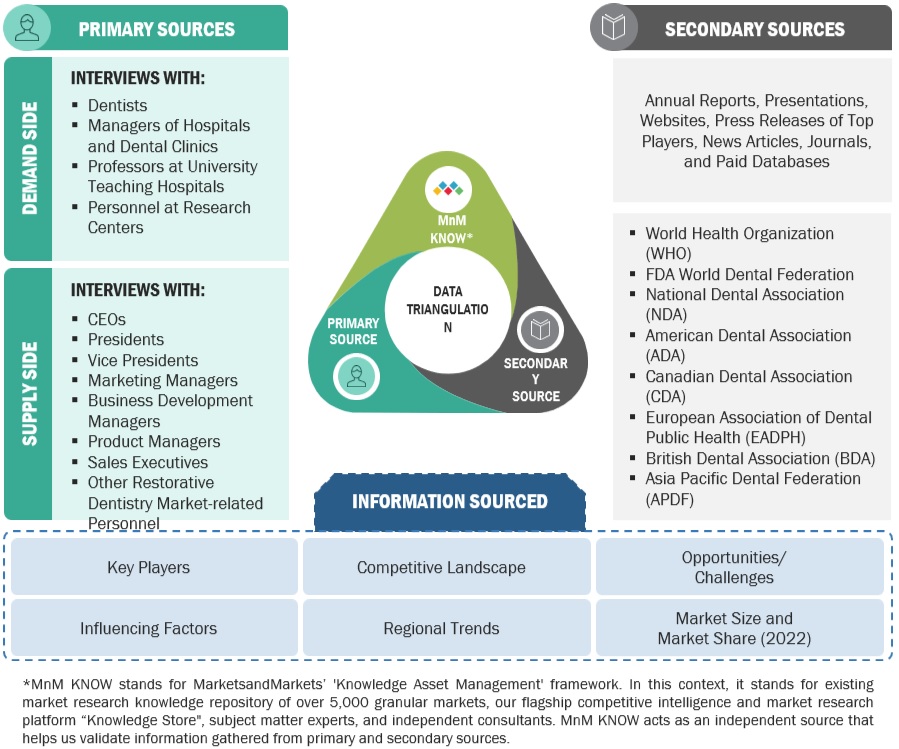

The study involved four major activities to estimate the current size of the Restorative dentistry market. Exhaustive secondary research was carried out to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments.

Secondary Research

This research study involved using various secondary sources; directories; databases such as Bloomberg Business, Factiva, and Wall Street Journal; white papers; annual reports; companies house documents; investor presentations; and SEC filings of companies. The secondary research approach has been used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the restorative dentistry market. It was also used to obtain important information about key players, market classification, and segmentation according to industry trends and key developments related to market perspectives. A database of the key industry leaders has also been prepared using secondary research.

Primary Research

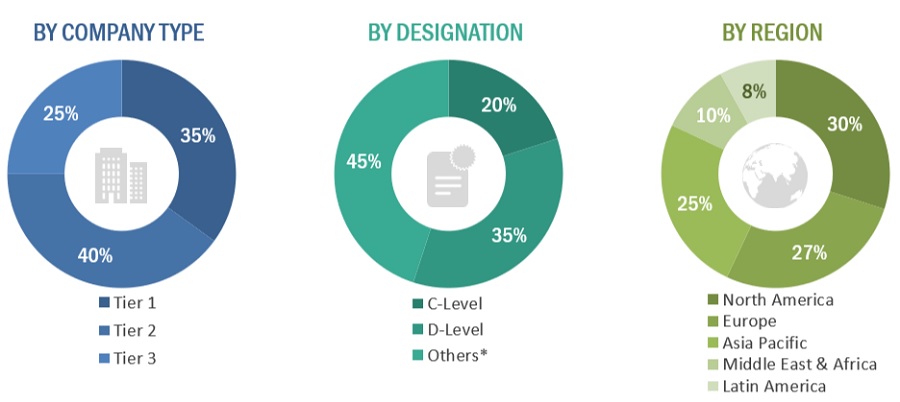

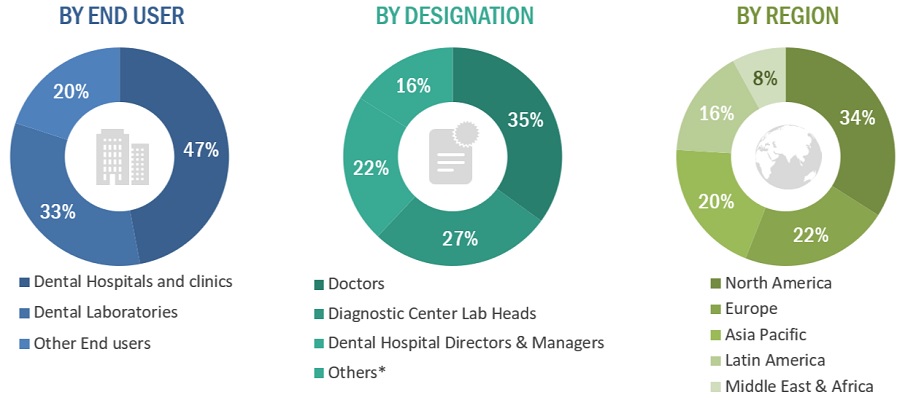

The restorative dentistry market comprises several stakeholders such as manufactures, distributers, In the primary research approach, various sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information pertaining to this report. The following is the breakdown of primary respondents:

