AI in Precision Medicine Market: Growth, Size, Share, and Trends

AI in Precision Medicine Market by Application (Drug Discovery, Screening, Diagnosis, Stratification, Staging, Prognosis, Therapy Selection, Monitoring, Risk Management), Indication (Cancer, CNS, CVS), Tools (ML, NLP), & End User -Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI in precision medicine market is projected to reach USD 3.92 billion by 2030 from USD 0.79 billion in 2024, at a CAGR of 30.7% from 2024 to 2030. The growth of the AI in precision medicine market is driven by rapid advancements in machine learning algorithms, increasing availability of large-scale genomic and clinical datasets, and rising demand for personalized therapies that improve treatment accuracy and patient outcomes. Additionally, expanding partnerships among healthcare providers, tech companies, and pharmaceutical firms are accelerating AI adoption across clinical workflows.

KEY TAKEAWAYS

-

By RegionThe North America AI in precision medicine market accounted for a 41.1% revenue share in 2023.

-

By ApplicationBy application, the therapeutics segment is expected to register the highest CAGR of 32.0%.

-

By Therapeutic AreaBy therapeutic area, the oncology segment is projected to grow at the fastest rate from 2024 to 2030

-

By ComponentBy component, the software segment is expected to dominate the market.

-

By ToolBy tool, the machine learning segment accounted for the largest share of AI in precision medicine market.

-

By DeploymentBy deployment, the cloud-based model segment is expected to dominate the market in 2030, growing at the highest CAGR of 32.4%.

-

By End UserBy end user, the healthcare providers segment accounted for the largest share in 2023.

-

Competitive Landscape - Key PlayersNVIDIA Corporation, Tempus Al, Inc., and Illumina, Inc. were identified as some of the star players in the AI in precision medicine market (global), given their strong market share and product footprint.

-

Competitive Landscape - StartupsPredictive Oncology, Paige AI, Inc., and Densitas Inc., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The AI in precision medicine market is experiencing strong growth as healthcare organizations increasingly use advanced algorithms to improve disease prediction, personalize treatment plans, and accelerate biomarker discovery. AI and machine learning platforms are enhancing diagnostic accuracy, integrating multi-omic data, and supporting real-time clinical decision-making across care pathways. Additionally, rising investment in targeted therapeutics, expanding use of genomic profiling, and growing collaborations between biopharma companies and technology providers are driving wider adoption of intelligent solutions to advance treatment precision and patient outcomes.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business in the AI in Precision Medicine market is driven by rising expectations for more personalized, data-centric healthcare that enhances diagnostic accuracy and therapeutic outcomes. Healthcare providers, genomic labs, and biopharma companies are the primary end users, and their growing need for automated data analysis, predictive modeling, and AI-enabled decision-support tools directly shapes market adoption. Increasing use of multi-omic profiling, real-time analytics, and targeted treatment development significantly strengthens operational efficiency and overall performance for AI-based precision medicine solution providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing investments in R&D and rising demand for personalized medication

-

Advancements in genomic research and data availability

Level

-

Increasing data breach concerns

-

High cost of implementation of precision medicine solutions

Level

-

Role of predictive analytics in advancing AI for healthcare

-

Leveraging research pipelines and new drug development for AI in healthcare

Level

-

Impact of fairness and bias on AI in healthcare

-

Interoperability challenges due to complexity of AI solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing investments in R&D and rising demand for personalized medication

Rising investments in R&D and the growing demand for personalized medication are major drivers of the AI in precision medicine market. Pharmaceutical companies continue to strengthen innovation, with the 20 largest global firms investing USD 145 billion in R&D in 2023, a 4.5% increase from the previous year. Although average drug development costs remain high at USD 2.3 billion, the declining forecast for peak sales is motivating companies to adopt AI tools that improve efficiency and enhance therapeutic precision. As personalized treatments gain traction, AI-enabled platforms are becoming essential for optimizing clinical insights and accelerating targeted drug development.

