AI for Customer Service Market

AI for Customer Service Market by Product Type (AI Agents, Recommendation Systems (Knowledge Base Platforms), Workflow Automation (RPA, CRM Automation), Content Generation, Customer Journey Analytics, Service Quality Management) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI for Customer Service market size was valued at USD 12.06 billion in 2024 and is projected to reach USD 47.82 billion by 2030, at a CAGR of 25.8%. This surge is driven by the widespread adoption of AI-powered customer engagement platforms, intelligent automation, and real-time analytics that are reshaping service delivery models across industries. Vendors are witnessing a shift in enterprise priorities—from cost containment to customer experience transformation, with AI technologies enabling Real-time support orchestration, Multilingual virtual assistants, Intelligent ticket routing and summarization, and Sentiment-aware engagement across channels. Solutions such as Conversational AI, Generative AI, and Predictive Support Tools are becoming foundational to modern customer service strategies. These tools deliver hyper-personalized interactions, reduce average handle time (AHT), and improve first-contact resolution (FCR)—key metrics that enterprises now use to evaluate vendor performance. This evolution marks a transition from reactive support to proactive, predictive, and personalized service delivery, positioning AI vendors as strategic enablers of customer loyalty and operational excellence.

KEY TAKEAWAYS

-

BY PRODUCT TYPEAI-powered chatbots and virtual assistants are leading adoption due to their ability to deliver 24/7 support, instant query resolution, and automated task handling, driving brand loyalty and workforce optimization.

-

BY DEPLOYMENT MODECloud-based deployment is emerging as the preferred model, offering scalability, low IT overhead, and seamless CRM integration, enabling enterprises to deploy AI solutions rapidly across geographies.

-

BY TECHNOLOGYGenerative AI is transforming service delivery with context-aware engagement, predictive insights, and automated ticket resolution, positioning it as a cornerstone of next-gen customer service platforms.

-

BY END USERBFSI organizations is leading the customer service market, leveraging AI for fraud detection, account management, and compliance, making it a strategic differentiator in high-volume, high-risk environments.

-

BY REGIONRegional dynamics show North America leading in adoption due to mature infrastructure, while Asia Pacific is the fastest-growing market, driven by e-commerce expansion and mobile-first engagement.

-

COMPETITIVE LANDSCAPEThe competitive landscape is defined by strategic alliances and innovation, with major players like Microsoft, Google, and Meta investing in scalable, personalized AI solutions to meet rising enterprise demand.

The AI for Customer Service market is accelerating as enterprises increasingly prioritize data-driven engagement, personalized support, and operational efficiency. Vendors are responding to this shift by embedding AI-powered automation, predictive analytics, and generative AI into customer service platforms, enabling businesses to deliver real-time resolution, proactive assistance, and seamless omnichannel experiences. The convergence of machine learning, natural language processing (NLP), and cloud-based AI infrastructure is driving a new era of intelligent customer service—where automation meets empathy, and data fuels personalization. These innovations are helping organizations reduce operational costs, improve agent productivity, and enhance customer satisfaction metrics such as CSAT, NPS, and FCR. Vendors are positioning AI not just as a tool, but as a strategic enabler of customer experience transformation, offering measurable business outcomes and competitive differentiation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AI for customer service market is evolving rapidly, driven by advancements in generative AI, predictive analytics, and automation. Traditional revenue models such as subscription-based SaaS, licensing, and professional services, are being disrupted as businesses demand performance-based, outcome-driven AI solutions. Conversational AI assistants and intelligent virtual agents are replacing standard chatbots, delivering proactive support, automated ticketing, and omnichannel customer engagement. Generative AI enables hyper-personalized responses, real-time sentiment analysis, and self-service automation, enhancing overall customer satisfaction. AI-powered workforce optimization and predictive support tools are improving agent performance and resolution times, positioning AI vendors as strategic partners driving measurable efficiency and superior customer experience outcomes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

The rise of omnichannel self-service platforms

-

Scalable AI-Driven Support Enhancing Strategic Focus

Level

-

Limitations in Emotional Intelligence and Security Risks

Level

-

Multimodal and Generative AI for Global Engagement

-

Enterprises are increasingly adopting proactive AI solutions

Level

-

Workforce Displacement and Ethical Deployment

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Scalable AI-Driven Customer Support Enhancing Efficiency and Strategic Focus

AI enables enterprises to scale customer support without proportional increases in headcount, allowing reallocation of resources toward high-value CX initiatives. By automating routine interactions across channels (chat, email, voice), businesses improve service quality, reduce operational costs, and strengthen brand loyalty.

