3D Weaving Market Size, Share & Trends, 2025 To 2030

3D Weaving Market by Glass Fiber, Composite Textile, Spacer, Carbon Fiber, Customized 3D Weaving, Structural Components, Protective Materials, Reinforcements, Insulation, Thermal Protective Applications - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The 3D weaving market is projected to grow from USD 0.03 billion in 2025 to USD 0.06 billion by 2030, at a CAGR of 12.7%. The shift to electric vehicles and green mobility increases demand for advanced manufacturing like 3D weaving. 3D woven components made from high-strength fibers such as carbon, glass, and aramid provide high strength-to-weight ratios and structural integrity. Using these in EVs—for battery enclosures, body panels, and interior parts—reduces weight, which improves energy efficiency, extends battery range, and enhances performance. OEMs increasingly use 3D weaving machines for lightweighting and next-generation vehicle design to meet global emissions and fuel economy goals.

KEY TAKEAWAYS

- By product type, the glass fiber weaving machines segment accounted for a share of 30.7% in terms of value in 2024.

- By application, thermal protection applications is projected to grow at a CAGR of 19.1% during the forecast period.

- By end-use industry, the aerospace & defense segment accounted for a share of 33.6% in 2024.

- Asia Pacific is estimated to dominate the 3D weaving market with a share of 34.6% in 2025.

- Lindauer DORNIER GmbH, Stäubli International AG, and UNSPUN were identified as star players in the 3D weaving market given their strong market share and product footprint.

A significant factor driving growth in the 3D weaving machine market is the increasing demand for advanced lightweight composites in high-performance sectors like aerospace, automotive, and defense. This demand arises from the need for materials that provide superior strength-to-weight ratios, enhanced thermal resistance, and the ability to be customized for complex shapes. These materials are essential for applications such as heat shields, crash structures, and body armor. As industries focus on improving fuel efficiency, reducing emissions, and ensuring structural integrity—especially with the rise of electric vehicles—3D weaving machines enable effective production of these composites, minimizing waste and contributing to market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The 3D weaving market is undergoing a significant shift in revenue due to technological advancements and changing customer demands. Traditional revenue sources, such as 2D weaving looms, Jacquard looms, and Rapier looms, are declining. In their place, advanced machines like spacer weaving systems and customized 3D weaving machines are emerging. Key trends affecting customer businesses include the integration of smart weaving technologies, the use of sustainable materials, the adoption of digital twin technology, and AI-driven automation. These innovations are allowing clients in industries such as aerospace, automotive, healthcare, and fashion to explore high-value applications, including urban air mobility, electric vehicle battery shielding, exoskeletons, and smart textiles. As a result, the competitive landscape is being redefined, and new revenue opportunities are being unlocked.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging demand for advanced lightweight composites across high-performance sectors

-

Accelerating EV adoption fuels demand for 3D-woven thermal-resistant components

Level

-

High capital investment and operational complexity

-

Regulatory and certification barriers increase time-to-market and operational costs

Level

-

Emergence of hybrid composites and smart textiles unlocks high-margin innovation

-

Sustainable production through advanced 3D weaving technology

Level

-

Cybersecurity vulnerabilities threaten operational continuity in digitized 3D weaving environments

-

Intensifying competition and market saturation pressure, profitability, and differentiation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging demand for advanced lightweight composites across high-performance sectors

The growing emphasis on performance optimization and operational efficiency in industries such as aerospace, automotive, defense, and energy is driving a strong demand for lightweight, high-strength materials. In this context, 3D weaving technology is playing a crucial role. For example, in the aerospace and defense sectors, 3D woven composites offer superior strength-to-weight ratios and excellent impact resistance. These properties are essential for structural components such as fuselage panels, engine parts, and protective armor.

Restraint: High capital investment and operational complexity

The high capital and operating costs are major barriers. Advanced machines require significant investment for purchase, installation, and integration, which is challenging for SMEs with limited funds. Beyond initial costs, ownership includes maintenance, power, specialized tooling, and custom software. Skilled labor is needed for programming, monitoring, and precision work, often requiring costly training or external experts. The complexity and novelty of the technology create a steep learning curve, slowing adoption, especially where ROI is closely monitored. High upfront costs hinder entry despite recognized long-term benefits, particularly in low-margin industries and developing countries.

Opportunity: Emergence of hybrid composites and smart textiles unlocks high-margin innovation

The integration of 3D weaving technology with new materials, such as nanomaterials, conductive fibers, and embedded electronics, leads to the creation of hybrid composites and smart textiles, presenting valuable opportunities across various high-value industries.

