Agriculture Waste Management Market

Agriculture Waste Management Market by Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Horticultural & Specialty crops, Rood & Tuber Crops), Technology Solution Type, End User, and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The agricultural waste management market is estimated at USD 14.50 billion in 2025 and is projected to reach USD 22.50 billion by 2030, at a CAGR of 9.2%. The market encompasses a range of technologies, practices, and infrastructure that minimize losses that occur throughout the supply chain, from post-harvest handling to storage, processing, and distribution.

KEY TAKEAWAYS

-

BY CROP TYPECereals & grains and fruits & vegetables represent the largest segments, driven by their high perishability and global consumption. Technologies targeting fruits & vegetables are in demand due to their short shelf life and susceptibility to post-harvest losses. Oilseeds & pulses require protection during storage and transport to minimize spoilage and contamination. Horticultural and specialty crops, though niche, benefit from customized solutions due to their high market value and export sensitivity.

-

BY SOLUTION TYPEPre-harvest loss prevention technologies are dominating the market with the rise of precision agriculture, helping prevent losses due to weather, pests, and diseases. Post-harvest loss prevention technologies are gaining attention due to improper storage, pest attacks, and inefficient logistics. Harvest technologies, including efficient harvesting machinery and handling systems, support timely harvesting and reduce field-level losses, especially in labor-scarce regions.

-

BY TECHNOLOGYSensor technology plays a pivotal role in monitoring crop conditions, storage environments, and supply chain logistics, enabling timely interventions to prevent loss. Cold chain & refrigeration technologies are crucial for maintaining the quality of perishable products, especially in fruits, vegetables, and dairy-based crops. Data & analytics technology empowers stakeholders with predictive insights to optimize harvesting, storage, and distribution decisions. Robotics & automation are increasingly adopted for mechanized harvesting, sorting, and grading, reducing human error and improving efficiency across the value chain.

-

BY END USERIndividual and smallholder farmers are gradually adopting low-cost, scalable technologies designed to minimize harvest and post-harvest losses. Commercial farmers invest in integrated systems that cover the entire pre- to post-harvest process to ensure higher yield preservation. Agricultural cooperatives benefit from shared infrastructure and technology solutions, enabling collective reduction in food loss. Logistics and warehousing providers are key to maintaining product quality during transit and storage through cold chain systems and smart tracking. Food processors and manufacturers prioritize loss reduction to ensure a consistent raw material supply and meet sustainability goals.

-

BY REGIONAsia Pacific is projected to be the fastest-growing region due to the increasing pressure to reduce post-harvest losses, growing food security initiatives, and rising investments in agri-tech solutions. Africa and Latin America are also emerging markets, supported by international development programs and government-led loss prevention strategies. North America and Europe lead in adoption due to advanced infrastructure, precision agriculture practices, and a strong emphasis on sustainability across agricultural value chains.

-

COMPETITIVE LANDSCAPEKey players such as AGCO Corporation, John Deere, IBM, and Corteva Agriscience focus on precision farming, AI-based analytics, and cold chain innovations to minimize food losses across the supply chain. Strategic partnerships with agri-tech startups, government-backed initiatives, and investment in smart farming technologies are helping companies expand their presence and offer tailored solutions for diverse crops and climatic conditions.

The agricultural waste management market is estimated at USD 14.50 billion in 2025 and is projected to reach USD 22.50 billion by 2030, at a CAGR of 9.2%. The market encompasses a range of technologies, practices, and infrastructure that minimize losses that occur throughout the supply chain, from post-harvest handling to storage, processing, and distribution. Solutions to food loss tackle various causes such as poor storage, inefficient harvesting, inadequate transport, and lack of market information, thus driving the market. Precision agriculture and cold chain logistics improve efficiency and food security. As sustainability concerns grow, reducing agricultural food loss is increasingly vital for economic and environmental benefits.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The agricultural waste management market is witnessing transformative shifts as downstream stakeholders—retailers, consumers, governments, and export buyers—increasingly demand fresher, safer, and more sustainably sourced food. Rising global food insecurity, stricter regulations around post-harvest handling, and the pressure to meet sustainability goals such as SDG 12.3 are driving the adoption of innovative loss-prevention technologies. Consumers are pushing for better shelf-life and reduced spoilage, while retailers and food processors seek stable, traceable supply chains. Governments are investing in modern infrastructure, such as cold chains and post-harvest processing, to minimize food waste and boost food security. Additionally, export buyers are demanding higher quality, compliance-ready produce, further accelerating the shift toward smart sensing, data-driven logistics, and automation in handling. These evolving expectations are disrupting traditional practices and compelling agricultural stakeholders to reimagine their loss reduction strategies with a focus on resilience, efficiency, and transparency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surge in food losses during farming and transportation

