Global Chemical Industry Outlook, 2024

Global Chemical Industry Outlook 2024

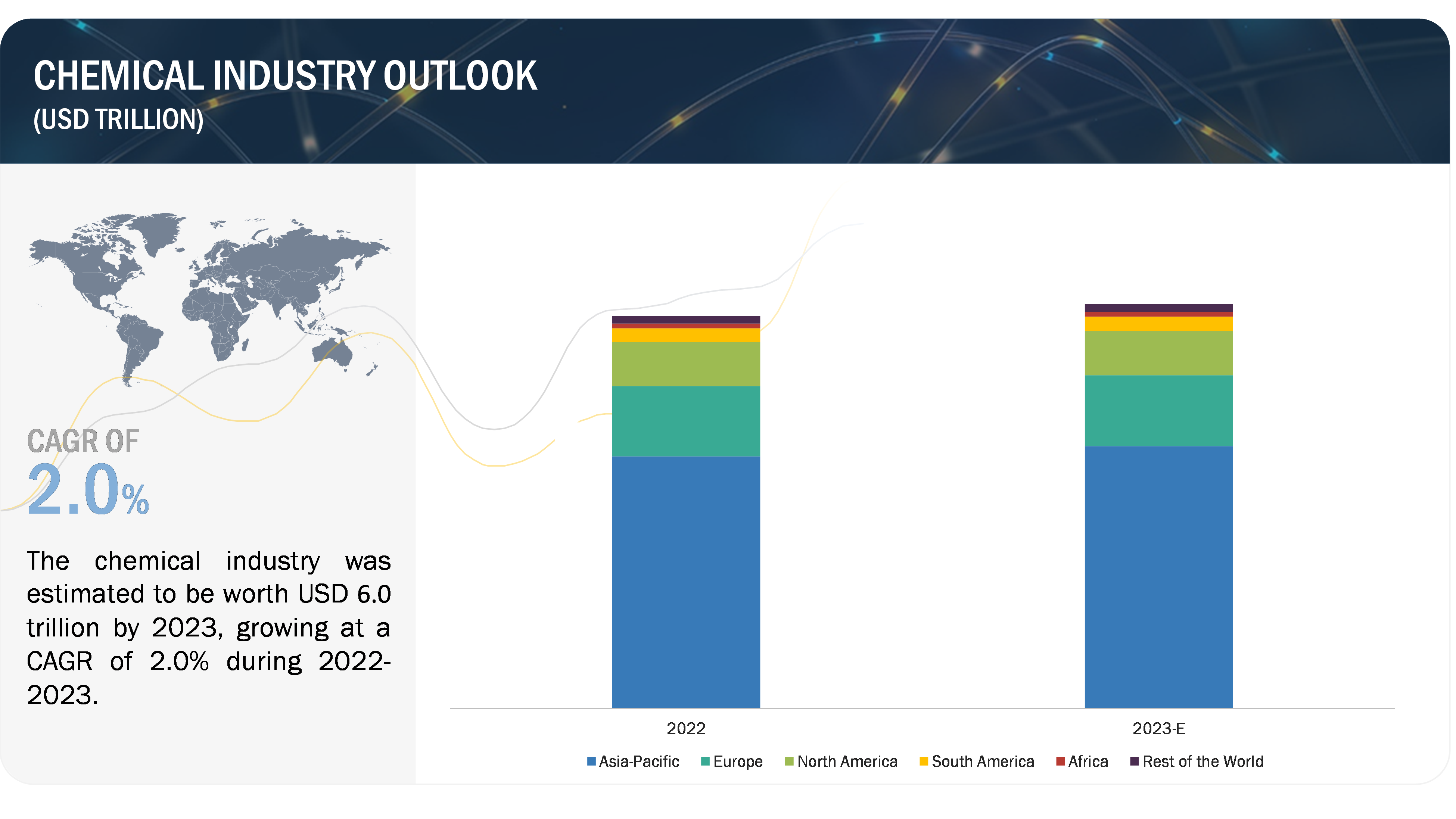

The global chemical industry was estimated to be worth USD 6.2 trillion in 2023, witnessing a CAGR of 2% from USD 5.9 trillion in 2022. While the total demand for chemicals was almost stable in 2023, the demand for chemicals and materials needed to support the energy transition is expected to rise in 2024 and beyond as the impact of new government policies and incentives policies reverberates through the economy.

