The study involved four major activities in order to estimate the current size of the hard coatings market. Exhaustive secondary research was conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, including International Organization of Motor Vehicle Manufacturers (OICA), Bureau of Transportation Statistics, European Automobile Manufacturers’ Association, World Bank, and American Coating Association.

Primary Research

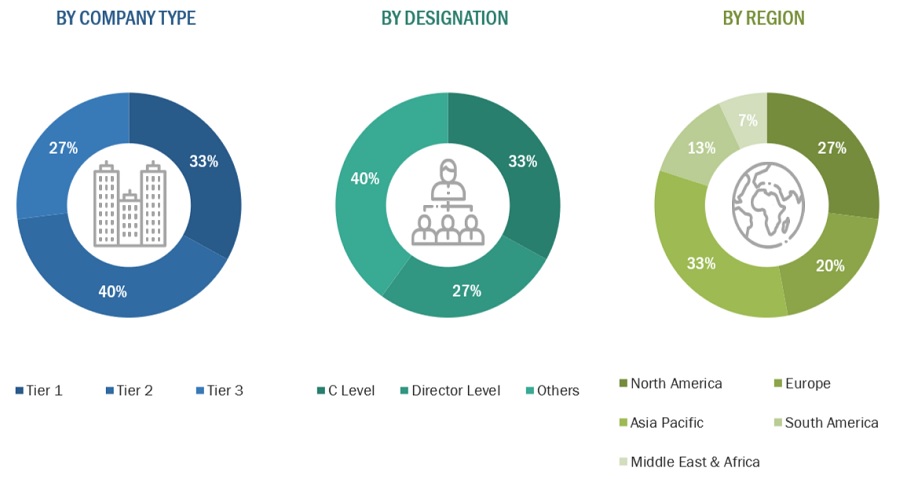

Extensive primary research was carried out after gathering information about hard coatings market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the hard coatings market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated with resin type, vehicle type, coat type, technology, and region.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME

|

DESIGNATION

|

|

Carl Zeiss Meditec AG

|

Sales Manager

|

|

SDC Technologies, Inc.

|

Project Manager

|

|

Ultra Optics

|

Individual Industry Expert

|

|

Cemecon AG

|

Manager

|

Market Size Estimation

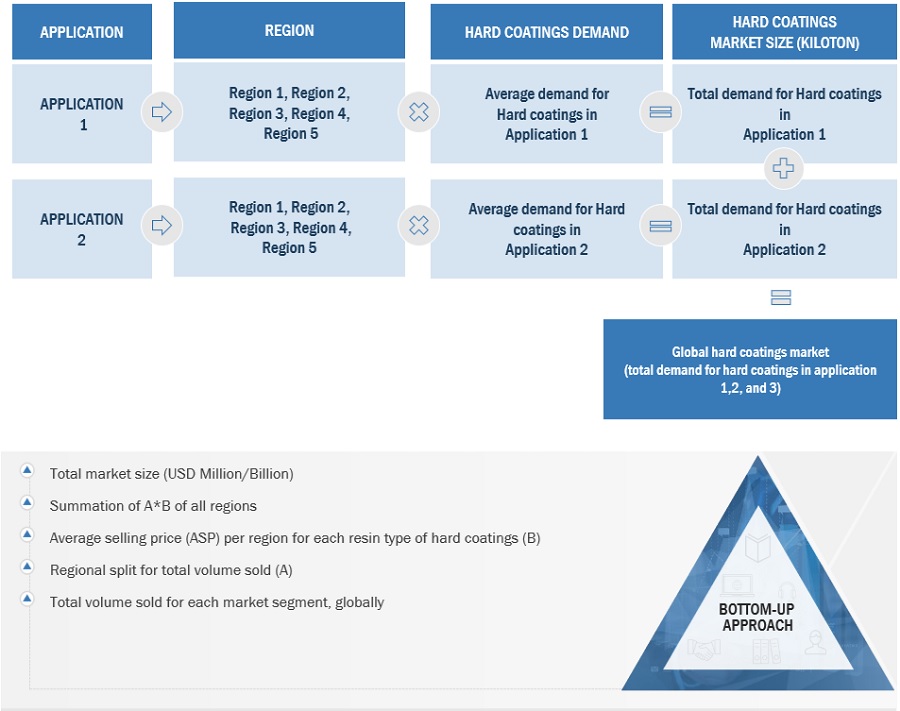

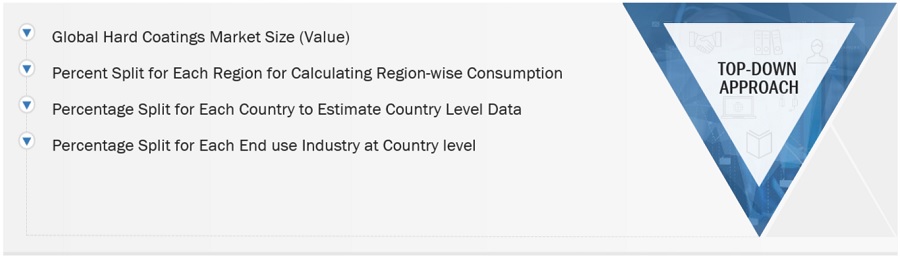

The following information is part of the research methodology used to estimate the size of the hard coatings market. The market sizing of the hard coatings market was undertaken from the demand side. The market size was estimated based on the market size for hard coatings in various applications.

Global Hard Coatings Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Hard Coatings Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Hard coating refers to a thin protective layer applied to surfaces, typically metals or ceramics, to enhance their resistance to wear, abrasion, corrosion, and friction. These coatings are composed of hard materials such as carbides, nitrides, or diamond-like carbon, which significantly increase the surface hardness of the substrate. Hard coatings find extensive applications in various industries, including automotive, aerospace, manufacturing, and electronics, where durability and performance optimization are critical.

Key Stakeholders

-

End User

-

Raw Material Suppliers

-

Senior Management

-

Procurement Department

Report Objectives

-

To define, describe, segment, and forecast the size of the hard coatings market based on material type, deposition techniques, application, end-use industry, and region.

-

To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Middle East & Africa and South America along with major countries in each region

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the hard coatings market

-

To analyze technological advancements and product launches in the market

-

To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

-

To identify financial positions, key products, and key developments of leading companies in the market

-

To provide a detailed competitive landscape of the market, along with market share analysis

-

To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

-

To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

-

Additional country-level analysis of the hard coatings market

-

Profiling of additional market players (up to 5)

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the automotive coatings Market

Growth opportunities and latent adjacency in Hard Coatings Market