2

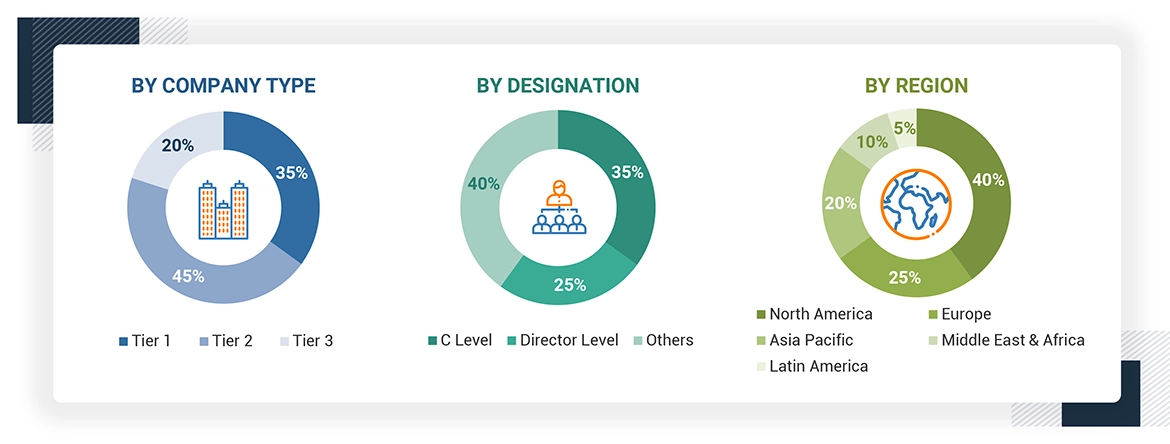

RESEARCH METHODOLOGY

47

5

MARKET OVERVIEW

Generative AI is revolutionizing media with hyper-personalization, yet ethical and job market challenges loom.

69

5.2.1.1

NEW CREATIVE POSSIBILITIES UNLOCKED BY GENERATIVE AI

5.2.1.2

HYPER-PERSONALIZED MEDIA EXPERIENCES WITH AI

5.2.1.3

INCREASING INTEGRATION OF AI INTO ANIMATION AND VISUAL EFFECTS SECTORS

5.2.2.1

ETHICAL AND COPYRIGHT ISSUES IN AI-GENERATED CONTENT

5.2.2.2

INADEQUATE LEGAL PROTECTION AGAINST DEEPFAKE MISUSE

5.2.3.1

ENHANCING CREDIBILITY THROUGH AI-DRIVEN FAKE NEWS DETECTION

5.2.3.2

PERSONALIZED ADVERTISING THROUGH AI-DRIVEN USER INSIGHTS

5.2.3.3

DYNAMIC STORYTELLING THROUGH TAILORED NARRATIVES

5.2.4.1

AI THREAT TO JOBS IN ENTERTAINMENT INDUSTRY

5.2.4.2

LACK OF TRANSPARENCY HINDERING TRUST IN AI DECISIONS

5.2.4.3

IMPACT OF AI ON CREATIVITY AND ORIGINALITY

6

INDUSTRY TRENDS

AI-driven innovations redefine media engagement and efficiency with cutting-edge analytics and automation.

75

6.1

EVOLUTION OF AI IN MEDIA AND ENTERTAINMENT MARKET

6.2.1

SPRINKLR EMPOWERED HYPERSPACE TO ENHANCE AUDIENCE ENGAGEMENT AND STREAMLINE OPERATIONS

6.2.2

DRAFTKINGS IMPLEMENTED MULTICHANNEL ADVERTISING STRATEGY WITH VERITONE

6.2.3

REVEDIA PLATFORM STREAMLINED MANUAL WORKFLOWS INTO UNIFIED SYSTEM AND IMPROVED OPERATIONAL EFFICIENCY

6.2.4

WARNER MUSIC GROUP LEVERAGED SNOWFLAKE AND HIGHTOUCH TO 'SUPER-SERVE' FANS, ARTISTS, AND LABELS

6.2.5

DNV GL ELEVATED SOCIAL MEDIA ENGAGEMENT THROUGH TRANSFORMATION WITH LUMEN5

6.3.1

CONTENT GENERATION PROVIDERS

6.3.2

CONTENT DISTRIBUTION PROVIDERS

6.3.3

AUDIENCE ANALYTICS PROVIDERS

6.3.4

WORKFLOW AUTOMATION PROVIDERS

6.3.5

SCRIPTWRITING, POST – PRODUCTION TOOLS, SECURITY & COMPLIANCE, ENGAGEMENT PLATFORM PROVIDERS

6.4.1.1

NLP AND DEEP LEARNING

6.4.1.3

PREDICTIVE ANALYTICS

6.4.1.4

ROBOTIC PROCESS AUTOMATION (RPA)

