High Performance Fluoropolymer (HPF) Market

High Performance Fluoropolymer (HPF) Market by Type (Ptfe, Fep, Pfa/Mfa, Etfe), Form, Application (Coatings & Liners, Components, Films, Additives), End-Use Industry (Electrical & Electronics, Industrial Processing, Transportation, Medical), And Region - Global Forecast To 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global High Performance Fluoropolymers Market is projected to grow from USD 4.87 billion in 2025 to USD 6.87 billion by 2030, registering a CAGR of 7.1% during the forecast period. High-performance fluoropolymers are primarily driven by the rising demand in the chemical processing, electronics, automotive, aerospace, and renewable energy sectors. The remarkable features of being chemically resistant, thermally stable, having low friction, and being durable and lightweight, together with the strict safety, emission, and performance regulations, are propelling the use of these materials in critical and high-temperature applications.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific dominated the high-performance fluoropolymers market, with a 35.7% share in terms of value in 2024.

-

By TypePTFE dominates the market, by type, with a share of 60%, in terms of value, in 2024.

-

By FormBased on form, fine powder/coagulated dispersions are the fastest-growing segment with a CAGR of 8.6% during the forecast period.

-

By End-Use IndustryThe electrical & electronics segment holds the highest market share of 35%, in terms of value, during the forecast period.

-

By ApplicationBased on applications, components are the fastest-growing application with a CAGR of 7.6%.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSCompanies such as Daikin Industries, AGC, and The Chemours Company were identified as some of the star players in the market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE- STARTUPSBitrez, Zeus Company LLC, and Guangzhou Fluoroplastic Co., Ltd., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The market for high-performance fluoropolymers is gradually progressing. The main factors behind this are rapid industrialization, the growing electronics and semiconductor industries, and the automotive, chemical processing, and renewable energy sectors. Their improved performance is attributed to further investments in high-tech manufacturing, closer cooperation between OEMs and suppliers, greater emphasis on lighter, more durable materials, ongoing research and development, and the introduction of sustainable, low-emission grades of fluoropolymer.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The market for high-performance fluoropolymers is evolving with the greater use of these materials in electric vehicles, semiconductors, and hydrogen systems, and this is backed up by technological innovations such as better polymerization processes, precise compounding, and higher-quality melt-processable grades. Besides, market evolution is pushed by tougher environmental regulations, the coming of low-PFAS and eco-friendly formulations, the reshaping of the supply chain, and the increase in R&D investments in recyclable and high-efficiency materials.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand from electronics, semiconductor, EV, and chemical processing industries

-

Increasing preference for lightweight, durable materials capable of withstanding harsh and high-temperature conditions

Level

-

High production and processing costs compared to conventional polymers

-

Stringent environmental regulations related to PFAS usage and emissions

Level

-

Growing adoption in renewable energy, hydrogen, and advanced battery applications

-

Development of low-PFAS, sustainable, and recyclable fluoropolymer grades

Level

-

Compliance with evolving global regulatory frameworks without compromising performance.

-

Supply chain volatility and limited availability of specialized raw materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand from electronics, semiconductor, EV, and chemical processing industries

The increasing demand from the electronics, semiconductor, EV, and chemical processing industries is the main driver of growth in the high-performance fluoropolymers market. Electronic and semiconductor applications for high-performance fluoropolymers include insulation for wires and cables, connector manufacturing, sealing, tubing, and even materials for wafer-processing equipment. The adoption is largely due to the incredible properties of these materials, such as excellent electrical insulation, inertness to chemicals, and resistance to high temperatures and aggressive materials. The fast growth of semiconductor fabs, especially located in the Asia Pacific, has a direct impact on the demand for ultra-pure and contamination-resistant fluoropolymer components, accelerating their usage even further. The power of fluoropolymers in electric vehicles is when they are incorporated in battery modules, thermal management, fuel lines, and gaskets, besides coatings, where reduction of weight, flame resistance, and long-lasting durability are the most critical requirements. The chemical industry has a similar reliance on fluoropolymers when it comes to the Installation of linings, pipes, valves, and membranes that will be in contact with highly corrosive chemicals and extreme temperatures and pressure. If industries keep up the pace and continue adopting advanced manufacturing technologies, the demand for high-performance fluoropolymers is likely to increase steadily through the forecast period, as the focus remains on efficiency, safety, and reliability.

