The Future of the Non-meat Ingredients Market: What’s Next for Meat Innovation?

In a meat industry where consumer expectations are evolving rapidly, manufacturers are rethinking how they create standout products. One critical shift? The growing use of non-meat ingredients that enhance everything from flavor and texture to shelf life and visual appeal.

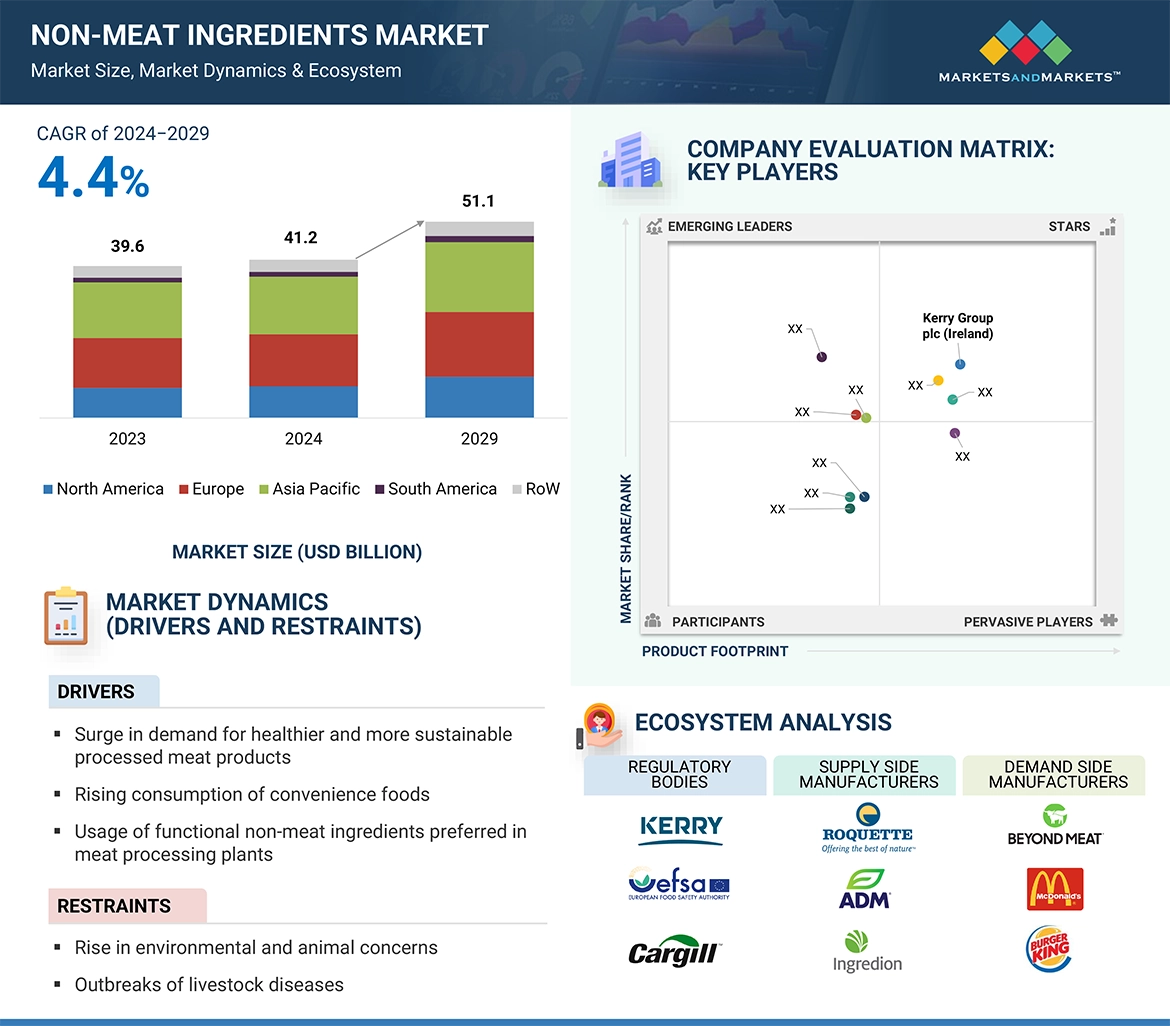

According to recent research, the global Non-meat Ingredients Market was valued at USD 41.2 billion in 2024 and is expected to reach USD 51.1 billion by 2029. This projected rise represents a compound annual growth rate of 4.4%, driven by rising demand for product differentiation and changing dietary preferences.

Creating Signature Experiences with Flavor and Texture

Consumers today are drawn to meats that offer more than just protein—they want memorable taste and consistency. From smoky barbecue to spicy chipotle, non-meat ingredients help deliver distinct flavor profiles that elevate a standard meat product into something unique.

