ADAS Simulation Market

ADAS Simulation Market by Method (On-Premises, Cloud-Based), Offering (Software, Services), Simulation Type (MIL, DIL, SIL, HIL), Vehicle Type (Passenger Cars, Commercial Vehicles), LoA, Application, End-users & Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The ADAS simulation market is projected to grow from USD 3.79 billion in 2025 to USD 9.66 billion in 2032, reflecting a CAGR of 14.3%. This growth is fueled by the rising need for faster and safer testing of driver-assistance systems as vehicles become more software-driven. Automakers and suppliers are shifting from physical road tests to advanced virtual validation tools that use AI, realistic sensor modeling, and automated test scenarios. These technologies help reduce development time while improving accuracy and safety. Stricter safety rules, changing NCAP standards, and the demand for large-scale testing of autonomous systems are also pushing companies toward simulation-based development. The move to cloud-based platforms and digital twins allows engineers to test thousands of driving situations quickly and at a lower cost.

KEY TAKEAWAYS

-

By RegionAsia Pacific is expected to be the fastest-growing market during the forecast period. It is projected to grow at a CAGR of 15.9% to reach USD 2,732.7 million during the forecast period.

-

By MethodBy method, the cloud-based segment is expected to lead the ADAS simulation market during the forecast period. It is projected to grow from USD 2,407.5 million in 2025 to USD 6,549.6 million by 2032.

-

By Level of AutonomyBy level of autonomy, the L2 segment is expected to lead the ADAS simulation market during the forecast period. It is projected to grow from USD 3,207.8 million in 2025 to USD 6,662.0 million at a CAGR of 11.0% from 2025 to 2032.

-

By Vehicle TypeBy vehicle type, the passenger cars segment is expected to lead the ADAS Simulation market during the forecast period. This segment is projected to grow from USD 3,314.4 million in 2025 to USD 7,721.1 million at a CAGR of 12.8% from 2025 to 2032.

-

By OfferingBy offering, the software segment is expected to lead the ADAS simulation market during the forecast period. It is projected to grow from USD 2,385.5 million in 2025 to USD 6,298.7 million at a CAGR of 14.9% from 2025 to 2032.

-

By Simulation TypeBy simulation type, the software-in-the-loop (SIL) segment is expected to lead the ADAS simulation market during the forecast period. This segment is projected to grow from USD 585.8 million in 2025 to USD 1,414.8 million at a CAGR of 13.4% from 2025 to 2032.

-

Competitive Landscape - Key PlayersSiemens (Germany), Ansys, Inc. (US), NVIDIA Corporation (US), dSPACE (germany), AVL (Austria) have been identified as some of the star players in the ADAS simulation market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsFlexport (US), Forto Logistics (Germany), and Beacon Logistics (India), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The ADAS simulation market is projected to grow at a substantial rate during the forecast period as automakers accelerate virtual validation to meet the rising safety, automation, and regulatory requirements. Additionally, the increasing system complexity, expanding sensor suites, and the push toward higher autonomy levels are strengthening the demand for high-fidelity simulation environments capable of replicating real-world scenarios at scale. Moreover, the rapid development of AI-driven perception models and sensor fusion architectures is creating a need for more advanced testing frameworks that can evaluate edge cases, unpredictable road behaviors, and rare safety-critical events. The adoption of cloud-based simulation, digital twins, and automated scenario generation is further supporting steady market growth by enabling faster diagnostics, lower physical testing costs, and improved assurance of ADAS performance under diverse operating conditions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The ADAS simulation market is undergoing significant disruption as the industry transitions from traditional, on-premises simulation tools to scalable, subscription-based, and pa-per-use cloud ecosystems. OEMs and Tier-1 suppliers are increasingly prioritizing virtual validation to meet the rising safety requirements, comply with NCAP and UNECE standards, and reduce physical testing costs. The growing need to validate complex ECU, sensor, and fusion-stack interactions is accelerating the demand for AI-driven scenario generation and automated testing workflows. At the same time, ecosystem partnerships, new use cases, and advanced scenario libraries are transforming revenue models and expanding adoption. These shifts are enabling more reliable ADAS performance, faster OTA driven updates, and reduced false positives/negatives, ultimately improving real-world safety outcomes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing system complexity and calibration

