Data Center GPU Market Size, Share & Trends, 2025 To 2030

Data Center GPU Market by Deployment (Cloud, On-premises), Function (Training, Inference), Application (Generative AI, Machine Learning, Natural Language Processing, Computer Vision), End User (CSP, Enterprises) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The data center GPU market is projected to reach USD 228.04 billion by 2030 from USD 119.97 billion in 2025, at a CAGR of 13.7% from 2025 to 2030. The rising use of machine learning (ML) and artificial intelligence (AI) drives demand for high-performance datacenter GPUs. Applications like fraud detection, autonomous vehicles, recommendation systems, and natural language processing require strong parallel processing capabilities, making accelerated computing essential for data centers an in turn are drivng market growth.

KEY TAKEAWAYS

-

By RegionThe North America data centr GPU market accounted for a 36.2% revenue share in 2024.

-

By DeploymentBy deployment, the on-premises segment is expected to register the highest CAGR of 15.7%.

-

By FunctionBy function, the inference segment is projected to grow at the fastest rate from 2025 to 2030.

-

By End-userBy end-user, the enteprises segment will grow the fastest during the forecast period.

-

By ApplicationBy application, the genertive AI segment is expected to dominate the market, growing at the highest CAGR of 14.9%.

The data center GPU market is experiencing robust expansion, fueled by the accelerating adoption of artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC) workloads across industries. The growing need for parallel processing, low latency, and high computational throughput is driving the integration of advanced GPUs in hyperscale and enterprise data centers. Strategic developments such as NVIDIA’s partnerships with major cloud providers like Amazon Web Services (AWS) and Microsoft Azure, AMD’s launch of the Instinct MI300 series, and Intel’s investments in GPU-based accelerator architectures are transforming the competitive landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Today’s revenue sources, which include technologies such as machine-to-machine (M2M) communication and deep learning, are gradually giving way to newer, high-value opportunities driven by rapid advancements in computing and AI. The market is shifting toward large language models, high-performance computing (HPC), and the rise of autonomous vehicles, which are emerging as the key growth areas shaping the future revenue mix. These developments are enabling transformative technologies such as generative AI, AI inference at the edge, data center virtualization, cloud gaming, HPC, and cryptocurrency mining. As these innovations mature, their influence extends to major industries including enterprise and financial services, manufacturing, healthcare, government, and private entities. This evolution is leading to a notable revenue shift among clients, who are increasingly focusing on AI-powered solutions, real-time AI applications, cloud-based healthcare platforms, advanced scientific research, digital twins, and the expanding metaverse economy

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of AI and machine learning

-

Demand for high-performance computing (HPC)

Level

-

Short product lifecycle

-

High costs of GPUs and infrastructure

Level

-

Growth in autonomous systems

-

Emergence of edge computing

Level

-

Existence of alternative technologies

-

Stringent regulatory framework

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of AI and machine learning

The rising use of machine learning (ML) and artificial intelligence (AI) drives demand for high-performance datacenter GPUs. Applications like fraud detection, autonomous vehicles, recommendation systems, and natural language processing require strong parallel processing capabilities, making accelerated computing essential for data centers. NVIDIA's Tensor Core GPUs, such as the A100 and H100, are widely used for AI training and inference. In 2024, Microsoft and NVIDIA expanded their collaboration to build AI supercomputing infrastructure for Azure. AMD is also gaining ground with partnerships, as its MI300 GPUs see increased adoption in hyperscale environments. While Google, Meta, and Amazon are investing in custom AI chips, they still depend on third-party GPUs for specific workloads. As the AI landscape evolves, the datacenter GPU market is set to grow with the demand for compute-intensive AI models