Challenge: Cybersecurity vulnerabilities threaten operational continuity in digitized 3D weaving environments

As 3D weaving machines increasingly incorporate Industry 4.0 technologies, such as IoT connectivity, cloud monitoring, and AI automation, they become more susceptible to cybersecurity threats that jeopardize operational integrity and protect intellectual property.

3D Weaving Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Production of complex, multi-layer composite fabrics for aerospace, automotive, and industry with the TRITOS PP machine | High-precision, programmable 3D weaving, digital pattern control, optimized material usage and waste reduction, and enhanced structural strength and durability |

|

3d-weaving-market-Dornier | Variable-height rapier weft insertion, minimal weft waste, handles sensitive yarns (carbon, aramid), high flexibility and yarn integrity for advanced applications |

|

On-demand, automated 3D weaving for localized, zero-waste garment production in the fashion and sportswear sector | Consolidates manufacturing steps, speeds up production, lowers labor & energy costs, supports microfactory/local production, and significantly reduces material waste |

|

Cost-effective, digitally controlled 3D weaving equipment for construction, automotives, and composites manufacturing | Scalable with automation and programming, targets cost-sensitive users, and enables affordable high-performance composite fabrication |

|

Custom 3D weaving machinery for niche prototyping, research, and specialized industrial uses | Tailored machines for unique application requirements, supports prototyping and low-volume specialty production, and fosters innovation in new composite structures |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The 3D weaving machine market ecosystem comprises a cohesive network of raw material suppliers, equipment manufacturers, and end users, each contributing to the development and deployment of advanced woven composite solutions. Raw material providers such as Teijin, Hexcel, Mitsubishi Chemical, and Thyssenkrupp supply high-performance fibers and resins that serve as the foundational inputs for weaving processes. Machine manufacturers like Lindauer DORNIER, Stäubli, VUTS, and Optima 3D focus on building technologically advanced equipment capable of producing complex 3D textile structures through precise hardware and software integration. On the demand side, end users, including Albany International, Spirit AeroSystems, Textech, and Bally Ribbon Mills, adopt 3D woven components across industries such as aerospace, defense, automotive, and industrial textiles to meet performance, weight, and design specifications. This interconnected ecosystem enables continuous innovation and alignment across the value chain, supporting the growing demand for high-strength, lightweight, and application-specific woven materials.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

3D Weaving Market, by Product Type

Composite textile weaving machines are projected to exhibit the highest CAGR (2025–2030) in the 3D weaving market due to their superior adaptability to material innovations and custom demands, enabling flexible handling of technical fibers for tailored, high-value woven structures in emerging applications like automotive frames, aerospace panels, and biomedical implants. This versatility supports both rapid prototyping and scalable production, making it a strategic investment for performance differentiation and innovation.

3D Weaving Market, by Application

Thermal protection application in the 3D weaving market is projected to register the highest CAGR (2025–2030) due to the rising need for heat-resistant composites that withstand extreme conditions in aerospace, defense, and space sectors, providing excellent insulation, structural durability, and delamination resistance for components like heat shields, nose cones, and engine panels.

3D Weaving Market, by End-use Industry

The automotive end-use industry is expected to account for the second-largest market share in the 3D weaving market, following the aerospace & defense segment, primarily due to the sector's relentless pursuit of lightweighting to enhance fuel efficiency, reduce emissions, and comply with stringent global regulations amid the surge in electric vehicle (EV) adoption. 3D woven composites enable the production of high-strength, complex components like crash structures, body panels, and battery enclosures that offer superior energy absorption and durability without adding weight, supporting both traditional and EV platforms while improving safety and range.

REGION

Asia Pacific to be fastest-growing region in global 3D weaving market during forecast period

The Asia Pacific region is expected to hold the largest share of the 3D weaving market in 2024. This growth is driven by an expanding manufacturing sector, increasing demand from key end-use markets, and advancements in next-generation materials and production technologies. Countries such as China, Japan, India, and South Korea are leading this regional growth through supportive government initiatives, industrial development, and a robust domestic textile machinery industry. Asia Pacific's dominance is largely attributed to its mature aerospace, automotive, construction, and electronics sectors, which are progressively adopting lightweight, high-strength 3D woven composites. The growing electric vehicle (EV) market in China and the flourishing aerospace supply chains in Southeast Asia and India are further enhancing the demand for 3D weaving machinery and products. Additionally, the Asia Pacific region offers cost-effective manufacturing, a skilled labor force, and favorable trade policies, making it an attractive destination for both regional and global manufacturers to establish their operations.