-

Population growth & rising food demand

Level

-

High capital investment in reefer transport to limit cold chain expansion in rural areas

-

Infrastructure gaps in emerging markets

Level

-

High post-harvest loss rates across crops to create demand for advanced loss-mitigation solutions

-

Circular Economy Model

Level

-

Unpredictable weather patterns and extreme events to affect crop yields

-

Financial Inclusion Barriers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surge in food losses during farming and transportation

The surge in food loss, both globally and domestically, is driving demand for agricultural food loss reduction solutions. USDA data indicate that approximately 30% of food in the US remains unconsumed at the retail and consumer level, with significant losses occurring at the farm stage due to unprofitable market prices for additional harvests and labor shortages. Perishable produce is particularly vulnerable, with overripe or cosmetically imperfect items often being excluded from wholesale markets, resulting in significant resource wastage. In October 2024, FAO estimates that approximately 30% of food production is lost or wasted annually, while in India, post-harvest losses cost approximately USD 18.5 billion (INR 1.53 lakh crore) each year, largely due to inadequate infrastructure, low mechanization, and insufficient storage facilities. These losses reduce food availability and exacerbate hunger, malnutrition, and resource inefficiencies while contributing significantly to greenhouse gas emissions, including methane from landfills. Moreover, the International Day of Awareness of Food Loss and Waste highlights the urgency of addressing this issue in line with environmental and climate objectives. This increased awareness, along with the economic and environmental effects of food loss, is driving investments in advanced technologies, infrastructure, and supply chain solutions to reduce losses throughout agricultural value chains.

Restraint: High capital investment in reefer transport to limit cold chain expansion in rural areas

The agricultural waste management market faces a significant restraint due to the high upfront capital requirements for critical infrastructure, including cold rooms, reefer transport vehicles, and packhouse equipment. According to the article published by Natural Storage Solution Pvt Ltd in May 2023, setting up cold storage facilities can cost around USD 127 per square foot, placing a considerable financial burden on stakeholders, particularly in developing markets. Similarly, acquiring reefer trucks and advanced packhouse machinery entails substantial investment in refrigeration technology, energy systems, and ongoing maintenance, further elevating initial costs. These substantial capital requirements stand in sharp contrast to the narrow profit margins of farmers, mainly small and marginal producers who often operate with limited cash reserves and face restricted access to affordable credit. The mismatch between the investment scale and the financial capacity of end users hinders the adoption of these solutions, despite their proven ability to minimize post-harvest losses. These high-cost barriers continue to discourage investment in cold chain and processing infrastructure. As a result, many producers and cooperatives delay or forgo technology adoption, perpetuating post-harvest inefficiencies and wastage, particularly in highly perishable categories such as fruits, vegetables, and dairy products.

Opportunity: High post-harvest loss rates across crops to create demand for advanced loss-mitigation solutions