Restraint: AI's limitations in interpreting complex emotions and nuanced buyer intent

AI’s inability to interpret complex emotions and nuanced buyer intent presents challenges in high-touch environments. Additionally, the rise of deepfake threats and voice spoofing necessitates advanced security protocols, increasing deployment costs and potentially delaying ROI.

Opportunity: Multimodal AI is revolutionizing video content, enabling real-time adaptation to viewer engagement

Multimodal AI is transforming customer engagement by enabling real-time adaptation to user behavior, especially in video and voice interactions. Generative AI supports multilingual, culturally nuanced responses, helping organizations expand globally, improve retention, and differentiate through hyper-personalized experiences.

Challenge: Threat of job displacements in customer service

The automation of routine tasks is leading to job displacement, with examples like British Telecom planning to replace thousands of roles. Vendors and enterprises must address this challenge by investing in human-AI collaboration models, reskilling programs, and ethical AI deployment frameworks.

AI for Customer Service Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Smokeball leveraged Brainfish’s AI Help Center to enhance self-service for its legal practice management software, reducing client reliance on human support, improving knowledge base navigation, and streamlining responses to boost overall customer experience. | Over 800 human support hours saved monthly, 80%+ deflection rate, and 750% ROI, demonstrating how AI can streamline support and reduce dependency on live agents. |

|

Philip Morris International implemented Tovie AI’s conversational agents, chatbot Mark and voice bot Christina to automate FAQs, streamline online and call center interactions, reduce handle times, lower operational costs, and enhance overall customer service efficiency. | 69% reduction in average handle time, 7x lower contact costs, enabling staff to focus on complex queries and improving service quality. |

|

Qapital deployed Ada’s no-code AI chatbot to automate customer service, handle high volumes of inquiries, reduce ticket backlogs, enable 24/7 support, and allow agents to focus on complex, high-value interactions. | 25,000 monthly interactions, 50%+ resolved without human intervention, reduced wait times, and actionable analytics for app enhancement. |

|

Corteva Agriscience implemented RingCentral’s unified communication platform to integrate voice, video, messaging, and collaboration tools, streamline global operations, enhance employee connectivity, and improve efficiency across remote and on-site teams. | Centralized voice, video, and messaging tools improved remote team efficiency, reduced costs from fragmented systems, and supported scalable innovation. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI for customer service market ecosystem comprises a diverse range of stakeholders. Key players include chatbots and virtual assistant providers, AI-driven ticketing systems providers, sentiment and feedback analysis tools, recommendation systems providers, visual and diagnostic tools, workflow automation providers, content management providers, AI agents, customer interaction channel providers, and end users. These entities collaborate to develop, implement, and leverage AI-driven customer service tools, fostering innovation and growth in the market

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI for customer service market, By product type

AI agents are the fastest-growing product category, offering real-time query handling, dynamic routing, and workflow automation. Enterprises are integrating AI agents with cloud orchestration, predictive engines, and conversational analytics to deliver 24/7 intelligent support, driving scalable deployment and competitive differentiation.

AI for customer service market, By Customer Interaction channel

Video and visual channels are emerging as strategic enablers of interactive, real-time support. Use cases include AI-powered video guides, AR-assisted troubleshooting, and live screen-sharing, supported by cloud-native platforms and contextual visual insights, enhancing customer satisfaction and service efficiency.

AI for customer service market, By Functional Area

AI is transforming post-sales support through automated complaint resolution, intelligent troubleshooting, and proactive follow-ups. Businesses benefit from reduced churn, higher upsell/cross-sell opportunities, and increased customer lifetime value, positioning post-sales AI as a driver of loyalty and reputation.

AI for customer service market, By End User

The telecom sector leads in AI adoption due to high interaction volumes and demand for 24/7 seamless support. Providers are deploying virtual agents, predictive troubleshooting, and automated ticketing, integrated with omnichannel platforms and AI-driven analytics, to reduce costs and improve customer satisfaction.

