AI in Pathology Market: Growth, Size, Share, and Trends

AI in Pathology Market by Neural Network (GAN, CNN, RNN), Function (Diagnostic, Image Analysis, CDSS, Data Management, Analytics), Use Case (Drug Discovery, Clinical Workflow), End User (Hospitals, Labs, Pharma/Biotech), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

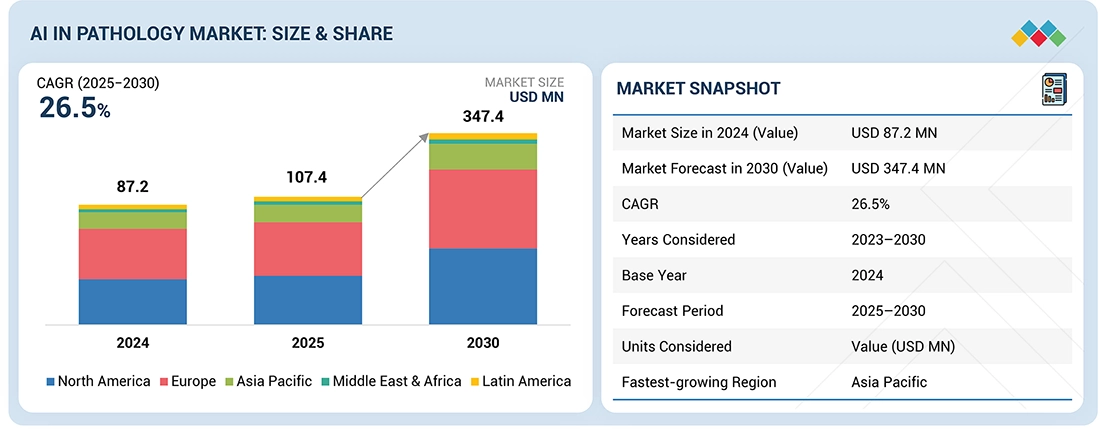

The AI in pathology market is projected to reach USD 347.4 million by 2030 from USD 107.4 million in 2025, at a CAGR of 26.5% from 2025 to 2030. The growth of the AI in pathology market is driven by the increasing adoption of digital pathology and AI-enabled telepathology that enable remote slide review, collaboration, and expert consultations among pathologists. These technologies enhance diagnostic accuracy, workflow efficiency, and access to specialized expertise. Additionally, factors such as the rising demand for advanced diagnostic technologies, growing concerns over misdiagnoses, increasing funding programs to improve patient care standards, and a strong focus on cost containment and hospital operational efficiency are further propelling market expansion.

KEY TAKEAWAYS

-

By RegionThe North America AI in pathology market accounted for a 41.0% revenue share of the global market in 2024.

-

By OfferingBy offering, the end to end solutions segment is expected to register the highest CAGR of 26.9%.

-

By Neural NetworkBy neural network, the Convolutional Neural Networks (CNNs) segment is projected to grow at the fastest rate from 2025 to 2030.

-

By FunctionBy function, the image analysis segment is expected to dominate the market.

-

By Use CaseBy use case, the drug discovery segment will grow the fastest during the forecast period.