A 2022 NABCONS study underscores significant post-harvest losses in India—3.89–5.92% for cereals, 5.65–6.74% for pulses, 2.87–7.51% for oilseeds, 6.02–15.05% for fruits, and 4.87–11.61% for vegetables—highlighting a critical market gap for loss-mitigation solutions. This presents a strategic growth opportunity for stakeholders across the agri-value chain to deploy advanced packaging technologies that can materially reduce wastage while enhancing product value. Edible coatings, formulated from biodegradable food-grade materials, act as moisture and gas barriers to slow ripening; vacuum packaging and modified atmosphere packaging (MAP) extend shelf life by controlling oxygen and gas composition; resealable formats maintain freshness through repeated use; and active, antimicrobial, and intelligent packaging solutions inhibit microbial growth and provide real-time freshness monitoring. The adoption of these technologies can result in reduced quantitative losses, prolonged marketability, improved price realization for producers, and higher operational efficiency for distributors and retailers. For packaging manufacturers and agri-tech innovators, this creates a scalable commercial opportunity driven by the dual imperatives of profitability and sustainability. As consumer demand for high-quality fresh produce rises, and with a focus on reducing food loss, market participants integrating solutions into India’s perishable supply chain can achieve competitive differentiation and capture long-term value.

Challenge: Unpredictable weather patterns and extreme events to affect crop yields

Climate change represents a significant challenge for the agricultural waste management market, primarily due to its disruptive impact on crop production and post-harvest management. Increasingly unpredictable weather patterns, including irregular rainfall, prolonged droughts, and unseasonal storms, can adversely affect crop yields and compromise produce quality. Extreme events such as floods, heatwaves, and cyclones further exacerbate losses by damaging standing crops and creating unfavorable conditions for storage, thereby increasing the risk of spoilage and post-harvest waste. Climate-induced uncertainties complicate infrastructure planning for businesses and solution providers. Cold storage facilities and refrigerated transport designed on historical trends may become inefficient, raising operational costs and lowering returns. Additionally, climate variability disrupts harvest schedules and distribution timelines, hindering effective food loss reduction efforts. Small and marginal farmers, who typically operate with constrained financial resources, are particularly vulnerable to climate-related losses, further hindering their ability to adopt advanced cold chain and post-harvest technologies. Consequently, the market faces obstacles in scaling solutions, achieving consistent utilization, and ensuring ROI for investors. Addressing these climate-related risks requires adaptive, resilient infrastructure and strategic planning to maintain effectiveness and drive long-term market growth.

Agriculture Waste Management Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Smart harvesting and precision agriculture equipment for cereals and grains | Reduced field-level losses, enhanced harvesting efficiency, and better preservation of yields |

|

Mechanized harvesting and baling solutions for horticultural and specialty crops | Minimized crop handling damage, faster harvesting, and reduced perishability |

|

Post-harvest grain handling and storage systems | Improved storage efficiency, reduced moisture-related spoilage, and maintained grain quality |

|

IoT and sensor-based monitoring systems for cold chain and storage infrastructure | Real-time temperature/humidity tracking, reduced spoilage, and improved traceability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The agricultural waste management market functions within a dynamic and collaborative ecosystem involving multiple stakeholders. Technology providers form the backbone of innovation, offering tools such as cold chain systems, IoT sensors, data analytics platforms, and eco-friendly packaging that help reduce losses across the value chain. Solution developers and service providers work closely with farmers, supply chain operators, and retailers to implement scalable and practical interventions that minimize food waste from field to fork. Regulatory authorities and policymakers play an essential role by setting food safety standards, sustainability goals, and waste reduction policies that drive industry compliance and innovation. Industry enablers such as agricultural cooperatives, research institutions, and NGOs facilitate knowledge transfer, funding, and capacity-building. End users, including smallholders, commercial farms, food processors, logistics providers, and retailers, adopt and integrate these technologies to improve efficiency, reduce waste, and meet quality standards. This interconnected ecosystem fosters synergy across production, post-harvest handling, distribution, and consumption, accelerating the transition toward a more resilient, sustainable, and food-secure future.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Agricultural Waste Management Market, by Type