Restraint: Short product lifecyle

One of the main challenges in the data center GPU market is the short lifespan of GPU hardware. Rapid advancements and rising performance demands from AI, ML, and high-performance computing require GPU vendors to release new versions frequently. This situation places pressure on data center operators, who face significant initial investments and the constant need for infrastructure upgrades. For instance, NVIDIA launched its A100 GPU in mid-2020, followed by the H100 GPU based on the Hopper architecture just two years later, while AMD released its Instinct MI250 series in 2021 and the MI300 series in 2023. These constant upgrades lead to quicker depreciation of older models, hampering long-term ROI, especially for smaller enterprises that cannot easily absorb regular upgrades. Additionally, each new GPU generation requires adjustments to software stacks and workloads, adding complexity and operational overhead. As a result, these short product lifecycles can discourage adoption in markets that value stability and long-term value

Opportunity: . Growth in autonomous systems

The emergence of autonomous technologies, including self-driving cars, drones, and robots, is creating significant opportunities for the data center GPU industry. These technologies rely on advanced AI algorithms like computer vision and real-time decision-making, all requiring substantial computational power. For example, Tesla's Dojo supercomputer trains autonomous driving software, showcasing the need for GPU-accelerated infrastructure. NVIDIA partners with automotive companies such as Mercedes-Benz and Volvo, providing platforms like NVIDIA DRIVE for autonomous development. In 2023, NVIDIA and Foxconn collaborated to create AI factories focused on autonomous platforms.

Challenge: Existence of alternative technologies

The growth of data center GPUs faces challenges from alternative technologies like application-specific integrated circuits (ASICs) and field-programmable gate arrays (FPGAs). These alternatives often provide better performance per watt for specialized workloads. For instance, Google’s Tensor Processing Units (TPUs) are ASICs optimized for machine learning and AI, offering faster training and inference for TensorFlow models than general-purpose GPUs. Similarly, Amazon Web Services (AWS) provides FPGAs in its EC2 F1 instances, which allow custom hardware acceleration for tasks like genomics and video encoding. Microsoft Azure has integrated FPGAs through Project Brainwave to improve real-time AI performance. As these more power-efficient technologies gain traction, especially in hyperscale environments, GPU vendors must adapt to remain competitive and justify their costs and power requirements

Data Center GPU Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

BEN Group utilized NVIDIA’s DGX A100 AI platform to accelerate large-scale data analysis, build predictive models, and detect fraud in influencer marketing campaigns | Reduced campaign costs, improved conversion rates, and accelerated data-driven decision-making through AI-powered insights |

|

Terray Therapeutics leveraged NVIDIA’s DGX Cloud and Base Command Platform to accelerate generative AI–driven small-molecule drug discovery | Accelerated model training, improved resource utilization, and faster discovery of optimized drug candidates through scalable generative AI infrastructure |

|

Siemens Healthineers implemented NVIDIA’s AI supercomputing infrastructure to automate and accelerate radiation therapy planning through intelligent organ segmentation | Reduced treatment planning time, improved workflow efficiency, and accelerated delivery of advanced, AI-driven oncology solutions |

|

GAC R&D Center utilized NVIDIA GPUs to accelerate CFD simulations and optimize vehicle aerodynamics for next-generation concept and production cars | Achieved record-low drag coefficients with 70% faster simulations and 60% reduced manual effort through GPU-accelerated CFD workflows |

|

Stone Ridge Technology partnered with Eni to deploy ECHELON 2.0, a GPU-optimized reservoir simulation platform, to accelerate large-scale geological modeling and forecasting | Reduced simulation runtimes from days to minutes, enabling faster, more detailed reservoir analysis and improved decision-making in energy exploration |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The data center GPU ecosystem comprises a tightly connected network of players spanning the entire value chain from raw material suppliers to end users. At the foundation are raw material suppliers such as SMC Global, Applied Materials, and SK Inc. Materials, which provide essential components and materials for chip fabrication. These feed into foundries like TSMC, Samsung, and GlobalFoundries, responsible for manufacturing the semiconductor wafers that form the backbone of GPUs. Data center GPU manufacturers such as NVIDIA, AMD, and Intel design and develop the core GPU architectures that power AI, high-performance computing, and data analytics workloads. These GPUs are then integrated by server OEMs and ODMs, including Dell Technologies, Hewlett Packard Enterprise, GIGABYTE, Inventec, and Quanta Computer, into scalable computing systems tailored for enterprise and cloud data centers. Finally, end users, primarily hyperscalers such as Amazon Web Services (AWS), Microsoft, and Google Cloud, deploy these GPU-powered infrastructures to run AI training, data analytics, and cloud-based applications. Together, this ecosystem enables continuous innovation and performance scaling across global data center operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Cener GPU Market, By Deployment

