The Sweet Shift: How the Next Generation Sweeteners Market Is Redefining Sugar

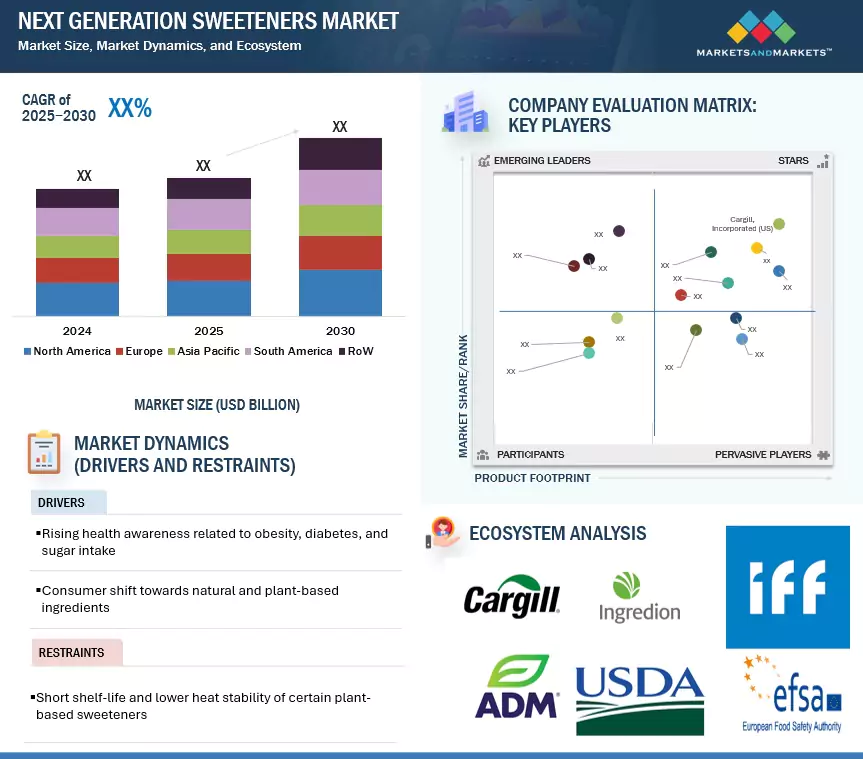

As the world pivots toward healthier, lower-calorie lifestyles, the demand for next generation sweeteners is accelerating at a remarkable pace. According to a recent MarketsandMarkets report, the global Next Generation Sweeteners Market, segmented by type, source, form, application, and region, is expected to witness robust growth through 2030—driven by sweeping regulatory reform, evolving consumer expectations, and technological innovation.

Why the Sweetener Market Is Ripe for Disruption

Health authorities worldwide—such as the FDA (US), EFSA (Europe), and FSSAI (India)—are urging or mandating sugar reduction in processed food and beverages. These initiatives are being reinforced by front-of-pack labeling laws and rising public health awareness around obesity and diabetes.

This regulatory push is compelling food and beverage companies to rethink formulation strategies. As a result, high-intensity, low-calorie sweeteners are replacing traditional sugars in everything from soft drinks to baked goods. Consumers, meanwhile, are leaning toward natural and plant-based sweeteners like stevia and monk fruit, while fermentation-based options like allulose and tagatose gain ground for their sugar-like taste and added functional benefits.

Request Personalized Data Insights for Your Business Goals

Sweetener by Type: Nutritive Sweeteners Hold the Flavor Advantage

Among the two key categories—Nutritive (Caloric) and Non-Nutritive (Zero-Calorie)—nutritive sweeteners continue to hold a substantial share of the market.

Why? Because beyond sweetness, they offer structure, texture, and preservation qualities essential to product quality. Sucrose, glucose, fructose, and sugar alcohols like sorbitol and erythritol are widely used in traditional applications such as confectionery, bakery, dairy, and ready-to-eat meals.

Despite rising health trends, consumer familiarity with sucrose remains strong. For example, USDA data from 2023 shows that Americans still consume around 58.6 kg/year of calorific sweeteners like sucrose and high-fructose corn syrup (HFCS).

Even sugar alcohols like erythritol are bridging the gap between indulgence and wellness. Products like Hershey’s sugar-free chocolate, featuring erythritol and maltitol, highlight the market’s ability to merge taste with reduced-calorie benefits.

Sweetener by Source: The Synthetic Segment Still Reigns

While natural sweeteners are trending, synthetic sweeteners like aspartame, sucralose, saccharin, and acesulfame-K dominate due to their intense sweetness (up to 600x that of sugar) and cost-efficiency.

Synthetic sweeteners are ideal for low-calorie and sugar-free formulations, thanks to their thermal and pH stability. They’re widely used in carbonated beverages, baked goods, and pharmaceuticals. In fact, sucralose continues to be a staple in U.S. diet sodas and flavored waters.

With approvals from the FDA, EFSA, and MHLW Japan, these sweeteners enjoy consumer confidence on safety, ensuring continued relevance—even as natural alternatives grow in popularity.

Asia-Pacific: The Fastest-Growing Sweet Spot

The Asia-Pacific region is projected to be the fastest-growing market for next generation sweeteners through 2030. Rising urbanization, shifting dietary habits, and a surge in lifestyle-related illnesses like diabetes and obesity are major growth drivers.

According to the International Diabetes Federation (2023), India and China combined host over 200 million diabetic patients. This has sparked demand for reformulated products using stevia, sucralose, and erythritol.

Government agencies like FSSAI (India) and NHC (China) are actively promoting sugar reduction through regulatory frameworks. Meanwhile, the presence of global food and beverage giants and local innovators ensures robust market penetration across the region.

Major Players Shaping the Future of Sweeteners

Leading companies driving innovation and market share include:

- Cargill (US)

- Tate & Lyle (UK)

- Archer Daniels Midland (US)

- Ingredion (US)

- Ajinomoto (Japan)

- Roquette (France)

- GLG Life Tech (Canada)

- Stevia Corp. (US)

- JK Sucralose (China)

- Zydus Wellness (India)

These companies are investing in product diversification, fermentation technologies, and natural formulations to stay ahead in a rapidly evolving space.

The Takeaway

The next generation sweeteners market is no longer just about sugar substitutes—it’s about functional, scalable, and sustainable solutions that satisfy both health standards and consumer taste preferences.

With regulatory pressure mounting and global wellness trends accelerating, brands that invest in smart reformulation and natural innovation are poised to lead this sweet transformation into 2030 and beyond.

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024