Agriculture Silos & Storage Systems Market

Agriculture Silos & Storage Systems Market by Silo Type (Flat Bottom, Hopper, Grain Bin, Square), Construction Material (Steel, Concrete), End-use Application (Food Storage, Farm Product, Processing & Industrial Use), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The agriculture silos & storage systems market is projected to expand from USD 5.09 billion in 2025 to USD 6.53 billion by 2030, at a CAGR of 5.1% during the forecast period. The agriculture silos and storage systems market is essential for global food security and improving supply chain efficiency. Driven by a rising global population, increasing food demand, and the need to minimize post-harvest losses, this market is consistently growing

KEY TAKEAWAYS

- North America agriculture silos & storage systems market accounted for 37.0% revenue share in 2024.

- By type, the hopper silos segment is expected to register the highest CAGR of 5.7%.

- By construction material, the metal/steel segment is projected to grow at the fastest rate from 2025 - 2030.

- By end-use, the food storage segment is expected to dominate the market, growing at the highest rate of 5.7%

- SUKUP MANUFACTURING CO., AGI, MySilo, Prado Silos, and SYMAGA were identified as some of the star players in the marine ingredients market (global), given their strong market share and product footprint.

- Michal ZUPH, & Coban Silo have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Advanced storage options, especially durable steel and concrete silos, are crucial for maintaining grain quality and extending shelf life by safeguarding against spoilage, pests, and environmental factors. A major trend shaping the market is the adoption of advanced technologies such as IoT sensors, AI-based monitoring systems, and automation tools.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The agriculture silos & storage systems market is evolving rapidly, fueled by rising grain production, climate challenges, and technological advancements. These disruptions are driving demand for efficient storage solutions to minimize post-harvest losses and enhance global market efficiency, creating new revenue streams for stakeholders.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Production of high-quality grains through effective storage and efficient post-harvest management

-

Post-harvest losses and food wastage to increase the sales of silos in agriculture industry

Level

-

High initial investments in equipment and its set up affect their demand across developing regions

Level

-

Rapid advancements and technological developments in attributes of silos to drive market

-

Initiatives undertaken by governments in various countries for setting up grain silos

Level

-

Managing supply chain issues within silo systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Production of high-quality grains through effective storage and efficient post-harvest management

Most farmers in developing countries focus on maximizing farm outputs to meet food demands. This results in the production of surplus farm produce that needs to be stored efficiently and sold over a longer period. Grain silos are essential for packaging and storing this produce, as they are large-scale commercial structures used for permanent grain storage. In addition to storage, silos also serve other post-harvest management functions, such as acting as grain collection and distribution centers. Consequently, farmers in North America and Europe are investing in establishing silos. This trend increasingly improves grain storage, allowing it to be kept longer under proper conditions, regardless of external weather. Governments and international agencies are recognizing the critical role of modern storage solutions in ensuring food security. Many policy initiatives and infrastructure projects have been launched to promote the construction of silos and grain storage systems.

Restraint: High initial investments in equipment and its set up affect their demand across developing regions

Smallholder farmers make up most of the farming population worldwide. They often lack the resources and facilities needed to produce high yields. These farmers are increasingly unaware of how important proper storage and maintenance of high-quality grains are. Small-scale farmers usually live in rural areas and have limited resources to build silos for storing their harvests. According to Prairies Partners, the cost to set up a steel grain silo system with a capacity of 5000 to 10,000 tons can range from USD 500,000 to USD 2 million, depending on customization, location, and extra equipment.

Opportunity: Rapid advancements and technological developments in attributes of silos to drive market growth

Using grain silos instead of warehouses to store grains offers several advantages, especially regarding land use. Silos can be designed to fit available land areas and come in both vertical and horizontal forms to meet farmers' needs. Maintaining optimal storage conditions is easier by controlling temperature, which, if not managed properly in long-term storage, can lead to economic losses. Many silos are now equipped with machinery that facilitates post-harvest tasks on farms, such as threshing, cleaning, and disinfecting. With proper maintenance, grains stored in silos can last for decades. Additionally, silos allow storing different grains in separate compartments to preserve each one effectively.