-

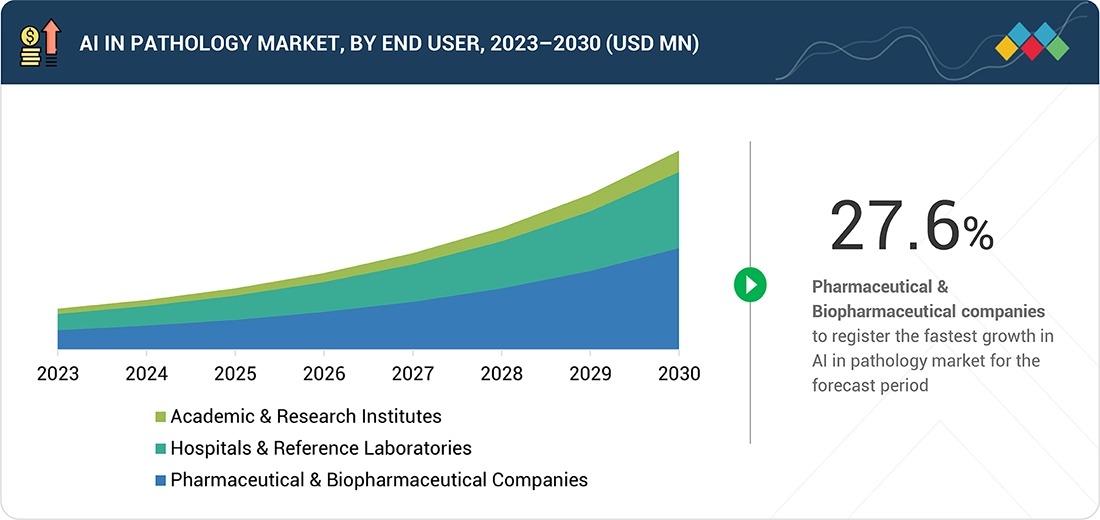

By End UserBy end user, the pharmaceutical & biopharmaceutical companies segment is expected to dominate the market, growing at the highest CAGR of 27.6%.

The AI in pathology market is witnessing robust growth, driven by the increasing adoption of digital and AI-powered diagnostic solutions that enhance accuracy, efficiency, and collaboration in pathology workflows. Growing demand for AI-enabled image analysis, clinical decision support systems (CDSS), and data management tools is transforming traditional pathology practices into connected, data-driven ecosystems. Key trends shaping the industry include strategic partnerships between AI developers, hospitals, and life sciences companies, advancements in deep learning models such as CNNs, GANs, and RNNs, and integration of telepathology for remote diagnostics and expert consultations. Additionally, ongoing investments in precision medicine, drug discovery applications, and workflow automation are expanding the market’s scope. As healthcare providers increasingly prioritize cost containment, diagnostic standardization, and improved patient outcomes, AI in pathology continues to emerge as a cornerstone of next-generation diagnostic innovation.

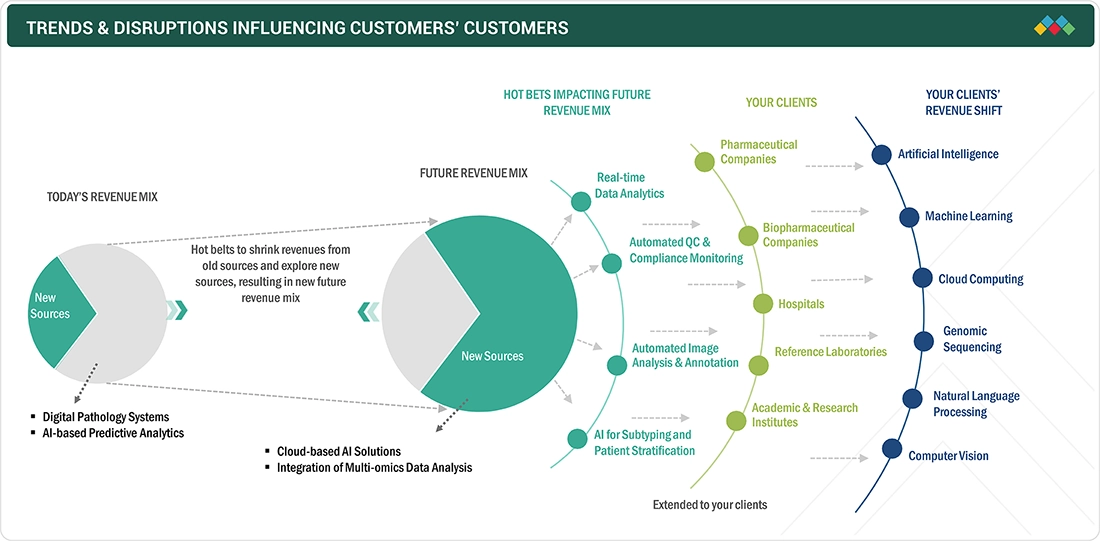

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the AI in pathology market arises from evolving healthcare demands and technological disruptions in diagnostic workflows. Hospitals, reference laboratories, pharmaceutical companies, and research institutions are the primary users of AI-powered pathology solutions, focusing on improving diagnostic accuracy, efficiency, and data-driven decision-making. Shifts toward digital pathology adoption, remote diagnostics, personalized medicine, and stringent regulatory compliance are transforming operational performance and revenue models of end users. These changes are fueling demand for advanced AI-enabled pathology platforms, image analysis tools, and workflow automation solutions, thereby shaping the market’s overall growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Integration of AI into multiplex imaging