REGION

Asia Pacific to be the fastest-growing region in the AI for customer service market during the forecast period

The Asia Pacific region is emerging as a global leader in AI adoption for customer service, driven by its vast consumer base, digital-first enterprises, and competitive market dynamics. Countries like China, India, and Japan are investing aggressively in AI-powered customer engagement technologies, including Intelligent virtual agents, AI chatbots, Predictive analytics, Automated ticketing, Omnichannel support platforms. China’s momentum is fueled by advanced NLP capabilities, automation maturity, and government-led AI initiatives, while India’s growth is supported by innovative vendors like Zoho and Freshworks, delivering real-time support and self-service optimization. This regional surge reflects a strategic shift toward proactive service delivery, sentiment-aware engagement, and scalable AI deployment, positioning Asia Pacific as a critical driver of global market expansion, efficiency gains, and competitive differentiation.

AI for Customer Service Market: COMPANY EVALUATION MATRIX

In the AI for customer service market matrix, Microsoft (Star) leads with a strong market presence and a comprehensive suite of AI-driven customer engagement capabilities, enabling large-scale adoption in areas such as intelligent virtual agents, automated ticketing, sentiment analysis, predictive support, and omnichannel service automation. Sprinklr (Emerging Leader) is gaining traction with its AI-powered social customer care, real-time feedback analytics, and unified experience management tools, helping enterprises deliver personalized and proactive support across channels. While Microsoft dominates with scale, innovation, and enterprise-wide integration, Sprinklr demonstrates strong growth potential, steadily advancing toward the star quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 9.53 Billion |

| Market Forecast in 2030 | USD 47.82 Billion |

| Growth Rate | CAGR of 25.8% during 2024-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: AI for Customer Service Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Delivered competitive profiling of additional vendors, brand comparative analysis, and a drill-down of country-level segmentation across key markets. | Enabled competitive positioning insights, product differentiation clarity, and multi-country market intelligence, supporting go-to-market strategy refinement and stakeholder alignment. |

| Leading Solution Provider (Europe) | Provided competitive profiling, brand benchmarking, and segmentation analysis across additional geographies. | Delivered in-depth market insights, comparative brand positioning, and segment-level intelligence, empowering strategic decision-making and regional growth planning. |

RECENT DEVELOPMENTS

- January 2025 : ServiceNow launched a significant focus on agentic AI during its annual sales kickoff on January 23, 2025. The company aims to enhance its global partner program, providing new incentives for the Now Assist Gen AI-powered application and expanding partner specializations. ServiceNow's vice president, Jen Odess, emphasized the importance of partners in this AI journey, introducing the Workflow Data Fabric technology to unify data access for AI agents. The company plans to hold a partner AI day and has launched an AI agent gallery with over 60 use cases, aiming to rally partners in building thousands of AI agents throughout the year.

- January 2025 : HCL Tech and Microsoft announced an expansion of their partnership, aimed at transforming contact centers through generative AI and cloud-based solutions. The collaboration will leverage Microsoft's Azure OpenAI Service to enhance customer interactions and streamline operations. This initiative is expected to improve efficiency and customer satisfaction by integrating advanced AI technologies into contact center processes. The companies aim to deliver innovative solutions that address the evolving needs of businesses and their customers in a digital-first environment.

- December 2024 : Genpact announced a strategic collaboration agreement with AWS aimed at accelerating AI adoption to enhance customer service solutions. This multi-year partnership focuses on integrating advanced AI technologies across various business lines, breaking down barriers to accessibility beyond traditional IT functions. The collaboration will enable Genpact to deliver innovative, industry-specific solutions, such as an AI-powered customer experience platform and generative AI applications for claims processing.

- November 2024 : Coveo announced the expansion of its partnership with SAP to deliver AI capabilities across customer experience channels. The new solution, Coveo AI Search and Recommendations for SAP Customer Experience is now an SAP-endorsed app available on the SAP Store. This app enhances both SAP Commerce Cloud and SAP Service Cloud, facilitating improved search and recommendation functionalities for businesses. The partnership aims to provide a unified source of truth for shopping and service experiences, leveraging AI to enhance customer interactions and satisfaction across digital platforms.

- September 2024 : Salesforce and IBM enhanced their partnership to deliver advanced AI agents aimed at improving sales and service processes, particularly for clients in regulated industries. The collaboration focuses on integrating Salesforce's Agentforce with IBM's Watsonx capabilities, allowing businesses to customize agents that automate tasks using enterprise data. This integration will enable seamless access to data from IBM Z mainframes and Db2 databases, enhancing productivity and compliance. Additionally, the partnership includes using Slack for dynamic interactions with AI agents, streamlining workflows, and offering tailored solutions to meet specific business challenges across various sectors.