6.4.2

COMPLEMENTARY TECHNOLOGIES

6.4.2.4

BIG DATA ANALYTICS

6.4.3

ADJACENT TECHNOLOGIES

6.4.3.4

QUANTUM COMPUTING

6.5.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.5.2

REGULATORY FRAMEWORK

6.5.2.4

MIDDLE EAST & AFRICA

6.6

SUPPLY CHAIN ANALYSIS

6.7

PORTER’S FIVE FORCES ANALYSIS

6.7.1

THREAT OF NEW ENTRANTS

6.7.2

THREAT OF SUBSTITUTES

6.7.3

BARGAINING POWER OF SUPPLIERS

6.7.4

BARGAINING POWER OF BUYERS

6.7.5

INTENSITY OF COMPETITIVE RIVALRY

6.8

KEY CONFERENCES AND EVENTS, 2025–2026

6.9

KEY STAKEHOLDERS AND BUYING CRITERIA

6.9.1

KEY STAKEHOLDERS IN BUYING PROCESS

6.10.1

INDICATIVE PRICING ANALYSIS, BY SOFTWARE TYPE

6.10.2

INDICATIVE PRICING ANALYSIS, BY APPLICATION

6.11.2

PATENTS FILED, BY DOCUMENT TYPE

6.11.3

INNOVATIONS AND PATENT APPLICATIONS

6.12

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6.13

INVESTMENT AND FUNDING SCENARIO

6.14

IMPACT OF GENERATIVE AI ON AI IN MEDIA AND ENTERTAINMENT MARKET

6.14.1

USE CASES AND MARKET POTENTIAL

6.14.2.1

ENHANCED CONTENT CREATION

6.14.2.2

PERSONALIZATION OF USER EXPERIENCE

6.14.2.3

COST REDUCTION IN PRODUCTION

6.14.2.4

IMPROVED AUDIENCE ENGAGEMENT

6.14.2.5

STREAMLINED CONTENT DISTRIBUTION

6.14.2.6

NEW MONETIZATION OPPORTUNITIES

7

AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 50 Data Tables

113

7.1.1

OFFERING: AI IN MEDIA AND ENTERTAINMENT MARKET DRIVERS

7.2.1.1

CONTENT GENERATION

7.2.1.2

CONTENT DISTRIBUTION

7.2.1.2.2

PERSONALIZED RECOMMENDATIONS

7.2.1.3

AUDIENCE ANALYTICS

7.2.1.3.1

SENTIMENT ANALYSIS

7.2.1.3.2

BEHAVIOR MODELING

7.2.1.3.3

CUSTOMER SEGMENTATION

7.2.1.3.4

MUSIC RECOMMENDATION AND DISCOVERY

7.2.1.4

WORKFLOW AUTOMATION

7.2.1.4.2

METADATA TAGGING

7.2.1.4.4

TRANSLATION AND LOCALIZATION

7.2.1.5

OTHER SOFTWARE TYPES

7.2.2.1.1

UNLOCKING SCALABILITY AND COST EFFICIENCY IN MEDIA WITH CLOUD INFRASTRUCTURE

7.2.2.2.1

MAXIMIZING SECURITY AND COST EFFICIENCY WITH ON-PREMISES AI SOLUTIONS IN MEDIA

7.3.1

PROFESSIONAL SERVICES

7.3.1.1

HARNESSING AI TO TRANSFORM MEDIA AND ENTERTAINMENT BUSINESS MODELS

7.3.1.2

CONSULTING & ADVISORY

7.3.1.3

IMPLEMENTATION & DEPLOYMENT

7.3.1.4

SUPPORT & MAINTENANCE

7.3.1.5

TRAINING & ENABLEMENT

7.3.2.1

OPTIMIZING ADVERTISING STRATEGIES WITH AI-DRIVEN MANAGED SERVICES

8

AI IN MEDIA AND ENTERTAINMENT, BY TECHNOLOGY

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 6 Data Tables

145

8.2.1

REVOLUTIONIZING CONTENT CREATION AND PERSONALIZATION WITH GENERATIVE AI

8.3.1

UNLOCKING CREATIVITY: AI TRANSFORMS CONTENT CREATION AND USER ENGAGEMENT

9

AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 30 Data Tables

149

9.1.1

APPLICATION: AI IN MEDIA AND ENTERTAINMENT MARKET DRIVERS

9.2.1

ARTICLE WRITING & SUMMARIZING

9.2.1.1

CONTENT PERSONALIZATION

9.2.1.1.1

ENHANCING USER EXPERIENCE WITH CONTENT PERSONALIZATION

9.2.1.2

MULTILINGUAL TRANSLATION

9.2.1.2.1

BREAKING LANGUAGE BARRIERS THROUGH MULTILINGUAL TRANSLATION

9.2.1.3

TOPIC CLUSTERING AND CATEGORIZATION

9.2.1.3.1

STREAMLINING INSIGHTS WITH TOPIC CLUSTERING AND CATEGORIZATION

9.2.2.1

AI-BASED SCENE DETECTION AND SEQUENCING

9.2.2.1.1

UNLOCKING PRECISION: AI-POWERED SCENE DETECTION AND SEQUENCING

9.2.2.2

VIRTUAL PRODUCTION

9.2.2.2.1

REVOLUTIONIZING FILMMAKING: VIRTUAL PRODUCTION TECHNOLOGIES

9.2.2.3

MOTION TRACKING AND ENHANCEMENT

9.2.2.3.1

ELEVATING PERFORMANCE: ADVANCED MOTION TRACKING AND ENHANCEMENT

9.2.3

FAKE NEWS DETECTION

9.2.3.1

CONTEXT-BASED CREDIBILITY SCORING

9.2.3.1.1

ENHANCING TRUSTWORTHINESS WITH CONTEXT-AWARE SCORING SYSTEMS

9.2.3.2

DEEPFAKE IDENTIFICATION

9.2.3.2.1

DETECTING AND MITIGATING DEEPFAKE CONTENT FOR SECURE INTERACTIONS

9.2.3.3

AUTOMATED DATA CROSS-REFERENCING

9.2.3.3.1

STREAMLINING DATA VALIDATION THROUGH AUTOMATION

9.2.4

LANGUAGE MODERATION

9.2.4.1

CULTURAL SENSITIVITY IDENTIFICATION

9.2.4.1.1

FOSTERING RESPECT THROUGH CULTURAL SENSITIVITY DETECTION

9.2.4.2

ADAPTIVE FILTERING

9.2.4.2.1

DYNAMIC CONTENT MODERATION WITH ADAPTIVE FILTERING

9.2.4.3

PROFANITY DETECTION

9.2.4.3.1

ENSURING RESPECTFUL COMMUNICATION WITH PROFANITY DETECTION

9.2.5

AD SAFETY OPTIMIZATION

9.2.5.1

BEHAVIORAL PATTERN ANALYSIS

9.2.5.1.1

ENHANCING SECURITY THROUGH USER BEHAVIOR INSIGHTS

9.2.5.2

AI-DRIVEN AD PLACEMENT

9.2.5.2.1

MAXIMIZING ENGAGEMENT WITH INTELLIGENT AD TARGETING

9.2.5.3

AUTOMATED FLAGGING

9.2.5.3.1

SWIFT IDENTIFICATION AND MITIGATION OF HARMFUL CONTENT

9.2.6.1

PREDICTIVE ANALYTICS FOR BREAKING NEWS TRENDS