Beyond flavor, texturizing agents are playing a bigger role than ever. Whether it’s a juicy, tender mouthfeel or a firmer bite, manufacturers now have more control over the sensory experience they deliver. These elements are not only improving consumer satisfaction but also contributing to the overall Non-meat Ingredients Market Size.

Preservation is another major advantage. Preservatives and stabilizers help maintain product quality throughout the supply chain, reducing waste and keeping products fresh longer. This directly supports both operational efficiency and sustainability goals.

Request Custom Data to Address your Specific Business Needs

Why Fresh Meat Still Dominates

Despite the growing popularity of ready-to-eat and frozen options, fresh meat continues to be the most preferred format. A study conducted in Kerala, India in 2023 found that 77.3% of consumers favor fresh meat, citing quality and safety as top priorities. The study also noted that many buyers associate freshness with better nutrition and lower chemical content.

Fresh meat’s appeal lies in its natural, minimally processed profile. However, even in fresh products, non-meat ingredients play a supportive role—improving texture, flavor retention, and product stability without compromising the fresh appearance and taste.

This strong and steady demand reinforces the resilience of this category within the broader Non-meat Ingredients Market Growth.

The Asia Pacific Advantage

Asia Pacific is emerging as a dominant region in the non-meat ingredient space, driven by rising fast-food culture and a growing appetite for Western-style meats such as burgers, sausages, and meatballs. As quick-service restaurants expand, so does the need for consistent, high-quality meat products that rely on specialized non-meat components.

In India, the QSR industry is projected to grow at 20–25% in FY2024, further accelerating the adoption of ingredients that boost flavor, shelf life, and consistency.

This momentum is helping define the Non-meat Ingredients Industry in the region, especially among suppliers and brands looking to tap into evolving culinary preferences.

Companies Leading the Way

Some of the key Non-meat Ingredients Companies shaping this space include:

- Kerry Group plc (Ireland)

- Ingredion (US)

- Associated British Foods plc (UK)

- International Flavors & Fragrances Inc. (US)

- ADM (US)

- Cargill, Incorporated (US)

- BASF SE (Germany)

- DSM (Netherlands)

These companies are continually innovating to develop new ingredient solutions that align with shifting consumer habits and market demands.

Looking Ahead

The growing need for enhanced taste, texture, and shelf life in meat products is placing non-meat ingredients in the spotlight. As the food industry becomes more dynamic and consumer-focused, the ability to offer versatile, high-performance ingredients is becoming a competitive advantage.

For meat product manufacturers aiming to differentiate in a crowded landscape, non-meat ingredients offer an essential toolkit to innovate, adapt, and grow.

Key Questions Addressed by the Report

1.What is the current size of the non-meat ingredients market?

The non-meat ingredients market is estimated at USD 41.2 billion in 2024 and is projected to reach USD 51.1 billion by 2029, at a CAGR of 4.4% from 2024 to 2029.

2.Which are the key players in the market, and how intense is the competition?

The key players in this market include Kerry Group plc. (Ireland), Ingredion (US), Associated British Foods plc (UK), International Flavors & Fragrances Inc. (US), ADM (US), Cargill, Incorporated (US), BASF SE (Germany), DSM (Netherlands), Advanced Food Systems, Inc. (US), and Essentia Protein Solutions (US).The non-meat ingredients market witnesses increased scope for growth. The market is seeing an increase in the number of mergers, acquisitions, and new expansions. Moreover, the companies involved in providing non-meat ingredients products are investing a considerable proportion of their revenues in research and development activities.

3.Which region is projected to account for the largest share of the non-meat ingredients market?

The Asia Pacific market is expected to dominate during the forecast period.The Asia Pacific region leads the non-meat ingredients market due to the booming fast-food culture and growing consumption of European cuisines like burgers and sausages. The surge in Quick Service Restaurants (QSRs) and Western influences have propelled the demand for non-meat additives, solidifying the region's dominance in meeting evolving consumer preferences.

4.What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

5.What are the factors driving the non-meat ingredients market?

The global non-meat ingredients market is primarily driven by increasing meat consumption, the need for brand differentiation among manufacturers, growing demand for RTE and convenience meat products, and the perishable nature of meat products.

6.Why are non-meat ingredients becoming increasingly important in the meat industry?

As consumer preferences shift toward products with enhanced flavor, texture, and shelf life, non-meat ingredients are playing a critical role. They help manufacturers create differentiated, high-quality products that align with modern expectations—without compromising freshness or safety.

7.How will regional trends shape the future of the Non-meat Ingredients Market?

Asia Pacific is expected to play a major role in the future of the Non-meat Ingredients Market, driven by the rapid growth of quick-service restaurants, increasing meat consumption, and Western culinary influences. This regional momentum is set to fuel demand for ingredient solutions that deliver consistency, quality, and scalability.

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024