-

Development of CNNs and advanced AI models

Level

-

Limited AI expertise and varied regulatory guidelines for medical software

-

High cost of digital pathology systems

Level

-

Integration of multi-omics data

-

Increasing demand for personalized medicines

Level

-

Insufficient data for AI algorithms

-

Data privacy and ethical concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Integration of AI into multiplex imaging

The integration of AI in multiplex imaging represents a transformative leap in the field of pathology, particularly as digital pathology continues to advance. Multiplex imaging techniques, such as multiplex immunohistochemistry (IHC) and fluorescence imaging, allow the simultaneous visualization of multiple biomarkers in a single tissue sample. This multi-dimensional data presents unparalleled opportunities for understanding complex biological processes, but it also presents challenges due to the sheer volume and complexity of information generated. AI, specifically deep learning algorithms, is instrumental in addressing these challenges by automating the analysis of multiplex imaging data, identifying patterns, and providing insights that may be beyond human recognition.

Restraint: Limited AI expertise and varied regulatory guidelines for medical software

Companies require a workforce with specific skill sets to develop, manage, and implement AI systems. For instance, personnel dealing with AI systems should be aware of cognitive computing, ML and machine intelligence, deep learning, and image recognition. Integrating AI solutions into existing systems is also challenging, requiring extensive data processing to replicate human brain behavior. Even a minor error can result in system failure or adversely affect the desired result. Despite the increasing demand for AI talent, this area has a notable shortage of skilled professionals. A Deloitte survey in 2024 revealed that the AI talent shortage remains a significant challenge across all industries, with 67% of companies struggling to find qualified professionals despite the ongoing demand, even amid economic disruptions. Notably, 23% of mature AI adopters report skill gaps, higher than less mature organizations, indicating they may have a clearer understanding of the skills they need for transformational projects.

Opportunity: Integration of multi-omics data

Integrating multi-omics data encompassing genomics, proteomics, metabolomics, and transcriptomics represents a massive opportunity for AI in the pathology market. By merging these diverse biological datasets, pathologists can obtain a more comprehensive view of disease mechanisms, enabling a deeper understanding of complex health conditions. This holistic approach identifies intricate relationships between different biological layers, which can be crucial in accurately diagnosing diseases and determining the best therapeutic strategies. The integration of multi-omics data allows for robust predictive analytics.

Challenge: Insufficient data for AI algorithms

AI algorithms require large, diverse, and well-annotated datasets for training and validation. However, acquiring such datasets in pathology can be challenging due to data privacy regulations, data fragmentation across multiple healthcare systems, and the need for expert annotations. Ensuring the availability of high-quality data remains a significant challenge for developing accurate and reliable AI models. Most AI systems require high-quality training photos. Ideally, these training images should be ‘labeled’ (i.e., annotated). Aside from the time constraints, human annotations are frequently an expensive impediment in app development. Crowdsourcing may be cheaper and quicker, but it has the potential to introduce noise.

AI in Pathology Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of AI-powered IntelliSite Pathology Solution enabling digital slide scanning, workflow orchestration, and remote collaboration. | Streamlined digital pathology adoption, faster diagnosis turnaround, improved inter-pathologist collaboration, and scalable hospital network integration. |

|

uPath enterprise software integrating AI image analysis for oncology and hematopathology. | Enhanced diagnostic accuracy, automated biomarker quantification, and better alignment with companion diagnostics. |

|

AI-based breast tissue analysis and digital pathology integration for oncology workflows. | Increased cancer detection rates, standardized pathology assessments, and improved patient risk stratification. |

|

Use of HALO AI for quantitative image analysis, biomarker scoring, and spatial tissue mapping. | Improved reproducibility, scalability for large-scale studies, and faster research-to-clinic transition. |

|

Whole-slide scanners integrated with OptraASSURE AI for automated cancer detection. | Cost-effective digital transformation, real-time remote diagnosis, and enhanced slide traceability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