By deployment, the cloud segment is expected to maintain a leading market position during the forecast period. Cloud deployment is expected to see significant growth in the data center GPU market due to the rising demand for flexible and affordable AI and high-performance computing. Cloud providers are integrating powerful GPUs into their infrastructure to support AI, machine learning, analytics, and complex simulations. This cloud-based GPU access helps businesses reduce costs associated with physical infrastructure, making high-powered computing resources more accessible. Major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are competing to enhance their GPU offerings. AWS offers NVIDIA-powered EC2 instances for AI training, Azure has partnered with NVIDIA for advanced GPUs for enterprise workloads, Google Cloud supports NVIDIA L4 GPUs for scalable tasks, and Oracle Cloud Infrastructure also collaborates with NVIDIA for on-demand AI solutions.

Data Center GPU Market, By Function

By function, the inference segment is expected to witness a high CAGR from 2025 to 2030. The inference segment for data center GPUs is set to grow significantly due to the rising use of AI in real-time applications like chatbots and recommendation engines. After training, AI models require substantial GPU capacity for low-latency inference under heavy loads, driving demand for inference-optimized GPUs. NVIDIA’s latest L4 and H100 GPUs, Meta’s extensive GPU use, and Microsoft Azure’s AI services integration highlight this trend. Generative AI applications like ChatGPT and DALL-E further increase inference workloads, boosting the need for efficient and scalable computing in data centers.

Data Center GPU Market, By Application

Generative AI is poised for significant growth in the data center GPU market, driven by applications like LLMs, video & image creation, code writing, and voice assistants. High-performance GPUs are in demand for these computationally intensive models, including OpenAI’s GPT-4, Google Gemini, and Meta’s LLaMA. Companies are investing heavily in meeting this demand. Microsoft has partnered with OpenAI to integrate ChatGPT into Azure, relying on NVIDIA GPUs. Google Cloud uses its Tensor Processing Units (TPUs) and NVIDIA GPUs for services like Bard and Duet AI. Meta is building an AI supercomputer, the Research SuperCluster, with thousands of NVIDIA GPUs. Amazon Web Services (AWS) is also expanding its EC2 UltraClusters with NVIDIA GPUs for generative model development. As generative AI expands into healthcare, finance, marketing, and design, the need for high-quality GPU-based infrastructure will drive growth in this sector.

REGION

Asia Pacific to be fastest-growing region in global data center GPU market during forecast period

The Asia Pacific region is expected to see significant growth in the data center GPU market due to rapid digitalization, increasing AI adoption, and expanding cloud infrastructure in countries like China, India, Japan, South Korea, and Southeast Asia. China leads with its "New Infrastructure" policy, promoting AI and cloud computing. Major companies, including Alibaba Cloud, Tencent Cloud, and Baidu, are utilizing high-performance GPUs for AI model training, with Baidu's PaddlePaddle relying on NVIDIA GPUs. In India, Google Cloud and Microsoft Azure are building GPU-backed data centers for startups, while South Korea's Naver and Kakao, along with Japan’s Fujitsu and NEC, are advancing AI initiatives. Collaborations with NVIDIA and AMD are further enhancing GPU-based cloud services. Overall, the region's data center GPU market is positioned for substantial growth, driven by government initiatives and rising demand for AI applications.

The North American data center GPU market is projected to reach USD 79.81 billion by 2030 from USD 43.19 billion in 2025, at a CAGR of 13.1% from 2025 to 2030. The North American data-center GPU market is expanding rapidly as enterprises, hyperscalers, and research institutions accelerate the adoption of AI, machine learning, and high-performance computing across various sectors. Growth is driven by the increasing deployment of GPU-optimized workloads such as fraud analytics, autonomous systems, large-scale recommendation engines, and advanced natural language models, all of which demand parallel compute capabilities beyond traditional CPUs. Continued investments by major cloud providers, increasing enterprise AI integration, and the rise of GenAI applications are further propelling the region’s transition toward GPU-accelerated data-center architectures.