Primary Interviews by Supply Side :

To know about the assumptions considered for the study, download the pdf brochure

Primary Interviews by Demand side:

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation

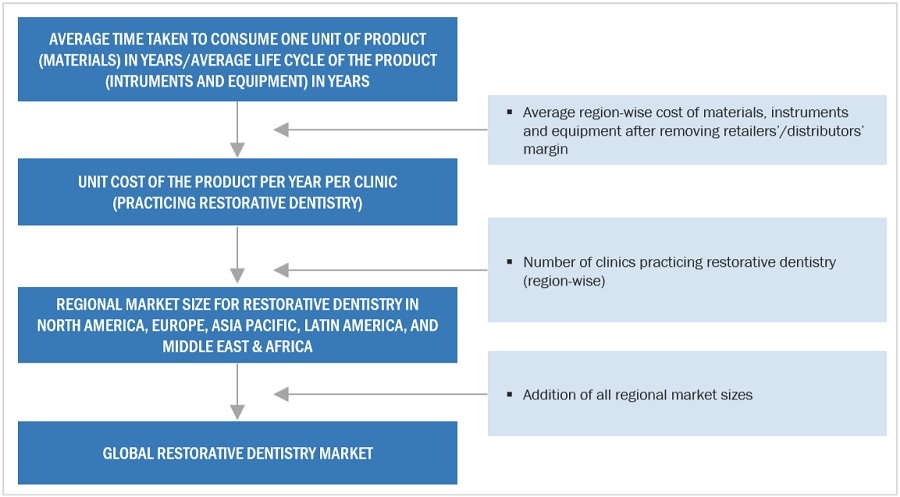

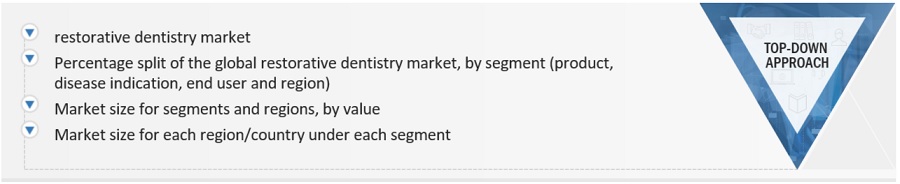

Both top-down and bottom-up approaches were used to estimate and validate the total size of the restorative dentistry market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and markets have been identified through extensive secondary research

-

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall size of the global restorative dentistry market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Restorative dentistry is a branch of dentistry that focuses on restoring the structure, function, and esthetics of the natural teeth, the lack of which results from dental caries, or dental injuries. Dental restoration procedures include class 1, 2, 3, 4, 5 and 6 cavity fillings (depending on the affected surface of the tooth) using various types of restorative materials, which maybe directly or indirectly placed.

Key stakeholders

-

Dental consumable manufacturers

-

Suppliers and distributors of dental consumables

-

Dental research institutes

-

Dental laboratories

-

Healthcare services providers (Hospitals and public & private clinics)

-

Government associations

-

Market research and consulting firms

-

Venture capitalists and investors

Report Objectives

-

To define, describe, and forecast the global restorative dentistry market on the basis of product, type of cavity, end user and region.

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

-

To analyze the opportunities in the market for key stakeholders and provide details of the competitive landscape for major market leaders

-

To forecast the size of the market segments with respect to five main regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa

-

To profile the key market players and comprehensively analyze their market shares and core competencies

-

To track and analyze competitive developments such as mergers and acquisitions, new product developments, partnerships, agreements, collaborations, and expansions in the global restorative dentistry market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the global restorative dentistry market report

Product Analysis

-

Product Matrix, which gives a detailed comparison of the product portfolios of the top five global players.

Company Information

-

Detailed analysis and profiling of additional market players (up to 5 OEMs)

Geographic Analysis

-

Further breakdown of the Rest of Europe restorative dentistry market into Belgium, Austria,s

-

Denmark, Greece, Poland, and Russia, among other countries

-

Further breakdown of the Rest of Asia Pacific restorative dentistry market into New Zealand, Vietnam, Philippines, Singapore, Malaysia, Thailand, and Indonesia, among other countries

-

Further breakdown of the Rest of Latin America restorative dentistry market into Argentina, and Colombia, among other countries.

Jesse

Mar, 2022

Can you share the detailed information on technological advancements in the Restorative Dentistry Market?.

Jordan

Mar, 2022

In what way COVID19 is Impacting the global growth of the Restorative Dentistry Market?.

Bryan

Mar, 2022

Can you enlighten us about the key players operating in the global Restorative Dentistry Market?.