9.2.6.1.1

HARNESSING PREDICTIVE ANALYTICS TO ANTICIPATE BREAKING NEWS TRENDS

9.2.6.2

EDITORIAL PLANNING AND CONTENT SCHEDULING

9.2.6.2.1

OPTIMIZING EDITORIAL PLANNING AND CONTENT SCHEDULING FOR MAXIMUM IMPACT

9.2.6.3

COMPETITIVE MEDIA BENCHMARKING

9.2.6.3.1

LEVERAGING COMPETITIVE MEDIA BENCHMARKING TO ENHANCE PERFORMANCE

9.3.1

FILM SCRIPTWRITING, VFX, & STORYBOARDING

9.3.1.1

DIALOGUE AND CHARACTER DEVELOPMENT

9.3.1.1.1

VOICES OF CONFLICT: CRAFTING DIALOGUE TO REVEAL CHARACTER

9.3.1.2

PRE-VISUALIZATION OF SCENES

9.3.1.2.1

VISUALIZING SCENES ENHANCES STORYTELLING AND GUIDES IN EFFECTIVE PRODUCTION DESIGN

9.3.1.3

INTELLIGENT ADAPTION OF SCRIPTS

9.3.1.3.1

ADAPTING SCRIPTS INTELLIGENTLY ENSURES RELEVANCE WHILE PRESERVING ORIGINAL NARRATIVE ESSENCE

9.3.2

REAL-TIME OTT CONTENT MODERATION

9.3.2.1

CONTEXT-BASED REGIONAL CONTENT FILTERING

9.3.2.1.1

TAILORING CONTENT DELIVERY BASED ON GEOGRAPHIC LOCATION

9.3.2.2

PROHIBITED OR INAPPROPRIATE LIVE CONTENT DETECTION

9.3.2.2.1

REAL-TIME MONITORING FOR INAPPROPRIATE CONTENT DURING LIVE STREAMS

9.3.2.3

VIEWER COMMENTS ANALYSIS

9.3.2.3.1

ANALYZING VIEWER FEEDBACK TO ENHANCE CONTENT ENGAGEMENT STRATEGIES

9.3.3

PREDICTING VIEWER PREFERENCES

9.3.3.1

CONTEXTUAL ANALYSIS

9.3.3.1.1

UNDERSTANDING VIEWER PREFERENCES THROUGH CONTEXTUAL INSIGHTS

9.3.3.2

VIEWER BEHAVIOR PREDICTION

9.3.3.2.1

FORECASTING AUDIENCE ENGAGEMENT AND CONTENT CHOICES

9.3.3.3

CLUSTERING VIEWERS

9.3.3.3.1

SEGMENTING AUDIENCES FOR TAILORED RECOMMENDATIONS

9.3.4

POST-PRODUCTION WORKFLOW EDITING

9.3.4.1

AUTOMATED LIP-SYNCING AND DUBBING

9.3.4.1.1

SEAMLESS VOICE SYNCHRONIZATION FOR GLOBAL AUDIENCES

9.3.4.2

NOISE REDUCTION AND CLARITY ENHANCEMENT

9.3.4.2.1

CRYSTAL-CLEAR AUDIO: ELEVATING SOUND QUALITY

9.3.4.3

FRAME RESTORATION

9.3.4.3.1

REVIVING VISUALS: RESTORING FRAMES TO PERFECTION

9.3.5

NPC BEHAVIOR MODELING

9.3.5.1

EMOTION STIMULATION

9.3.5.1.1

ELICITING PLAYER EMOTIONS THROUGH DYNAMIC NPC INTERACTIONS

9.3.5.2

ADAPTIVE STORYTELLING

9.3.5.2.1

CRAFTING PERSONALIZED NARRATIVES WITH INTELLIGENT NPCS

9.3.5.3

NPC LEARNING FROM PLAYER PATTERNS

9.3.5.3.1

ENHANCING NPC INTELLIGENCE BY ANALYZING PLAYER BEHAVIOR

9.3.6

GAMING CONTENT OPTIMIZATION

9.3.6.1

PLAYER FEEDBACK INTEGRATION

9.3.6.1.1

ENHANCING ENGAGEMENT THROUGH PLAYER INSIGHTS

9.3.6.2

GAME LOGIC TESTING AND DEBUGGING

9.3.6.2.1

ENSURING FLAWLESS GAMEPLAY WITH RIGOROUS TESTING

9.3.6.3

PROCEDURAL CONTENT GENERATION

9.3.6.3.1

DYNAMIC WORLDS CRAFTED BY INTELLIGENT ALGORITHMS

9.3.7

IMMERSIVE ENTERTAINMENT

9.3.7.1

MULTI-SENSORY INTERACTION

9.3.7.1.1

ENGAGING ALL SENSES FOR UNFORGETTABLE EXPERIENCES

9.3.7.2

AVATAR CUSTOMIZATION

9.3.7.2.1

CRAFTING IDENTITY: PERSONALIZING AVATAR ADVENTURE

9.3.7.3

DYNAMIC STORYTELLING

9.3.7.3.1

SHAPING NARRATIVE: BECOME THE HERO OF THE STORY

10

AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 30 Data Tables

184

10.1.1

END USER: AI IN MEDIA AND ENTERTAINMENT MARKET DRIVERS

10.2.1.1

AI-DRIVEN CONTENT RECOMMENDATION PERSONALIZING NEWS FEEDS FOR BETTER READER ENGAGEMENT

10.2.2.1

EMPLOYING AI FOR TARGETED ADVERTISING TO ANALYZE USER DATA FOR BETTER ENGAGEMENT

10.2.3

ADVERTISING & MARKETING AGENCIES

10.2.3.1

AI TOOLS EMPOWERING AD AGENCIES WITH PREDICTIVE ANALYTICS TO FORECAST TRENDS AND ENHANCE CAMPAIGN EFFECTIVENESS

10.2.4

BROADCASTING & JOURNALISM

10.2.4.1

AI STREAMLINING VIDEO PRODUCTION FOR FASTER, HIGH-QUALITY CONTENT

10.2.5.1

INTEGRATING AI INTO PERSONAL MEDIA CONSUMPTION TO ENRICH INDIVIDUAL EXPERIENCES AND PROVIDE TAILORED INTERACTIONS

10.3.1.1

LEVERAGING AI TO IMPROVE OPERATIONAL EFFICIENCY AND CREATE PERSONALIZED VIEWING EXPERIENCES

10.3.2

GAME DEVELOPMENT COMPANIES

10.3.2.1

EMPLOYING AI TO CREATE IMMERSIVE EXPERIENCES AND ENHANCE GAMEPLAY

10.3.3

TELEVISION & OTT PLATFORMS

10.3.3.1

LEVERAGING AI TO TRANSFORM CONTENT DELIVERY AND VIEWER ENGAGEMENT

10.3.4

LIVE EVENTS & SPORTS BROADCASTING

10.3.4.1

INTEGRATING AI TECHNOLOGIES FOR IMMERSIVE AND ENGAGING EXPERIENCES

10.3.5

THEME & AMUSEMENT PARKS

10.3.5.1

LEVERAGING AI TO ENHANCE GUEST EXPERIENCES AND STREAMLINE OPERATIONS

10.3.6.1

UTILIZING AI ALGORITHMS TO EXPLORE NEW CREATIVE AVENUES

10.3.7.1

IMPLEMENTING AI TOOLS TO CREATE VIDEOS, CAPTIONS, AND SCRIPTS FOR BROADER AUDIENCE ENGAGEMENT IN REAL-TIME

11

AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION

Comprehensive coverage of 7 Regions with country-level deep-dive of 17 Countries | 186 Data Tables.

