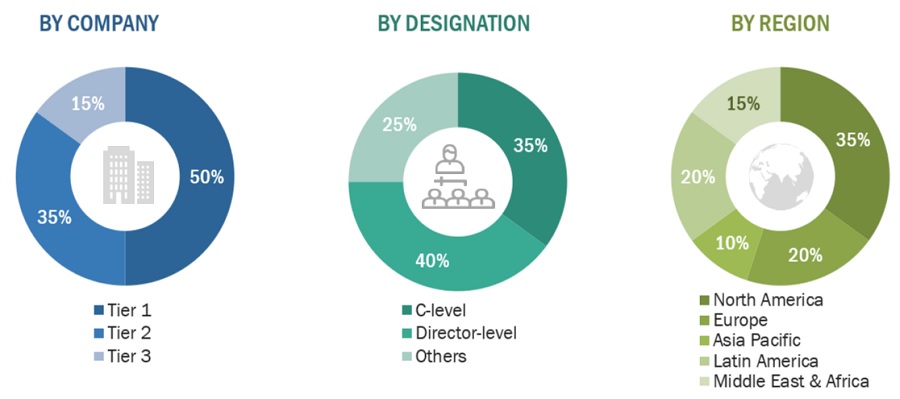

A breakdown of the primary respondents for the surgical suction instruments market is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include Others include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

The research methodology used to estimate the size of the surgical suction instruments market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the surgical suction instruments market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall surgical suction instruments market was obtained from secondary data and validated by primary participants to arrive at the total surgical suction instruments market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall surgical suction instruments market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Surgical suction instruments Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Surgical suction instruments Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Surgical suction instruments are specialized medical devices used during surgery to remove fluids, blood, smoke, and debris from the surgical site. They play a critical role in maintaining a clear operative field, promoting efficient surgery, and improving patient outcomes. Surgical suction instruments work by creating a partial vacuum through a tubing system connected to a suction pump. The tip of the instrument is placed near the area requiring suction, and the fluids or debris are drawn into the tubing and disposed of in a collection canister.

Key Stakeholders

-

Manufacturers and distributors of medical devices

-

Manufacturers and distributors of medical device components

-

Surgical suction instruments companies

-

Healthcare institutes

-

Diagnostic laboratories

-

Hospitals and clinics

-

Academic institutes

-

Research institutes

-

Government associations

-

Market research and consulting firms

-

Venture capitalists and investors

Objectives of the Study

-

To define, describe, segment, analyze, and forecast the global surgical suction instruments market by type, usability, application, end user and region

-

To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

-

To analyze micro markets concerning individual growth trends, prospects, and contributions to the overall market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

-

To forecast the size of the surgical suction instruments market in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa and GCC countries.

-

To profile the key players in the surgical suction instruments market and comprehensively analyze their core competencies.

-

To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches and approvals in the surgical suction instruments market.

-

To analyze the impact of the recession on the surgical suction instruments market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

-

Further breakdown of the Rest of Asia Pacific surgical suction instruments market into Indonesia, Philippines, Vietnam, Hong Kong, and other countries

-

Further breakdown of the Rest of Europe surgical suction instruments market into Belgium, Russia, the Netherlands, Switzerland, and other countries.

-

Further breakdown of the Rest of Latin America surgical suction instruments market into Argentina, Peru, and other countries.

Growth opportunities and latent adjacency in Surgical Suction Instruments Market