The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the AI in video surveillance market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the AI in video surveillance market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information and assess growth prospects. Key players in the AI in video surveillance market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

Various sources were used in the secondary research process to identify and collect information important for this study. These include company annual reports, press releases, investor presentations, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry's value chain, the total pool of market players, the market classification according to industry trends to the bottom-most level, regional markets, and key developments from market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the AI video surveillance market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

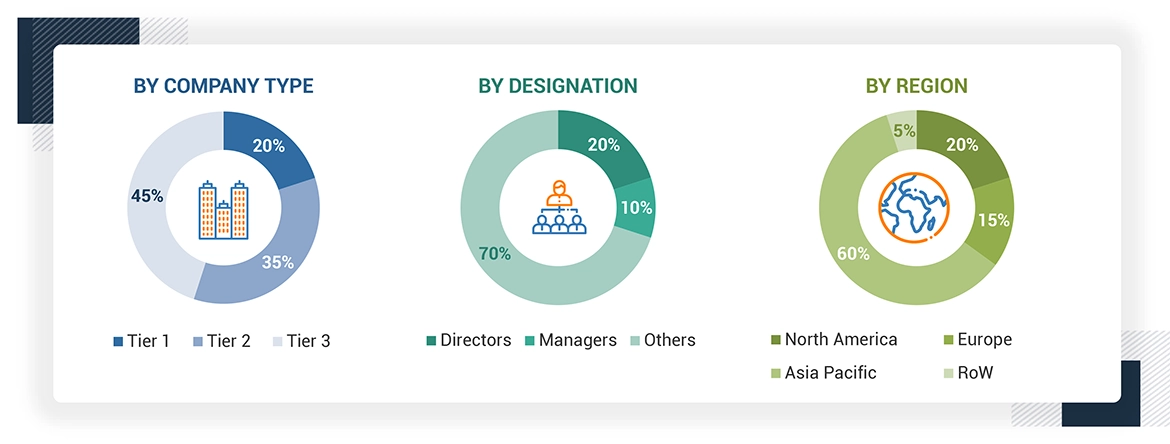

Extensive primary research has been conducted after acquiring knowledge about AI in video surveillance market scenarios through secondary research. Several primary interviews have been conducted with experts from both the demand (vertical and region) and supply side (use case, offering, deployment, function, technology, and application) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews were conducted from the supply and demand sides. These primary data have been collected through questionnaires, emails, and telephonic interviews.

Note: The three tiers of the companies have been defined based on their total/segmental revenue as of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 1 billion–USD 500 million, and Tier 3 = USD 500 million. ‘Others’ include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were implemented to estimate and validate the size of the AI in video surveillance market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

AI in Video Surveillance Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

The scope of AI in video surveillance encompasses a range of applications and capabilities that revolutionize traditional security systems. AI-powered video surveillance leverages advanced algorithms and machine-learning techniques to analyze vast amounts of real-time visual data. It enables intelligent video analytics, such as object detection, tracking, and recognition, allowing for automated identification of suspicious activities, persons of interest, or potential threats. AI algorithms can also enhance video quality, optimize camera placements, and facilitate intelligent search and retrieval of relevant footage. Additionally, AI-based video surveillance systems can integrate with other technologies, such as facial recognition, biometrics, and data analytics, enabling comprehensive security solutions for various domains, including public spaces, transportation, retail, and critical infrastructure. The scope of AI in video surveillance holds promise for enhancing public safety, crime prevention, and operational efficiency while raising concerns related to privacy, ethical considerations, and the responsible use of such technologies.

Key Stakeholders

-

Raw material vendors

-

Component (image sensor, lens, and module) providers

-

Software providers

-

AI-based video surveillance cameras manufacturers

-

Original equipment manufacturers (OEMs)

-

AI-based video surveillance system integrators

-

Service providers

-

Technology standards organizations, forums, alliances, and associations

-

Governments, financial institutions, and investment communities

-

Research organizations

-

Analysts and strategic business planners

-

Venture capitalists, private equity firms, and start-up companies

-

Distributors

-

Infrastructure, commercial, institutional, industrial, residential, and other end users

Report Objectives

-

To define, describe, and forecast the AI in video surveillance market, in terms of value, by offering, deployment, function, technology, vertical, and region

-

To describe and forecast the AI cameras market, in terms of volume

-

To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and RoW

-

To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To offer an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the market

-

To give a detailed overview of the value chain of the AI in video surveillance market ecosystem

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies2

-

To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

-

To study competitive developments such as collaborations, partnerships, product developments, and acquisitions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Growth opportunities and latent adjacency in AI in Video Surveillance Market