The study involved major activities in estimating the current size of the shore power market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the shore powers market.

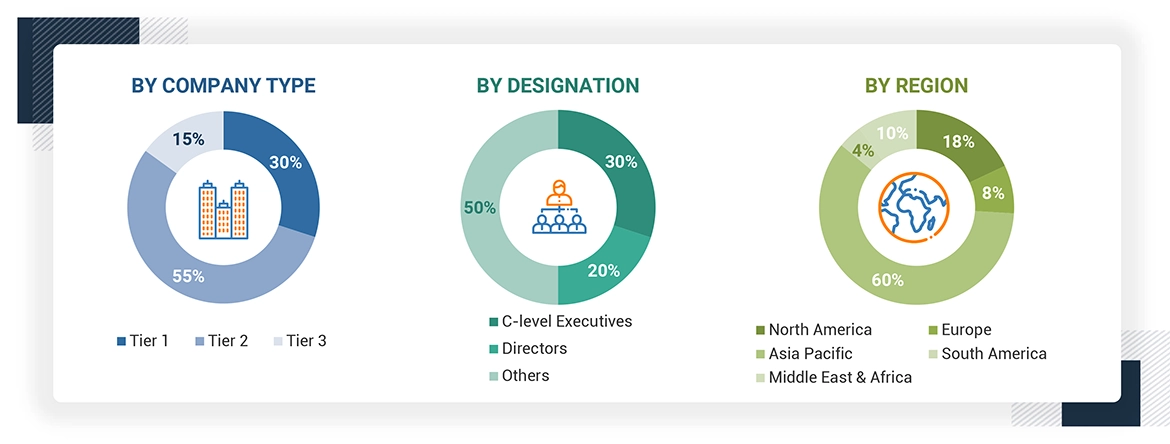

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. Following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2023: Tier 1 = > USD 1 billion,

Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the shore power market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Shore Power Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

Shore power, also known as cold ironing or alternative maritime power (AMP), refers to the supply of electricity from the shore directly to a moored vessel, allowing it to switch off its own on-vessel diesel generators. It, therefore reduces fuel burning and greenhouse gas emissions in a berthed vessel. In addition, shore power has been applied in several types of vessels, among them, vessels cruising, transport ferries, container shipping, and tankers. The main drivers of shore power adoption are, therefore, environmental regulations, government initiatives, and calls for more sustainable and greener port operations, good ways to reduce noise and air pollution, thus improving health and safety conditions for port workers and other local communities. Advances in power management, renewable energy integration, and growth in investments related to port electrification are all resulting in growth in shore power.

Stakeholders

-

Government & research organizations

-

Institutional investors

-

Investors/Shareholders

-

Environmental research institutes

-

Manufacturers’ associations

-

Shore power manufacturers, dealers, and suppliers

-

Organizations, forums, alliances, and associations

-

Shore Power equipment manufacturing companies

-

Shore Power project developers

-

Government and research organizations

-

Universities and Research institutes

Report Objectives

-

To define, describe, segment, and forecast the shore power market by installation type, connection, component, power output, and region, in terms of value

-

To forecast the market size for four key regions: North America, Europe, Asia Pacific, Middle East & Africa and South America along with their country-level market sizes, in terms of value

-

To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the market growth

-

To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

-

To provide value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, average selling price (ASP) analysis, Porter’s five forces analysis, and regulations pertaining to the market

-

To analyze opportunities for stakeholders in the market and draw a competitive landscape for market players

-

To strategically analyze the ecosystem, regulations, patents, and trading scenarios pertaining to the market

-

To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business and product strategies

-

To compare key market players with respect to their market share, product specifications, and applications

-

To strategically profile key players and comprehensively analyze their market rankings and core competencies2

-

To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, partnerships, and collaborations, in the market

-

To study the impact of AI/Gen AI on the market under study, along with the global macroeconomic outlook

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players

Martin

Jun, 2022

I would like to know more about the Shore Power Market size for the North America region for the 2022 to 2027 forecast year..