Table of Contents

Methodology

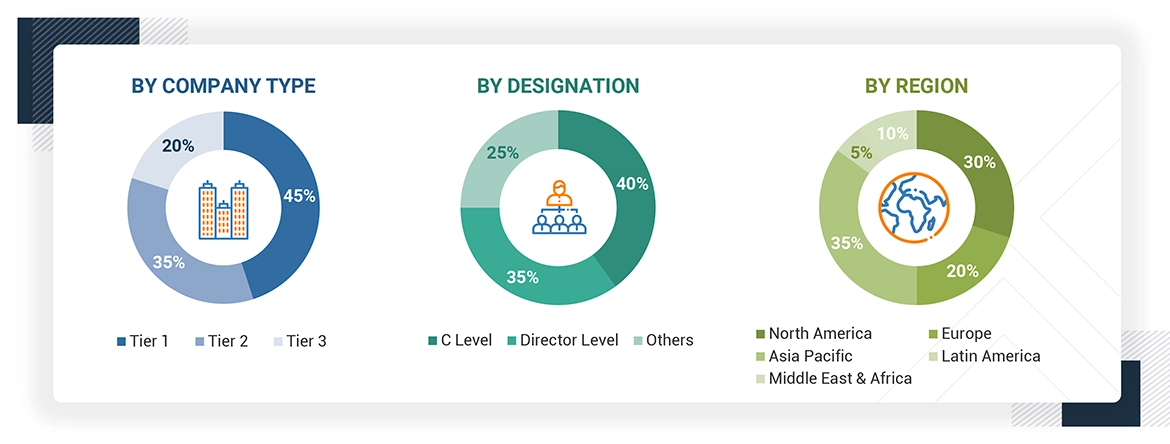

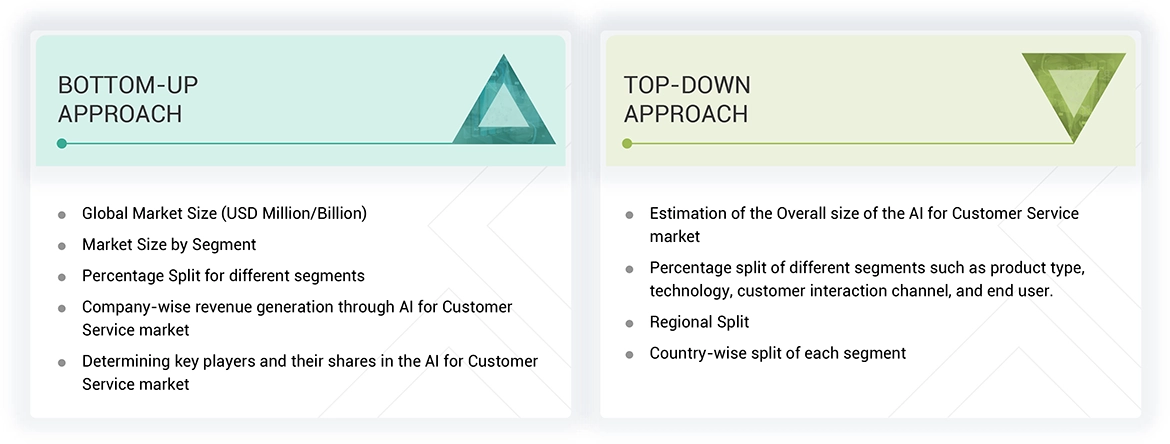

The study involved major activities in estimating the current market size for the AI for Customer Service market. Exhaustive secondary research was done to collect information on the AI for customer service market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the AI for customer service market.

