The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, automotive turbocharger magazine articles, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases, which were used to identify and collect information for an extensive study of the automotive turbocharger market. Primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

The automotive turbocharger market is directly dependent on vehicle production. The vehicle production is derived from various secondary sources such as automotive industry organizations, corporate filings (such as annual reports, investor presentations, and financial statements), trade analysis, paid repositories, and automotive associations such as Organisation Internationale des Constructeurs d'Automobiles (OICA). Historical production data was collected and analyzed, and the industry trend is considered to arrive at the forecast, further validated by primary research. All the data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

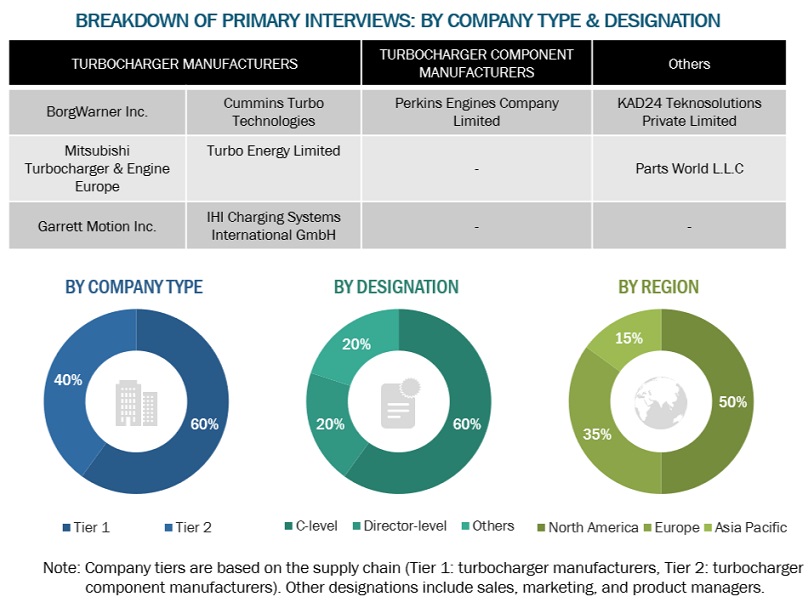

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from the primaries. This and the in-house subject matter experts’ opinions have led to the findings described in this report's remainder.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the automotive turbocharger market. This approach considered the vehicle production statistics for each vehicle type (passenger cars, LCVs, trucks, and buses) at a country and regional level. The country-level penetration of turbochargers in gasoline, diesel & alternate fuel/CNG engines is derived through country-wise model mapping of vehicle types, validated through primary respondents. This gives the country-level gasoline and diesel turbochargers market by vehicle and turbo types. The summation of the country-level markets gives the regional market, and further summation of the regional markets provides the global on-highway turbocharger market. A similar methodology was followed to estimate the automotive turbocharger market for off-highway vehicles (construction equipment, agricultural tractors, and mining equipment).

Automotive Turbocharger Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

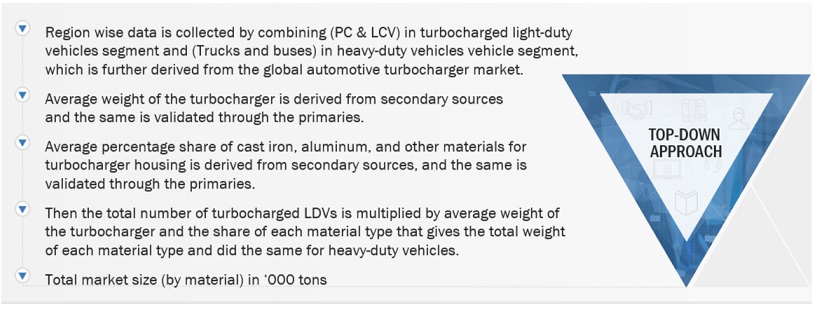

Automotive Turbocharger Market: Top-Down Approach

The top-down approach was followed to determine the market size, in terms of volume, for turbochargers by material. The global automotive turbocharger market derives the region-wise volume of turbocharged light-duty (passenger car & LDV) and heavy-duty (HDV) vehicles. The average weight of the turbocharger is derived from secondary sources and is validated through primary interviews. The average percentage of cast iron, aluminum, and other materials for turbocharger components is derived from secondary sources. Then, the total number of turbocharged LDVs is multiplied by the average weight of the turbocharger and the share of each material type. This gives the total weight of each material type. This calculation was repeated for heavy-duty vehicles as well.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by the primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Market Definition

