AI in Sports Market

AI in Sports Market by Solutions (Performance Analytics, Player Monitoring, Broadcast Management), Technology (Generative AI and Other AI), and End User (Sports Associations, Sports Teams) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI in Sports market is projected to grow from USD 1.03 billion in 2024 to USD 2.61 billion by 2030 at a compound annual growth rate (CAGR) of 16.7% from 2024 to 2030. The AI in Sports market is revolutionizing the way sports are played, managed, and experienced by integrating advanced technologies like generative AI and predictive analytics. AI-powered performance analytics is transforming athlete monitoring and game strategies, enabling teams to optimize coaching techniques and improve player performance.

KEY TAKEAWAYS

-

BY OFFERINGAI in sports is transforming the industry by enhancing player performance, optimizing game strategies, boosting fan engagement, and streamlining operations. Tools like Second Spectrum and Hudl deliver real-time performance insights and tactical adjustments, while systems from Catapult Sports monitor player health and fitness to reduce injury risks.

-

BY TYPEAI technologies are revolutionizing the sports industry through advancements in generative AI and other technologies like machine learning, natural language processing (NLP), computer vision, and predictive analytics. Generative AI drives innovation in game content creation, player training simulations, and fan engagement.

-

BY SPORTS TYPEAI is revolutionizing sports by enhancing performance, strategy, and fan engagement across individual, team, and e-sports. AI has become a driver of innovation in sports, improving athletic performance, team coordination, and the overall spectator experience.

-

BY END USEIn the sports industry, AI is leveraged by various end users, each utilizing the technology for distinct purposes. Sports associations such as FIFA, the International Olympic Committee (IOC), and the National Basketball Association (NBA) utilize AI to improve operational efficiency, enhance decision-making, and ensure fairness in gameplay.

-

BY REGIONAsia Pacific is expected to grow the fastest, with a CAGR of 21.1%, fueled by the countries in the region increasingly leverage AI technologies across sports for various applications, such as enhancing player performance, improving fan engagement, and optimizing operational efficiencies. The region’s burgeoning sports ecosystem, combined with the growth of digital technologies, is driving the adoption of AI, with governments, sports organizations, and tech companies working to foster innovation.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships, collaborations, and investments. For instance, in September 2024, IBM partnered with ESPN to bring AI-powered insights to the Fantasy Football platform, leveraging IBM Watson to provide personalized recommendations, real-time player analysis, and enhanced user experiences for fantasy football enthusiasts.

The AI in Sports market is being driven by a combination of technological advancements and growing industry needs. The explosion of data from wearables, sensors, and smart equipment is fueling demand for advanced analytics, while improvements in machine learning and computer vision enable precise performance tracking, injury prediction, and tactical decision-making. Teams and coaches are increasingly relying on real-time insights to optimize player health, training loads, and in-game strategies, while broadcasters and media companies leverage AI for automated highlight generation, immersive content, and personalized fan experiences.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

AI is rapidly transforming the sports industry, driving significant disruptions and opportunities for businesses. Advanced machine learning and predictive analytics are enhancing athlete performance and preventing injuries by analyzing data from wearables and sensors, enabling timely interventions and reducing downtime. Simultaneously, AI is personalizing fan engagement through tailored content, merchandise recommendations, and customized viewing experiences, boosting loyalty and creating new revenue streams. Coaches and analysts are leveraging AI for tactical insights, optimizing strategies through data-driven decision-making, while broadcasters are using AI to deliver real-time highlights, augmented reality overlays, and enriched viewing experiences. However, the widespread adoption of AI also raises ethical and regulatory challenges around data privacy, fairness, and transparency, requiring sports organizations to establish clear guidelines.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Enhanced player performance analytics driving competitive advantage

-

Growth of AI in sports driven by increasing availability of data

Level

-

High implementation costs limiting widespread adoption

-

Data privacy concerns hindering trust in AI solutions

Level

-

AI-driven personalization unlocking new revenue streams in fan experiences

-

Significant opportunity for expanding AI in sports training, scouting, and performance enhancement

Level

-

Complexity in integrating AI with existing sports infrastructure

-

Shortage of skilled professionals hindering AI integration in sports

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth of AI in sports driven by increasing availability of data

The growth of AI in sports is largely fueled by the increasing availability of data. With advancements in technology, large volumes of data are now accessible through various channels, such as wearable devices, performance tracking systems, and fan engagement platforms. This data provides teams and organizations with valuable insights that can enhance player performance, refine strategies, and predict injuries. For instance, the NBA (National Basketball Association) leverages player tracking systems to assess movement and performance, while wearable devices like those from Catapult Sports monitor players' health metrics to guide training and injury prevention. As the volume of data continues to expand, AI systems are becoming more precise, enhancing decision-making and operational efficiency.