202

11.2.1

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET DRIVERS

11.2.2

NORTH AMERICA: MACROECONOMIC OUTLOOK

11.2.3.1

AI TRANSFORMING MEDIA AND ENTERTAINMENT WITH ENHANCED PRODUCTION EFFICIENCY

11.2.4.1

INCREASING FOCUS ON AI REGULATIONS AND INVESTMENTS IN MEDIA AND ENTERTAINMENT

11.3.1

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET DRIVERS

11.3.2

EUROPE: MACROECONOMIC OUTLOOK

11.3.3.1

EMERGING GENERATIVE AI FIRMS TRANSFORMING MEDIA AND ENTERTAINMENT LANDSCAPE

11.3.4.1

FOSTERING AI INNOVATION THROUGH STRATEGIC COLLABORATIONS IN MEDIA SECTOR

11.3.5.1

ENFORCING STRICTER REGULATIONS ON INFLUENCERS TO ENHANCE TRANSPARENCY AND CONSUMER PROTECTION

11.3.6.1

AI REVOLUTIONIZING CONTENT PERSONALIZATION IN MEDIA LANDSCAPE

11.3.7.1

HARNESSING AI TO REVOLUTIONIZE STORYTELLING AND CONTENT CREATION

11.4.1

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET DRIVERS

11.4.2

ASIA PACIFIC: MACROECONOMIC OUTLOOK

11.4.3.1

AI REVOLUTIONIZING MEDIA AND ENTERTAINMENT

11.4.4.1

STRATEGIC AI COLLABORATIONS AND REGULATORY FRAMEWORKS IN MEDIA AND ENTERTAINMENT

11.4.5.1

HARNESSING AI FOR IMMERSIVE MEDIA EXPERIENCES

11.4.6.1

AI INNOVATIONS ENHANCING FAN ENGAGEMENT AND PRODUCTION IN ENTERTAINMENT INDUSTRY

11.4.7

AUSTRALIA & NEW ZEALAND

11.4.7.1

RISE OF AI TECHNOLOGIES LEADING TO INNOVATIVE APPLICATIONS TO CREATE IMMERSIVE EXPERIENCES

11.4.8.1

TRANSFORMING MEDIA AND ENTERTAINMENT THROUGH PARTNERSHIPS AND AI INNOVATIONS

11.4.9

REST OF ASIA PACIFIC

11.5

MIDDLE EAST & AFRICA

11.5.1

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET DRIVERS

11.5.2

MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

11.5.3.1.1

AI REVOLUTION TRANSFORMING MEDIA AND ENTERTAINMENT LANDSCAPE

11.5.3.2.1

ENHANCING MEDIA EXPERIENCES THROUGH GLOBAL TECH PARTNERSHIPS AND AI

11.5.3.3.1

FOSTERING INNOVATION THROUGH PARTNERSHIPS BETWEEN LOCAL MEDIA FIRMS AND TECH GIANTS

11.5.3.4.1

HARNESSING AI AND EMERGING TECHNOLOGIES FOR TRANSFORMATIVE MEDIA EXPERIENCES

11.5.3.5

REST OF MIDDLE EAST

11.5.4.1

SURGE IN STARTUPS FOCUSING ON AI SOLUTIONS FOR VIDEO EDITING, SCRIPTWRITING, AND AUDIENCE SEGMENTATION

11.6.1

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET DRIVERS

11.6.2

LATIN AMERICA: MACROECONOMIC OUTLOOK

11.6.3.1

FOSTERING AI INNOVATION THROUGH STRATEGIC COLLABORATIONS AMONG RESEARCH CENTERS

11.6.4.1

ENHANCING MEDIA WITH AI PARTNERSHIPS AND CLOUD SOLUTIONS

11.6.5.1

AI PARTNERSHIPS TRANSFORMING ENTERTAINMENT SECTOR

11.6.6

REST OF LATIN AMERICA

12

COMPETITIVE LANDSCAPE

Gain insights into market dominance with key player strategies and financial metrics analysis.

278

12.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

12.3

REVENUE ANALYSIS, 2019–2023

12.4

MARKET SHARE ANALYSIS, 2023

12.4.1

MARKET SHARE ANALYSIS OF KEY PLAYERS (MEDIA)

12.4.2

MARKET RANKING ANALYSIS (MEDIA), 2023

12.4.3

MARKET SHARE ANALYSIS OF KEY PLAYERS (ENTERTAINMENT)

12.4.4

MARKET RANKING ANALYSIS (ENTERTAINMENT)

12.5

BRAND/PRODUCT COMPARISON, BY SOFTWARE TYPE

12.5.1

PRODUCT COMPARATIVE ANALYSIS, BY CONTENT GENERATION

12.5.2

PRODUCT COMPARATIVE ANALYSIS, BY AUDIENCE ANALYTICS

12.5.2.1

TABLEAU WITH EINSTEIN ANALYTICS (SALESFORCE)

12.5.3

PRODUCT COMPARATIVE ANALYSIS, BY WORKFLOW AUTOMATION

12.5.3.1

FILM ANALYTICS TOOLS (CINELYTIC)

12.5.3.2

FRAME.IO (ADOBE)

12.6

COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

12.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

12.7.1

COMPANY EVALUATION MATRIX: KEY PLAYERS (MEDIA)

12.7.1.2

EMERGING LEADERS

12.7.1.3

PERVASIVE PLAYERS

12.7.2

COMPANY EVALUATION MATRIX: KEY PLAYERS (ENTERTAINMENT)

12.7.2.2

EMERGING LEADERS

12.7.2.3

PERVASIVE PLAYERS

12.7.3

COMPANY FOOTPRINT: KEY PLAYERS

12.7.3.1

COMPANY FOOTPRINT

12.7.3.2

REGIONAL FOOTPRINT

12.7.3.3

SOFTWARE TYPE FOOTPRINT

12.7.3.4

APPLICATION FOOTPRINT (MEDIA)

12.7.3.5

APPLICATION FOOTPRINT (ENTERTAINMENT)

12.7.3.6

END-USER FOOTPRINT (MEDIA)

12.8

COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

12.8.1

COMPANY EVALUATION MATRIX: START-UPS/SMES (MEDIA)

12.8.1.1

PROGRESSIVE COMPANIES

12.8.1.2

RESPONSIVE COMPANIES

12.8.1.3

DYNAMIC COMPANIES

12.8.2

COMPANY EVALUATION MATRIX: START-UPS/SMES (ENTERTAINMENT)

12.8.2.1

PROGRESSIVE COMPANIES

12.8.2.2

RESPONSIVE COMPANIES

12.8.2.3

DYNAMIC COMPANIES

12.8.3

COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

12.8.3.1

DETAILED LIST OF KEY START-UPS/SMES

12.8.3.2

COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (MEDIA)

12.8.3.3

COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (ENTERTAINMENT)