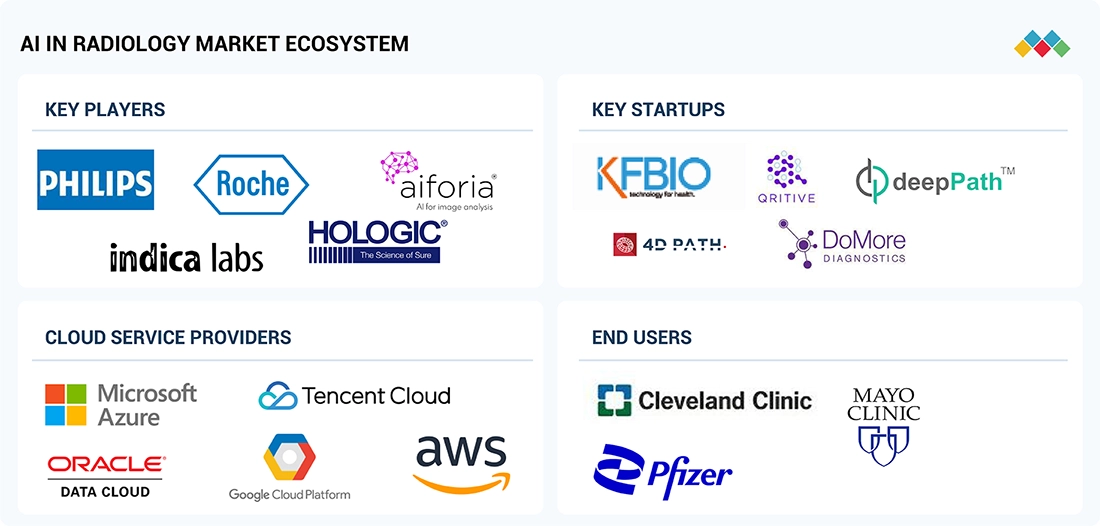

MARKET ECOSYSTEM

The AI in pathology market ecosystem consists of AI software developers (Philips, Roche, Aiforia, Indica Labs), hardware manufacturers (Hamamatsu, Leica), and end users (hospitals, reference laboratories, pharmaceutical and biopharmaceutical companies). High-resolution scanners and imaging systems digitize pathology slides, which are then analyzed by AI-powered platforms and cloud-based analytics solutions to improve diagnostic accuracy and workflow efficiency. Middleware and cloud providers enable seamless data integration and large-scale processing, while cybersecurity and compliance vendors ensure data privacy and regulatory adherence. End users drive demand for faster, more accurate, and cost-efficient diagnostics, while technology providers deliver advanced AI solutions. Collaboration across the value chain—from software developers to healthcare providers and regulators—is key to driving innovation, interoperability, and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI in Pathology By Offering

Based on the offering, AI in the pathology market is segmented into end-to-end solutions (integration platforms), niche point solutions, technology, and hardware. The end-to-end solutions segment accounted for the largest share of the market in 2024. The large share of this segment can be attributed to the ability of these solutions to provide enhanced interoperability, data sharing, and simplified data sharing & support. The increasing demand for scalable and advanced technology solutions is also a key growth factor.

AI in Pathology By Neural Network

Based on neural networks, the market is segmented into generative adversarial networks (GANs), convolutional neural networks (CNNs), recurrent neural networks (RNNs), and other neural networks. The CNNs segment accounted for the largest share of AI in the pathology market in 2024. This segment is also expected to grow at the highest CAGR during the forecast period. The large share and the high growth rate of this segment can be attributed to the ability of these neural networks to analyze complex visual data, such as pathological images, extract relevant features, and provide accurate diagnoses. These neural networks also help in the localization & segmentation of the regions of interest within images. They can continuously learn and improve over time by leveraging new data & feedback from pathologists.

AI in Pathology By Function

By function, the AI in pathology market is segmented into image analysis, diagnostics, workflow management, data management, predictive analytics, CDSS (Clinical Decision Support System), automated report generation, and quality assurance tools. In 2024, the image analysis segment accounted for the largest share of the market. The large share of the image analysis segment is attributed to the increasing demand for early diagnosis & precision capabilities, the integration of digital pathology, the shortage of skilled pathologists, and the increased demand for personalized and targeted therapies.