Data Center GPU Market: COMPANY EVALUATION MATRIX

In the data center GPU market matrix, NVIDIA (Star) leads with a dominant market share and extensive product portfolio, driven by its cutting-edge GPU architectures such as the Hopper and Blackwell series, widely adopted across AI training, deep learning, and high-performance computing workloads. The company’s strong ecosystem, encompassing CUDA software, DGX systems, and cloud partnerships with hyperscalers like AWS, Microsoft, and Google, further reinforces its leadership position. AMD (Emerging Leader), meanwhile, is rapidly gaining traction with its Instinct GPU lineup and ROCm software platform, offering competitive performance and scalability for AI and HPC environments. While NVIDIA maintains its edge through technological maturity and a robust developer base, AMD continues to strengthen its presence, positioning itself to move toward the leaders’ quadrant as demand for open GPU ecosystems and AI compute diversity accelerates.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 87.32 Billion |

| Market Forecast in 2030 (Value) | USD 228.04 Billion |

| Growth Rate | CAGR of 13.7% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Thousand Unts) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East, Africa |

WHAT IS IN IT FOR YOU: Data Center GPU Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| GPU Manufacturer |

|

|

| Server OEM / ODM |

|

|

| Cloud Service Provider (Hyperscaler) |

|

|

| Semiconductor Foundry / Material Supplier |

|

|

RECENT DEVELOPMENTS

- January 2025 : Alibaba Cloud released an updated version of its AI model, Qwen 2.5, named Qwen 2.5-Max. According to Alibaba Cloud, Qwen 2.5-Max outperforms models such as DeepSeek-V3 and Meta's Llama 3.1 across 11 benchmarks. This release reflects the company's ongoing efforts to advance AI capabilities and maintain competitiveness in the rapidly evolving AI landscape.

- December 2024 : AWS launched Amazon Nova, a new family of foundation models integrated into Amazon Bedrock. These models are designed to enhance generative AI capabilities, enabling businesses to create text, images, and videos more efficiently.

- October 2024 : the AMD Instinct MI325X is designed for AI and machine learning workloads in data centers. It offers high computational performance and is optimized for complex rendering and simulation tasks. This GPU is suitable for AI-driven visualization, media rendering, and data-intensive applications.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

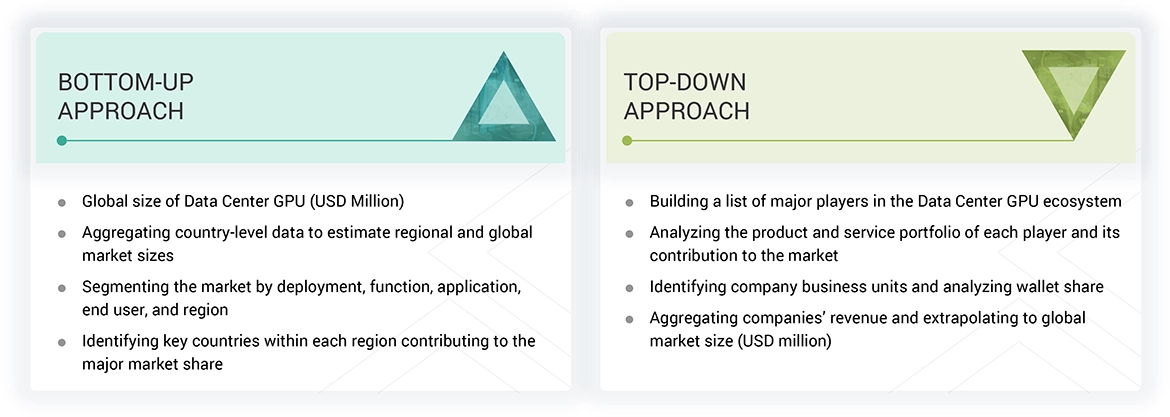

The study involved four major activities in estimating the current size of the data center GPU market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