3D Weaving Market: COMPANY EVALUATION MATRIX

In the 3D weaving market matrix, Lindauer DORNIER GmbH (Star) leads with a strong market share and an extensive product footprint, driven by its advanced multi-layer weaving technologies and high-performance machines, which are widely adopted in aerospace, automotive, and composites manufacturing. Stäubli International AG (Emerging Leader) is gaining visibility with its specialized Jacquard and automation systems, tailored for precision 3D textiles, and is strengthening its position through innovation and niche offerings in technical applications. While Lindauer DORNIER dominates through scale and a diverse portfolio, Stäubli shows significant potential to move toward the leaders’ quadrant as demand for automated, customizable 3D weaving solutions continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.03 Billion |

| Market Forecast in 2030 (Value) | USD 0.06 Billion |

| Growth Rate | CAGR of 12.7% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, and RoW |

WHAT IS IN IT FOR YOU: 3D Weaving Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Aerospace OEM | Developed lightweight, high-tensile 3D woven composites for aircraft wing and fuselage reinforcement | Enhanced structural integrity, reduced overall aircraft weight, improved fuel efficiency, and increased load-bearing capacity |

| Automotive Manufacturer | Supplied 3D woven carbon fiber fabrics for crash-resistant and heat-dissipating components | Improved passenger safety, better thermal management, and superior impact absorption for EV and ICE vehicle parts |

| Defense Contractor | Engineered ballistic-grade 3D woven aramid fabrics for body armor and protective gear | Provided superior energy absorption, reduced penetration, and longer product durability under extreme conditions |

| Wind Energy Solution Provider | Delivered 3D woven glass-fiber reinforcements for turbine blades | Increased fatigue resistance, minimized maintenance downtime, and extended turbine lifespan under high-stress environments |

| Sports Equipment Brand | Customized 3D woven carbon-fiber panels for lightweight, high-performance bicycles and helmets | Achieved superior strength-to-weight ratio, improved aerodynamics, and enhanced user comfort and safety |

RECENT DEVELOPMENTS

- October 2024 : UNSPUN partnered with Decathlon to deploy its Vega 3D weaving technology across Europe, enabling on-demand, low-waste, and locally produced sportswear. The multi-year deal supports Decathlon’s sustainability goals and expands UNSPUN’s footprint through localized micro-factories.