-

Increasing ADAS adoption for high vehicle automation

Level

-

Mismatch between simulation conditions and real-world environments

-

Human behavioral variability and system failure complexity

Level

-

Unlocking strategic control and deep customization through in-house ADAS simulation development

-

Leveraging digital twins to accelerate ADAS validation and reduce cycles

Level

-

Integrating real-world and synthetic data at scale

-

Regulatory and homologation acceptance of simulation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing system complexity and calibration

As ADAS features become more advanced, the systems behind them are becoming significantly more complex. Modern vehicles rely on multiple sensors cameras, radar, LiDAR, and these must work together seamlessly under all driving conditions. Calibrating these sensors and ensuring algorithms respond correctly is becoming increasingly difficult using only physical testing. Even small errors in calibration can lead to false alerts, missed detections, or inconsistent performance on the road. To manage this growing complexity, automakers are turning to simulation to test thousands of scenarios quickly and safely. Simulation allows engineers to fine-tune sensor behavior, optimize fusion algorithms, and validate edge cases that are hard to capture in real life. It also reduces dependency on costly road tests and shortens development cycles. As vehicles move toward levels 3 and 4 autonomy, the need for highly accurate, scalable simulation platforms continues to rise, making virtual testing a critical part of product development.

Restraint: Mismatch between simulation conditions and real-world environments

A key restraint in the ADAS simulation market is the gap that still exists between simulated conditions and real-world driving environments. Even with advanced modeling tools, simulation cannot always capture the full variability of weather, lighting, road surfaces, traffic behavior, and unexpected human actions. Small inaccuracies in sensor modeling or environmental rendering can lead to results that differ from real-world performance. This mismatch makes it challenging for OEMs to rely solely on virtual validation for safety-critical decisions. In many cases, certain edge cases, such as unusual reflections, rare pedestrian behaviors, or unpredictable multi-vehicle interactions, do not translate perfectly into synthetic scenarios. As a result, physical testing is still required to validate and fine-tune system performance. The inability to fully replicate real-world uncertainty in simulation slows adoption, increases testing costs, and limits confidence for higher levels of autonomy.

Opportunity: Unlocking strategic control and deep customization through in-house ADAS simulation development

An emerging opportunity in the ADAS simulation market is the ability for OEMs and Tier-1 suppliers to build in-house simulation platforms, giving them greater strategic control over their validation workflows. By developing proprietary tools, companies can tailor simulation models, sensor stacks, and scenario libraries to match their exact vehicle architectures and driving domains. This deep customization allows them to optimize performance, maintain data confidentiality, and reduce dependency on third-party vendors. In-house platforms also enable faster iteration cycles, as engineering teams can modify algorithms, run tests, and integrate new features without waiting for external updates. They can incorporate unique edge cases from their own fleet logs, improving realism and competitive differentiation. Additionally, ownership of simulation IP enhances long-term scalability and cost efficiency as ADAS systems evolve. For companies targeting levels 3 and 4 autonomy, developing proprietary simulation capabilities becomes a strategic asset, strengthening innovation and accelerating the deployment of next-generation safety features.

Challenge: Integrating real-world and synthetic data at scale

A major challenge in the ADAS simulation market is the integration of massive volumes of real-world driving data with synthetic simulation environments. OEMs collect millions of miles of sensor logs from test fleets, but transforming this raw data into structured, simulation-ready formats is complex and resource-intensive. Differences in sensor characteristics, weather conditions, resolutions, and metadata make alignment difficult. At the same time, synthetic scenarios though scalable often lack the nuance and unpredictability found in real traffic. Bringing these two data sources together at scale requires advanced tools for cleaning, labeling, synchronization, and scenario reconstruction. Without seamless integration, companies risk gaps in validation coverage and inconsistent system behavior between simulated and real conditions.

