Active Harmonic Filter Market

Active Harmonic Filter Market by Type (Shunt, Hybrid), Voltage (Low (<1 kV), Medium(1 to 35 kV), Phase (Single, Three), Application (Industrial & Automation, Commercial &Infrastructure, Power utilities & Transportation), and Region - Global Forecast to 2030

OVERVIEW

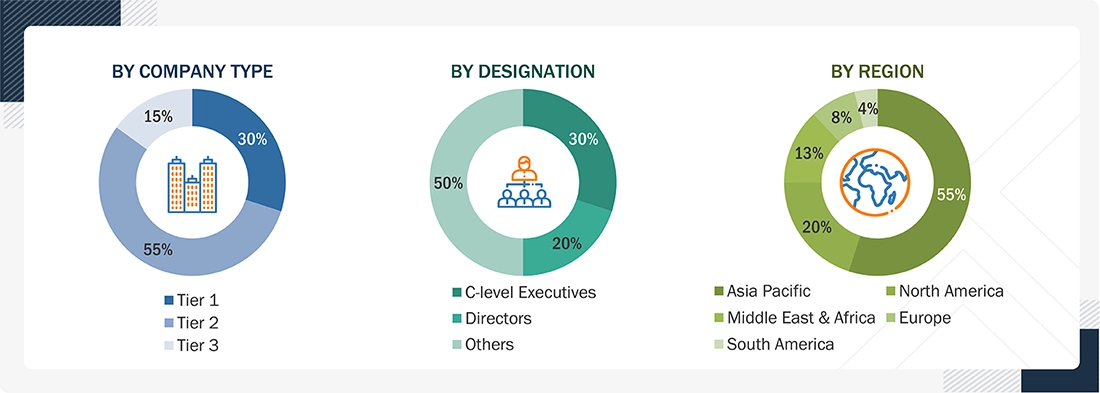

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Active Harmonic Filter market is projected to reach USD 1.11 billion by 2030 from an estimated USD 0.76 billion in 2025, at a CAGR of 7.8% during the forecast period. Market growth is driven by the increasing demand for enhanced power quality, improved energy efficiency, and equipment protection across the industrial, commercial, and utility sectors. Advancements in digital control technology, modular architectures, and AI-based monitoring are enhancing system reliability and scalability.

KEY TAKEAWAYS

-

BY PHASEThe three-phase segment is expected to remain the largest during the forecast period. This dominance is primarily attributed to the widespread use of three-phase electrical systems in industrial, commercial, and utility applications, where high-power equipment, such as motors, variable frequency drives, and automation systems, generates significant harmonic distortion.

-

BY TYPEThe shunt active filter segment dominates due to its superior efficiency, cost-effectiveness, and adaptability across diverse applications. By injecting compensating currents parallel to the load, it effectively mitigates harmonics, improves power factor, and enhances system stability. Its compact design and easy integration make it ideal for industrial and commercial installations worldwide.

-

BY VOLTAGEBy voltage segment, the low voltage (less than 1 kV) category is expected to grow at the highest CAGR during the forecast period. This growth is driven by the rising deployment of AHFs in commercial buildings, data centers, and light industrial applications, where compact and cost-effective solutions are preferred.

-

BY APPLICATIONThe industrial manufacturing segment is expected to dominate the AHF market during the forecast period, driven by the rapid adoption of automation, robotics, and advanced machinery that generate significant harmonic distortions. Increasing use of variable frequency drives (VFDs), motors, and other nonlinear loads in production facilities necessitates effective harmonic mitigation to ensure equipment reliability, energy efficiency, and compliance with IEEE standards. Additionally, the growing focus on operational continuity, reduced downtime, and adherence to power quality regulations further accelerates the adoption of AHF across manufacturing industries.

-

BY REGIONThe Asia Pacific region dominates the market, driven by rapid industrialization, urbanization, and expansion of manufacturing and data center infrastructure across China, India, Japan, and South Korea. The growing adoption of automation, renewable energy integration, and electric mobility is increasing harmonic distortion, thereby boosting demand for active harmonic filters. Supportive government policies and smart grid initiatives further strengthen regional market growth.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships and investments. For instance, Eaton, Danfoss, and TE Connectivity have entered into several agreements and partnerships to meet the growing demand for active harmonic filters.