Restraint: Increasing data breach concerns

Growing concerns around data breaches act as a significant restraint on the AI in precision medicine market. As precision medicine relies heavily on large volumes of genomic, clinical, and personal health data, the risk of unauthorized access, misuse, or cyberattacks poses a major challenge for healthcare organizations. High-profile breaches erode patient trust and make institutions more cautious about adopting advanced AI systems that require sensitive data integration. Additionally, evolving privacy regulations and the need for robust cybersecurity measures increase operational complexity and costs, slowing the pace of AI deployment across precision medicine applications.

Opportunity: Role of predictive analytics in advancing AI for healthcare

The growing role of predictive analytics presents a strong opportunity for advancing AI in the precision medicine market. By leveraging machine learning models capable of analyzing genomic, clinical, lifestyle, and environmental data, predictive analytics enables earlier disease detection, more accurate risk stratification, and targeted therapy selection. This supports healthcare providers in delivering highly personalized care while improving outcomes and reducing treatment costs. As health systems increasingly adopt data-driven frameworks, the demand for AI tools that offer precise prognostic insights continues to rise, creating substantial opportunities for technology developers to expand innovative precision medicine solutions.

Challenge: Impact of fairness and bias on AI in healthcare

Fairness and bias remain major challenges for AI in precision medicine, as uneven representation in training datasets can lead to inaccurate predictions and gaps in care for underrepresented populations. Limited diversity in genomic and clinical data increases the risk of skewed algorithms that undermine treatment equity and reduce trust among patients and clinicians. Addressing these issues requires transparent model development, ongoing validation, and the inclusion of diverse datasets, adding complexity and slowing the deployment of AI-driven precision medicine solutions.

AI IN PRECISION MEDICINE MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AI computing platforms enabling large-scale genomic analysis, multimodal data processing, digital twins, and predictive modeling for personalized care. | Faster interpretation of complex biological data, improved treatment predictions, and enhanced ability to tailor therapies to individual patients. |

|

AI-driven precision oncology and clinical data platforms integrating genomic sequencing, molecular profiling, and real-world evidence. | More accurate patient stratification, optimized therapy selection, and higher likelihood of successful treatment outcomes. |

|

AI-enhanced genomic sequencing and interpretation solutions supporting personalized diagnostics and targeted therapy development. | Improved genomic variant detection, faster diagnosis, and more effective use of personalized treatment plans. |

|

AI-driven drug design and patient-specific therapy modeling using deep learning and multimodal biological data. | Accelerated discovery of tailored therapeutics, improved prediction of patient response, and enhanced precision in treatment development. |

|

Advanced AI and deep learning models for medical imaging, genomics, and predictive analytics supporting precision medicine initiatives. | Earlier detection of diseases, more accurate diagnostic predictions, and improved personalization of care using large-scale data insights. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI in precision medicine market ecosystem includes key players such as Nvidia Corporation, Tempus AI, Inc., and Illumina, Inc., which deliver advanced platforms for genomic analysis, clinical decision support, and AI-enabled predictive modeling. These technologies improve diagnostic accuracy, streamline data interpretation, and support personalized treatment planning. Cloud and big data partners enhance scalability and real-time insights, while healthcare providers, genomic labs, and biopharma companies depend on these solutions to advance targeted therapies. Growing cross-industry collaboration continues to strengthen innovation in precision medicine.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI in Precision Medicine Market, By Application

Based on application, the drug discovery and development segment holds the largest share of the AI in precision medicine market in 2023. The growth of this segment is attributed to the rising use of AI algorithms to accelerate target identification, optimize molecular design, and predict drug efficacy with greater accuracy. AI-enabled platforms significantly reduce development timelines and costs by streamlining compound screening and improving decision-making in early research stages. Additionally, the integration of multi-omic datasets enhances the precision of therapeutic discovery, driving broader adoption of AI in drug development pipelines.

