The research report includes four major activities, estimating the size of the augmented reality navigation market. Secondary research has been done to gather important information about the market and peer markets. To validate the findings, assumptions, and sizing through primary research with industry experts across the supply chain is the next step. Both bottom-up and top-down approaches have been used to estimate the market size. After this, the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments

Secondary Research

For estimating the revenues of the augmented reality navigation providing companies around the world, the secondary data were collected from paid and free online sources. Sample sources for secondary research include government body publications, companies’ annual reports, financial statements and trade/professional association publications. This data contributes to establish the market size that in turn was verified during the primary research.

Secondary research approach is used to obtain key insights about the supply chain of the industry to identify key players and to prevail trends with regards to different instruments, sampling methods, applications, and geographical area. Also, the market and the technology trends were monitored during the study.

Primary Research

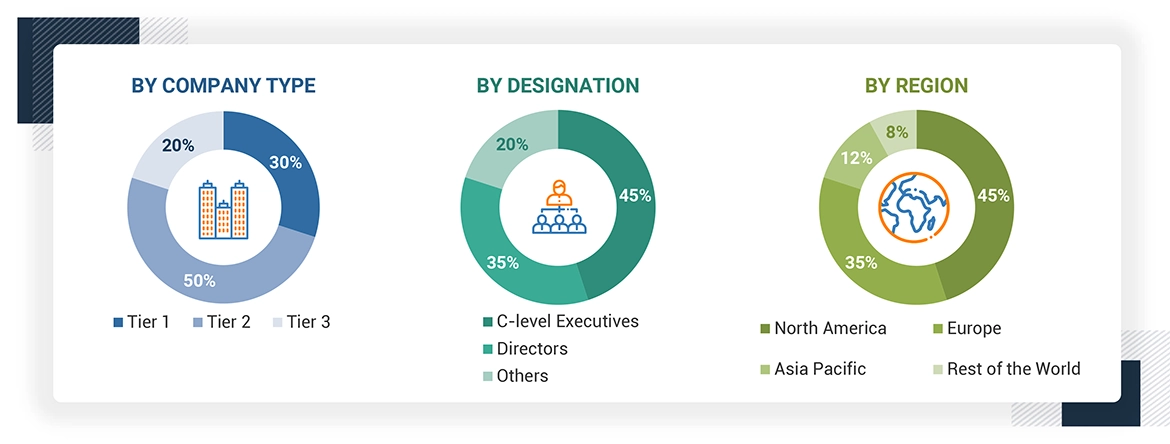

In the primary research phase, a variety of industry experts were interviewed to gather qualitative and quantitative insights about the market across four key regions: North America, Europe, Asia Pacific and RoW (the Middle East, Africa, and South America). These experts included CEOs, vice presidents, marketing directors, technology and innovation directors, subject-matter experts (SMEs), consultants and other key executives from leading companies and organizations in the augmented reality navigation market.

Market engineering process entailed calculations for breakdowns, market statistics, forecasting, size estimations, and data triangulation. Extensive primary research was conducted to collect, verify, and validate critical numerical data. This primary research results in identifying segmentation types, industry trends, competitive landscapes, key players, and market dynamics such as drivers, restraints, opportunities, and challenges. Additionally, it sought to understand the key strategies adopted by market players.

Note: Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were extensively employed in the market engineering process. Various data triangulation methods were utilized to forecast and estimate the market segments and subsegments covered in the report. Multiple qualitative and quantitative analyses were conducted during the market engineering process to extract key insights throughout the report.

Secondary research helped identify key players in the augmented reality navigation market. Their revenues were determined through a combination of primary and secondary research, analyzed both geographically and by market segment, using financial statements and annual reports. Insights were further enriched through interviews with CEOs, VPs, directors, and marketing executives.

Bottom-Up Approach

The market shares were estimated using this combined research approach. The data was then consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

The bottom-up approach was employed to arrive at the overall size of the augmented reality navigation market from the calculations based on the revenues of the key players and their shares in the market. Key players in augmented reality navigation market, including Google LLC (US), Apple Inc. (US), Microsoft (US), WayRay AG (Switzerland), and Neusoft Corporation (China) were studied. The market size estimations were carried out considering the market size of their augmented reality navigation offerings.

Top-Down Approach

In the top-down approach, the overall market size was utilized to forecast the size of individual markets, using percentage splits derived from both secondary and primary research. The most relevant parent market size was employed to calculate specific market segments.

The revenue shares calculated earlier in the bottom-up approach were verified by identifying and estimating the market share of each company. This study determined and confirmed the overall parent market size and individual market sizes through data triangulation and validation with primary sources.

Augmented Reality (AR) Navigation Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process, the total market was divided into various segments and subsegments. To finalize the market engineering process and obtain precise statistics for all segments and subsegments, data triangulation was employed. This involved analyzing various factors and trends from both the demand and supply sides. Additionally, the market was validated using both top-down and bottom-up approaches.

Market Definition

Augmented reality navigation is an innovative solution that incorporates real-time positioning with virtual data overlay onto the physical world for an improved navigation experience. The prominent goal of augmented reality navigation technology is to enhance the user’s navigation experience by overlaying digital information such as directional arrows, points of interest and real-time data to user onscreen through a device’s camera view. Augmented reality navigation software, HUD and HMDs are the major offerings of augmented reality navigation market. Augmented reality navigation depends on sensors, cameras, and algorithms to track the movement of the user and provide real-time navigation guidance. Augmented reality navigation operates in both indoor and outdoor areas. This technology helps to navigate in complex locations such as retail stores & shopping malls, airports, healthcare, museums & cultural institutions and many others. Real-time location data management, routing & navigation, asset tracking, reverse geocoding, emergency & safety, interactive training & simulation are the key applications of augmented reality navigation.

The market for extended reality spans across multiple sectors such as games and entertainment, healthcare, education, retail, automotive, and industrial training, among others. It serves for various purposes including training and simulation, teamwork done through the internet, going on virtual tours, playing computer games, surgeries, etc. This shifts the paradigm on the way people perceive and use technology, while it is as well embraced by businesses for the purpose of enhancing productivity, developing customer relationships and optimizing processes.

Key Stakeholders

-

Raw material suppliers

-

Original equipment manufacturers (OEMs)

-

Augmented reality device manufacturer

-

Software and technology providers

-

Standardization and testing firms

-

Government bodies such as regulatory authorities and policymakers

-

Research organizations

-

Technology investors

Report Objectives

-

To define, describe, and forecast the augmented reality navigation market by offering, type, application, end-users, and region in terms of value.

-

To define, analyze, and forecast the augmented reality navigation market by device in terms of volume.

-

To forecast the market for various segments with respect to 4 main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value.

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence the growth of the market.

-

To provide a detailed overview of the augmented reality navigation value chain, along with industry trends, technology trends, use cases, regulatory landscape, and Porter’s five forces.

-

To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market.

-

To analyze market ecosystem; trends/disruptions impacting customer’s business; technology analysis; pricing analysis; key stakeholders & buying criteria; case study analysis; trade analysis; patent analysis; key conferences & events, 2024–2025; regulations related to the augmented reality navigation market; and investment and funding scenario.

-

To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detailing the competitive landscape for market players.

-

To strategically profile key players and comprehensively analyze their market rankings, core competencies, company valuation and financial metrics, and product/brand comparison, along with detailing the competitive landscape for the market leaders.

-

To analyze the competitive developments such as product launches, partnerships, collaborations and acquisitions, and research and development (R&D) carried out by market players

-

To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments, such as product developments, collaborations, and acquisitions

-

To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information for Asia Pacific

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Augmented Reality Navigation Market