12.9

COMPETITIVE SCENARIO

12.9.1

PRODUCT LAUNCHES AND ENHANCEMENTS

13

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

316

13.2.1.1

BUSINESS OVERVIEW

13.2.1.2

PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.1.3

RECENT DEVELOPMENTS

13.2.1.3.1

PRODUCT LAUNCHES AND ENHANCEMENTS

13.2.1.4.2

STRATEGIC CHOICES

13.2.1.4.3

WEAKNESSES AND COMPETITIVE THREATS

14

ADJACENT AND RELATED MARKETS

404

14.2

ARTIFICIAL INTELLIGENCE (AI) MARKET – GLOBAL FORECAST TO 2030

14.2.2.1

ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING

14.2.2.2

ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION

14.2.2.3

ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY

14.2.2.4

ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL

14.2.2.5

ARTIFICIAL INTELLIGENCE MARKET, BY REGION

14.3

AI IN SOCIAL MEDIA MARKET

14.3.2.1

AI IN SOCIAL MEDIA MARKET, BY PRODUCT TYPE

14.3.2.2

AI IN SOCIAL MEDIA MARKET, BY DEPLOYMENT MODE

14.3.2.3

AI IN SOCIAL MEDIA MARKET, BY USE CASE

14.3.2.4

AI IN SOCIAL MEDIA MARKET, BY END USER

14.3.2.5

AI IN SOCIAL MEDIA MARKET, BY REGION

15.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3

CUSTOMIZATION OPTIONS

TABLE 1

AI IN MEDIA AND ENTERTAINMENT MARKET DETAILED SEGMENTATION

TABLE 2

USD EXCHANGE RATES, 2019–2023

TABLE 3

PRIMARY INTERVIEWS

TABLE 5

AI IN MEDIA AND ENTERTAINMENT MARKET SIZE AND GROWTH RATE, 2019–2023 (USD MILLION, Y-O-Y %)

TABLE 6

AI IN MEDIA AND ENTERTAINMENT MARKET SIZE AND GROWTH RATE, 2024–2030 (USD MILLION, Y-O-Y %)

TABLE 7

AI IN MEDIA AND ENTERTAINMENT MARKET: ECOSYSTEM

TABLE 8

NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9

EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10

ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11

MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12

LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13

PORTER’S FIVE FORCES IMPACT ON AI IN MEDIA AND ENTERTAINMENT MARKET

TABLE 14

AI IN MEDIA AND ENTERTAINMENT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025–2026

TABLE 15

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 16

KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 17

INDICATIVE PRICING ANALYSIS, BY SOFTWARE TYPE

TABLE 18

INDICATIVE PRICING OF AI IN MEDIA AND ENTERTAINMENT, BY APPLICATION

TABLE 19

PATENTS FILED, 2015–2025

TABLE 20

AI IN MEDIA AND ENTERTAINMENT MARKET: LIST OF PATENTS GRANTED, 2024–2025

TABLE 21

AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 22

AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 23

AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2019–2023 (USD MILLION)

TABLE 24

AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2024–2030 (USD MILLION)

TABLE 25

SOFTWARE TYPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 26

SOFTWARE TYPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 27

AI IN MEDIA AND ENTERTAINMENT MARKET, BY CONTENT GENERATION, 2019–2023 (USD MILLION)

TABLE 28

AI IN MEDIA AND ENTERTAINMENT MARKET, BY CONTENT GENERATION, 2024–2030 (USD MILLION)

TABLE 29

CONTENT GENERATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 30

CONTENT GENERATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 31

TEXT: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 32

TEXT: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 33

IMAGE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 34

IMAGE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 35

AUDIO: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 36

AUDIO: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 37

VIDEO: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 38

VIDEO: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 39

MULTIMODAL: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 40

MULTIMODAL: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 41

CONTENT DISTRIBUTION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 42

CONTENT DISTRIBUTION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 43

AUDIENCE ANALYTICS: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 44

AUDIENCE ANALYTICS: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 45

WORKFLOW AUTOMATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 46

WORKFLOW AUTOMATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 47

OTHER SOFTWARE TYPES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 48

OTHER SOFTWARE TYPES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 49

AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 50

AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 51

CLOUD: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 52

CLOUD: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 53

ON-PREMISES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 54

ON-PREMISES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 55

AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 56

AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 57

AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 58

AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 59

PROFESSIONAL SERVICES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 60

PROFESSIONAL SERVICES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 61

CONSULTING & ADVISORY: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 62

CONSULTING & ADVISORY: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 63

IMPLEMENTATION & DEPLOYMENT: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 64

IMPLEMENTATION & DEPLOYMENT: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 65

SUPPORT & MAINTENANCE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 66

SUPPORT & MAINTENANCE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 67

TRAINING & ENABLEMENT: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 68

TRAINING & ENABLEMENT: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 69

MANAGED SERVICES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 70

MANAGED SERVICES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 71

AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2019–2023 (USD MILLION)

TABLE 72

AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

TABLE 73

GENERATIVE AI: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 74

GENERATIVE AI: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 75

OTHER AI: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 76

OTHER AI: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 77

AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2019–2023 (USD MILLION)

TABLE 78

AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2024–2030 (USD MILLION)

TABLE 79

ARTICLE WRITING & SUMMARIZING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 80

ARTICLE WRITING & SUMMARIZING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 81

VIDEO PRODUCTION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 82

VIDEO PRODUCTION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 83

FAKE NEWS DETECTION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 84

FAKE NEWS DETECTION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 85

LANGUAGE MODERATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 86

LANGUAGE MODERATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 87

AD SAFETY OPTIMIZATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 88

AD SAFETY OPTIMIZATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 89

NEWSROOM ANALYTICS: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 90

NEWSROOM ANALYTICS: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 91

AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 92

AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 93

FILM SCRIPTWRITING, VFX, & STORYBOARDING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 94

FILM SCRIPTWRITING, VFX, & STORYBOARDING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 95

REAL-TIME OTT CONTENT MODERATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 96

REAL-TIME OTT CONTENT MODERATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 97

PREDICTING VIEWER PREFERENCES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 98

PREDICTING VIEWER PREFERENCES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 99

POST-PRODUCTION WORKFLOW EDITING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 100

POST-PRODUCTION WORKFLOW EDITING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 101

NPC BEHAVIOR MODELING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 102

NPC BEHAVIOR MODELING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 103

GAMING CONTENT OPTIMIZATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 104

GAMING CONTENT OPTIMIZATION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 105

IMMERSIVE ENTERTAINMENT: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 106

IMMERSIVE ENTERTAINMENT: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 107

AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 108

AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 109

AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2019–2023 (USD MILLION)

TABLE 110

AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2024–2030 (USD MILLION)

TABLE 111

NEWS & PUBLISHING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 112

NEWS & PUBLISHING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 113

SOCIAL MEDIA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 114

SOCIAL MEDIA: AI IN MEDIA AND ENTERTAINMENT MARKET BY REGION, 2024–2030 (USD MILLION)

TABLE 115

ADVERTISING & MARKETING AGENCIES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 116

ADVERTISING & MARKETING AGENCIES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 117

BROADCASTING & JOURNALISM: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 118

BROADCASTING & JOURNALISM: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 119

INDIVIDUAL USERS (MEDIA): AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 120