AI in Precision Medicine Market, By Therapeutic Area

In 2023, the oncology segment accounted for the largest share of the AI in precision medicine market. This dominance is driven by the high prevalence of cancer, growing use of genomic profiling, and increasing adoption of AI tools that enhance tumor characterization and treatment selection. AI-powered platforms help identify actionable mutations, predict therapy response, and support clinicians in designing personalized oncology treatment plans. Additionally, the rapid expansion of biomarker-based drug development and rising investment in cancer research continue to strengthen the role of AI in advancing precision oncology.

AI in Precision Medicine Market, By Component

In 2023, software segment accounted for the largest share of the AI in precision medicine market. This is largely due to the growing demand for advanced AI platforms that support genomic analysis, predictive modeling, and clinical decision support across healthcare settings. Software solutions enable seamless integration of large, complex datasets and provide real-time insights that enhance diagnostic accuracy and personalized treatment planning. Additionally, continuous innovation in machine learning algorithms and increasing adoption of cloud-based tools further strengthen the dominance of software in the precision medicine landscape.

AI in Precision Medicine Market, By Tool

By tool, the machine learning segment accounted for the largest share of the AI in precision medicine market due to its powerful ability to analyze complex genomic, clinical, and imaging data with high accuracy. Machine learning models support disease prediction, biomarker identification, treatment optimization, and patient stratification, making them essential across precision medicine workflows. Their adaptability and continuous learning capabilities further enhance clinical insights, driving widespread adoption among healthcare providers, biotech companies, and research institutions.

AI in Precision Medicine Market, By Deployment

By deployment, the cloud-based model segment is expected to dominate the market, growing at the highest CAGR during the forecast period due to its ability to store and process large genomic and clinical datasets efficiently. Cloud platforms offer greater scalability, easier integration with AI tools, and faster data access for real-time analytics. Additionally, their cost-effectiveness and flexibility support broader adoption among healthcare providers, research labs, and biopharma companies working to advance precision medicine applications.

AI in Precision Medicine Market, By End User

By end user, the healthcare providers segment accounted for the largest share in 2023, driven by the rapid integration of AI tools into clinical workflows to enhance diagnosis, treatment planning, and patient management. Hospitals and clinics increasingly rely on AI-powered platforms to interpret genomic data, support clinical decision-making, and personalize therapies. The need for improved care outcomes, reduced diagnostic errors, and streamlined operations further supports widespread adoption of precision medicine solutions among healthcare providers.

REGION

North America to be fastest-growing region in global AI in Precision Medicine market during forecast period

The North American AI in precision medicine market is expected to register the highest CAGR during the forecast period, supported by strong advancements in genomic research and rapid adoption of AI-driven diagnostics and treatment tools across the US and Canada. Healthcare providers, biopharma companies, and genomic labs increasingly rely on AI for disease prediction, therapy optimization, and multi-omic data analysis. Rising R&D investments and favorable regulatory frameworks further accelerate adoption, while the region’s expanding focus on personalized care continues to drive market growth.

AI IN PRECISION MEDICINE MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

In the AI in precision medicine market matrix, Nvidia Corporation (Star) holds a leading position with its powerful AI computing platforms and deep learning frameworks that accelerate genomic analysis, predictive modeling, and personalized treatment development. Its strong ecosystem of healthcare partnerships and advanced GPU-powered capabilities reinforces its market dominance. Microsoft Corporation (Emerging Leader) is rapidly gaining traction through its cloud-based AI solutions that support multi-omic data integration, clinical decision support, and scalable precision medicine workflows, positioning it as a key innovator driving next-generation healthcare intelligence.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- NVIDIA Corporation (US)

- Google, Inc. (US)

- Microsoft (US)

- IBM (US)

- Illumina, Inc. (US)

- Exscientia (UK)

- Insilico Medicine (US)

- GE Healthcare (US)

- Tempus AI, Inc. (US)

- Siemens Healthiness AG (Germany)

- Bio Xcel Therapeutics, Inc. (US)

- Benevolent AI (UK)