Restraint: High production and processing costs compared to conventional polymers

In comparison to conventional polymers, high production and processing costs are the major factors that hold back the high-performance fluoropolymers market. The manufacturing of fluoropolymers requires a lot of money, not only to buy the specialized raw materials but also to employ complex polymerization processes and utmost control conditions, which are very hard to break and operate; therefore, the capital and operating costs go up discreetly. Moreover, fluorescent polymers often need special corrosion-resistant equipment and advanced safety systems, which drives up the total production cost even more. Processing these materials can be quite challenging, as they may have very high melting points, exhibit very poor melt flow, or require specialized molding, extrusion, and sintering techniques. This translates into increased energy consumption, tooling expenses, and scrap rates, all of which are especially detrimental for small-scale or customized applications. All in all, the total cost of finished fluoropolymer components is still very much higher than that of engineering plastics or commodity polymers. For price-sensitive end-user industries, particularly in developing countries, the superior performance benefits must be weighed against the cost premiums, which, in most cases, lead to the non-adoption of the product.

Opportunity: Growing adoption in renewable energy, hydrogen, and advanced battery applications

The high-performance fluoropolymers market is opening up a considerable opportunity due to the increasing use of these materials in renewable energy, hydrogen and advanced battery applications developments. In renewable energy systems like solar and wind power, fluoropolymers are becoming more and more preferred over other materials as they possess superb weatherability, UV resistance, and long lifespan under extreme situations. The hydrogen economy, which is still emerging, adds to the demand, as the fluoropolymer is then being applied in fuel cells, electrolyzers, and hydrogen storage and transfer, where wear and tear resistance, high-pressure filling, and aggressive working environments are needed for safety and performance. In the case of advanced battery application technology, particularly lithium-ion and next-generation solid-state batteries, the role of high-performance fluoropolymers is significant in the areas of binders, separators, gaskets, and thermal management components, given the benefits of chemical stability, flame retardancy, and light weight. As part of the global investment in clean energy infrastructure, the demand for durable and highly reliable materials is also growing, and government carbon-reduction initiatives are indirectly contributing to the creation of durable and highly reliable materials.

Challenge: Compliance with evolving global regulatory frameworks without compromising performance

Maintaining compliance with changing global regulatory frameworks and, at the same time, not compromising on performance is still the main challenge for the high-performance fluoropolymers market. PFAS-related substances are now under the microscope in many areas worldwide, including Europe, North America, and parts of Asia, which have made companies that deal with these substances in one way or another face more stringent regulations concerning their operations, invariably affecting fluoropolymer manufacturers the most. The companies are obliged to reformulate their products, adjust their manufacturing processes, and conduct extensive testing and certification—all these while keeping the main quality of the high-performance fluoropolymers, such as chemical resistance, thermal stability, and electrical insulation. It is especially complicated to balance the performance expectations along with the regulatory compliance in the above-mentioned sectors and in applications like electronics, semiconductors, energy, and chemical processing, where failure of the material can cause safety hazards and result in the loss of operations. Moreover, the uncertainty in regulations and the constant updates in policies lead to increased compliance costs and longer timelines for product commercialization. The smaller manufacturers usually encounter more difficulties than the larger ones because of their limited budgets and lack of technical resources for R&D. As the regulations are constantly changing, the players in the market are obligated to innovate continuously to come up with compliant, low-impact solutions that are still reliable, durable, and efficient, hence making regulatory compliance a constant and strategic challenge for the industry.

HPF MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A manufacturer of advanced fluoropolymers such as PTFE, ETFE, PFA, and FEP used in semiconductor manufacturing equipment, chemical processing linings, wire & cable insulation, and photovoltaic components. AGC focuses on high-purity grades and customized solutions for critical environments. | Excellent chemical and thermal resistance, high purity for contamination-sensitive applications, long service life, enhanced electrical insulation, and reliability in extreme operating conditions. |

|

A global supplier of fluoropolymers, including PTFE, PVDF, FEP, and ETFE, for applications in EV components, lithium-ion batteries, hydrogen systems, and industrial piping. Strong integration of material innovation with downstream application development. | Lightweighting, superior durability, flame resistance, improved energy efficiency, and compatibility with next-generation EV, battery, and hydrogen technologies. |