Rapid industrialization, urbanization, and automation are increasing the use of nonlinear loads such as drives, inverters, and UPS systems, which generate harmful harmonics. AHFs effectively mitigate these distortions, enhance equipment lifespan, and ensure compliance with international standards for power quality. Advancements in digital control, modular design, and real-time monitoring are improving system performance and scalability.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ businesses in the AHF market arises from evolving customer needs and rapid technological advancements. End users, including data centers, industrial facilities, utilities, commercial buildings, and renewable energy plants, represent the primary clients of AHF manufacturers. Shifts in energy consumption patterns, increasing deployment of sensitive electronic equipment, and grid modernization are key factors influencing this market. These trends directly affect operational efficiency and costs for end users, as AHFs improve power quality, reduce harmonic distortions, and minimize downtime. Consequently, growing demand for reliable and efficient electrical performance drives the revenues of solution providers and system integrators, ultimately contributing to the overall revenue growth of AHF equipment manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising Focus on Energy Efficiency and Power Quality Enhancement

-

Increasing Industrial Automation and Integration of Renewable Energy Systems

Level

-

Regulatory and System Integration Complexities

-

Substantial Upfront Costs

Level

-

Integration of Digital Intelligence and Smart Grid Technologies

-

Growing Adoption of Distributed Energy Resources (DERs) Driving Decentralized Power Management

Level

-

Semiconductor Supply Chain Constraints Impacting AHF Production and Pricing

-

Intensifying Market Competition from Passive and Hybrid Harmonic Filters

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Focus on Energy Efficiency and Power Quality Enhancement

The global emphasis on energy efficiency, combined with the surge in electricity consumption, serves as a key driver for the AHF market. As industries and utilities strive to reduce power losses and enhance energy utilization, maintaining superior power quality has become increasingly vital. AHFs play an essential role in this effort by reducing harmonic distortions, improving power factor, and ensuring stable and efficient energy distribution. Moreover, the growing electricity demand across industrial, commercial, and residential sectors is placing added pressure on power networks, creating the need for advanced technologies to sustain grid reliability. As a result, the heightened focus on energy conservation and dependable power systems is fueling widespread adoption of AHFs across multiple sectors globally.

Restraint: Regulatory and System Integration Complexities

The AHF market encounters significant restraints due to complex regulatory requirements and system integration challenges. Different countries and regions enforce varying power quality standards, such as IEEE 519, IEC 61000, and EN 50160, making it difficult for manufacturers to design products that comply universally. Achieving certification and maintaining adherence to these standards increases both development time and costs. Moreover, integrating AHFs into existing electrical systems, particularly in legacy infrastructures or industries with customized configurations, can be technically demanding. It often requires detailed harmonic analysis, precise tuning, and coordination with other power quality equipment to ensure optimal performance. This complexity extends project timelines, raises installation costs, and limits scalability for end users. Consequently, these regulatory and integration hurdles collectively slow down large-scale adoption and present a key restraint to the market’s growth.

Opportunity: Integration of Digital Intelligence and Smart Grid Technologies

The growing integration of digital intelligence and smart grid technologies presents a major opportunity for the AHF market. With the increasing adoption of IoT, AI, and advanced analytics in power systems, utilities and industries can now monitor, predict, and manage harmonic distortions in real-time. Smart grids enable two-way communication between power suppliers and consumers, improving load management and enhancing overall energy efficiency. AHFs equipped with digital control systems and intelligent algorithms can automatically detect and mitigate harmonics, adjust reactive power, and dynamically optimize system performance. This convergence of digitalization and power quality management not only improves operational reliability but also reduces maintenance costs and downtime. As global investments in smart grid infrastructure accelerate, the demand for intelligent, connected AHFs capable of supporting automated and adaptive energy systems is expected to grow significantly.

Challenge: Semiconductor Supply Chain Constraints Impacting AHF Production and Pricing

The AHF market heavily relies on advanced semiconductor components, such as IGBTs and SiC switches, for efficient operation and compact designs. However, global semiconductor shortages, long lead times, and fluctuating raw material costs have created supply chain bottlenecks, impacting AHF manufacturing schedules and pricing stability. These disruptions not only delay project deliveries but also strain manufacturers' profitability. Moreover, as AHFs require high-reliability components, sourcing alternatives is challenging without compromising quality or performance. Consequently, managing semiconductor supply risks has become a critical challenge for AHF producers aiming to maintain consistent production and meet rising global demand.