AI in Pathology By Use Case

Based on the use case, the AI in pathology market is segmented into drug discovery, disease diagnosis & prognosis, clinical workflow, and training & education. In 2024, the drug discovery segment accounted for the largest share of the market. This segment is also expected to grow at the highest CAGR during the forecast period. The increasing pharmaceutical & biotechnology R&D expenditure; the growth in high-throughput screening & imaging; the rising use of AI algorithms in pathology image analysis for the identification & classification of diseases; and the ability of AI to accelerate the development of new therapeutics to improve diagnostic accuracy, and enhance personalized medicine are the factors expected to contribute to market growth of this segment.

AI in Pathology By End User

Based on end users, the AI in pathology market is segmented into pharmaceutical & biopharmaceutical companies, hospitals & reference laboratories, and academic & research institutes. The pharmaceutical & biopharmaceutical companies segment is the largest end user of the market. This segment's large share and high growth rate can be attributed to advancements in drug discovery & development and the growing use of AI in pathology for drug toxicology testing. Biotechnology companies use AI-based digital pathology for biobanking, biopharmaceutical studies, molecular assays, and the development of individualized medicine.

REGION

Asia Pacific to be fastest-growing region in global AI in pathology market during forecast period

The Asia Pacific AI in pathology market is expected to register the highest CAGR during the forecast period, market growth in the Asia Pacific can be attributed to government healthcare initiatives and AI policy support, R&D investments by key players and startups, expanding healthcare infrastructure, and hospital digitization.