INDIVIDUAL USERS (MEDIA): AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 121

AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 122

AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 123

FILM STUDIOS: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 124

FILM STUDIOS: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 125

GAME DEVELOPMENT COMPANIES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 126

GAME DEVELOPMENT COMPANIES: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 127

TELEVISION & OTT PLATFORMS: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 128

TELEVISION & OTT PLATFORMS: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 129

LIVE EVENTS & SPORTS BROADCASTING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 130

LIVE EVENTS & SPORTS BROADCASTING: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 131

THEME & AMUSEMENT PARKS: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 132

THEME & AMUSEMENT PARKS: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 133

MUSIC PRODUCTION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 134

MUSIC PRODUCTION: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 135

INDIVIDUAL USERS (ENTERTAINMENT): AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 136

INDIVIDUAL USERS (ENTERTAINMENT): AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 137

AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 138

AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 139

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 140

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 141

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2019–2023 (USD MILLION)

TABLE 142

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2024–2030 (USD MILLION)

TABLE 143

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE (CONTENT GENERATION), 2019–2023 (USD MILLION)

TABLE 144

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE (CONTENT GENERATION), 2024–2030 (USD MILLION)

TABLE 145

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 146

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 147

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 148

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 149

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 150

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 151

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2019–2023 (USD MILLION)

TABLE 152

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

TABLE 153

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2019–2023 (USD MILLION)

TABLE 154

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2024–2030 (USD MILLION)

TABLE 155

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 156

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 157

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 158

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 159

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2019–2023 (USD MILLION)

TABLE 160

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2024–2030 (USD MILLION)

TABLE 161

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 162

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 163

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 164

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 165

US: AI IN EDUCATION MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 166

NORTH AMERICA: AI IN EDUCATION MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 167

CANADA: AI IN EDUCATION MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 168

CANADA: AI IN EDUCATION MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 169

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 170

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 171

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2019–2023 (USD MILLION)

TABLE 172

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2024–2030 (USD MILLION)

TABLE 173

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE (CONTENT GENERATION), 2019–2023 (USD MILLION)

TABLE 174

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE (CONTENT GENERATION), 2024–2030 (USD MILLION)

TABLE 175

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 176

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 177

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 178

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 179

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 180

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 181

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2019–2023 (USD MILLION)

TABLE 182

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

TABLE 183

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2019–2023 (USD MILLION)

TABLE 184

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2024–2030 (USD MILLION)

TABLE 185

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 186

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 187

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 188

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 189

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2019–2023 (USD MILLION)

TABLE 190

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2024–2030 (USD MILLION)

TABLE 191

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 192

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 193

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 194

EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 195

UK: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 196

UK: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 197

GERMANY: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 198

GERMANY: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 199

FRANCE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 200

FRANCE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 201

ITALY: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 202

ITALY: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 203

SPAIN: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 204

SPAIN: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 205

REST OF EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 206

REST OF EUROPE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 207

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 208

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 209

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2019–2023 (USD MILLION)

TABLE 210

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2024–2030 (USD MILLION)

TABLE 211

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE (CONTENT GENERATION), 2019–2023 (USD MILLION)

TABLE 212

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE (CONTENT GENERATION), 2024–2030 (USD MILLION)

TABLE 213

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 214

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 215

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 216

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 217

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 218

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 219

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2019–2023 (USD MILLION)

TABLE 220

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

TABLE 221

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2019–2023 (USD MILLION)

TABLE 222

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2024–2030 (USD MILLION)

TABLE 223

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 224

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 225

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 226

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 227

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2019–2023 (USD MILLION)

TABLE 228

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2024–2030 (USD MILLION)

TABLE 229

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 230

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 231

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 232

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 233

CHINA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 234

CHINA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 235

JAPAN: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 236

JAPAN: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 237

INDIA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 238

INDIA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 239

SOUTH KOREA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 240

SOUTH KOREA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 241

AUSTRALIA & NEW ZEALAND: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 242

AUSTRALIA & NEW ZEALAND: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 243

ASEAN: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 244

ASEAN: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 245

ASEAN: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 246

ASEAN: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 247

REST OF ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 248

REST OF ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 249

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 250

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 251

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2019–2023 (USD MILLION)

TABLE 252

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2024–2030 (USD MILLION)

TABLE 253

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE (CONTENT GENERATION), 2019–2023 (USD MILLION)

TABLE 254

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE (CONTENT GENERATION), 2024–2030 (USD MILLION)

TABLE 255

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 256

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 257

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 258

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 259

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 260

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 261

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2019–2023 (USD MILLION)

TABLE 262

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

TABLE 263

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2019–2023 (USD MILLION)

TABLE 264

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2024–2030 (USD MILLION)

TABLE 265

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 266

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 267

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 268

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 269

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2019–2023 (USD MILLION)

TABLE 270

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2024–2030 (USD MILLION)

TABLE 271

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 272

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 273

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 274

MIDDLE EAST & AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY REGION, 2024–2030 (USD MILLION)

TABLE 275

MIDDLE EAST: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 276

MIDDLE EAST: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 277

KSA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 278

KSA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 279

UAE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 280

UAE: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 281

BAHRAIN: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 282

BAHRAIN: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 283

KUWAIT: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 284

KUWAIT: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 285

REST OF MIDDLE EAST: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 286

REST OF MIDDLE EAST: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 287

AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 288

AFRICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 289

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 290

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY OFFERING, 2024–2030 (USD MILLION)

TABLE 291

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2019–2023 (USD MILLION)

TABLE 292

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE TYPE, 2024–2030 (USD MILLION)

TABLE 293

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE (CONTENT GENERATION), 2019–2023 (USD MILLION)

TABLE 294

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SOFTWARE (CONTENT GENERATION), 2024–2030 (USD MILLION)

TABLE 295

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 296

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY DEPLOYMENT MODE, 2024–2030 (USD MILLION)

TABLE 297

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 298

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY SERVICE, 2024–2030 (USD MILLION)

TABLE 299

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2019–2023 (USD MILLION)

TABLE 300

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY PROFESSIONAL SERVICE, 2024–2030 (USD MILLION)

TABLE 301

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2019–2023 (USD MILLION)

TABLE 302

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

TABLE 303

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2019–2023 (USD MILLION)

TABLE 304

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (MEDIA), 2024–2030 (USD MILLION)

TABLE 305

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 306

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY APPLICATION (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 307

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 308

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 309

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2019–2023 (USD MILLION)

TABLE 310

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (MEDIA), 2024–2030 (USD MILLION)

TABLE 311

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2019–2023 (USD MILLION)

TABLE 312

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER (ENTERTAINMENT), 2024–2030 (USD MILLION)