|

Producer of Teflon fluoropolymers used in chemical processing, aerospace, electronics, membranes, and coatings. Chemours emphasizes high-performance and low-emission grades to meet evolving regulatory requirements. | Outstanding non-stick and low-friction properties, high thermal stability, corrosion resistance, extended equipment life, and consistent performance under harsh chemical and mechanical stress. |

|

Supplier of fluoropolymers and fluorochemicals for industrial, pharmaceutical, agrochemical, and specialty applications. GFL supports customized formulations and serves cost-sensitive markets alongside performance-critical applications. | Cost-effective access to high-performance materials, good chemical resistance, process reliability, and suitability for diverse industrial applications. |

|

Developer of specialty fluoropolymers and fluorinated materials for electronics, energy storage, thermal management, and advanced industrial applications, with a strong focus on innovation and application-specific solutions. | Enhanced thermal management, electrical reliability, precision performance, strong application engineering support, and innovation-driven material solutions for advanced technologies. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The high-performance fluoropolymers market ecosystem is structured around integrated raw material suppliers and fluorochemical manufacturers who produce, but are not limited to, PTFE, PVDF, FEP, PFA, ETFE, and related specialty grades. These materials are turned by compounders and converters into reinforcing films, coatings, membranes, linings, tubing, and molded parts that can withstand extreme temperatures, corrosive chemicals, and demanding electrical conditions. Distributors and specialty chemical suppliers ensure global availability, technical services, and local supplies. North America, Europe, and APAC are the main centers of manufacturing and consumption, backed by strong R&D capabilities, regulatory compliance frameworks, and advanced processing infrastructure.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

High Performance Fluoropolymers Market, By Form

By form, the market includes granular/suspension, fine powder & suspension, fine powder, coagulated dispersion, aqueous dispersion, and micro powder. The market is mostly occupied by granular/suspension grades because of their extensive application in molding and extrusion, thus giving superior mechanical properties and processing efficiency. Besides, fine powders and dispersions are the most suitable for coatings, films, membranes, and precision applications, whereas micropowders are used as additives in inks, lubricants, and surface treatments.

High Performance Fluoropolymers Market, By Type

The market, by type, consists of PTFE, FEP, PFA/MFA, ETFE, and other types. PTFE is the leading type in this market due to its remarkable capabilities of resistance to chemicals, heat, and friction, as well as its extensive use in various sectors like chemical processing, electronics production, car manufacturing, and power generation industries. FEP and PFA/MFA are chosen mainly for their coating, tubing, and insulation applications to the exclusion of ETFE, which is confined to films and architectural applications, while other specialty types play roles in serving only niche, high-performance needs.

High Performance Fluoropolymers Market, By End-Use Industry

End-use industries studied in this market include electrical & electronics, transportation, industrial processing, medical, and other end-use industries. The electrical and electronics segment is the largest market segment among all these, owing to the rising usage of wire and cable insulations, connectors, semiconductor components, and high-performance electronic devices that demand high thermal stability, chemical resistance, and electrical insulation properties. The transportation, industrial processing, and medical applications sectors also promote the market by catering to specialized needs in the areas of EV parts, chemical processing, and medical instruments.

High Performance Fluoropolymers Market, By Applications

Applications include coatings & liners, components, films, additives, and other uses. Of these segments, coatings & liners are the largest, and their extensive utilization in chemical processing equipment, pipelines, tanks, and industrial machinery is the major reason for the growth of this segment. These applications use coatings and liners because they offer superior chemical resistance, thermal stability, corrosion protection, and long service life, making them indispensable in harsh, high-temperature environments. Moreover, components, films, and additives are also contributing to the growth of the market in electronics, automotive, and specialty industrial applications.

REGION

Asia Pacific to be fastest-growing region during forecast period

The Asia Pacific region is the largest market for high-performance fluoropolymers, and this growth is mainly attributed to rapid industrialization, the rise of electronics and semiconductor manufacturing, and the increasing use of the material in electric vehicles (EVs), renewable energy, and chemical processing, among others. It is also worth noting that China's, Japan's, South Korea's, and Southeast Asia's strong manufacturing hubs are an important factor for the growth of the global fluoropolymer market, along with the government's support for clean energy and advanced materials, and the rising demand for high-reliability, high-durability fluoropolymer solutions in critical applications.