ADAS SIMULATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Rapid expansion from a single autonomous vehicle to a full robotaxi fleet created large volumes of drive logs and required more scalable simulation capabilities | Offers automated management of fleet drive logs, faster replay, and synthetic scenario generation | Offers improved root-cause analysis, reduced testing time, and more efficient validation of software updates for level 4 autonomy |

|

Validate level 3 ADAS for extremely rare safety-critical events that traditional road testing and classical Monte Carlo simulations could not efficiently capture | Require a smarter, faster method to reduce simulation volume while maintaining certification-level safety assurance | Offers reduced simulation load through intelligent scenario reduction, faster identification of rare-event risks, improved confidence for certification, and significant time & cost savings in level 3 ADAS validation |

|

Need for a scalable and realistic method to validate ADAS performance under unpredictable real-world conditions, including rare edge cases that traditional road testing could not consistently capture | Require a way to convert real traffic data into repeatable, controllable scenarios while ensuring safe testing without risk to vehicles or drivers | Enables real-to-virtual scenario generation for repeatable testing, improved capture of complex edge cases, enhanced calibration with multi-sensor data, and safer evaluation of hazardous scenarios through vehicle-in-the-loop simulation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ADAS simulation market ecosystem is built around four interconnected participant groups that collectively enable end-to-end virtual validation for advanced driver-assistance systems. Simulation platform providers serve as the core orchestrators, delivering high-fidelity environments, scenario engines, and sensor models that replicate complex driving conditions. Hardware-in-the-loop, software-in-the-loop, and model-in-the-loop integration providers supply the computational and testing infrastructure needed to validate ECUs, perception algorithms, and control systems in real-time. Data infrastructure and HD mapping providers contribute high-resolution maps, fleet logs, and synthetic datasets that enhance the realism and coverage of simulation workflows. OEMs and automotive innovators drive market demand based on vehicle program requirements, ADAS feature roadmaps, and safety certification needs, shaping the scale, complexity, and evolution of simulation technologies across global markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

ADAS Simulation Market, By Method

The cloud-based simulation segment is projected to account for a larger share than the on-premises simulation segment during the forecast period. This growth is driven by the superior scalability of cloud-based simulation, its cost efficiency, and its ability to support massive scenario execution. Cloud-based simulation enables OEMs to run millions of tests in parallel, integrate real-world driving data, and collaborate across global engineering teams without hardware constraints. As ADAS features grow more complex and demand faster iteration cycles, cloud-native platforms have become the preferred method for large-scale validation. Their increasing adoption across OEMs, Tier-1 suppliers, and autonomous developers further strengthens cloud-based simulation as the dominant approach in the market.

ADAS Simulation Market, By Simulation Type

The software-in-the-loop segment is projected to account for the largest share of the ADAS simulation market during the forecast period. The growth of the segment is supported by the ability of SIL to validate algorithms early in the development cycle with high speed and low cost. it enables engineers to test perception, decision-making, and control software without physical hardware, making it ideal for rapid iteration and large-scale scenario coverage. As ADAS architecture becomes increasingly software-driven, SiL offers the flexibility and repeatability needed for continuous updates and OTA validation. Additionally, its widespread adoption across OEMs and Tier-1 suppliers reinforces SiL as the foundational simulation type for modern ADAS development.

ADAS Simulation Market, By Level of Autonomy

The level 2 segment is projected to account for the largest share of the ADAS simulation market during the forecast period. This growth is driven by strong global demand for features, such as adaptive cruise control, lane-keeping, and traffic-jam assist. These systems require extensive virtual validation to ensure reliability across diverse driving conditions and sensor combinations. As automakers scale level 2 features across mass-market vehicle platforms, simulation workloads for perception, sensor fusion, and control algorithms continue to rise. This widespread deployment cements Level 2 as the dominant autonomy level shaping ADAS simulation demand.

ADAS Simulation Market, By Vehicle Type

The passenger cars segment is projected to account for a larger share than the commercial vehicles segment during the forecast period. This growth is supported by the large production of passenger cars and growing integration of safety and driver-assist features across mid-range and premium segments. As consumer demand for improved comfort, safety, and partial automation rises, OEMs increasingly rely on simulation to validate ADAS functions efficiently and at scale. Additionally, the need to test diverse driving environments, sensor configurations, and use cases further expand simulation workloads for passenger vehicles. This strong and sustained adoption firmly positions passenger cars as the leading vehicle type driving ADAS simulation demand.