TABLE 313

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 314

LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

TABLE 315

BRAZIL: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 316

BRAZIL: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 317

MEXICO: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 318

MEXICO: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 319

ARGENTINA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 320

ARGENTINA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 321

REST OF LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 322

REST OF LATIN AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET, BY END USER, 2024–2030 (USD MILLION)

TABLE 323

AI IN MEDIA AND ENTERTAINMENT MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS, 2020–2024

TABLE 324

AI IN MEDIA AND ENTERTAINMENT MARKET: DEGREE OF COMPETITION (MEDIA), 2023

TABLE 325

AI IN MEDIA AND ENTERTAINMENT MARKET: DEGREE OF COMPETITION (ENTERTAINMENT), 2023

TABLE 326

AI IN MEDIA AND ENTERTAINMENT MARKET: REGIONAL FOOTPRINT

TABLE 327

AI IN MEDIA AND ENTERTAINMENT MARKET: SOFTWARE TYPE FOOTPRINT

TABLE 328

AI IN MEDIA AND ENTERTAINMENT MARKET: APPLICATION FOOTPRINT (MEDIA)

TABLE 329

AI IN MEDIA AND ENTERTAINMENT MARKET: APPLICATION FOOTPRINT (ENTERTAINMENT)

TABLE 330

AI IN MEDIA AND ENTERTAINMENT MARKET: END-USER FOOTPRINT (MEDIA)

TABLE 331

AI IN MEDIA AND ENTERTAINMENT MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 332

AI IN MEDIA AND ENTERTAINMENT MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (MEDIA)

TABLE 333

AI IN MEDIA AND ENTERTAINMENT MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (ENTERTAINMENT)

TABLE 334

AI IN MEDIA AND ENTERTAINMENT MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021–DECEMBER 2024

TABLE 335

AI IN MEDIA AND ENTERTAINMENT MARKET: DEALS, JANUARY 2021– DECEMBER 2024

TABLE 336

GOOGLE: COMPANY OVERVIEW

TABLE 337

GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 338

GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 340

MICROSOFT: COMPANY OVERVIEW

TABLE 341

MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 342

MICROSOFT: PRODUCT LAUNCHES

TABLE 343

MICROSOFT: DEALS

TABLE 344

IBM: COMPANY OVERVIEW

TABLE 345

IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 346

IBM: PRODUCT ENHANCEMENTS

TABLE 347

META: COMPANY OVERVIEW

TABLE 348

META: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 349

META: PRODUCT LAUNCHES

TABLE 351

OPENAI: COMPANY OVERVIEW

TABLE 352

OPENAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 353

OPENAI: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 355

BAIDU: COMPANY OVERVIEW

TABLE 356

BAIDU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 357

BAIDU: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 359

AWS: COMPANY OVERVIEW

TABLE 360

AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 361

AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 363

ADOBE: COMPANY OVERVIEW

TABLE 364

ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 365

ADOBE: PRODUCT ENHANCEMENTS

TABLE 367

SPRINKLR: COMPANY OVERVIEW

TABLE 368

SPRINKLR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 369

C3 AI: COMPANY OVERVIEW

TABLE 370

C3 AI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 372

ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2019–2023 (USD BILLION)

TABLE 373

ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2024–2030 (USD BILLION)

TABLE 374

ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2019–2023 (USD BILLION)

TABLE 375

ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2024–2030 (USD BILLION)

TABLE 376

ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2019–2023 (USD BILLION)

TABLE 377

ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2024–2030 (USD BILLION)

TABLE 378

ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2019–2023 (USD BILLION)

TABLE 379

ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2024–2030 (USD BILLION)

TABLE 380

ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2019–2023 (USD BILLION)

TABLE 381

ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2024–2030 (USD BILLION)

TABLE 382

AI IN SOCIAL MEDIA MARKET, BY PRODUCT TYPE, 2019–2023 (USD MILLION)

TABLE 383

AI IN SOCIAL MEDIA MARKET, BY PRODUCT TYPE, 2024–2029 (USD MILLION)

TABLE 384

AI IN SOCIAL MEDIA MARKET, BY DEPLOYMENT MODE, 2019–2023 (USD MILLION)

TABLE 385

AI IN SOCIAL MEDIA MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

TABLE 386

AI IN SOCIAL MEDIA MARKET, BY USE CASE, 2019–2023 (USD MILLION)

TABLE 387

AI IN SOCIAL MEDIA MARKET, BY USE CASE, 2024–2029 (USD MILLION)

TABLE 388

AI IN SOCIAL MEDIA MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 389

AI IN SOCIAL MEDIA MARKET, BY END USER, 2024–2029 (USD MILLION)

TABLE 390

AI IN SOCIAL MEDIA MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 391

AI IN SOCIAL MEDIA MARKET, BY REGION, 2024–2029 (USD MILLION)

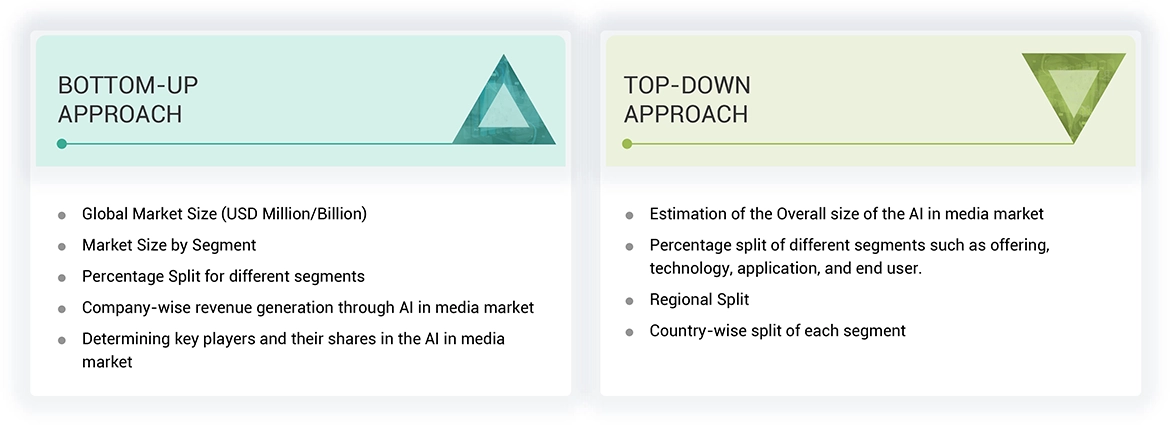

FIGURE 1

AI IN MEDIA AND ENTERTAINMENT MARKET: RESEARCH DESIGN

FIGURE 2

DATA TRIANGULATION

FIGURE 3

AI IN MEDIA AND ENTERTAINMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 4

APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM SOFTWARE/SERVICES OF AI IN MEDIA AND ENTERTAINMENT MARKET

FIGURE 5

APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF AI IN MEDIA AND ENTERTAINMENT MARKET