It has been observed in the global chemical industry outlook report that the industry is witnessing a surge in the development of sustainable and eco-friendly solutions, responding to the global push for environmental consciousness. Additionally, the recovery from the economic impacts of the COVID-19 pandemic has stimulated demand across various end-use segments, such as automotive, construction, and electronics.

APAC was the largest chemical market in 2023 and witnessed a high growth rate of 4.0% in market size from 2022 to 2023. At the same time, Europe experienced a 1% growth in market size despite the decline in regional production. This is due to increased imports from interregional countries such as China and India. Moreover, Chemical production volumes in Europe dropped by 6.6% in 2023, and output is forecasted to make only a fragile recovery in 2024.

Chemical production in China is showing resilience, buoyed by domestic demand. Output was predicted to increase by 6.9% in 2023 and 5.2% in 2024. While the industry has been impacted by slow growth in the country’s property sector, policy measures are designed to promote growth in key sectors such as construction and automotive.

For more details, get in touch with us here

APAC accounted for the largest share in the GLOBAL CHEMICAL INDUSTRY GROWTH

GLOBAL CHEMICAL INDUSTRY OUTLOOK: MARKET DYNAMICS

Growth Factors: Decarbonization of Supply Chain

According to the global chemical industry outlook report, the chemical industry is poised to witness a significant trend in 2024 as it strives to decarbonize supply chains, responding to a global imperative to reduce carbon emissions and foster sustainability. Key developments and expectations for the year include:

Advanced Technologies Investment- Approximately 50% of supply chain organizations within the chemical industry are anticipated to invest in applications supporting artificial intelligence and advanced analytics capabilities.

Electric Vehicles and Transport- The adoption of battery electric commercial vehicles (BECVs) is forecasted to achieve a sales penetration between 15% and 34% in 2024, contributing to the decarbonization of the transport and logistics sector.

Renewable Energy and Clean Technology- The clean energy technology sector foresees a 15% increase in investments in 2024, specifically focusing on decarbonization opportunities related to using low-carbon electricity resources and reducing materials consumption.

Sustainability and decarbonization efforts increasingly are top priorities for technology companies as customers, shareholders, and regulators all push for more sustainable products and services. In response, most tech companies are setting ambitious goals to reduce emissions, but only half report being on track to reach their goals.

Growth Factors: Development of Smart Materials

To meet the demands of specific industrial applications, newly developed materials exhibit characteristics tailored for particular uses. Progress in materials science facilitates the creation of smart materials with properties that can be programmed to react or respond to external stimuli. Innovative startups are creating materials and products that incorporate a diverse range of features, including but not limited to thermo-, electro-, and photo-chromism, as well as piezoelectricity, shape memory, self-healing, and phase-change attributes, among other distinctive qualities.

For instance, the German startup Memetis specializes in crafting ultra-compact miniature actuators utilizing shape memory alloys. The company harnesses a memory effect in its materials, allowing them to endure significant deformations and subsequently return to their original shape. Similarly, Sorex Sensors, a startup based in the UK, is creating high-sensitivity Micro-electromechanical System (MEMS) sensors on silicon wafers. The company achieves this by employing a thin-film piezoelectric material and utilizing FBAR (Film Bulk Acoustic Resonator) technology to induce a piezoelectric effect.

Challenges: Excess manufacturing capacity in China poses a risk to global green goods trade

Increased petrochemical production in China and the US has resulted in a global excess of industrial chemicals utilized in plastics. Consequently, this surplus has caused a decline in the cost of new materials, rendering recycled alternatives less cost-effective. The surplus can be attributed to heightened production in China, influenced by its economic policies, and in the US, propelled by the shale gas boom. China alone accounted for around 60% of the rise in petrochemical capacity in 2023.

The reduced cost of virgin plastics presents a challenge to lowering reliance on single-use plastics and achieving regulatory and environmental goals, hampering efforts to reduce plastic waste pollution and adopting recycled plastics. As per global chemical industry outlook research report, the petrochemical industry worldwide faces a challenge to close uncompetitive assets and cancel unnecessary projects to balance supply and demand. An increasing surplus in China has decreased prices, reducing feedstock expenses for manufacturers and providing them with a competitive advantage over Europe. With the alleviation of logistics challenges, the influx of Asian exports to Europe has already exerted downward pressure on European prices.