Challenge: Managing supply chain issues within silo systems

Sealed silos are loaded for the purpose of controlling pest infestations or the maintenance and regulation of temperature conditions. Operators of silos generally face a respiratory health hazard due to grain dust, which causes dust-induced breathing issues. Silos help the US meet the global demand for food, feed, and ethanol-based fuel. However, the increase in silo-based accidents and risks in various countries leads to significant challenges for the market’s growth. The need to climb silos to get inside, check levels, or close and seal lids poses risks of falling and serious injuries. Entering silos presents risks of suffocation from insufficient oxygen, exposure to harmful gases, explosive vapors, and fumigants like phosphine gas. There is a risk assessment to be undertaken before anyone works inside silo or other confined spaces, which to some extent, shields the employees from potential risks.

Agriculture Silos & Storage Systems Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops steel flat-bottom and hopper silos with integrated aeration, temperature monitoring, and unloading systems for on-farm and commercial grain storage | Ensures consistent grain quality, prevents spoilage, and enhances operational efficiency through advanced aeration control and automation |

|

Provides complete grain handling and storage solutions integrating silos, conveyors, dryers, and IoT-enabled smart monitoring systems | Offers end-to-end grain management efficiency, reduced post-harvest losses, and data-driven operational optimization |

|

Manufactures galvanized steel silos with modular bolted construction for rapid installation and long-term durability under diverse climatic conditions | Enables cost-effective installation, improved logistics flexibility, and extended equipment lifespan with minimal maintenance |

|

Designs high-capacity flat-bottom silos with advanced ventilation systems and corrosion-resistant coatings for large-scale grain terminals | Provides reliable bulk storage for cooperatives and commercial mills, minimizing grain deterioration and maximizing throughput efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Some of the prominent companies in this market include well-established and financially sound manufacturers of agricultural silos & storage systems. These companies have been operational in the market for more than a decade and have diversified portfolios, the latest technologies, and excellent global sales and marketing networks. Some of the prominent companies in this market include SUKUP MANUFACTURING CO. (US), AGI (Canada), MySilo (Turkey), Prado Silos (Spain), SYMAGA (Spain), TSC SILOS (Netherlands), Bentall Rowlands (UK), American Industries Partners (US), SRON SILO ENGINEERING CO. (China).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Agriculture Silos& Storage Systems Market, By Silo Type

Hopper silos are used to store grains, pellets, seeds (such as sunflower seeds, soybeans, maize, sorghum, and rice), legumes, and other grain-based products that need specific storage conditions. They can also serve as temporary storage for wet grains during drying processes and act as buffer bins in silo systems. These stored items are kept off the ground to prevent moisture buildup and reduce breakage risk. Designed for gravity-assisted unloading, hopper silos are mounted on supporting structures. Their capacity varies from 80 m³ to 1,260 m³. Additionally, they are suitable for storing other free-flowing materials, such as pellets, in various industrial applications.

Agriculture Silos& Storage Systems Market, By End-use Application

Food storage is crucial in the agriculture silos market, protecting crops from contamination, pests, and spoilage while ensuring quality after harvest. Influenced by global food security, crop yields, and trade, large-scale storage with software and temperature controls is vital, especially in major exporting countries and those aiming for self-sufficiency, like India and China. It also reduces post-harvest waste in regions like Sub-Saharan Africa and Southeast Asia. Safety standards in developed countries boost investment in advanced silo tech.

Agriculture Silos& Storage Systems Market, By Construction Material

Metal and steel are among the most common materials used for constructing agricultural silos because of their strength, durability, and versatility. Galvanized steel, in particular, provides excellent resistance to environmental factors like wind, moisture, and temperature changes. Steel silos can be precisely fabricated, transported in modular sections, and quickly assembled on-site, making them suitable for both small and large agricultural operations.

