The study encompassed primary tasks to determine the present and future scope of the vehicle subscription service product portfolio of OEMs and third-party providers. Initially, extensive secondary research was conducted to gather data on the market, related sectors, and overarching industries. Subsequently, primary research involving industry experts across the value chain corroborated and validated these findings and assumptions. The complete market size was estimated using a bottom-up methodology. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

Secondary sources include the company’s annual reports/presentations, industry association publications, directories, technical handbooks, the International Energy Agency, and databases used to identify and collect information for an extensive study of OEMs and third-party providers. The sources used while estimating the market sizing are corporate filings (such as annual reports, investor presentations, and financial statements), automotive sales databases, and government websites. Secondary data was collected and analyzed to determine the overall market size, and was further validated through primary research. The primary sources—experts from related industries, OEMs, and third-party vehicle subscription providers—were interviewed to obtain and verify critical information and assess prospects and market estimations. Historical sales data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, which is further validated by primary research.

Primary Research

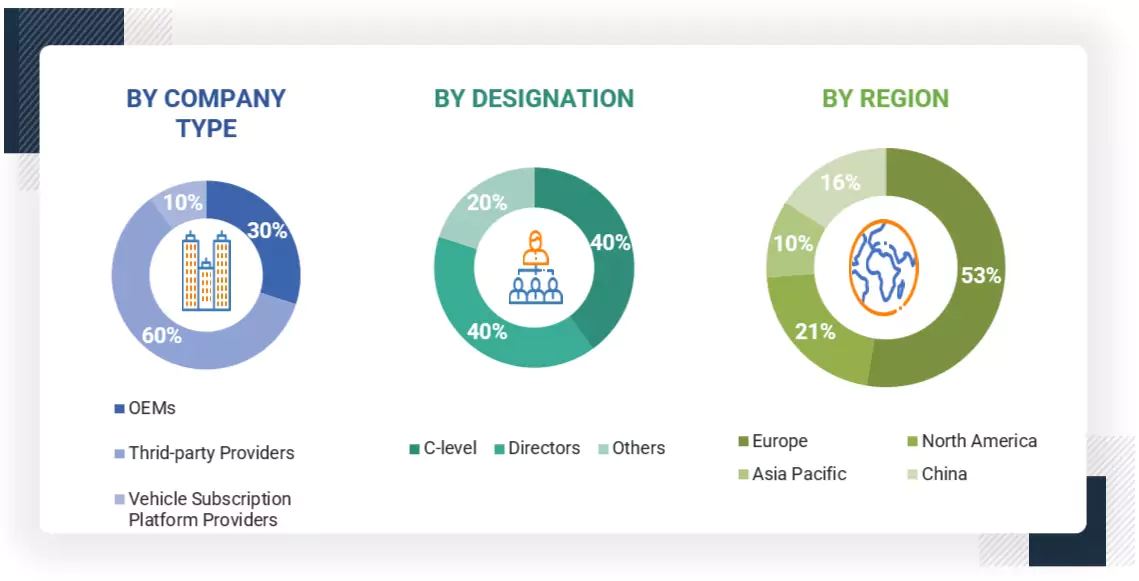

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, and product development/innovation teams, and related executives from various key companies. System integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as sizing estimates on the vehicle subscription services market, factors contributing to the high share of vehicle subscription services, key drivers, consumers’ preference in price, vehicle popularity, and future technology trends. Data triangulation of these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the abovementioned points.

Note: Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As mentioned below, a detailed market estimation approach was followed to estimate and validate the value of the vehicle subscription services.

-

The bottom-up approach was used to estimate and validate the size of the vehicle subscription services market.

-

The market size was derived by average subscription period, fleet size, average subscription price, adoption rate of the vehicle subscription service, and EV adoption rate at the country level.

-

The data points were largely fetched from country-level associations, databases, and data experts. Each country/region’s total value was summed up to reveal the total revenue of the vehicle subscription services market. The data was validated through primary interviews with industry experts. The penetration of different segments was derived from secondary research and primary interviews.

-

The data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Vehicle Subscription Services Market : Top-Down and Bottom-Up Approach

Market Definition

A vehicle subscription service is a business model where a customer pays a monthly fee for the use of one or more vehicles, without long-term commitment or responsibilities associated with traditional ownership or leasing.

Vehicle subscription providers that serve as intermediaries include platform-based companies that connect third-party providers, such as Myles and REVV.

Stakeholders

-

OEMs

-

Third-party providers

-

Vehicle subscription service platform providers

Report Objectives

-

To define, describe, and forecast the size of the vehicle subscription services market in terms of value (USD million)

-

To understand the dynamics (drivers, restraints, opportunities) of the vehicle subscription services market

-

To strategically analyze key player consumer retention strategies

-

To study the following with respect to the market

-

Trends and disruptions impacting customer business

-

Ecosystem analysis

-

Business model

-

Pricing analysis

-

Consumer analysis

-

Competitive benchmarking

Growth opportunities and latent adjacency in Vehicle Subscription Services Market