Pre-harvest loss prevention technologies are projected to grow at the highest CAGR in the agricultural food loss reduction market, driven by the increasing adoption of precision farming solutions. Precision agriculture represents a data-driven, technology-centric approach that enables farmers to optimize crop production, enhance sustainability, and improve operational efficiency. By integrating advanced tools such as artificial intelligence (AI), GPS, Internet of Things (IoT) devices, automated machinery, and data analytics, farmers can monitor field conditions with exceptional accuracy, ensuring that inputs such as water, fertilizers, and pesticides are applied precisely where and when needed. Key technologies underpinning this transformation include satellite imagery and remote sensing, which detect variations in crop health, water stress, pest infestations, and nutrient deficiencies at scale. AI-powered platforms analyze large datasets to forecast diseases, optimize yields, and provide tailored recommendations. Autonomous machinery and robotics automate labor-intensive tasks such as planting, fertilization, and pest control, reducing human error and operational costs. Data analytics platforms consolidate field and financial data to support strategic decision-making, while IoT devices and sensors continuously monitor soil, weather, and environmental conditions for targeted interventions. Additionally, drones offer high-resolution mapping for irrigation and pest management, and blockchain technologies enable transparent, tamper-proof traceability from farm to fork.

Agricultural Waste Management Market, by Technology

Cold chain logistics account for a significant share of the agricultural waste management market, driven by the critical need to address transport-related losses. According to the World Food Programme, inadequate transport resulted in a loss of approximately 6,246.624 metric tons of agricultural produce, valued at USD 4.88 million. These transport-associated losses accounted for 47% of pre-delivery losses, underscoring the significant role that logistics inefficiencies play in food wastage. The high proportion of losses occurring during transit highlights the urgent demand for reliable cold chain solutions that maintain optimal temperature and handling conditions from farm to market. By minimizing spoilage during transport, these technologies directly enhance food security and reduce economic losses for growers, distributors, and retailers. Transport inefficiencies significantly contribute to pre-delivery losses, creating a valuable opportunity for investment in cold chain logistics. Optimizing transport conditions can greatly reduce waste, making cold chain solutions a key segment in reducing agricultural food loss.

Agricultural Waste Management Market, by Crop Type

Cereals and grains remain a strategic focus within the agricultural waste management market, as highlighted in the OECD-FAO Agricultural Outlook 2025–2034 (July 2025). Global consumption of coarse grains is projected to increase by approximately 33 million tons, or 1% annually, driven primarily by growth in Africa and Asia. Despite relatively lower losses compared with other commodities, nearly 19% of global cereal production is lost, with the majority occurring across transport, processing, distribution, and household segments. Industry players are adopting targeted, technology-driven approaches to mitigate these losses. In June 2024, Mitsubishi Logistics and Hitachi deployed IoT-enabled monitoring systems in Japanese grain silos to optimize storage and reduce spoilage. Similarly, Sumitomo Corporation invested in moisture-proof packaging for rice and wheat in March 2023, while Ajinomoto partnered with NTT Data in May 2025 to pilot a blockchain-based grain tracking platform, enhancing end-to-end supply chain visibility. Such initiatives, underpinned by public-private collaboration and innovative packaging solutions, are essential to minimizing cereal loss as the food share of global cereal consumption is expected to reach 29% by 2034.

REGION

Asia Pacific to be fastest-growing region in global agricultural waste management market during forecast period

Asia Pacific is emerging as the fastest-growing region in the agricultural waste management market, driven by rapid technological adoption and strong government initiatives across key economies such as India and China. In India, Escorts and Mahindra & Mahindra are producing affordable, compact precision harvesters designed for a range of crops, including wheat, rice, sugarcane, and pulses, while partnerships with tech startups are enabling AI-powered yield estimation tools and data-driven maintenance systems. Pilot projects in agricultural hubs such as Punjab, Haryana, and Maharashtra have demonstrated significant efficiency gains and labor savings through semi-autonomous harvesting solutions, further supported by the Digital Agriculture Mission, which equips farmers with real-time weather and market insights to optimize harvest timing and reduce losses. China is accelerating agricultural modernization through the National Smart Agriculture Action Plan (2024–2028), which integrates big data, AI, and GPS technologies to boost yields, cut costs, and improve efficiency. The incorporation of the BeiDou satellite system into precision agriculture applications further enhances machinery guidance, mapping, and timing accuracy, enabling more precise and loss-minimizing operations. Collectively, these advancements position the Asia Pacific region at the forefront of innovation, making it a pivotal growth engine for the agricultural waste management market.