HPF MARKET: COMPANY EVALUATION MATRIX

Daikin Industries (Star) holds the top spot in the global market for high-performance fluoropolymers due to its complete range of products, including PTFE, PVDF, FEP, and ETFE, its powerful R&D, and its strategic partnerships with OEMs in the sectors of electronics, automotive, and chemical processing. HaloPolymer (Emerging Player) is obtaining popularity through the expansion of its specialty fluoropolymers and custom formulations for industrial, chemical, and energy applications. It is also using its technical knowledge to support the demand of EVs, renewable energy, and semiconductor industries; thus, it is becoming a competitive emerging player in the high-performance fluoropolymer solution market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Daikin Industries (Japan)

- The Chemours Company (US)

- AGC Inc (Japan)

- Synesqo (Belgium)

- GFL Limited (India)

- Dongyue Group (China)

- HaloPolymer (Russia)

- 3M (US)

- Fluoroeals Spa (Italy)

- Hubei Everflon Polymer (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 4.87 Billion |

| Market Forecast in 2030 (value) | USD 6.87 Billion |

| Growth Rate | CAGR of 7.1% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: HPF MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Demand for country-specific market insights | Provided detailed analysis of high-performance fluoropolymers demand, pricing trends, regulatory frameworks, and key end-use industries for targeted countries in APAC, North America, and Europe. | Helps clients identify high-growth regional markets, assess regulatory impact, and plan targeted expansion strategies. |

| Request for competitor benchmarking | Delivered a comparative assessment of leading fluoropolymer manufacturers, including product portfolios, production capacity, pricing strategies, R&D focus, and strategic initiatives. | Enables better strategic positioning, highlights competitive gaps, and identifies market opportunities for growth and innovation. |

| Application-specific insights | Provided insights on fluoropolymer use across electronics, chemical processing, EVs, renewable energy, and medical devices, highlighting performance benefits and adoption trends. | Supports product development, targeted marketing, and alignment of material solutions with industry-specific requirements. |

| Custom material formulation support | Evaluated and recommended tailored fluoropolymer grades for specific thermal, chemical, or electrical requirements, including PTFE, FEP, PFA, and PVDF solutions. | Reduces R&D cycle times, ensures performance optimization, and enhances compatibility with client-specific manufacturing processes. |

| Technical feasibility & process guidance | Delivered detailed guidance on processing methods, extrusion, molding, coating, and compounding techniques for selected fluoropolymers. | Improves production efficiency, reduces material waste, and ensures consistent product quality for end-use applications. |

| Regulatory & compliance support | Provided analysis of regional and global regulations related to PFAS, chemical safety, and environmental compliance for fluoropolymer products. | Ensures adherence to legal standards, mitigates risk, and supports sustainable and responsible material sourcing strategies. |

RECENT DEVELOPMENTS

- December 2024 : Fluorseals SpA partnered with Victrex plc. developed innovative material solutions by combining Fluorseals' expertise in fluoropolymers with Victrex's high-performance polymers.

- August 2024 : AGC developed an innovative process for manufacturing fluoropolymers without the use of surfactants, which would influence the HPF market.

- April 2023 : AGC invested substantially in expanding its fluoropolymer production capabilities in Japan, signaling a strategic move to capitalize on the burgeoning demand from the semiconductor and green hydrogen sectors.

- February 2022 : Gujarat Fluorochemicals Limited (GFL) announced an investment in expanding PTFE and PVDF capacities in its integrated manufacturing facility at Dahej, India.

- November 2020 : AGC installed Fluon ETFE film on the roof of SoFi Stadium, Los Angeles, US. The films aim to provide a comfortable, clear blue-sky view for the audience.