FIGURE 6

APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF AI IN MEDIA AND ENTERTAINMENT MARKET

FIGURE 7

APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF AI IN MEDIA AND ENTERTAINMENT THROUGH OVERALL DIGITAL SOLUTIONS SPENDING

FIGURE 8

SOFTWARE SEGMENT TO DOMINATE MARKET IN 2024

FIGURE 9

CONTENT DISTRIBUTION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

FIGURE 10

TEXT SEGMENT TO LEAD MARKET IN 2024

FIGURE 11

PROFESSIONAL SERVICES SEGMENT TO HOLD LARGER MARKET SHARE THAN MANAGED SERVICES SEGMENT IN 2024

FIGURE 12

CONSULTING & ADVISORY SEGMENT TO LEAD MARKET IN 2024

FIGURE 13

CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE THAN ON-PREMISES SEGMENT IN 2024

FIGURE 14

OTHER AI SEGMENT TO HOLD LARGER MARKET SHARE THAN GENERATIVE AI SEGMENT IN 2024

FIGURE 15

ENTERTAINMENT END USER SEGMENT TO DOMINATE MARKET IN 2024

FIGURE 16

ARTICLE WRITING & SUMMARIZING SEGMENT TO LEAD MARKET IN 2024

FIGURE 17

NEWS & PUBLISHING AGENCIES SEGMENT TO LEAD MARKET IN 2024

FIGURE 18

FILM SCRIPTING, VFX, & STORYBOARDING SEGMENT TO DOMINATE MARKET IN 2024

FIGURE 19

FILM STUDIOS SEGMENT TO HAVE LARGEST MARKET SIZE IN 2024

FIGURE 20

ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 21

INCREASING DEMAND FOR HYPER-PERSONALIZED MEDIA EXPERIENCE TO DRIVE MARKET

FIGURE 22

FAKE NEWS DETECTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 23

NPC BEHAVIOR MODELING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 24

CLOUD AND ENTERTAINMENT SEGMENTS TO HOLD LARGEST MARKET SHARES IN NORTH AMERICA IN 2024

FIGURE 25

NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2024

FIGURE 26

AI IN MEDIA AND ENTERTAINMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 27

EVOLUTION OF AI IN MEDIA AND ENTERTAINMENT MARKET

FIGURE 28

KEY COMPANIES IN AI IN MEDIA AND ENTERTAINMENT MARKET ECOSYSTEM

FIGURE 29

AI IN MEDIA AND ENTERTAINMENT MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 30

AI IN MEDIA AND ENTERTAINMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 31

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

FIGURE 32

KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

FIGURE 33

INDICATIVE PRICING ANALYSIS, BY SOFTWARE TYPE

FIGURE 34

NUMBER OF PATENTS GRANTED TO VENDORS IN LAST 10 YEARS

FIGURE 35

REGIONAL ANALYSIS OF PATENTS GRANTED, 2015–2025

FIGURE 36

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 37

AI IN MEDIA AND ENTERTAINMENT MARKET: INVESTMENT AND FUNDING SCENARIO (USD MILLION AND NUMBER OF FUNDING ROUNDS)

FIGURE 38

MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING AI IN MEDIA AND ENTERTAINMENT ACROSS KEY END USERS

FIGURE 39

SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN SOFTWARE SEGMENT DURING FORECAST PERIOD

FIGURE 40

AUDIENCE ANALYTICS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 41

AUDIO SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 42

ON-PREMISES SEGMENT TO REGISTER HIGHER CAGR THAN CLOUD SEGMENT DURING FORECAST PERIOD

FIGURE 43

MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN PROFESSIONAL SERVICES SEGMENT DURING FORECAST PERIOD

FIGURE 44

SUPPORT & MAINTENANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 45

OTHER AI SEGMENT TO REGISTER HIGHER CAGR THAN GENERATIVE AI SEGMENT DURING FORECAST PERIOD

FIGURE 46

FAKE NEWS DETECTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 47

NPC BEHAVIOR MODELING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 48

MEDIA SEGMENT TO REGISTER HIGHER CAGR THAN ENTERTAINMENT SEGMENT DURING FORECAST PERIOD

FIGURE 49

ADVERTISING & MARKETING AGENCIES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 50

TELEVISION & OTT PLATFORMS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 51

INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 52

ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 53

NORTH AMERICA: AI IN MEDIA AND ENTERTAINMENT MARKET SNAPSHOT

FIGURE 54

ASIA PACIFIC: AI IN MEDIA AND ENTERTAINMENT MARKET SNAPSHOT

FIGURE 55

AI IN MEDIA AND ENTERTAINMENT MARKET: REVENUE ANALYSIS OF 5 KEY PLAYERS (MEDIA), 2019–2023

FIGURE 56

AI IN MEDIA AND ENTERTAINMENT MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS (ENTERTAINMENT), 2019–2023

FIGURE 57

SHARE ANALYSIS OF LEADING COMPANIES IN AI IN MEDIA AND ENTERTAINMENT MARKET (MEDIA), 2023

FIGURE 58

SHARE ANALYSIS OF LEADING COMPANIES IN AI IN MEDIA AND ENTERTAINMENT MARKET (ENTERTAINMENT), 2023

FIGURE 59

BRAND/PRODUCT COMPARISON, BY SOFTWARE TYPE (KEY PLAYERS)

FIGURE 60

BRAND/PRODUCT COMPARISON, BY SOFTWARE TYPE (START-UPS & SMES)

FIGURE 61

COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

FIGURE 62

YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

FIGURE 63

AI IN MEDIA AND ENTERTAINMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS, MEDIA), 2023

FIGURE 64

AI IN MEDIA AND ENTERTAINMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS, ENTERTAINMENT), 2023

FIGURE 65

AI IN MEDIA AND ENTERTAINMENT MARKET: COMPANY FOOTPRINT (MEDIA)

FIGURE 66

AI IN MEDIA AND ENTERTAINMENT MARKET: COMPANY FOOTPRINT (ENTERTAINMENT)

FIGURE 67

AI IN MEDIA AND ENTERTAINMENT MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES, MEDIA), 2023

FIGURE 68

AI IN MEDIA AND ENTERTAINMENT MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES, ENTERTAINMENT), 2023

FIGURE 69

GOOGLE: COMPANY SNAPSHOT

FIGURE 70

MICROSOFT: COMPANY SNAPSHOT

FIGURE 71

IBM: COMPANY SNAPSHOT

FIGURE 72

META: COMPANY SNAPSHOT

FIGURE 73

BAIDU: COMPANY SNAPSHOT

FIGURE 74

AWS: COMPANY SNAPSHOT

FIGURE 75

ADOBE: COMPANY SNAPSHOT

FIGURE 76

SPRINKLR: COMPANY SNAPSHOT

FIGURE 77

C3 AI: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in AI In Media Market