Table of Contents

Methodology

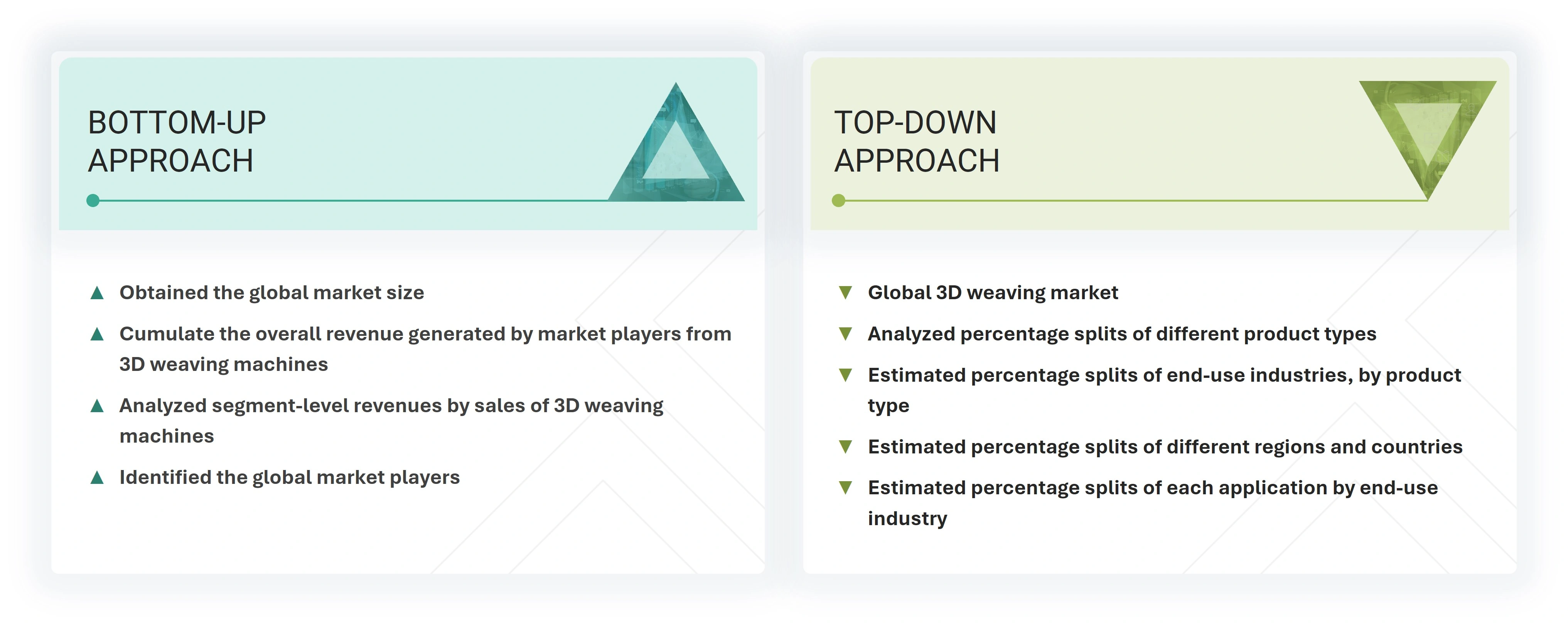

The study involved major activities in estimating the current size of the 3D weaving market. Exhaustive secondary research was conducted to gather information on the market, peer markets, and parent markets. Industry experts across the supply chain participated in primary research to validate these findings, assumptions, and estimates. Both top-down and bottom-up approaches were used to determine the overall market size. Subsequently, market segmentation and data triangulation methods were applied to estimate the size of segments and subsegments. Secondary and primary sources were utilized to gather information for a comprehensive technical and commercial analysis of the 3D weaving market.

Secondary Research

Secondary research for this study involved gathering information from various credible sources such as company reports, white papers, journals, and industry publications. This process helped understand the supply and value chains, identify key players, analyze market segmentation and regional trends, and track major market and technology developments. The data collected was used to estimate the overall market size, which was later validated through primary research.

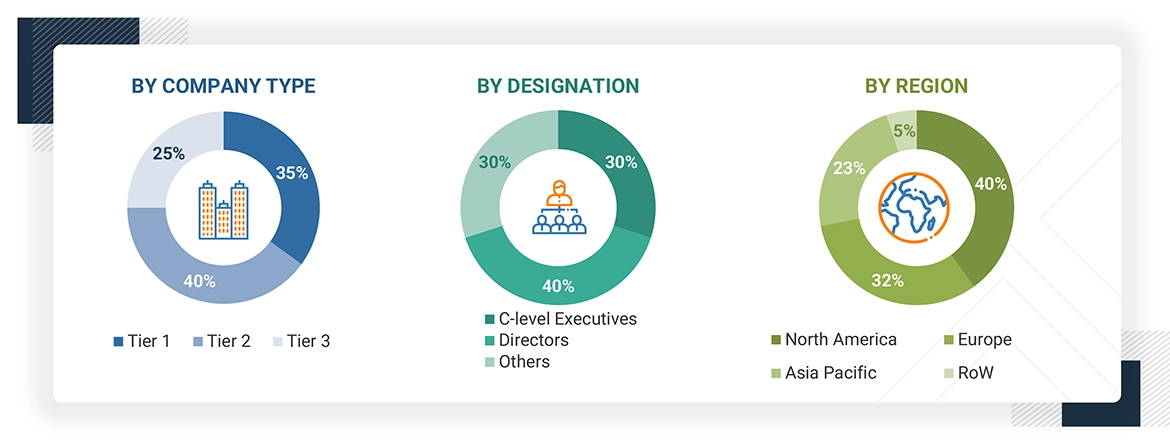

Primary Research

Extensive primary research was conducted after understanding the current state of the 3D weaving market through secondary research. Several interviews with experts from the demand and supply sides were carried out across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was gathered through questionnaires, emails, and phone interviews.

Notes: The RoW mainly comprises the Middle East, Africa, and South America.

Note: Tier 1 companies include market players with revenues above USD 500 million; tier 2 companies earn revenues between USD 100 million and USD 500 million; and tier 3 companies earn revenues of up to USD 100 million.

Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the 3D weaving market.

- Analyzed major manufacturers of 3D weaving machines, studied their portfolios, and understood products based on their features and functions

- Analyzed the revenue of the companies profiled in the study

- Arrived at the global 3D weaving market size by adding the scope revenue of the key manufacturers in the market

- Conducted multiple discussions with key opinion leaders to understand different 3D weaving product types, applications, end-use industries, and current trends in the market, and analyzed the breakup of the scope of the study by major manufacturing companies.