REGION

Asia Pacific to be fastest-growing region in global agriculture silos & storage systems market during forecast period

Asia Pacific is the fastest-growing market for agriculture silos & storage systems, driven by the region’s population growth, urbanization, and rising grain production, especially in countries like China, India, Japan, Australia, and New Zealand. The region’s 2023 grain output reached 1.2 billion metric tons, with rice and maize dominating. Post-harvest losses, averaging 20-30%, particularly in India, necessitate modern silos to enhance food security for a population projected to hit 5.3 billion by 2030. Steel silos are preferred for their resistance to humidity, with flat-bottom silos used for long-term storage and hopper silos for exports.

Agriculture Silos & Storage Systems Market: COMPANY EVALUATION MATRIX

In the agriculture silos & storage systems market matrix, Sukup Manufacturing stands out as a leading player in the agricultural silos and storage systems market due to its broad product portfolio of steel silos, drying, and material handling systems, catering to both on-farm and commercial applications. TSC Silos, as an emerging leader, is gaining traction through its modular and hygienic silo designs that cater to food, feed, and industrial bulk storage segments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.76 Billion |

| Market Forecast in 2030 (Value) | USD 2.65 Billion |

| Growth Rate | CAGR of 7.1% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: Agriculture Silos & Storage Systems Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Market assessment for grain silos, flat-bottom silos, and hopper silos across North America and Europe | Delivered segment-wise and country-level market sizing with growth rates, material breakdown (steel, concrete, fiberglass) and automation adoption trends | Enabled Sukup and AGI to target high-growth regions and optimize manufacturing capacity planning |

| Competitive benchmarking of global and regional silo manufacturers | Profiled leading players (Sukup, Mysilo, Prado Silos, SYMAGA, AGI) on production capacity, product innovation, distribution reach, and pricing strategy | Provided strategic clarity for M&A, regional expansion, and differentiation based on technology and service offerings |

| Analysis of on-farm vs commercial silo demand drivers | Delivered a comparative assessment of post-harvest storage trends, mechanization rates, and investment patterns in smallholder vs large-scale farming | Helped clients like Mysilo and SYMAGA align marketing strategies toward high-demand farm segments |

| Evaluation of smart and automated storage systems (IoT, aeration control, temperature monitoring) | Provided analysis of current adoption rates, technology providers, and case studies from AGI and Sukup installations | Supported product innovation and partnership opportunities with agri-tech sensor companies |

| Price and profitability analysis for galvanized steel silos across key grain-producing countries | Delivered cost structure, price per ton analysis, and sensitivity to steel prices and energy costs | Helped Prado Silos and SYMAGA improve pricing models and manage input cost volatility |

| Study on regulatory standards and safety compliance in grain storage (OSHA, CE, ISO) | Compiled key regulatory frameworks by region with impact assessment on design, safety, and export opportunities | Ensured compliance readiness and improved export competitiveness for global manufacturers |

| Customer perception and brand preference in silo procurement | Conducted B2B survey among cooperatives, grain processors, and logistics firms | Enabled clients to refine sales channels, improve after-sales services, and enhance brand visibility |

| Emerging demand from developing regions (Asia-Pacific, Latin America, Africa) | Delivered forecast models on mechanization rates, subsidy impacts, and local manufacturing opportunities | Supported expansion strategy for Mysilo and AGI into emerging markets with localized production |

| Analysis of material innovation and modular construction in silos | Benchmarked new anti-corrosive coatings, modular assembly techniques, and prefabricated designs | Helped clients reduce installation time and improve durability to gain competitive edge |

| Feasibility study for end-to-end grain management systems | Designed integrated storage-to-distribution model including conveyors, dryers, and control systems | Enabled Sukup and AGI to position as full-solution providers rather than silo-only manufacturers |

RECENT DEVELOPMENTS

- April 2025 : American Industries Partners (US) completed the acquisition of AGCO's Grain & Protein division, which has since been rebranded as Grain & Protein Technologies. This division specializes in grain storage and seed processing solutions, as well as feeding, watering, and climate control systems for protein production, primarily in poultry, swine, and egg sectors.