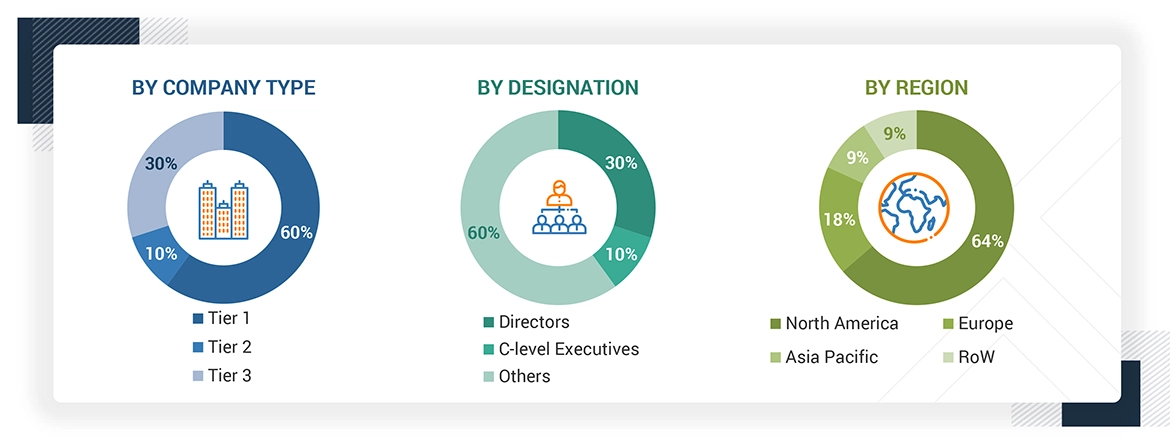

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the image sensor market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions: North America, Europe, the Asia Pacific, and the Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

Companies are classified into tiers based on their total revenues as of 2024?Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed input and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Bottom-Up Approach

- Identifying key participants that influence the entire market, along with the related component players

- Analyzing major manufacturers of data center GPUs, studying their portfolios, and understanding different types

- Analyzing trends pertaining to the use of data center GPUs in different kinds of industries

- Tracking the ongoing and upcoming developments in the market, such as investments, R&D activities, product/service launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand different types of data center GPU trends in the market, thereby analyzing the breakup of the scope of work carried out by major companies

- Arriving at the market estimates by analyzing the revenues of companies generated and then combining them to get the market estimate

- Segmenting the overall market into various other market segments

- Verifying and cross-checking the estimate at every level, from discussions with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of the data center GPU market, splitting the key market areas based on type, function, end user, and region, and listing the key developments

- Identifying all leading players in the data center GPU market based on type, function, and end user through secondary research and fully verifying them through a brief discussion with Industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Center GPU Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides in the data center GPU market.

Market Definition

A data center GPU is a specialized processor optimized for parallel processing in large-scale computing environments. It is used primarily to accelerate workloads such as artificial intelligence (AI) inference and training, high-performance computing (HPC), data analytics, and video processing in cloud and enterprise data centers.

Key Stakeholders

- Raw Material Suppliers

- Original Equipment Manufacturers (OEMs)

- Original Design Manufacturers (ODM) and Technology Solution Providers

- Research Institutes

- Data Center GPU Manufacturers

- Data Center GPU Forums, Alliances, and Associations

- Governments and Financial Institutions

- Analysts and Strategic Business Planners

Report Objectives

- To describe and forecast the data center GPU market by deployment, function, application, end user, and region.

- To forecast the data center GPU market by function in terms of volume

- To provide the market size estimation for North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To provide a value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter’s five forces analysis, investment and funding scenario, and regulations pertaining to the market.

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive market landscape

- To analyze strategic approaches, such as product launches, expansions, and partnerships, in the data center GPU market

- To analyze the impact of the macroeconomic outlook for each region

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center GPU Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center GPU Market