Agriculture Waste Management Market: COMPANY EVALUATION MATRIX

In the agricultural waste management market matrix, Deere & Company (US), positioned as a star player, leads the market with its advanced, technology-driven solutions, including precision farming equipment, storage systems, and supply chain optimization tools. Hexagon AB (Sweden), recognized as an emerging leader, maintains a strong global presence by providing innovative monitoring, IoT-enabled solutions, and data analytics for reducing post-harvest losses. While Deere & Company dominates through its established customer base and comprehensive solution offerings, Hexagon AB continues to expand its capabilities and strategic partnerships, demonstrating strong potential to strengthen its position in the market further.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 13.44 Billion |

| Market Forecast, 2030 (value) | USD 22.50 Billion |

| Growth Rate | CAGR of 9.2% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Millon Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: Agriculture Waste Management Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Grain Producer | Detailed food loss reduction forecast by commodity (cereals, coarse grains, pulses, oilseeds) | Actionable insights on loss hotspots and targeted intervention strategies |

| Cold Chain & Logistics Operator | Analysis of storage, transport, and distribution losses across regions | Analysis of storage, transport, and distribution losses across regions |

| Agri-Tech & Equipment Manufacturer | Mapping of post-harvest solution adoption for storage systems, sensors, and automated handling | Enabled product positioning, investment prioritization, and differentiation in the market |

| Retail & FMCG Companies | Food loss reduction analysis for processed and perishable products | Strategic insights for shelf-life extension, supply chain transparency, and cost savings |

RECENT DEVELOPMENTS

- May 2025 : Lineage, Inc. (US) expanded its Vejle cold storage facility in Denmark, adding 6,000 sq. meters and boosting capacity to 93,500 EUR pallet positions. Strategically located near key highways and ports, the site enhanced cold chain connectivity across the Nordics and Europe. The facility features advanced energy-efficient technologies, supporting sustainability and food security. This move aligns with Lineage’s strategy to strengthen its cold storage network in Northern Europe.

- May 2025 : Lineage, Inc. (US) acquired Norway-based cold storage company Permanor AS, strengthening its presence in the Nordic region. The acquisition includes facilities in Haugesund and Brumunddal, offering 24,500 pallet positions and 10,000+ sq. meters of space. These sites support the meat and food industries with freezing, thawing, and logistics, and focus on sustainability through solar-powered operations. This strategic move enhances Lineage’s cold chain capabilities and commitment to energy-efficient, responsible operations in Northern Europe.

- November 2024 : MaterioBiocatalysts Ltd launched the PlantPro enzyme range to address key challenges in the plant-based food industry. The new enzymes enhanced taste, texture, and functionality in plant-based beverages, meat, and cheese alternatives. Highlighting innovation, the PlantPro 726L enzyme boosted umami flavor naturally, improving sensory appeal without artificial additives. This launch empowered manufacturers to create premium, clean-label plant-based products that meet rising consumer demand and stand out in a competitive market. Beryllium & Composites (subsidiary of Materion Corporation) partnered with Liquidmetal Technologies Inc. and other Certified Liquidmetal Partners to use their alloy production technologies to provide high-quality products and support services to their customers.

- January 2024 : Amazon Web Services (US) and Carrier (US) announced a collaboration to develop the Lynx digital platform, which aimed to reduce food spoilage across the cold chain. The platform unified fragmented cold chain operations, offering end-to-end visibility, predictive insights, and optimized logistics for refrigerated storage and transport. Using AWS IoT, machine learning, and analytics, Lynx helped match supply with transport, improve fleet utilization, and proactively identify risks to minimize waste.

- December 2023 : Lineage Inc. (US) officially opened a new cold storage facility in Tauriko, Tauranga, New Zealand, featuring over 3 million cubic feet of space and 16,000+ pallet positions. Strategically located near the Port of Tauranga, the facility enhances export logistics and supply chain efficiency. It incorporated sustainable features such as an 890 kW solar array, rainwater harvesting for refrigeration, and rapid doors to reduce energy loss. With this addition, Lineage operates 25 facilities across New Zealand.

