The study involved four major activities to estimate the current size of the global luxury vinyl tiles market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of luxury vinyl tiles through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the luxury vinyl tiles market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and subsegments of the market.

Secondary Research

The market for the companies offering luxury vinyl tiles is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the luxury vinyl tiles market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of luxury vinyl tile vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the luxury vinyl tiles market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of luxury vinyl tiles offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

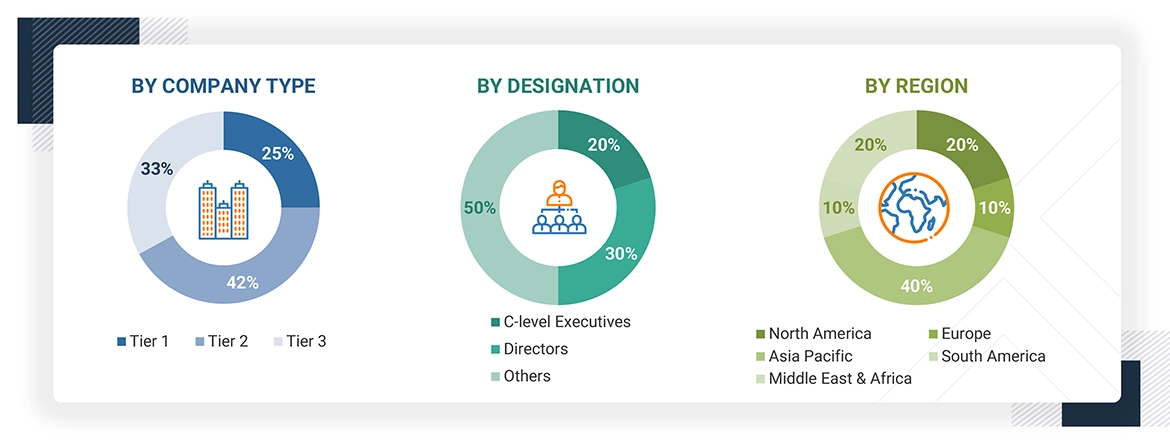

Notes: Others include sales, marketing, and product managers.

Tier 1: > USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global luxury vinyl tiles market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Luxury vinyl tiles are made from vinyl material and consist of several layers, including a protective wear layer and a design layer that frequently mimics the look of natural materials such as wood, stone, or ceramic. Besides being commonly utilized as flooring in residential and commercial environments due to their durability, aesthetic flexibility, and minimal maintenance needs, luxury vinyl tiles are also used in various other contexts. In interior design, luxury vinyl tiles are used as wall coverings, providing a resilient and visually attractive option compared to traditional choices like paint or wallpaper. Additionally, luxury vinyl tiles function as backsplashes in kitchens and bathrooms, offering moisture protection and an appealing visual style.

Stakeholders

-

Luxury Vinyl Tile Manufacturers

-

Raw Material Suppliers

-

Distributors and Traders

-

Industry Associations

-

Government Bodies

-

End Users

Report Objectives

-

To define, describe, and forecast the size of the global luxury vinyl tiles market based on type, product type, distribution channel, end-use sector, and region in terms of value and volume

-

To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

-

To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

-

To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

-

To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies

-

To analyze competitive developments such as product launches, acquisitions, expansions, partnerships, and agreements in the luxury vinyl tiles market

-

To provide the impact of AI/Gen AI on the market.

Growth opportunities and latent adjacency in Luxury Vinyl Tiles Market