- May 2024 : Prado Silos (Spain) expanded its operational capacity with a new logistics centre located near the company’s production plant. This new facility implemented in Barakaldo (Spain) will double the space available for logistics activities, bringing significant improvements in terms of flexibility, productivity, quality and customer support, while contributing to the reduction of the company’s carbon footprint

- April 2025 : Sukup manufacturing (US) expanded its presence in Ames, Iowa. This location is home to the SynkTM Hub and will serve as a central point for evolving company culture and expanding the recruitment funnel for top engineering and technology talent.

Table of Contents

Methodology

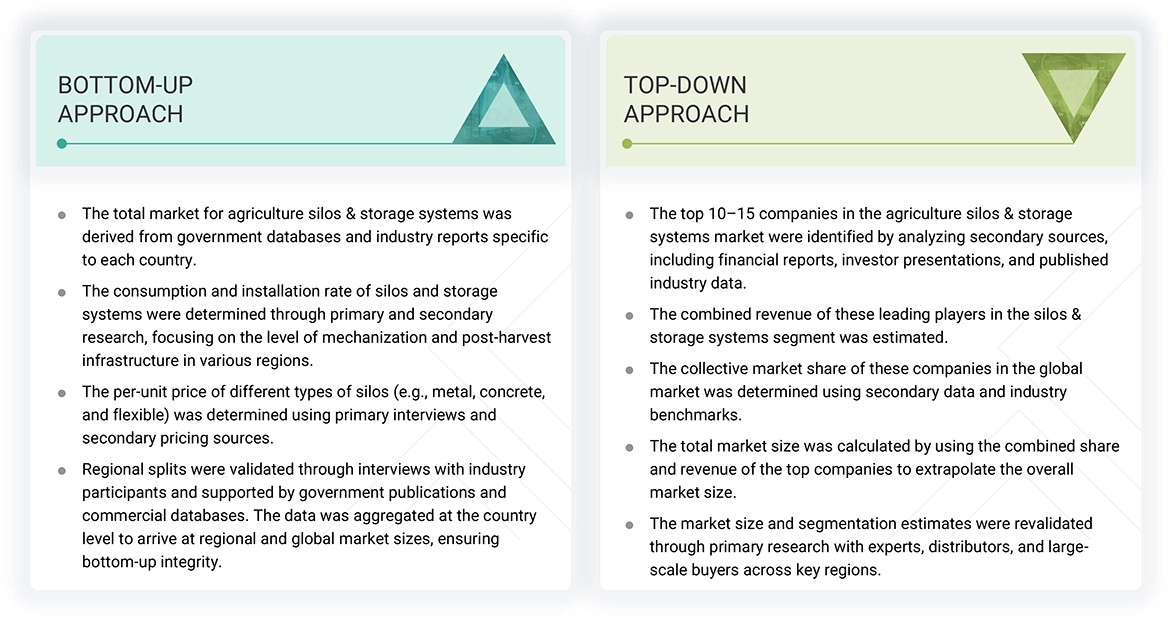

The study involved two major approaches to estimating the current size of the agriculture silos and storage systems market. Exhaustive secondary research was conducted to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources, such as company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were used to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