ADAS Simulation Market, By Offering

The software segment is projected to account for the largest share of the ADAS simulation market during the forecast period. This growth is driven by the growing need for high-fidelity scenario generation, sensor modeling, and virtual testing environments. As ADAS functionalities become more software-centric, automakers depend heavily on simulation platforms to validate algorithms, reduce development cycles, and minimize physical testing costs. Cloud-enabled and AI-powered software tools provide unmatched scalability and flexibility, enabling the efficient execution of millions of test cases. This rising reliance on advanced simulation software firmly establishes it as the dominant offering in the ADAS simulation ecosystem.

ADAS Simulation Market, By Application

The ADAS simulation market, by application, covers autonomous emergency braking, adaptive cruise control, lane departure warning (LDW) & lane keeping assist (LKA), traffic sign recognition (TSR), blind spot detection (BSD), parking assistance, automated parking assist, and other advanced safety functions. Simulation enables engineers to virtually test and refine these features under different traffic, weather, and road conditions, helping automakers accelerate innovation while meeting global safety and performance standards.

ADAS Simulation Market, By End User

The ADAS simulation market, by end user, covers OEMs, Tier 1/Tier 2 suppliers, and technology providers, all using simulation tools to design, test, and validate advanced driver-assistance features more efficiently. These end users rely on virtual validation to shorten development cycles, lower costs, and ensure system reliability before real-world deployment.

REGION

Asia Pacific is projected to record the highest growth in ADAS simulation market during forecast period

Asia Pacific is projected to witness the highest growth in the ADAS simulation market during the forecast period, supported by rapid vehicle production, rising adoption of driver-assistance features, and strong investment in autonomous driving R&D. Countries like China, Japan, and South Korea are encouraging OEMs to expand virtual validation under stricter safety and NCAP standards. The region’s growing electric vehicle market is also fueling the need for advanced simulation platforms to test complex software systems. Additionally, players in this region are adopting various strategies to strength their footprint in the region. For example, in May 2024, Hyundai Mobis opened a new ADAS simulation and testing center in South Korea, reflecting the region’s focus on building large-scale testing infrastructure and establishing itself as a key global hub for ADAS innovation.

ADAS SIMULATION MARKET: COMPANY EVALUATION MATRIX

In the ADAS simulation market, Siemens (Star) leads with its comprehensive Simcenter portfolio, deep multi-physics expertise, and strong integration of digital twins, PLM systems, and scenario-based validation workflows, which enable large-scale adoption of end-to-end virtual testing across global OEM programs. Keysight Technologies (Emerging Leader) is also gaining momentum through its expanding automotive test and measurement solutions, growing focus on sensor validation and scenario emulation, and increasing investments in software-centric simulation tools, which is positioning it as a rising player with strong potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Siemens (Germany)

- Ansys, Inc. (US)

- NVIDIA Corporation (US)

- dSPACE (Germany)

- AVL (Austria)

- IPG Automotive GmbH (Germany)

- Applied Intuition, Inc. (US)

- The MathWorks, Inc. (US)

- Hexagon AB (Sweden)

- Vector Informatik GmbH (Germany)

- Keysight Technologies (US)

- Dassault Systemes (France)

- Cognata (Israel)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.27 Billion |

| Market Forecast in 2032 (Value) | USD 9.66 Billion |

| Growth Rate | CAGR of 14.3% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, competitive landscape, company share, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe |

WHAT IS IN IT FOR YOU: ADAS SIMULATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| OEM |

|

|

| Tier-1 ADAS System Provider |

|

|

| Simulation Platform Provider |

|

|

| Simulation Platform Provider |

|

Optimize revenue model aligned with OEM and Tier-1 budgets |

RECENT DEVELOPMENTS

- November 2025 : Siemens (Germany) introduced PAVE360 as a next-generation digital twin toolchain that connects semiconductor behavior directly to full vehicle architectures. This platform enables earlier, more accurate chip-to-vehicle validation by replicating complex automotive systems in a virtual environment. The solution helps OEMs synchronize design decisions across teams, reducing integration risks and accelerating ADAS and autonomous development timelines.

- November 2025 : dSPACE (Germany) enhanced its AURELION sensor simulation platform by integrating OMNIVISION’s CMOS image sensor models, enabling highly realistic virtual camera testing. This upgrade allowed engineers to evaluate ADAS perception performance under varied lighting, weather, and traffic conditions without extensive real-world testing. The collaboration strengthened simulation accuracy, helping OEMs calibrate sensors more effectively and accelerate development cycles.