active harmonic filter market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Ford Motor Company of Southern Africa (FMCSA) operates the Silverton Assembly Plant in Pretoria, which assembles light commercial vehicles, and the Struandale Engine Plant in Port Elizabeth, producing engine component kits for local assembly and export. FMCSA invested approximately USD 272 million to upgrade both plants into world-class facilities, increasing the Silverton Assembly Plant’s annual capacity to 110,000 units. To reduce direct and indirect costs associated with harmonic pollution on the electrical power system, FMCSA implemented AHFs across its substations. | The implementation of AHFs reduced peak RMS currents through the 14 transformers, lowered copper and core losses, and decreased kVA demand, contributing to reduced electricity costs. Transformer life was extended due to lower operating temperatures. Indirect costs from unplanned downtime were minimized, and source balancing of unbalanced load currents improved the LV supply voltage for other sensitive equipment, ensuring reliable plant operation. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Ecosystem mapping highlights the interconnected relationships among raw materials & component suppliers, AHF manufacturers, distributors & system integrators, and end users. Raw material suppliers provide critical inputs, including semiconductors, capacitors, inductors, resistors, and enclosures. AHF manufacturers, including ABB, Schneider Electric, Siemens, and Toshiba Energy Systems, design, assemble, and test complete filter systems. Distributors and system integrators, such as Eaton, Vertiv, and Delta Electronics, handle logistics, customization, installation, and maintenance. End users across industrial facilities, data centers, renewable energy plants, commercial buildings, and transportation systems deploy AHFs to enhance power quality, reduce harmonics, and improve system efficiency.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Active Harmonic Filter, By Type

The shunt active filter segment dominates the AHF market due to its superior ability to mitigate current harmonics and improve power factor in real time. Widely adopted across industrial and commercial sectors, these filters efficiently enhance system stability, ensure IEEE-519 compliance, and offer flexible installation, making them ideal for diverse power quality improvement applications.

Active Harmonic Filter, By Phase

The three-phase segment holds the largest market share, driven by its extensive use in industrial, commercial, and utility-scale power systems. Three-phase AHFs efficiently manage harmonic distortions in heavy machinery, variable frequency drives, and automation equipment. Their higher load-handling capacity and reliability make them essential for maintaining balanced voltage and current in complex electrical networks.

Active Harmonic Filter, By Voltage

The low voltage (<1 kV) segment leads the market owing to its widespread deployment in manufacturing facilities, commercial buildings, and renewable energy systems. These filters provide effective harmonic mitigation for low-voltage distribution networks, ensuring improved power quality, reduced system losses, and compliance with stringent energy efficiency and power quality standards.

Active Harmonic Filter, By Application

The automation & electronics segment is expected to be the fastest-growing in the AHF market, driven by the rapid adoption of automation technologies, robotics, and advanced electronic equipment across industries. These systems rely heavily on power electronics, which generate harmonic distortions affecting equipment performance and energy efficiency. The increasing demand for precision control, uninterrupted operations, and compliance with IEEE power quality standards is further fueling the need for AHFs.

REGION

Asia Pacificto be largest-growing region in global AHF market during forecast period

The Asia Pacific region dominates the AHF market, driven by rapid industrialization, urban infrastructure expansion, and increasing investments in automation and the integration of renewable energy. Countries such as China, India, Japan, and South Korea are leading adopters due to the growing need for energy efficiency and power quality improvement in manufacturing and commercial sectors. The region’s expanding data center infrastructure, coupled with supportive government initiatives promoting clean energy and industrial modernization, further fuels demand for AHFs. Additionally, the presence of key market players and ongoing technological advancements contribute to the Asia Pacific’s strong position in the global AHF market.

active harmonic filter market: COMPANY EVALUATION MATRIX

Eaton (Star) and MTE Corporation (Emerging Leader) are key players driving growth in the AHF market. Eaton leads with advanced power quality solutions and large-scale deployments across industrial and commercial sectors, leveraging its global engineering expertise and smart energy technologies to enhance grid reliability and efficiency. Its focus on energy optimization and sustainable electrification aligns with global decarbonization objectives. Meanwhile, MTE Corporation is accelerating market development through innovative filter designs, modular solutions, and intelligent monitoring systems that ensure compliance with stringent harmonic standards. The company’s strong North American presence and collaborative approach to industrial power quality improvement are enhancing operational efficiency and electrical stability, collectively strengthening the global AHF ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.71 Billion |

| Market Forecast in 2030 (Value) | USD 1.11 Billion |

| Growth Rate | CAGR of 7.8% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: active harmonic filter market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- September 2025 : MTE Corporation announced the launch of its next-generation active harmonic filter, SyntriX AHF, on September 22, 2025, in Menomonee Falls, Wisconsin. Powered by Silicon Carbide (SiC) technology, it boasts over 99% efficiency, a <50-microsecond response time, and mitigation up to the 50th harmonic order for IEEE-519 compliance. The compact, modular design (up to 30% smaller) scales from 50A to 450A+, with real-time HMI monitoring for 3-phase systems up to 480V.