Secondary Research

The market for the companies offering AI for customer service solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of AI for customer service vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the AI for customer service market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of AI for customer service solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: Tier 1 companies account for annual revenue of >USD 10 billion; tier 2 companies’ revenue ranges

between USD 1 and 10 billion; and tier 3 companies’ revenue ranges between USD 500 million–USD 1 billion

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cell culture market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

AI for Customer Service Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into various segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

AI for customer service utilizes AI technologies to scale up all aspects of customer support and enable organizations to automate customer experiences, streamline workflows, and assist agent productivity. AI-driven customer support tools such as chatbots, voice bots, workflow automation, AI Agents, recommendation systems, diagnostic tools, and many more offer more personalized data-driven round-the-clock support with the aim of augmenting agent experience. These tools analyze data generated from customer service interactions to resolve or handle customer queries in real-time. The AI-driven agent assistance tools benefit support teams across key enterprises to resolve issues quickly and efficiently, along with tailor-made customer responses. Additionally, the advent of Gen AI for customer service offers more personalized human-like interactions with custom-made responses in real-time.

Stakeholders

- Executives/business owners

- Customer service representatives

- IT/Technology teams

- Customer service managers

- Legal and Compliance teams

- Data Analysts

- Product managers

- Distributors and Value-added Resellers (VARs)

- Independent Software Vendors (ISV)

- Managed service providers

- Support & maintenance service providers

- System Integrators (SIs)/migration service providers

- OEMs

- Technology providers

Report Objectives

- To define, describe, and predict the AI for customer service market by product (type, deployment mode, customer service delivery mode, functional area), technology, customer interaction channel, end users, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AI for customer service market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers & acquisitions, in the AI for customer service market

- To analyze the impact of the recession across all regions in the AI for customer service market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American AI for customer service market

- Further breakup of the European AI for customer service market

- Further breakup of the Asia Pacific AI for customer service market

- Further breakup of the Middle Eastern & African AI for customer service market

- Further breakup of the Latin America AI for customer service market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What are the opportunities for the AI for customer service market?

AI in customer service drives proactive and generative solutions, revolutionizing customer engagement. Proactive AI anticipates needs through predictive analytics, fostering loyalty and streamlining operations. Generative AI enhances efficiency with automated responses, multilingual support, and real-time sentiment analysis. Together, these technologies enable businesses to deliver personalized, anticipatory, and efficient service, boosting customer satisfaction and operational performance across channels.

Define the AI for customer service market.

AI for customer service utilizes AI technologies to scale up all aspects of customer support and enable organizations to automate customer experiences, streamline workflows, and assist agent productivity. AI-driven customer support tools such as chatbots, voice bots, workflow automation, recommendation systems, diagnostic tools, and many more offer personalized data-driven round-the-clock support with the aim of augmenting agent experience. These tools analyze data generated from customer service interactions to resolve or handle customer queries in real-time. The AI-driven agent assistance tools benefit support teams across key enterprises to resolve issues quickly and efficiently, along with tailor-made customer responses. Additionally, the advent of Gen AI for customer service offers more personalized human-like interactions with custom-made responses in real-time.

Which region is expected to have the largest market share in the AI for customer service market?

North America will acquire the largest share of the AI for customer service market during the forecast period.

Which are the major market players covered in the report?

Some of the key companies in the AI for customer service market are Microsoft (US), IBM (US), Google (US), AWS (US), Salesforce (US), Atlassian (Australia), ServiceNow (US), SAP (Germany), Zendesk (US), Sprinklr (US), OpenAI (US), Aisera (US), UiPath (US), HubSpot (US), NICE (Israel), Intercom (US),Qualtrics (US), Freshworks (US), LivePerson (US), HelpShift (US), Yellow.ai (US), Cogito (US), SmartAction (US), Talkdesk (US), Five9 (US), RingCentral (US), Nextiva (US), Kore.ai (US), Dynamic Yield (US), Jio Haptik (India), Oracle (US), Afiniti (Bermuda), Kommunicate (US), Help Scout (US), Gorgias (US), Atera (Israel), Ada (US), Kustomer (US), Levity (Germany), Cognigy (Germany), Engageware (US), Netomi (US), Level AI (US), Sybill AI (US), OneAI (US), Brainfish (Australia), SentiSum (England), Balto (US), Tovie AI (UK), Guru (US), Tidio (US), Quiq (US), Aircall (US), OneReach.ai (US), Cresta (US), Deepdesk (Netherlands), Front (US), Fullview (Denmark), Crescendo AI (US), Gridspace (US).

How big is the global AI for customer service market today?

The global AI for customer service market is estimated to be USD 12.06 billion in 2024 and is projected to reach USD 47.82 billion by 2030, at a CAGR of 25.8% during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI for Customer Service Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI for Customer Service Market