- May 2025 : IPG Automotive GmbH (Germany) and UTAC (Singapore) partnered to deliver an integrated simulation and validation framework combining CarMaker with UTAC’s scoring methodologies. This solution helped OEMs prepare for upcoming Euro NCAP regulations through standardized scenario libraries and early-stage virtual testing capabilities. The collaboration enhanced regulatory compliance efficiency and reduces reliance on time-consuming physical proving grounds.

- February 2025 : Applied Intuition (US) expanded its capability footprint by acquiring EpiSci, a leader in AI-powered autonomy technologies for defense applications. The acquisition allowed the company to extend its simulation and autonomy solutions across multiple domains, including land, air, sea, and space. This move not only broadened Applied Intuition’s scenario libraries but also strengthened its strategic role in high-assurance autonomous system development.

- January 2025 : Vector Informatik GmbH (Germany) joined forces with Mahindra and Mahindra (India) to develop a modern software-defined vehicle architecture for the company’s Electric Origin SUV lineup. The partnership focused on enabling AI-driven intelligence, modular software platforms, and improved system integration for future ADAS and autonomous features. This collaboration supported Mahindra’s transition toward intelligent EVs while strengthening India’s capabilities in advanced vehicle software development.

Table of Contents

Methodology

The research study draws extensively on secondary sources, including company reports, industry association publications, automotive safety guidelines, simulation-focused technical articles, trade websites, and academic databases, to identify and compile key information on the ADAS simulation market. In-depth primary interviews were conducted with OEMs and Tier-1 engineers, simulation software providers, sensor technology experts, and testing organizations to validate critical insights, refine market estimates, and assess growth prospects. This combined research approach ensures a reliable understanding of market dynamics, technological developments, and future opportunities in the ADAS simulation landscape.

Secondary Research

Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and trade-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data was collected and analyzed to determine the overall market size, which has been further validated by primary research.

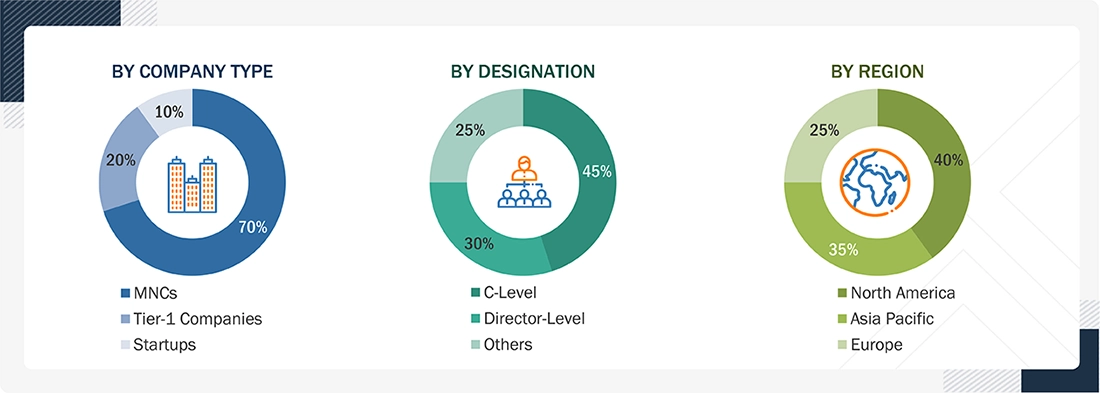

Primary Research

Extensive primary research was conducted after a comprehensive understanding of the ADAS simulation market. Multiple interviews were conducted with stakeholders from the demand and supply sides. Demand-side participants included OEM ADAS program leads, Tier-1 engineering teams, autonomous driving developers, and semiconductor companies involved in the perception and compute platforms. Supply-side respondents comprised simulation software vendors, cloud and HPC providers, sensor model developers, scenario content creators, testing organizations, and automotive research institutes.