- April 2024 : TCI launched its smallest HGA Active Harmonic Filters, the 30A and 50A models, offering full harmonic mitigation in a compact footprint. The HarmonicGuard Active (HGA) filter dynamically monitors load currents and injects counter-currents to cancel harmonics, achieving a total demand distortion (TDD) of less than 5% and a near-unity power factor. Designed for multiple non-linear loads, including ECM motors, it complies with IEEE-519 2022, supports parallel operation without calibration, and offers communication via Modbus, EtherNet/IP, and BACNet/IP, providing efficient, flexible harmonic mitigation.

- June 2023 : Schneider Electric introduced the EasyLogic APF series, designed to provide harmonic mitigation, power factor correction, and load balancing for small- and mid-sized industrial sites and commercial buildings. These filters aim to enhance the efficiency of electrical networks by minimizing waste and reducing CO2 emissions. The EasyLogic APF is a scalable, flexible, and cost-effective solution that enhances the stability and reliability of power networks.

Table of Contents

Methodology

This research study utilized extensive secondary sources, including press releases, investment reports, industry white papers, presentations, and other publicly available data, to gather information relevant to the technical, market-oriented, and commercial aspects of the AHF market. Primary sources included industry experts from the power quality, automation, and electrical equipment sectors, as well as manufacturers, suppliers, distributors, service providers, and technology developers across the AHF value chain. In-depth interviews were conducted with key industry participants, subject-matter experts, C-level executives, and market consultants to validate qualitative and quantitative insights and assess growth opportunities and future trends within the global market.

Secondary Research

Secondary sources consulted for this research study include annual reports, press releases, investor presentations from companies, white papers, certified publications, articles by recognized authors, and databases from various companies and associations. Secondary research has been mainly used to obtain key information about the industry’s supply chain to identify the key players offering various products and services, market classification and segmentation according to the offerings of major players, industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

During the primary research process, various primary sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEO), vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the active harmonic filter market.

In the market engineering process, both top-down and bottom-up approaches were extensively employed, along with several data triangulation methods, to estimate market sizes and forecast values for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process, listing key information/insights throughout the report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global AHF market and its dependent submarkets. The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through a combination of primary and secondary research. The research methodology employed in this study draws on annual and financial reports of top market players, as well as interviews with industry experts, including CEOs, VPs, directors, sales managers, and marketing executives, to gather key insights, both quantitative and qualitative, into the market. The following segments provide details about the overall market size estimation process employed in this study.

Active Harmonic Filter Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process explained below, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market was validated using both top-down and bottom-up approaches.

Market Definition

Active harmonic filters—also known as active filters—are devices that utilize power electronics (such as switching converters and transistors) to inject compensating currents into the power network, thereby canceling or reducing harmonic distortion while simultaneously performing functions like reactive power compensation, load balancing, and damping.

Stakeholders

- Manufacturers/Suppliers

- End Users

- Regulatory Bodies and Standards Organizations

- Research & Development/Innovators

- Consultants/Engineering Firms/System Integrators

- Government/Policy Makers

- Utilities/Power Grid Operators

- Financers/Investors

- Distributors

- Consumers/Public/Industry Associations

- Maintenance/Service Providers

Report Objectives

- To define, describe, segment, and forecast the size of the active harmonic filters market, by type, voltage, application, end user, and region, in terms of value

- To segment and forecast the size of the active harmonic filters market by region, in terms of volume

- To forecast the market sizes for five key regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the active harmonic filters market

- To offer the supply chain analysis, trends/disruptions impacting customer business, ecosystem analysis, regulatory landscape, patent analysis, case study analysis, technology analysis, key conferences & events, the impact of AI/Gen AI, macroeconomic outlook, pricing analysis, Porter’s five forces analysis, and regulatory analysis, the impact of the 2025 US tariff on the market

- To analyze opportunities for stakeholders in the active harmonic filters market and draw a competitive landscape of the market

- To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players for the market share, product specifications, and end uses

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as contracts, agreements, partnerships, and joint ventures, in the active harmonic filters market

Available Customizations

MarketsandMarkets offers customizations tailored to the specific needs of companies, utilizing the provided market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the active harmonic filter market by region, including North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Active Harmonic Filter Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Active Harmonic Filter Market