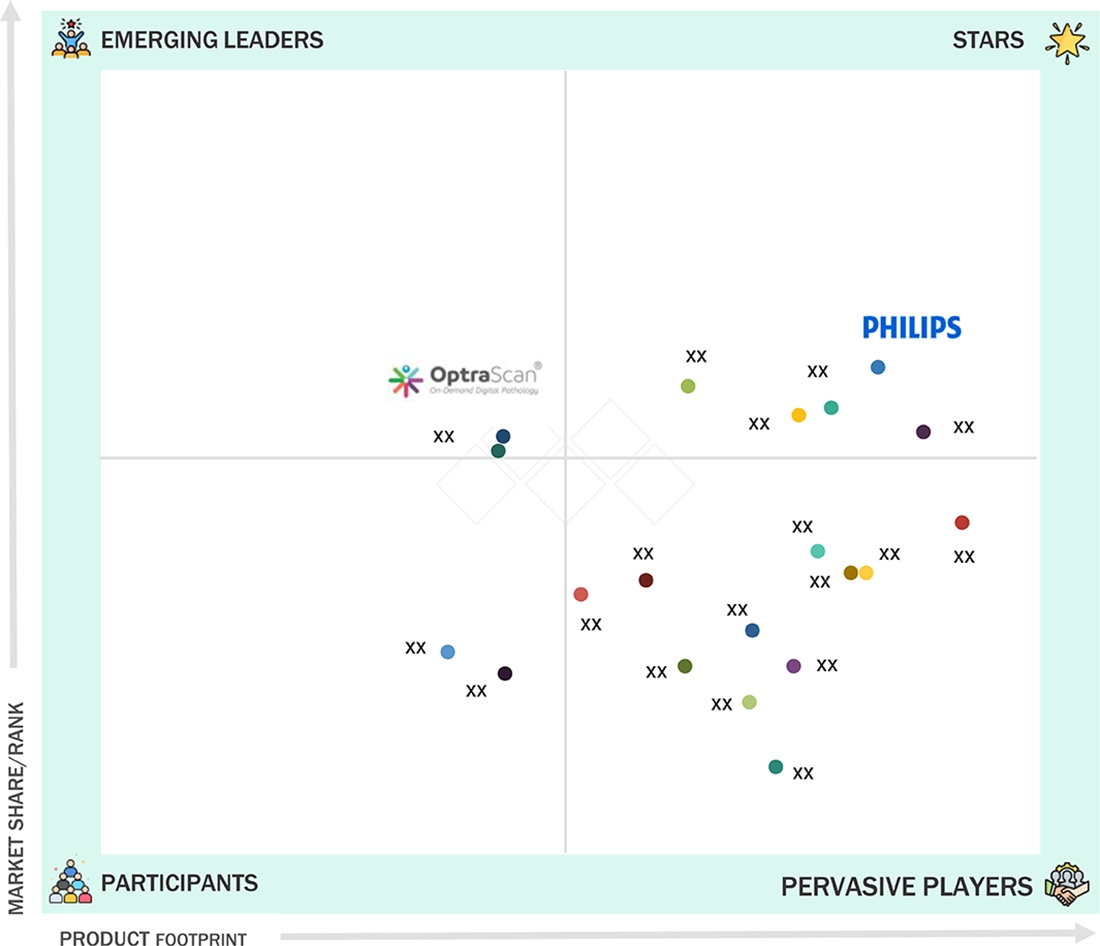

AI in Pathology Market: COMPANY EVALUATION MATRIX

In the AI in pathology market matrix, Koninklijke Philips N.V. (Star) leads with a strong market share and comprehensive product footprint, driven by its advanced digital pathology and AI-powered diagnostic platforms that enhance workflow efficiency, image analysis accuracy, and remote collaboration in clinical and research settings. OptraScan (Emerging Leader) is gaining recognition with its cost-effective digital pathology scanners and AI-driven image analysis solutions, catering to mid-sized laboratories and healthcare institutions seeking scalable digital transformation. While Philips dominates through its global reach, integrated ecosystem, and continuous innovation in AI diagnostics, OptraScan demonstrates strong potential to advance toward the leaders' quadrant as demand for affordable and accessible AI-enabled pathology solutions continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 87.2 Million |

| Market Forecast in 2030 (Value) | USD 347.4 Million |

| Growth Rate | CAGR of 26.5% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

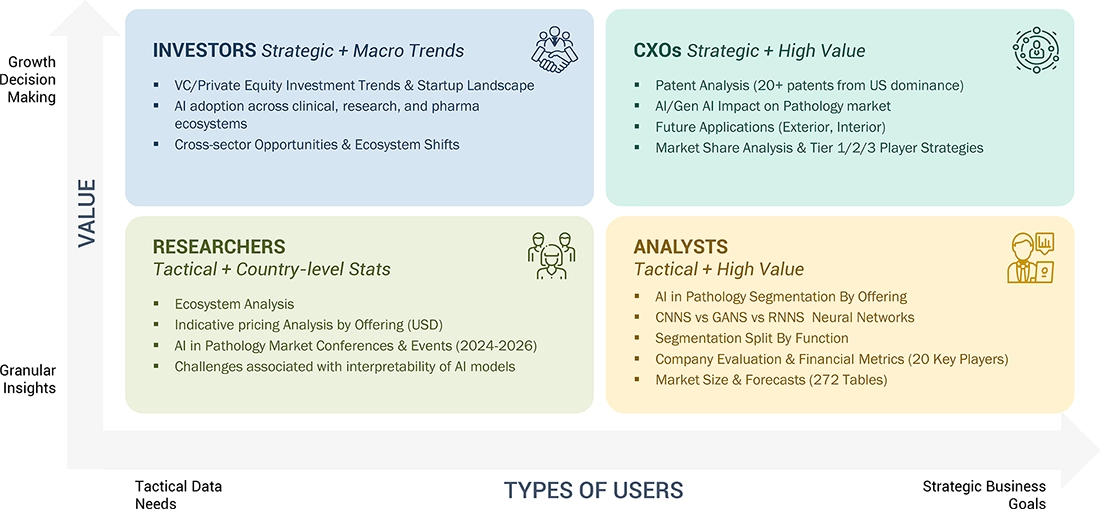

WHAT IS IN IT FOR YOU: AI in Pathology Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Mapping | Profiles and market share analysis of leading AI in pathology vendors covering digital pathology platforms, image analysis software, diagnostic workflow automation tools, and AI-driven tissue characterization solutions. | Enables benchmarking of AI pathology offerings, identifies innovation gaps in image analytics and automation, supports portfolio enhancement, and informs partnership or acquisition strategies. |

| Market Entry & Growth Strategy | Regional assessment of digital pathology and AI adoption trends, key drivers (e.g., shortage of pathologists, cancer diagnostics modernization), reimbursement dynamics, and competitive landscape across hospitals, diagnostic labs, and research organizations. | Reduces market entry risk, accelerates commercialization through tailored regional strategies, ensures alignment with local regulatory and reimbursement frameworks, and supports scaling in high-growth markets. |

| Technology & Adoption Trends | Insights into adoption of AI-powered image analysis, digital slide scanners, cloud-based pathology workflows, and integration with LIS/EHR systems, along with trends in multimodal and precision diagnostics. | Guides product development and investment priorities, helps vendors align technology innovation with diagnostic efficiency and precision medicine goals, and identifies emerging use cases and customer segments. |

RECENT DEVELOPMENTS

- February 2024 : Roche Tissue Diagnostics (RTD) collaborated with PathAI to create AI-powered digital pathology algorithms for RTD's companion diagnostics division. These image analysis algorithms are planned to be implemented on the Roche Navify Digital Pathology platform, ensuring smooth integration into pathology labs worldwide.