The research study covered respondents across North America, Europe, Asia Pacific, and key innovation hubs in Israel and South Korea. Approximately one-third of the interviews represented ADAS and autonomous development teams, while the remaining participants were taken from simulation technology providers and validation service companies. Primary insights were gathered through structured questionnaires, virtual interviews, and email interactions with experts in system validation, AI model training, simulation architecture, safety compliance, and toolchain integration. These discussions captured perspectives on testing requirements, scalability challenges, regulatory expectations, and future investment priorities shaping the ADAS simulation market.

Others include Sales, Managers, and Product Managers.

Company Tiers are based on the value chain; the company’s revenue is not considered.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As outlined below, a comprehensive market estimation methodology was applied to assess and validate the value of the ADAS simulation market, as well as its associated subsegments.

The following steps were involved in the market size estimation process:

- Mapping country- and region-level ADAS/AV development activity using data from automotive regulatory bodies, NCAP programs, government safety mandates, vehicle production statistics, R&D investment reports, and simulation-related publications from organizations such as SAE, ISO, and UNECE

- Identifying ADAS penetration across vehicle categories (passenger cars, commercial vehicles, robotaxis, and autonomous test fleets) by analyzing OEM technology roadmaps, model launches, and availability of L1–L3 features in each region

- Assessing intensity of simulation by evaluating the number of active ADAS/AV programs, software-defined vehicle development maturity, dependency on virtual validation over physical testing, and cloud/HPC availability supporting large-scale simulation

- Developing regional simulation demand forecasts using macro indicators, such as vehicle electrification growth, regulatory safety revisions, digital validation mandates, AV testing activity, and investment trends in AI, sensor technologies, and mobility innovation hubs

- Refining segment assumptions using insights from primary interviews with OEM validation leads, simulation engineers, sensor manufacturers, cloud providers, and AV testing organizations

- Aggregating company-level spending on simulation platforms, test automation, dataset generation, scenario libraries, and compute infrastructure to build region-wise simulation expenditure models

- Converting simulation usage metrics into market value by multiplying user-base estimates (engineers per program, simulation licenses deployed, compute hours consumed) with average pricing benchmarks for software licenses, cloud GPU costs, service contracts, and hardware components

- Summing up values across regions and offerings to derive the total global market size for the ADAS Simulation market and validate it against top-down indicators such as total ADAS R&D expenditure and industry digital validation budgets