Opportunity: Industry 5.0 is expected to create sustainability in the chemical value chain.

Industry 5.0 in the chemical industry outlook report focuses on human-centricity, sustainability, and integrating advanced technologies. Industry 5.0 represents an evolution of Industry 4.0, focusing on the synergy between humans and machines to drive sustainable business growth and societal well-being. Industry 5.0 advocates for industries' economic advancement while prioritizing workers' well-being and interests and addressing the escalating concerns surrounding climate change.

Industry 5.0 represents a significant shift in the chemical value chain, impacting how manufacturers implement technology and prompting a reorientation of their priorities towards planet-centric initiatives. To establish and set benchmarks for these objectives in 2024, manufacturers are assessing their progress toward sustainable growth, identifying areas for cost reduction, determining the most suitable product-quality enhancements, and strategically focusing on initiatives that strongly contribute to sustainability goals and the shift toward achieving net-zero carbon emissions.

GLOBAL CHEMICAL INDUSTRY OUTLOOK: KEY MARKET TRENDS 2024

ATTRACTIVE OPPORTUNITIES IN THE GLOBAL CHEMICAL INDUSTRY

GREEN ENERGY:

Renewables will make up more than one-third of the world’s power supply for the first time in 2024. According to the EIA, there is enough renewable energy supply to meet additional electricity demand worldwide through 2024. Some positive developments include the fact that China’s carbon dioxide (CO2) emissions are set to fall in 2024 and could be facing structural decline. This is due to record installations of new low-carbon energy sources, particularly wind and solar, sufficient to exceed the average annual increase in China’s electricity demand.

At the global level, lower production costs, growing concern around climate change, evolving international energy policies, and increased pressure from investors on companies to adopt Environmental Social Governance (ESG) policies are driving renewables.

3D PRINTING:

The demand for industrial additive solutions from customers tends to follow a cyclical pattern, and the early months of 2023 experienced modest growth. However, starting from the fourth quarter, industrial customers have been utilizing their end-of-year budgets for significant solutions and simultaneously strategizing for 2024. It is anticipated that there will be robust growth in 3D printing in the upcoming year.

In 2024, mass customization is poised for unprecedented growth, driven by advancements in 3D printing technologies. Manufacturers will increasingly leverage the power of additive manufacturing to produce personalized products at scale, catering to individual customer preferences. This trend is expected to disrupt the industry by offering businesses a competitive edge in delivering tailor-made solutions.

Integrating 5G technology with 3D printing processes will streamline production workflows in 2024. There is a noticeable buzz in desktop solutions as lower-cost options expedite the adoption of additive technologies. Additionally, the introduction of new products and services by well-established global leaders in professional desktop printing is expected to spur market growth by 2024.

For more details, get in touch with us here

USE OF LIGHTWEIGHT MATERIALS IN NEXT-GENERATION VEHICLES:

The use of lightweight materials in next-generation vehicles, such as advanced composites, high-strength steel, and aluminum alloys, is projected to grow significantly. The automotive lightweight materials market is expected to reach USD 101.5 billion by 2027, with a compound annual growth rate (CAGR) of 6.5% from 2022-2027.

Several developments in the mobility space next year will usher in the era of autonomous travel. Vehicle OEMs such as BMW and Mercedes-Benz will offer Level 3 autonomous driving in specific geographies, boosting the demand for lightweight materials.

In addition to land, the first steps to autonomous mobility will hit the skies. Paris will be the first city to offer electric air taxi services to the general public for the 2024 Olympics. Although the first flights will have a pilot, Volocopter aims to ultimately provide autonomous air mobility, and the VoloCity aircraft was designed to take to the skies eventually as an autonomous air taxi.

MAJOR DISRUPTIONS IN CHEMICAL INDUSTRY IN 2024

-

Energy transition and need for high energy density in automotive and other industries

- To increase energy density and lower cobalt content and BOM cost, Ni-shares are constantly increasing, which shifts the demand from LiCO3 precursor towards LiOH.