- PathAI, Inc. (US)

- Guardant Health (US)

- GRAIL, Inc. (US)

- FOUNDATION MEDICINE, INC. (US)

- FLATIRON HEALTH (US)

- Proscia Inc. (US)

- DEEP GENOMICS. (Canada)

- Verge Genomics (US)

- Predictive Oncology (US)

- Paige AI, Inc. (US)

- Densities Inc. (Canada)

- Zephyr AI (US)

- Iktos (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 0.60 Billion |

| Market Forecast in 2030 (Value) | USD 3.92 Billion |

| Growth Rate | CAGR of 30.7% from 2024-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: AI IN PRECISION MEDICINE MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Mapping | Profiles of leading AI-driven precision medicine vendors (e.g., Tempus, Foundation Medicine, IBM Watson Health, Sophia Genetics) covering genomics analytics, clinical decision support, and multi-omics integration capabilities. | Supports competitive benchmarking, highlights differentiation opportunities, and informs partnership/M&A strategies. |

| Market Entry & Growth Strategy | Regional analysis of genomics adoption, precision oncology programs, digital health readiness, reimbursement trends, and ecosystem maturity. | Reduces entry risk, guides prioritization of high-value markets and therapeutic areas, and supports strategic expansion. |

| Regulatory & Operational Risk Analysis | Review of FDA/EMA regulations for AI/ML-based diagnostics, genomic data standards, model validation, and compliance with HIPAA/GDPR for sensitive patient data. | Ensures regulatory alignment, mitigates data-privacy risks, and boosts trust among healthcare providers and payers. |

| Technology Adoption Trends | Insights into adoption of AI for genomics interpretation, biomarker discovery, patient stratification, predictive treatment selection, and integration with EHR/clinical workflows. | Shapes product roadmap, strengthens market positioning, and enables targeted investment in high-impact precision medicine capabilities. |

RECENT DEVELOPMENTS

- August 2024 : NVIDIA Corporation launched NVIDIA NIM Agent Blueprints. It is a catalog of pretrained, customizable Al workflows that equip enterprise developers with software for building and deploying generative Al applications for use cases, such as drug discovery and virtual screening, and precision medicine.

- July 2024 : Exscientia expanded its collaboration with Amazon Web Services, Inc. by utilizing AWS's Al and ML services to enhance its end-to-end drug discovery including precision medicine and automation platform.

- April 2024 : Tempus launched, Tempus Next is designed to accelerate the adoption of precision medicine and improve patient outcomes. The solution integrates smoothly with EMRs to analyze a wide range of data including clinical notes, molecular data, and imaging to identify deviations from care guidelines