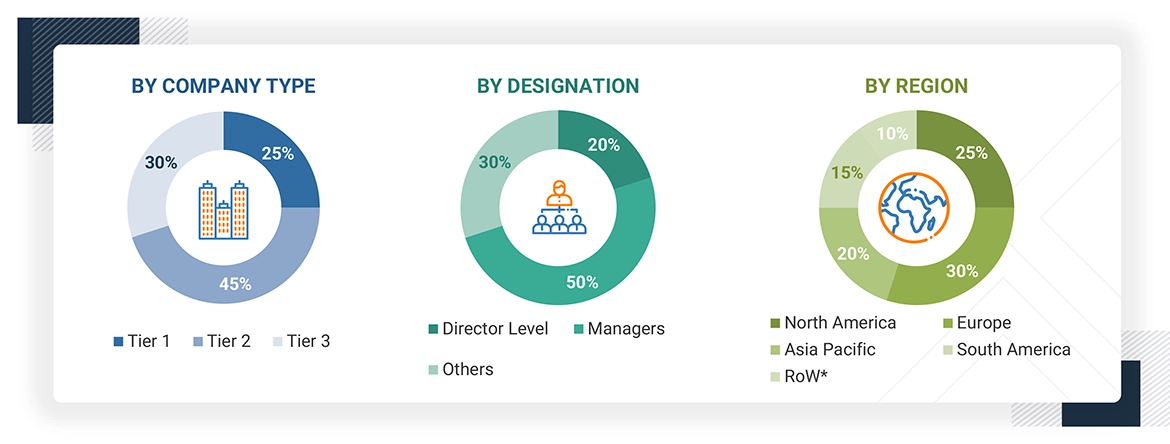

Primary Research

Extensive primary research was conducted after obtaining information regarding the agriculture silos & storage systems market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, research, and development teams, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to agriculture silos & storage systems silo type, end-use application, construction material, and region. Stakeholders from the demand side, such as research institutions and universities, third-party vendors, were interviewed to understand the buyer’s perspective on the service, and their current usage of agriculture silos & storage systems and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, as per the

availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue = USD 1 billion;

Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Symaga (Spain) |

R&D Expert |

|

Sioux Steel Company (US) |

Sales Manager |

|

Bentall Rowlands (UK) |

Manager |

|

M.I.P Group (Belgium) |

Sales Manager |

|

AGI (Canada) |

Marketing Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the agriculture silos & storage systems market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Agriculture Silos & Storage Systems Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall agriculture silos & storage systems market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

A storage silo system is a device used for storing bulk materials. Silos are used in various industries for storing different types of powdered or granular materials. Silos typically act as an intermediate storage device between receiving the raw material into your factory and before it is used in the manufacturing process.

Stakeholders

- Agriculture silo manufacturers and suppliers

- Agriculture silo equipment importers

- Agriculture storage systems manufacturers

- Food Corporation of India (FCI)

- USDA

- Food and Agriculture Organization (FAO)

- European Food Safety Authority (EFSA)

- Occupational Safety and Health Administration (OSHA)

- Associations such as International Silo Association, International Feed Industry Federation (IFIF), FEFAC - European Feed Manufacturers' Federation, and the Brewers Association

- End-use industry: Grains & oilseeds processors, brewery companies, and feed manufacturers

Report Objectives

- To determine and project the size of the agriculture silos & storage systems market with respect to the silo type, end-use application, construction material, and region in terms of value over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the agriculture silos & storage systems market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Service Analysis

- Service Matrix, which gives a detailed comparison of the service portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of European agriculture silos & storage systems market into key countries.

- Further breakdown of the Rest of Asia Pacific agriculture silos & storage systems market into key countries.

- Further breakdown of the Rest of South American agriculture silos & storage systems market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the agriculture silos & storage systems market?

The agriculture silos & storage systems market is estimated to be USD 5.09 billion in 2025 and is projected to reach USD 6.53 billion by 2030, registering a CAGR of 5.1% during the forecast period.

Which are the key players in the market, and how intense is the competition?

Sukup Manufacturing Co. (US), AGI (Canada), MySilo (Turkey), Prado Silos (Spain), and SYMAGA (Spain) are some of the key market players.

The market for agriculture silos & storage systems market is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also investing heavily.

Which region is projected to account for the largest share of the agriculture silos & storage systems market?

In North America, the agriculture silos & storage systems is experiencing stable growth, driven by rising need to curb post-harvest losses and the region’s focus on durable, smart silos.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the agriculture silos & storage systems market?

The market for agriculture silos & storage systems is driven by increased production of high-quality grains through effective storage and efficient post-harvest management, post-harvest losses, and food wastage.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Agriculture Silos & Storage Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Agriculture Silos & Storage Systems Market