-

Growing demand for fuel cell electric vehicles (FCEVS)

- High investment from OEMs and fuel cell manufacturers to improve overall efficiency of vehicles. Development of new FCEV model with improved range.

-

Rising demand for lightweight, high-performance materials

- Carbon fiber-reinforced plastic materials offer significant weight reduction and improved strength-to-weight ratio compared to traditional materials like aluminum and steel, making them ideal for aerospace, defense, and wind energy applications.

-

Growth for sustainable fuel source

-

The urgency to address climate change and reduce greenhouse gas emissions

is intensifying globally. Governments, businesses, and individuals are increasingly seeking sustainable solutions. Biofuels and synthetic fuels offer promising alternatives to fossil fuels.

-

The urgency to address climate change and reduce greenhouse gas emissions

-

Digitalization

- As smart technologies and digitalization continue to evolve, the water treatment industry is transitioning from a reactive model to a proactive and predictive one, ensuring sustainable water management practices that are efficient, resilient, and capable of meeting the challenges of the future.

Ready to embrace the future of Chemical Industry Outlook 2024 and unlock growth opportunities for your business?

Reach out now to our experts to learn more and stay ahead of the competition!

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024

KEY MARKET PLAYERS

The top players in the chemical market are BASF SE (Germany), Dow Inc. (USA), Saudi Basic Industries Corporation (SABIC) (Saudi Arabia), ExxonMobil (USA), Royal Dutch Shell (Netherlands/UK), DuPont (USA), LyondellBasell Industries (Netherlands/USA), Mitsubishi Chemical Holdings Corporation (Japan), INEOS (Switzerland/UK), Sumitomo Chemical Co., Ltd. (Japan), LG Chem (South Korea), Formosa Plastics Corporation (Taiwan), Bayer AG (Germany), Chevron Phillips Chemical Company LLC (USA), Air Liquide (France), Akzo Nobel N.V. (Netherlands), Eastman Chemical Company (USA), Evonik Industries AG (Germany), and others. Continuous developments in the market, including new partnerships, mergers and acquisitions, agreements, and expansions, are expected to help the market grow. Leading chemical manufacturers have opted for investment and expansion to sustain their market position in 2023.

RECENT DEVELOPMENTS, 2023

- In September 2023, BASF SE partnered with Nanotech Energy to produce lithium-ion batteries in North America with locally recycled content and a low CO2 footprint. The agreement will enable BASF SE in North America to provide cathode active materials produced with recycled metals on a commercial scale starting in 2024.

- In May 2023, Xylem Inc. completed the acquisition of Evoqua Water Technologies, a provider of water and wastewater treatment solutions and services, in an all-stock transaction valued at approximately USD 7.5 billion. Headquartered in Washington, DC, the combined company becomes the world’s largest pure-play water technology company.

- Queensland Nitrate Pty. Ltd. (QNP) partnered with Neoen and Worley to jointly develop a green hydrogen-to-ammonia manufacturing plant at QNP’s Moura site. The proposed facility includes a 30 MW electrolyzer and a small-scale ammonia plant consuming 208 GWh of electricity.

- In September 2022, Umicore inaugurated its carbon-neutral production facility for cathode-active materials in Nysa, Poland. The gigafactory supplies battery materials to Umicore’s car and European battery cell customers. Nysa’s annual production capacity is set to reach 20 GWh by the end of 2023 and 40 GWh in 2024, with the potential to rise to over 200 GWh, or 3 million electric vehicles, in the second half of the decade.

- In February 2023, Toray Industries developed a rapid integrated molding technology for carbon fiber-reinforced plastics mobility components. This material sandwiches a light, porous carbon fiber reinforced foam core with a thermosetting prepreg skin offering outstanding mechanical properties.

- Hexagon Purus opened a new hydrogen cylinder manufacturing facility in Westminster, Maryland, US, in January 2023, with an annual production capacity of up to 10,000 cylinders for heavy-duty vehicle applications and will employ up to 150 skilled workers.

- Yara Pilbara and ENGIE partnered to build a renewable hydrogen plant to produce renewable ammonia. The proposed facility includes a 10 MW electrolyzer. It is an on-site facility for photovoltaic panels.