Table of Contents

Methodology

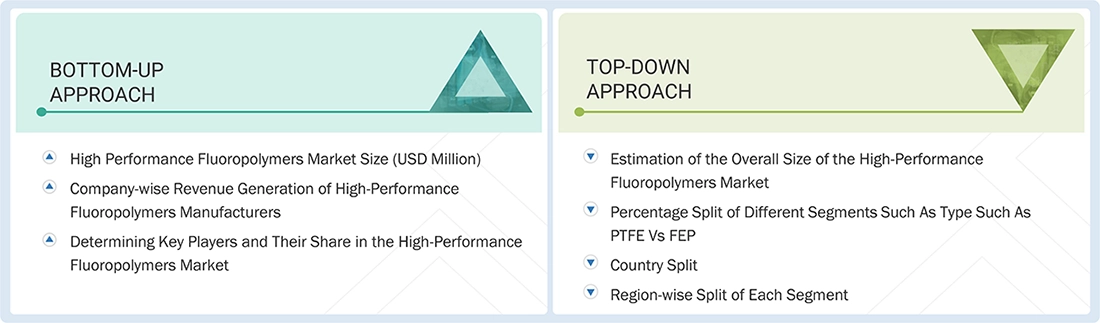

The study involves two major activities in estimating the current market size for the global high-performance fluoropolymers market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources used for this research include the financial statements of companies that offer high-performance fluoropolymers and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation by industry trends down to the bottom-most level and regional markets. Secondary data were collected and analyzed to determine the overall size of the high-performance fluoropolymers market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after secondary research provided information on the high-performance fluoropolymers market. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from high-performance fluoropolymers industry vendors; material providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights into market statistics, revenue from products and services, market breakdowns, market size estimates, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, applications, end users, and regions. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking high-performance fluoropolymers services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of high-performance fluoropolymers and future outlook of their business, which will affect the overall market.

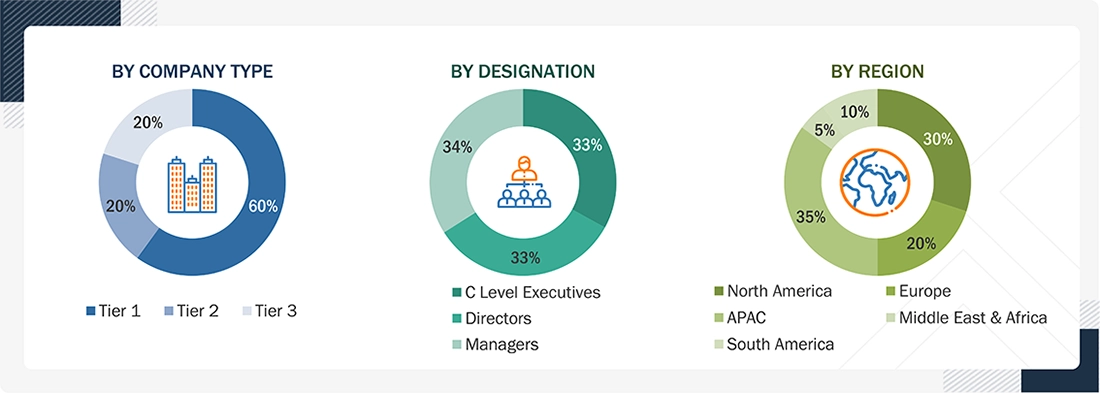

The Breakup of Primary Research:

Market Size Estimation

The research methodology used to estimate the size of the high-performance fluoropolymers market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on regional demand for high-performance fluoropolymers across different end-use industries. Such procurements provide information on the demand aspects of the high-performance fluoropolymers industry for each end-use industry. For each end-use, all possible market segments were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, as applicable, to complete the overall market engineering process and obtain exact statistics for various market segments and subsegments. The data was triangulated by examining various factors and trends on both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

High-performance fluoropolymers are advanced polymer materials that demonstrate exceptional resistance to heat, chemicals, weathering, and electrical stress. The polymers PTFE, FEP, PFA, PVDF, and ETFE retain their mechanical strength when exposed to extreme temperatures and severe operating environments. High-performance fluoropolymers find extensive application in the chemical processing, electronics, automotive, aerospace, energy, and healthcare industries because they offer low friction and non-stick properties, as well as exceptional dielectric strength. The material provides better safety, longer equipment life, and improved operational capacity for coatings, linings, seals, wires and cables, membranes, and industrial equipment.

Key Stakeholders

- High-performance Fluoropolymer Manufacturers

- High-performance Fluoropolymer Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and forecast the market by type, form, end-use industry, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, partnerships & collaborations, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Available customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the high-performance fluoropolymers market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the High Performance Fluoropolymer (HPF) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in High Performance Fluoropolymer (HPF) Market

Brad

May, 2012

Information in Fluoropolymers Market for marine, oil and gas, aircraft, heavy equipment and construction, and trend and forecast in US and global market.

Sina

Oct, 2012

The client wants a complementary copy.

Avanish

Jul, 2012

Interested in Fluoropolymers Market.

Stéphane

Sep, 2013

Wants specific section of the report. i.e PTFE report portion.

Cameron

Mar, 2017

General information on PFA fluoropolymers market, trends and forecast .