A turbocharger can compress more air into the engine’s cylinder. The oxygen molecules are packed closer together when the air is compressed. This increase in the air means more fuel can be added to a naturally aspirated engine of the same size. The same engine then generates increased mechanical power and improves the overall efficiency of the combustion process. Therefore, the engine size can be reduced to a turbocharged engine, leading to better packaging, weight-saving benefits, and improved fuel economy.

Key Stakeholders

-

On-highway vehicles and off-highway Equipment Manufacturers

-

Automotive Turbocharger and Component Manufacturers

-

Raw material Suppliers

-

Automotive OEMs

-

Regulatory Bodies

-

Software providers

-

Traders, dealers, Suppliers, and Distributors

Report Objectives

-

To define, describe, and forecast the size of the global automotive turbocharger market in terms of value (USD million) and volume (million units)

-

By Vehicle Type (Passenger cars, LCVs, HCVs, Trucks, Buses) at the regional level

-

By Fuel Type (Gasoline, Diesel, Alternate fuel/CNG) at the regional level

-

Diesel Turbocharger Market, By Turbo Type (VGT, Wastegate, E-Turbocharger) at the regional level

-

Gasoline Turbocharger Market, By Turbo Type (VGT, Wastegate, E-Turbocharger) at the regional level

-

Gasoline Turbocharger Market, By Vehicle Type (Passenger cars, LCVs, HCVs, Trucks, Buses) at the regional level

-

By Material (Cast Iron, Aluminum, Others) at the regional level

-

By Component (Turbine wheel, Compressor wheel, Housing) at the regional level

-

Off-highway automotive turbocharger Market, By Application (Agriculture Tractors, Construction Equipment, and Mining Equipment) at a regional level

-

Aftermarket, By vehicle type (LCV and HCV) at a regional level.

-

By Region (Asia Pacific, Europe, North America, and the Rest of the World) by turbo type and vehicle type

-

Country-level analysis of class-wise and usage-wise segments (Asia Pacific, Europe, and North America)

-

To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

-

To analyze the competitive landscape of the global players in the market, along with their market share/ranking

-

To analyze the competitive leadership mapping of the global automotive turbocharger manufacturers and automotive turbocharger component suppliers in the market.

-

To analyze recent developments, including expansions and new product launches, undertaken by key industry participants in the market

-

To strategically analyze the market with trade analysis, case studies, patent analysis, supply chain analysis, market ecosystem, pricing analysis, and the impact of the recession.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Automotive Turbocharger Market, By Sales Channel

-

Original Equipment Manufacturer

-

Aftermarket

Off-highway TURBOCHARGER MARKET, BY technology

-

Wastegate

-

Variable Geometry Turbochargers (VGT)

-

Electric Actuator

Note: This market sizing will be further segmented at the regional level.

Detailed Analysis And Profiling Of Additional Market Players

User

Aug, 2019

Power Range 200kW-10000kW Market Trends (electrification, e-boost, hybridizationetc.) Which TC is on which engine builder.

User

Aug, 2019

Looking for the upcoming trends in turbocharger as well as Pneumatic actuator requirement in turbocharger.

User

Aug, 2019

I have develop the study to introduce Rapid Prototype for Turbocharger. In order to understand the market trend I wuold like more information to complete my study..

User

Aug, 2019

My focus is the South america market of turbochargers, but i need to know about the international market too. Mainly the quantitative information. Could you send a sample with focus in Brazil and Argentina markets?.

Nilesh

Jun, 2019

Evaluating Turbocharger market for opportunities related to Wastegate actuators and other potential business opportunities..