- July 2024 : Castile and León, the Spanish regional health authority, partnered with Aiforia Technologies Plc (Finland) for AI-powered diagnostics. This aims to enhance the diagnostic processes in the region's pathology labs, incorporating an image management system from Sectra alongside AI-based image analysis solutions from Aiforia.

- February 2024 : The US Food and Drug Administration (FDA) approved the Genius Digital Diagnostics System of Hologic Inc. with its AI algorithm features. This system is the first FDA-approved digital cytology solution that integrates deep-learning AI with advanced volumetric imaging technology to detect pre-cancerous lesions and cervical cancer cells.

- January 2022 : Aiforia Technologies Plc collaborated with Mayo Clinic to establish AI-powered pathology research support architecture at the Clinic to enable faster results and scalable studies in translational research.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

This research study involved the extensive use of primary and secondary sources. It analyzes various factors affecting the industry to identify the segmentation, industry trends, key players, the competitive landscape, and key market dynamics.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, whitepapers, annual reports, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the AI in pathology market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply-side and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the AI in pathology market. Primary sources from the demand side included personnel from pharmaceutical & biopharmaceutical companies, research institutes, and hospitals (small, medium-sized, and large hospitals).

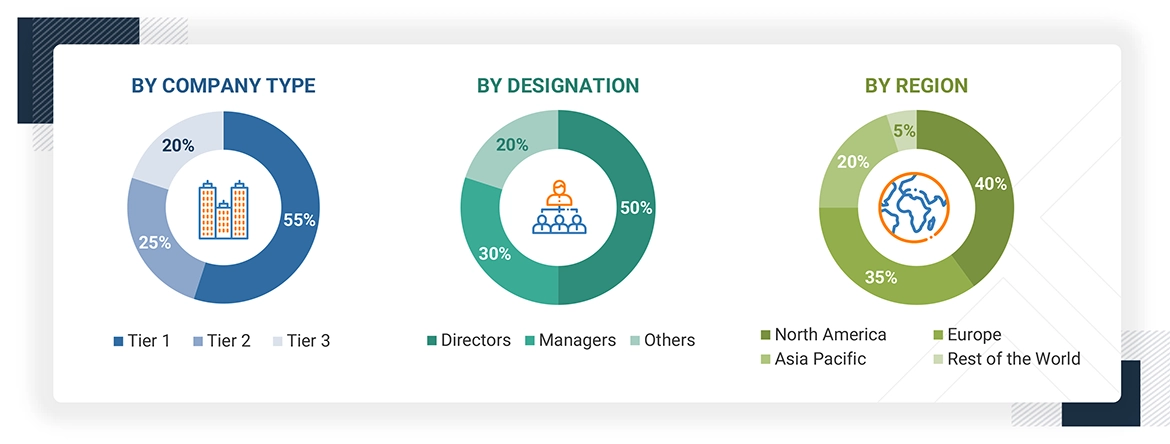

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

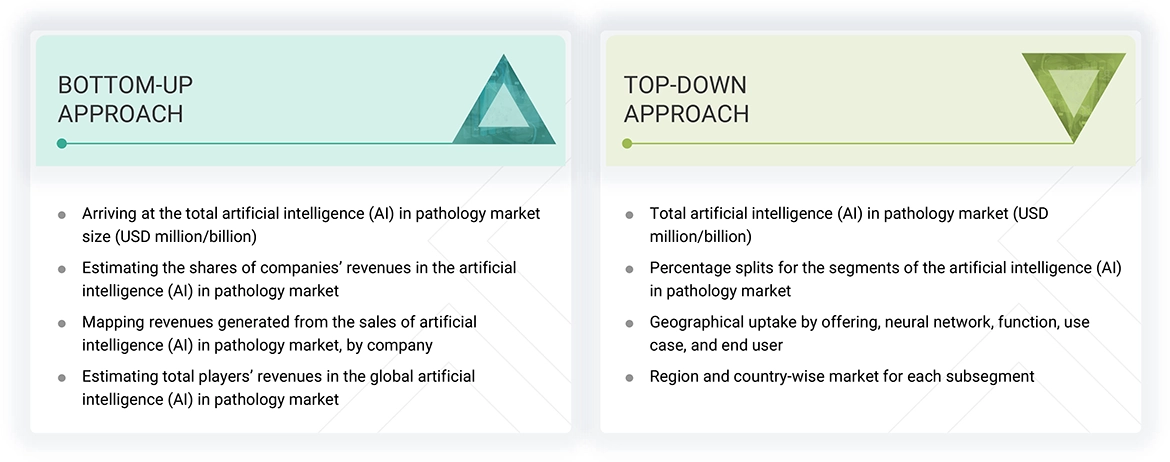

The total size of the AI in pathology market was determined after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

The size of the AI in pathology market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

- Revenues for individual companies were gathered from public sources and databases.

- Shares of leading players were gathered from secondary sources to the extent available. In certain cases, shares of AI in pathology businesses have been ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

- The total revenue in the AI in pathology market was determined by extrapolating the market share data of major companies.

Market Definition

The AI in pathology market refers to the commercial space where companies develop, market, and provide products and services that incorporate artificial intelligence technologies specifically designed for pathology applications. This market leverages AI algorithms, machine learning techniques, and advanced computational tools to enhance and automate various aspects of the pathology workflow.

Stakeholders

- Pathologists