Table of Contents

Methodology

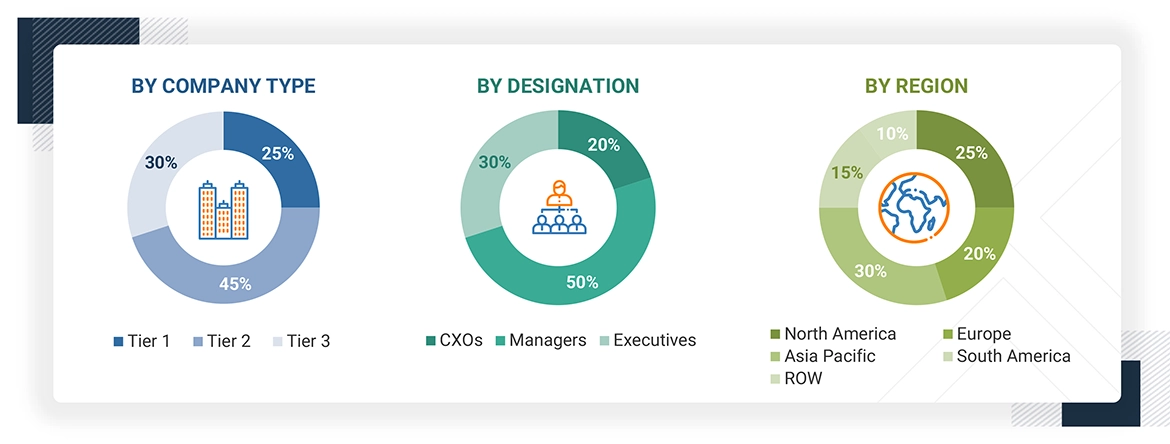

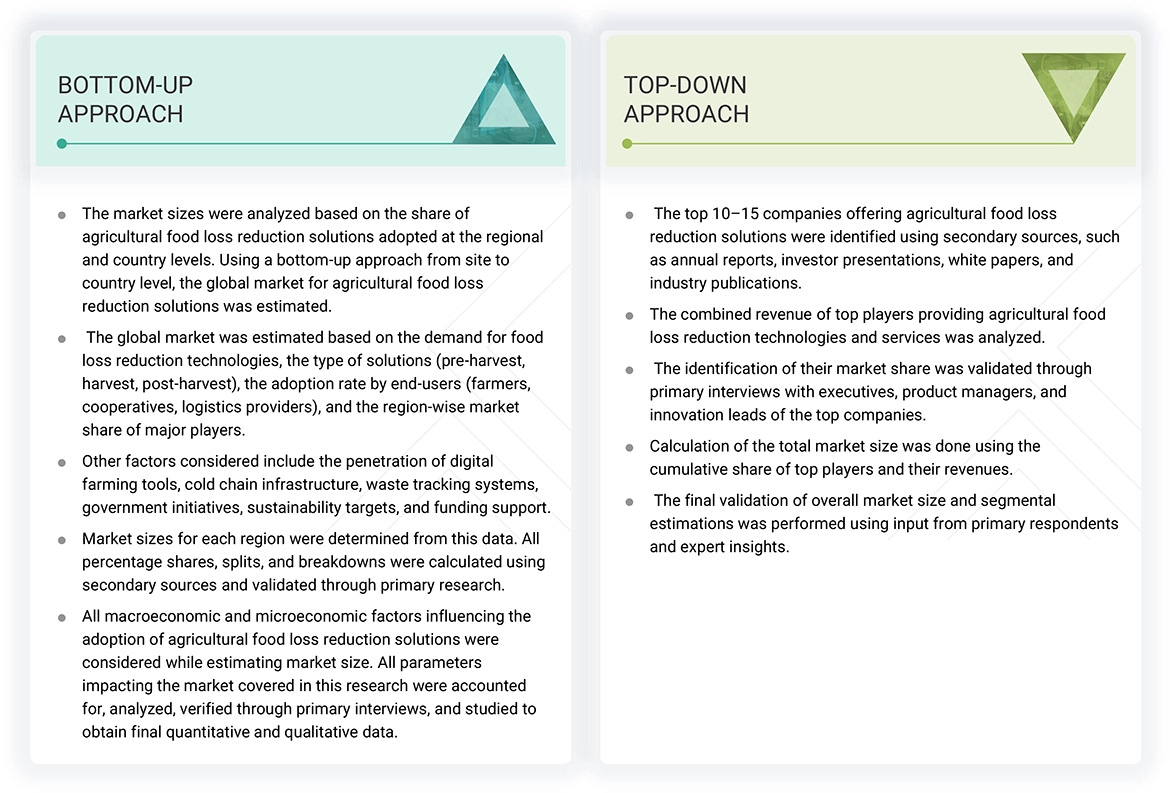

The study involved two major approaches in estimating the current size of the agricultural food loss reduction solutions market. Exhaustive secondary research collected information on the market, crop type, by technology, solution type, and end user. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect valuable information for a technical, market-oriented, and commercial market study. In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information. Secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, and market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the agricultural food loss reduction solutions scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief officers (CXOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. It also helped understand the solution type, technology, crop type, end user, and region trends. Stakeholders from the demand side, such as farmers & growers, food processing companies, and cold chain logistics providers, were interviewed to understand the buyers’ perspective on the suppliers, products, and their business outlook, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024,

as per the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = revenue = USD 1

billion; Tier 3: Revenue < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Deere & Company (US) |

Product Development Manager |

|

DJI (China) |

Senior R&D Scientist |

|

AGCO (US) |

Marketing Director |

|

CNH Industrial (UK) |

Sales Head |

|

Hexagon AB (US) |

Senior Research Executive |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the agricultural food loss reduction solutions market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Agricultural Food Loss Reduction Solutions Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to estimate the overall agricultural food loss reduction solutions market and determine the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

According to the FAO, Food losses refer to the decrease in edible food mass throughout the part of the supply chain that specifically leads to edible food for human consumption. Food losses occur at production, postharvest, and processing stages in the food supply chain. Food losses occurring at the end of the food chain (retail and final consumption) are often called “food waste,” which relates to retailers’ and consumers’ behavior.

The agricultural food loss reduction solutions market refers to the collection of technologies, equipment, services, and practices aimed at minimizing food loss during pre-harvest, harvest, post-harvest, storage, processing, and transportation stages of the agricultural supply chain.