The top-down approach has been used to estimate and validate the total size of the 3D weaving market.

- The global size of the 3D weaving market was estimated through the data sanity of major companies offering 3D weaving machines.

- The product type penetration splits were estimated using secondary sources, based on several factors, such as the number of companies offering specific types of 3D weaving machinery (such as glass fiber weaving machines, composite textile weaving machines, spacer weaving machines, carbon fiber weaving machines, and customized 3D weaving machines)

- The market size for the global end-use industries (aerospace & defense, automotive, construction & infrastructure, sporting goods, energy & goods, healthcare, and other end-use industries) was determined by understanding the penetration split of each end-use industry by each product type.

- The market size for global regions (North America, Europe, Asia Pacific, and the RoW) was estimated by analyzing the penetration split of each end-use industry by each region.

- The country-level penetration split was analyzed for each region to estimate the market size.

- The market sizes of application segments were estimated by analyzing the penetration split of each end-use industry by application.

3D Weaving Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides in the 3D weaving market.

Market Definition

3D weaving machinery is advanced equipment designed to produce three-dimensional woven structures by interlacing yarns in warp, weft, and Z directions. Unlike traditional two-dimensional weaving machines, 3D machines create multi-layered, volumetric, or near-net-shape products with superior strength, delamination resistance, and structural integrity. They are used in aerospace, defense, automotive, marine, and construction industries to reinforce composite structures that require complex shapes and load capabilities. These machines can be jacquard-based, shuttleless, or custom-configured, often integrated with CAD/CAM software for precise design and production, supporting lightweight, durable, and efficient composite solutions.

Key Stakeholders

- Machinery Manufacturers

- Fiber & Yarn Suppliers

- Software Providers

- Composite Manufacturers

- OEMs (Original Equipment Manufacturers)

- End-Use Industries

- Research Institutions & Universities

- Regulatory Bodies & Standards Organizations

- Investors & Government Bodies

Report Objectives

- To define, describe, and forecast the size of the 3D weaving market, by product type, application, end-use industry, and region, in terms of value

-

To forecast the market for various segments concerning key regions, namely,

North America, Europe, the Asia Pacific, and the Rest of the World (RoW), in terms of value, and study the macroeconomic outlook for each region - To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market’s growth

- To analyze the market in terms of the trends/disruption impacting customers’ business, supply chain, ecosystem, technological landscape, patent scenario, trade, use cases, regulatory landscape, Porter’s five force analysis, key stakeholders & buying criteria, impact of AI/Gen AI, and the impact of the 2025 US tariffs

- To strategically analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detailing the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings, core competencies, market share analysis, company evaluation matrix, along with detailing the competitive landscape for the market leaders

- To analyze the competitive developments, such as partnerships carried out by market players

- To map competitive intelligence based on company profiles and key player strategies

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company‘s specific needs. The following customization options are available for the report.

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What are the opportunities in the global 3D weaving market?

The increasing production of aircraft, satellites, and reusable space vehicles creates demand for lightweight, thermally stable, and structurally strong components ideal for 3D woven composites.

How does this report define the 3D weaving market?

The 3D weaving market refers to the industry focused on machines that produce three-dimensional woven fabrics or composite structures, where fibers are interlaced in the X, Y, and Z directions. These machines are essential for manufacturing lightweight, high-strength components used in aerospace, automotive, defense, and other advanced industries, offering improved structural integrity, design flexibility, and material efficiency.

Which region is expected to have the largest share of the 3D weaving market?

The Asia Pacific is expected to hold the largest share of the 3D weaving market.

What are the major market players covered in the report?

Some of the leading players in the 3D weaving market are Lindauer DORNIER GmbH (Germany), Stäubli International AG (Switzerland), Unspun (US), Dashmesh Jacquard and Powerloom Pvt. Ltd. (India), VÚTS a.s. (Czech Republic), Hefei Fanyuan Instrument Co., Ltd (China), Sino Textile Machinery (China), Optima 3D Ltd (UK), Kale?Texnique (India), and 3D Weaving (Belgium).

What is the size of the global 3D weaving market?

The global 3D weaving market is expected to grow from USD 32.8 million in 2025 to USD 59.7 million by 2030, at a CAGR of 12.7%.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the 3D Weaving Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in 3D Weaving Market