- Suppliers and Distributors of Digital Pathology Equipment

- AI System and Solution Providers

- Medical Research and Biopharmaceutical Companies

- Pharmaceutical Companies and CROs

- Hospitals and Clinics

- Laboratories

- Regulatory Bodies

- Academic and Medical Research Institutes

- Universities and Research Organizations

- Forums, Alliances, and Associations

- Technology Providers

- Healthcare Payers

Report Objectives

- To define, describe, and forecast the AI in pathology market by offering, neural network, function, use case, end user, and region

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies in the AI in pathology market

- To benchmark players operating in the AI in pathology market using the Competitive Leadership Mapping framework, which analyzes key market players and start-ups on various parameters within the broad categories of market share/rank and product/service footprint

- To track and analyze competitive developments such as product launches, expansions, agreements, partnerships, collaborations, product approvals, investments, and acquisitions to strengthen their market presence in the AI in pathology market.

Frequently Asked Questions (FAQ)

Which are the top industry players in the global AI in pathology market?

Koninklijke Philips N.V. (Netherlands), F. www Hoffmann-La Roche Ltd (Switzerland), Hologic, Inc. (US), Akoya Biosciences, Inc. (US), Aiforia Technologies Plc (Finland), Indica Labs Inc. (US), OptraScan (US), Ibex Medical Analytics Ltd. (Israel), Mindpeak GmbH (Germany), Tribun Health (France), Techcyte, Inc. (US), Deep Bio Inc. (Korea), Lumea Inc. (US), Visiopharm (Denmark), aetherAl (Taiwan), Aiosyn (Netherlands), Paige Al, Inc. (US), Proscia Inc. (US), PathAl, Inc. (US), Tempus Labs, Inc. (US), Konfoong Biotech International Co., Ltd. (China), DoMore Diagnostics AS (Norway), Verily Life Sciences, LLC (US), deepPath (US), and 4D Path Inc (US) are the top industry players.

Which offerings have been included in the AI in pathology market report?

This report contains the following AI in pathology offerings:

- End-to-end Solutions

- Niche Point Solutions

- Technology

-

Hardware

- Scanners

- Microscopes

- Storage Systems

Which geographical region dominated the global AI in pathology market in 2024?

North America held the largest market share in 2024.

Which end-user segments have been included in the AI in pathology market report?

The report contains the following end-user segments:

- Pharmaceutical & Biopharmaceutical Companies

- Hospitals & Reference Laboratories

- Academic & Research Institutes

What is the total CAGR expected to be recorded for the AI in pathology market during 2025–2030?

The CAGR is expected to record a CAGR of 26.5 % from 2025-2030

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI in Pathology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI in Pathology Market