This study extensively investigated the current power SCADA market size, initiating with a thorough secondary research phase dedicated to gathering data on the market, related markets, and the broader industry landscape. The collected information, along with assumptions and calculated market sizes, underwent rigorous validation in the subsequent primary research phase, which involved consultations with industry experts spanning the entire value chain. The assessment of the overall market size was tailored to each country, followed by a detailed market dissection where the data was cross-referenced to estimate the sizes of various segments and sub-segments. This two-phased approach, incorporating both secondary and primary research methodologies, enhances the reliability and accuracy of the study's findings.

Secondary Research

Throughout this research study, a wide range of secondary sources was utilized, incorporating directories, databases, and reputable references such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, the US Department of Energy (DOE), and the International Energy Agency (IEA). These sources played a crucial role in gathering valuable data necessary for conducting a thorough analysis of the global power SCADA market. Covering technical, market-oriented, and commercial aspects, these secondary sources significantly contributed to the study's depth and breadth. Additional secondary sources encompassed annual reports, press releases, investor presentations, whitepapers, authoritative publications, articles by esteemed experts, information from industry associations, trade directories, and various database resources. The diverse range of secondary sources employed ensures a robust and well-informed foundation for the research study.

Primary Research

The power SCADA market involves various stakeholders throughout its supply chain, including component manufacturers, product manufacturers/assemblers, service providers, distributors, and end-user industries. The primary driver of market demand originates from industrial end-users, while the increasing needs of transmission and distribution utilities also contribute significantly to market growth. On the supply side, a noticeable trend is the heightened demand for contracts from the industrial sector, accompanied by a notable prevalence of mergers and acquisitions among major industry players.

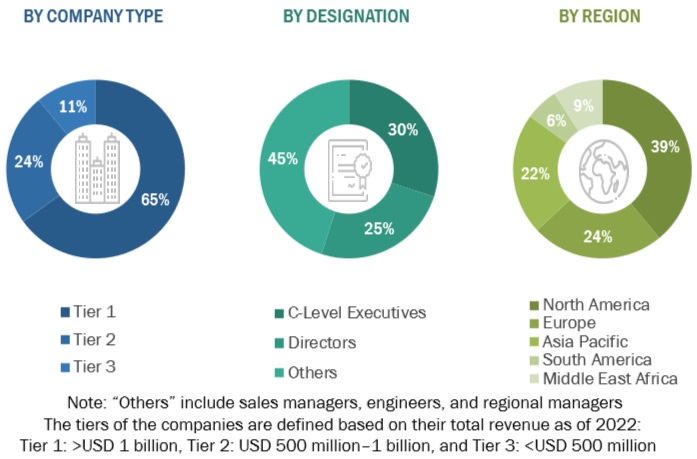

To gain a comprehensive understanding of the market, both qualitatively and quantitatively, a diverse set of primary sources from both the supply and demand sides underwent interviews. The breakdown below outlines the primary respondents who played a crucial role in providing insights for the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches are combined in the research strategy to evaluate the global power SCADA market size and its associated submarkets. The sizes of the market's several subsegments were ascertained by carefully applying these techniques. The following essential phases comprise the research process.

-

This methodology has examined production data for all types of power SCADA systems at both the national and regional levels.

-

A comprehensive understanding of the global market environment for various power SCADA system types has been achieved through extensive secondary and primary research.

-

Several primary interviews with notable power SCADA system development specialists, including important OEMs and Tier I suppliers, have been undertaken.

-

When evaluating and projecting the market size, qualitative factors such as market drivers, restraints, opportunities, and challenges have been taken into account.

Global Power SCADA Market Size: Bottom-Up Approach

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Global Power SCADA Market Size: Top-Down Approach

Data Triangulation

The procedure for determining the overall market size involved the previously outlined methodologies, which included segmenting the market into various segments and subsegments. To conclude the comprehensive market analysis and obtain accurate statistics for each market segment and subsegment, the implementation of data triangulation and market segmentation techniques was deemed essential. Data triangulation entailed a thorough examination of various factors and trends from both the demand and supply perspectives within the ecosystem of the market.

Market Definition

The Power SCADA (Supervisory Control and Data Acquisition) market refers to the industry involved in providing advanced control and monitoring solutions for power systems. This technology encompasses a comprehensive suite of hardware and software components that enable real-time supervision and data acquisition across power generation, transmission, and distribution processes. Power SCADA systems play a pivotal role in enhancing operational efficiency, reliability, and automation within the power sector, utilizing a centralized platform to monitor diverse elements of the infrastructure. These systems are crucial for managing the complexities of modern power networks, facilitating the integration of renewable energy sources, and supporting the overall digitization of power infrastructure. The market encompasses various stakeholders, including component manufacturers, product assemblers, service providers, distributors, and end-users in industries such as utilities and manufacturing, contributing to the growth and evolution of the Power SCADA market.

Key Stakeholders

-

Government Utility Providers

-

Independent Power Producers

-

SCADA System Developers

-

Power equipment and garden tool manufacturers

-

Consulting companies in the energy & power sector

-

Distribution utilities

-

Government and research organizations

-

Organizations, forums, and associations

-

Raw material suppliers

-

State and national regulatory authorities

-

SCADA System Developers, distributors, and suppliers

-

SCADA System original equipment manufacturers (OEMs)

Objectives of the Study

-

Based on variables like component, architecture, and end-use industry, the power SCADA system market will be defined, characterised, categorised, and forecasted.

-

To project market sizes for the major countries in each of these five regions, as well as those for North America, South America, Europe, Asia Pacific, the Middle East, and Africa.

-

To provide in-depth analyses of the elements driving market dynamics, industry-specific opportunities, constraints, and difficulties.

-

To systematically assess the market share, growth trends, and prospects of each subsegment.

-

To evaluate the competitive landscape for leaders in the industry and the market prospects for interested parties.

-

To create strategic profiles of the top players by closely examining their market shares and essential strengths.

-

To monitor and assess competitive changes in the power SCADA market, including as joint ventures, acquisitions, contracts, partnerships, agreements, sales contracts, new product launches, expansions, and investments.

-

The market for power SCADA is evaluated in this report.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Power SCADA Market