Stakeholders

- Farmers & Growers

- Agri-tech Companies

- Equipment & Machinery Manufacturers

- Cold Chain Logistics Providers

- Food Processing Companies

- Government & Regulatory Bodies

- NGOs & International Agencies

- Research & Academic Institutions

- Investors & Funding Agencies

- Retailers & Wholesalers

Report Objectives

- To determine and project the size of the agricultural food loss reduction solutions market based on solution type, crop type, technology, end user, and region over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro markets concerning individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the agricultural food loss reduction solutions market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- A product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the European agricultural food loss reduction solutions into key countries

- Further breakdown of the Rest of Asia Pacific agricultural food loss reduction solutions into key countries

- Further breakdown of the Rest of the South American agricultural food loss reduction solutions into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the projected size of the agricultural food loss reduction solutions market?

The market is estimated at USD 14.50 billion in 2025 and is projected to reach USD 22.50 billion by 2030, at a CAGR of 9.2%.

Which are the key players in the market, and how intense is the competition?

The key players are Deere & Company (US), DJI (China), AGCO (US), and CNH Industrial (UK). The market competition is intense, with continuous R&D investments, mergers, acquisitions, and innovations in storage technologies.

What are the growth prospects for the market in the next five years?

The Agricultural food loss reduction solutions market is expected to grow robustly over the next five years, driven by the global demand for clean & hygienic foods.

What kind of information is provided in the company profiles section?

The company profiles offer valuable information, such as a comprehensive business overview, including details on the company’s various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company’s product offerings, significant milestones, and expert analyst perspectives to further explain the company’s potential.

How is the Asia Pacific region contributing to market growth?

The Asia Pacific region is becoming a key growth driver for the Agricultural food loss reduction solutions market. India, China, and Vietnam are significantly increasing their logistics sectors to meet domestic and export demands.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Agriculture Waste Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Agriculture Waste Management Market