The study involved four major activities in order to estimate the current size of the thermo compression forming market. Exhaustive secondary research was conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the supply chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource; and publications and databases from associations, American Composites Manufacturers Association, Plastics Industry Association (PLASTICS), American Mold Builders Association, International Special Tooling & Machining Association, and British Plastics Federation.

Primary Research

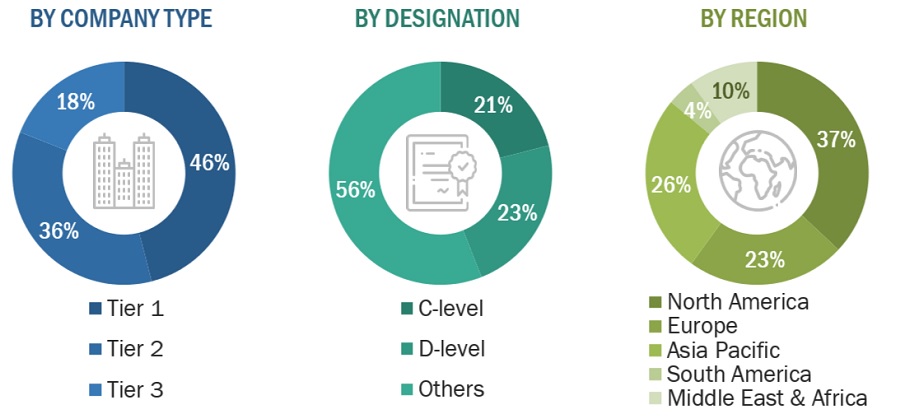

Extensive primary research was carried out after gathering information about thermo compression forming market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the thermo compression forming market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, application, and region.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

THERMO COMPRESSION FORMING MANUFACTURERS

|

|

FLEXTECH

|

The Platinum Tool Group

|

|

Janco, Inc.

|

Chicago Gasket Co.

|

|

Core Molding Technology

|

Haysite

|

|

UFP Technologies, Inc.

|

Linecross

|

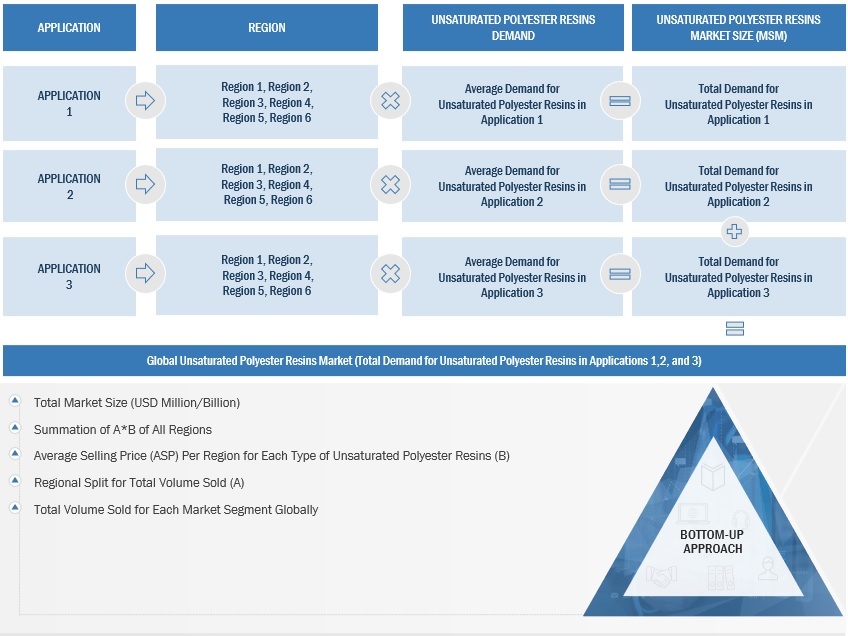

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the thermo compression forming market. The market sizing of the thermo compression forming market was undertaken from the demand side. The market size was estimated based on market size for thermo compression forming in various technology.

Global Thermo Compression Forming Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Thermo Compression Forming Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

“Thermo compression forming market encompasses the production, distribution, and utilization of technology and equipment that use heat and pressure to shape and bond materials, primarily polymers and composites, into desired forms and structures," according to the American Composites Manufacturers Association. Thermo compression forming is widely used in the automotive, construction, aerospace, electronics, and medical sectors. It is highly implemented for its capabilities to manufacture components that are durable, lightweight, and high-strength. This market includes a variety of materials that can be molded utilizing thermo compression processes, including as composite materials and thermoplastics.

Key Stakeholders

-

Thermo compression forming providers

-

Raw material suppliers

-

Manufacturing technology providers

-

Industry associations

-

Stakeholders in the forming/molding industry

-

Traders, distributors, and suppliers of thermo compression forming

-

NGOs, government bodies, regional agencies, and research organizations

Report Objectives

-

To describe and forecast the thermo compression forming market in terms of value and volume

-

To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the market growth

-

To analyze and forecast the market size based on foam type, end-use industry, and region

-

To forecast the thermo compression forming market size for North America, Europe, Asia Pacific, South Africa, and the Middle East & Africa

-

To strategically analyze micromarkets1 concerning individual growth trends, growth prospects, and their contributions to the overall market

-

To assess the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

-

To analyze competitive developments, such as acquisitions, product launches, investments, expansions, agreements, collaborations, and partnerships, in the market

-

To strategically profile the key players and comprehensively evaluate their market shares and core competencies

Based on foam type, the thermo compression forming market has been segmented as follows:

-

Thermoplastic Foams

-

Needle-Punch Nonwovens

-

Light Weight Glass Mat Thermoplastic

Based on End-use Industry, the thermo compression forming market has been segmented as follows:

-

Automotive

-

Aerospace

-

Medical

-

Construction

-

Electrical & Electronics

-

Other End-use Industries

Based on the region, the thermo compression forming market has been segmented as follows:

-

Asia Pacific

-

Europe

-

North America

-

Middle East & Africa

-

South America

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

-

Further breakdown of a specific region of the thermo compression forming market

-

Detailed analysis and profiling of additional market players (up to five)

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the thermo compression forming market

Growth opportunities and latent adjacency in Thermo Compression Forming Market