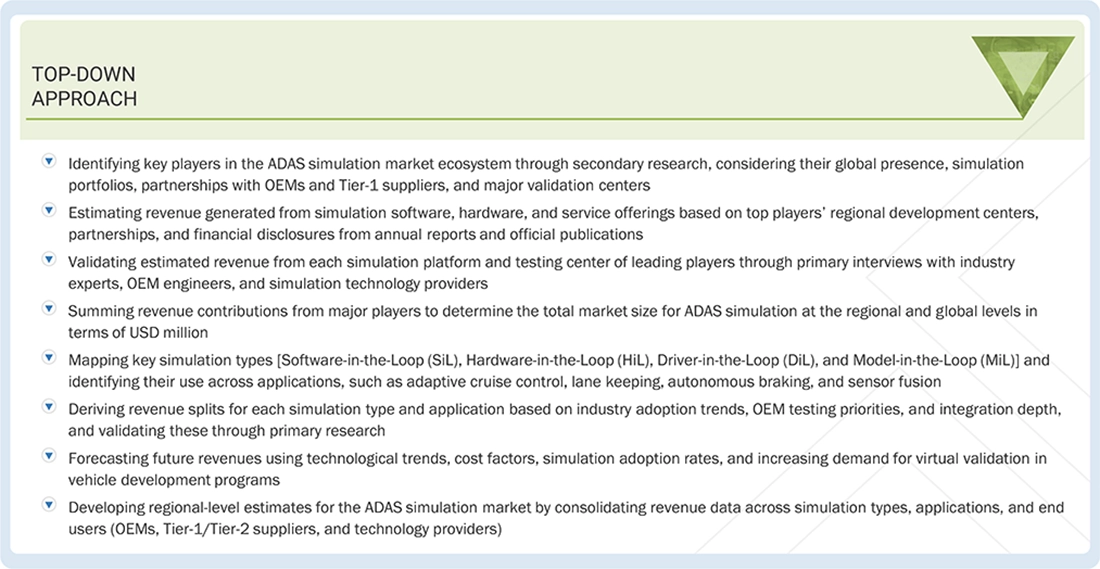

ADAS Simulation Market : Top-Down and Bottom-Up Approach

Data Triangulation

After establishing the overall market size using the outlined methodology, the ADAS simulation market was segmented by simulation type, method, level of autonomy, vehicle type, offering, application, and region. A rigorous data triangulation process was applied to validate these segment-level estimates and ensure consistency across the final market figures. This involved cross-checking derived values through multiple analytical lenses, including regional ADAS adoption rates, regulatory safety requirements, OEM and Tier-1 development activity, and simulation technology utilization trends. Inputs from demand-side stakeholders (OEM validation teams, autonomous driving developers, semiconductor companies) and supply-side participants (simulation software providers, cloud/HPC vendors, testing organizations) were incorporated to refine assumptions. By reconciling insights from secondary databases, primary interviews, and industry indicators such as vehicle production, AV testing intensity, and digital validation spending, each segment and subsegment was validated to deliver a reliable and coherent assessment of the ADAS simulation market.

Market Definition

The ADAS simulation market covers a suite of software platforms, hardware systems, and computational tools that enable virtual testing, validation, and optimization of Advanced Driver Assistance Systems (ADAS) before real-world deployment. It studies technologies designed to recreate realistic driving environments, including road networks, traffic behavior, weather conditions, and dynamic event sequences, to evaluate the performance of perception, decision-making, and control algorithms under safe, repeatable, and highly scalable virtual conditions. This market integrates advanced modeling capabilities, such as physics-accurate sensor simulation (camera, radar, lidar, ultrasonic), 3D scene rendering, vehicle dynamics modeling, and scenario generation to replicate real-world and edge-case situations that are otherwise difficult, costly, or unsafe to test physically. By enabling automotive OEMs, Tier-1 suppliers, semiconductor companies, and autonomous driving developers to conduct extensive validation in a virtual environment, ADAS simulation significantly reduces development timelines, lowers testing costs, and enhances system reliability needed to meet evolving global safety standards.

Key Stakeholders

- Government & Regulatory Bodies

- Automotive OEMs & Tier-1 Suppliers

- Simulation Technology & Solution Providers

- Cloud, HPC, and Hardware Infrastructure Providers

- Testing, Certification, and Safety Assessment Agencies

- Financial & Investment Institutions

- Industry Associations & Standards Organizations (SAE, ISO, UNECE, NCAP)

- Research Institutes, Universities, and Automotive R&D Centers

Report Objectives

- To analyze and forecast the ADAS simulation market in terms of value (USD million) from 2025 to 2032

-

To segment and forecast the ADAS simulation market in terms of value, based on the following:

- By Method (On-premises Simulation, Cloud-based Simulation)

- By Simulation Type (Model-in-the-loop, Software-in-the-loop, Hardware-in-the-loop ,Driver-in-the-loop)

- By Level of Autonomy (Level 1, Level 2/2+, Level 3, Level 4 & 5)

- By Vehicle Type (Passenger Cars, Commercial Vehicles)

- By Offering (Software, Services)

- By Application [Autonomous Emergency Braking, Adaptive Cruise Control, Lane Departure Warning (LDW) & Lane-keeping Assist (LKA), Traffic Sign Recognition (TSR), Blind Spot Detection (BSD), Parking Assistance, Automated Parking Assist, Others]

- By End User (OEMs, TIER 1/ TIER 2 Component Manufacturers, Technology Providers/Software Developers)

- By Region (Asia Pacific, Europe, North America)

- To understand market dynamics (Drivers, Restraints, Opportunities, and Challenges), and to analyze the evaluation matrix of leading players operating in the market

- To strategically analyze the key player strategies and company revenue analysis of key players in the market from 2021 to 2025

-

To study the following aspects of the report

- Trends/Disruptions Impacting ADAS Simulation Market

- Market Ecosystem

- Technology Analysis

- Patent Analysis

- Regulatory Landscape

- Case Study Analysis

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- Macroeconomic Outlook

- Company Valuation and Financial Metrics

- Brand/Product Comparison

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product launches, and other activities undertaken by the key industry participants

Customization Options

With the given market data, MarketsandMarkets offers customizations tailored to the company’s specific needs. The following customization option is available:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the ADAS Simulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in ADAS Simulation Market