The study involved four major activities in estimating the size of the ETFE & ECTFE coatings market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the total pool of key ETFE & ECTFE coatings, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The ETFE & ECTFE coatings market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, service providers, and end users. Various primary sources from the supply and demand sides of the ETFE & ECTFE coatings market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. Primary sources from the supply side include manufacturers, associations, service providers, and institutions involved in the ETFE & ECTFE coatings industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, form, end-use industry, product, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of ETFE & ECTFE coatings and future outlook of their business, which will affect the overall market.

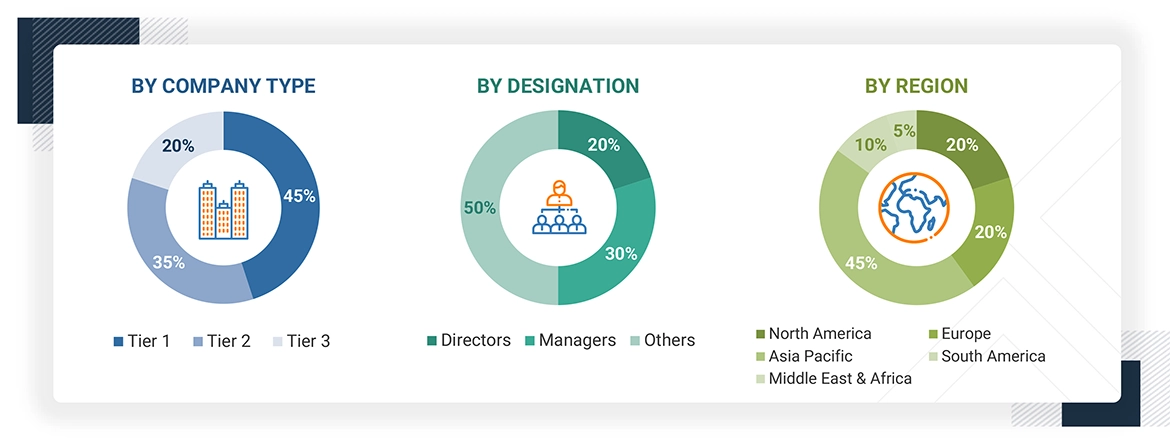

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024, available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for ETFE & ECTFE coatings for each region. The research methodology used to estimate the market size included the following steps:

-

The key players in the industry have been identified through extensive secondary research.

-

The supply chain of the industry has been determined through primary and secondary research.

-

The global market was then segmented into five major regions and validated by industry experts.

-

All percentage shares, splits, and breakdowns based on chemistry, form, product, end-use industry, and regions were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed input and analysis and presented in this report.

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources: the top-down approach, the bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The ETFE & ECTFE coatings market encompasses the provision of specialized coating services designed to protect industrial equipment operating in chemically aggressive, thermally extreme, and mechanically demanding environments. These coatings are applied to a wide array of equipment—including tanks, vessels, pipes, fittings, reactors, and fasteners—serving critical industries such as chemical processing, pharmaceuticals, semiconductors, and aerospace and defense.

Primarily applied to metallic substrates, ETFE and ECTFE coatings offer advanced corrosion protection, contamination control, and extended operational life for assets exposed to corrosive chemicals and high temperatures. ETFE coatings are characterized by their exceptional thermal stability, tensile strength, and broad chemical resistance, making them suitable for high-stress applications. ECTFE coatings, while offering slightly lower temperature resistance, are highly effective in preventing the permeation of small, aggressive molecules such as chlorine and hydrogen fluoride.

The service scope within this market includes surface pretreatment, coating application, curing, and post-application inspection—often tailored to meet stringent industry-specific standards such as FDA, USP, and ASTM compliance. An emerging trend in the market is the outsourcing of coating services to qualified third-party applicators with the expertise and certifications to deliver consistent quality and regulatory compliance.

As industries increasingly seek to enhance equipment longevity and operational efficiency while adhering to evolving environmental and safety regulations, demand for ETFE and ECTFE coating services is expected to grow steadily. This trend presents significant opportunities for specialized service providers offering value-added solutions backed by technical expertise and robust quality assurance frameworks.

Stakeholders

-

ETFE & ECTFE Coating Service Providers

-

Coatings Manufacturers

-

Coatings Traders, Distributors, and Suppliers

-

Raw Material Suppliers

-

End-use Industries

-

Associations and Regulatory Bodies

-

R&D Institutions

Report Objectives

-

To define, describe, and forecast the size of the ETFE & ECTFE coatings market, in terms of value

-

To provide detailed information about significant drivers, opportunities, restraints, and challenges, influencing market growth

-

To estimate and forecast the market size based on chemistry, form, product, end-use industry, and region

-

To forecast the size of the market with respect to major regions: Europe, North America, Asia Pacific, Rest of the World, along with their key countries

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

-

To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

-

To track and analyze recent development such as product launches, partnerships, acquisitions, and expansions in the market

-

To strategically profile key market players and comprehensively analyze their core competencies

Growth opportunities and latent adjacency in ETFE & ECTFE Coatings Market