Table of Contents

Methodology

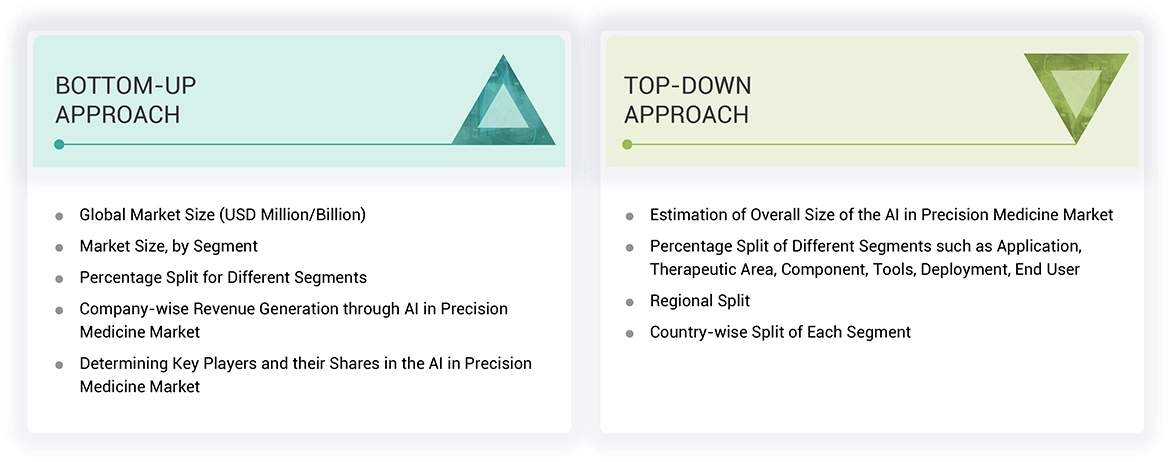

The study involved significant activities to estimate the current size of the AI in precision medicine market. Exhaustive secondary research was done to collect information on the AI in precision medicine market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the AI in precision medicine market.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for the companies offering AI in precision medicine solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Various secondary sources were referred to in the secondary research process to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of AI in precision medicine vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the AI in precision medicine market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of AI in precision medicine solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

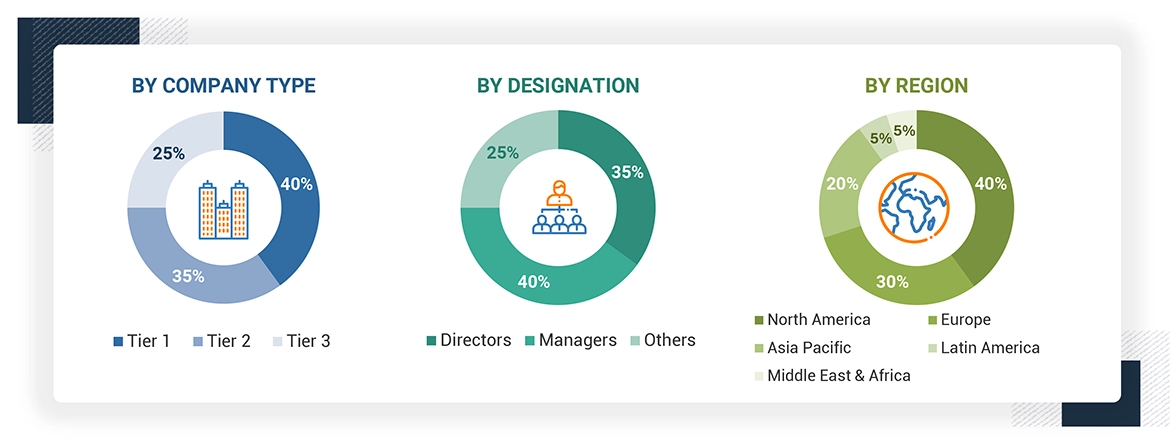

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined based on their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AI in precision medicine market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The AI in precision medicine market utilises AI technologies such as machine learning and natural language processing to analyse complicated biological and clinical data in order to provide possibly personalised healthcare solutions. It promotes applications such as drug discovery, diagnostics, predictive analytics, and tailored treatment plans by integrating genomics, proteomics, and real-world data using AI capabilities with the goal of improving patient outcomes and accelerating innovation benefits for stakeholders ranging from pharmaceutical companies and healthcare providers to researchers.

Stakeholders

- Transfection products manufacturing companies

- Pharmaceutical & Biopharmaceutical Companies

- Chemical Companies

- Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Contract Development and Manufacturing Organizations (CDMOs)

- Research Institutes and Universities

- Venture Capitalists & Investors

- Government Associations

Report Objectives

- To define, describe, and forecast the AI in precision medicine market based on application, therapeutic area, component, tools, deployment, end user, and region.

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players and comprehensively analyze their market sizes and core competencies.

- To track and analyze competitive developments such as acquisitions, collaborations, agreements, mergers, product launches & updates, partnerships, expansions, and other recent developments in the market globally.

Key Questions Addressed by the Report

- Healthcare providers

- Pharmaceutical & biotechnology companies

- Medical device/equipment companies

- Research centers, academic institutes, and government organizations

- Others

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI in Precision Medicine Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI in Precision Medicine Market