The study involved four major activities for estimating the smart glasses market size. Exhaustive secondary research has been conducted to collect information relevant to the market, its peer markets, and its child market. Primary research has been undertaken to validate key findings, assumptions, and sizing with industry experts across the value chain of the smart glasses market growth. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology used to estimate and forecast the size of the smart glasses market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources have been referred to in the secondary research process for identifying and collecting information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the value chain of the smart glasses market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research. The secondary research referred to for this research study involves the VR/AR Association (VRARA), Institute of Electrical and Electronics Engineers (IEEE), and Consumer Technology Association, National Institute of Standard and Technology, and Augmented Reality for Enterprise Alliance. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect valuable information for a technical, market-oriented, and commercial study of the smart glasses market size. Vendor offerings have been taken into consideration to determine market segmentation.

Primary Research

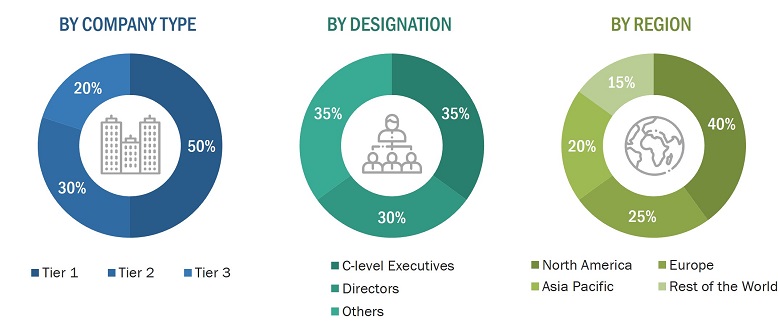

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include the key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the smart glasses ecosystem. After the complete market engineering (including calculations for the market statistics, the market breakdown, the market size estimations, the market forecasting, and the data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Extensive qualitative and quantitative analyses have been performed during the market engineering process to list key information/insights throughout the report. Extensive primary research has been conducted after understanding the smart glasses market size scenario through secondary research. Several primary interviews have been conducted with market experts from the demand and supply-side players across key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (Middle East, Africa, and South America). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

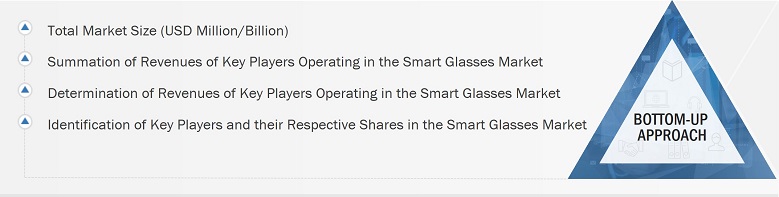

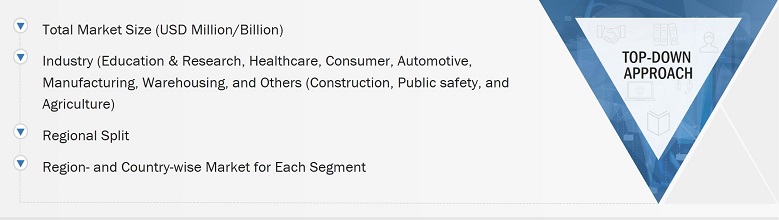

The total size of the smart glasses market has been estimated and validated using both top-down and bottom-up approaches. Furthermore, these methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

-

Identifying various entities influencing the value chain of the smart glasses market

-

Identifying major companies, components manufacturers, system integrators, and OS providers operating in the market

-

Estimating segment-level revenue of individual key players operating in the smart glasses market

-

Estimating the size of the market for each industry segment, such as education & research, healthcare, automotive, consumer, manufacturing, warehousing, and other industries (construction, public safety, and agriculture)

-

Estimating the size of the market share for each region based on the demand for smart glasses

-

Tracking the ongoing and upcoming smart glasses product launches to forecast the market size based on these developments and other critical parameters

-

Estimating the size of the global smart glasses market and growth rate at the segment and sub-segment levels

Global Smart Glasses Market Size: Bottom-Up Approach

Global Smart Glasses Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size of the smart glasses market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

Smart glasses are wearable devices that combine a small computer display with traditional glasses, helping users interact with digital content while maintaining awareness of their surroundings. As compared to traditional glasses, smart glasses typically feature augmented reality or mixed reality capabilities, enhancing the user experience by overlaying the digital information in the real-world using camera, sensors, processors, and wireless technology.

Some smart glasses only have audio capability while others can have display. In case of smart glasses with a display, they deliver digital content such as text, images, or 3D objects directly into the user’s vision.

Stakeholders:

-

Raw material suppliers and smart glasses developers

-

Operating systems developers

-

Technology developers

-

Augmented reality device manufacturers

-

Industrial and consumer industries

-

Industries utilizing smart glasses such as education and research, automotive, healthcare, manufacturing, warehousing, and other industries (public safety, agriculture, construction)

-

Research organizations

-

Technology investors

-

Governments, financial institutions, and investment communities

-

Analysts and strategic business planners

-

Technology standard organizations, forums, alliances, and associations

-

Venture capitalists, private equity firms, and startups

-

Technology standard organizations, forums, alliances, and associations

-

Venture capitalists, private equity firms, and startups

Report Objectives

-

To define, describe, segment, and forecast the size of the smart glasses market, by type, feature, and industry, in terms of value

-

To describe the various connectivity technologies and operating systems in smart glasses

-

To forecast the market size for various segments with respect to four main regions—the North America, Europe, Asia Pacific, and Rest of the World (RoW)—in terms of value

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the smart glasses market

-

To study the complete value chain analysis of the smart glasses market landscape

-

To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

-

To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) in the smart glasses market

-

To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape

-

To strategically profile key players in the market and comprehensively analyze their market share/ranking and core competencies2

-

To analyze competitive developments by players in the smart glasses market, such as contracts, product launches/developments, expansions, and research and development (R&D) activities

1. Micromarkets are defined as the further segments and subsegments of the smart glasses market included in the report.

2. Core competencies of companies are defined in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

-

Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Growth opportunities and latent adjacency in Smart Glasses Market