Restraint: High Cost of Implementing AI Solutions in Sports is Restricting Their Adoption

One major restraint to the widespread adoption of AI in sports is the high cost associated with implementing and maintaining these systems. AI-driven solutions, including injury prediction models and performance optimization tools, often require substantial investments in technology infrastructure, specialized software, and hardware. Additionally, the need for skilled professionals to manage these systems increases operational costs. These financial burdens can be prohibitive for smaller organizations or those with limited resources. Consequently, the cost of adoption remains a significant barrier for many sports organizations, limiting their ability to integrate AI technologies effectively.

Opportunity: Significant Opportunity for Expanding AI in Sports Training, Scouting, and Performance Enhancement

The integration of AI in sports presents a significant opportunity for growth, particularly in areas such as training, player performance optimization, and talent scouting. AI-driven tools can offer personalized insights that help coaches and teams refine training regimens tailored to individual players. Additionally, AI systems play a crucial role in scouting by assessing players’ potential and identifying the best team fits based on performance data. For example, AI platforms such as IBM’s Watsonx are used to evaluate players' statistics and match them with team needs. The opportunity for further growth lies in AI's ability to evolve continuously, providing deeper insights into player performance, predicting injury risks, and optimizing overall team strategies, which can be a game-changer for sports organizations aiming to stay competitive.

Challenge: Shortage of Skilled Professionals is Hindering AI Integration in Sports

A key challenge in the integration of AI in sports is the shortage of professionals who have both technical expertise in AI and a deep understanding of sports. AI-driven systems, such as those used for performance tracking, injury prediction, and game strategy, require specialists who can navigate the complexities of both fields. However, there is a limited supply of professionals with this dual expertise, which can impede the implementation of AI technologies. This skill gap poses a significant challenge for sports organizations, making it difficult to realize the potential of AI tools fully. Bridging this gap is essential for the continued growth and innovation in AI-powered sports applications.

AI in Sports Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Catapult is an Australian sports analytics company founded in 1999 through collaboration with the Australian Institute of Sport (AIS) and the Australian Cooperative Research Centres (CRC) Program. The company specializes in wearable technology to monitor and measure athletes’ performance in real time. FIFA needed to approve Catapult's wearable tracking devices for use in live games. | Gained global recognition and expanded its reach to over 500 sports teams. Strengthened its brand by securing partnerships with major football teams in the 2018 FIFA World Cup. Increased its market value by around USD 200 million. |

|

Orlando Magic is a professional basketball team based in Orlando, Florida, competing in the NBA. The team is committed to enhancing fan experiences in the arena and through digital channels. Orlando Magic also aims to optimize operational efficiency and increase profitability across its business operations. The team needed to improve fan engagement by delivering personalized and real-time experiences during games and beyond. | Enhanced fan engagement with tailored experiences, improving satisfaction and loyalty. Increased ticket sales and revenue through data-driven pricing and promotions. Streamlined operations and decision-making processes with real-time insights. Improved ability to measure and predict fan behaviors, creating more personalized marketing opportunities |

|

Vodafone is a global telecommunications company that provides mobile and broadband services, with operations in over 20 countries. The company sought to enhance its sports content offerings through AI-driven insights. | Vodafone integrated Stats Perform’s AI technology, enabling real-time data analysis and predictive insights. This improved match engagement by delivering dynamic, tailored content to viewers and attracted six months' worth of users in just one week. Increased engagement through customized match insights. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI in sports market ecosystem comprises various solutions and service providers along with various regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include GlobalStep (US), IBM (US), Intel (US), Microsoft (US), AWS (US), and SAP SE (Germany).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI in Sports Market, By Offering

AI in sports is transforming the industry by enhancing player performance, optimizing game strategies, boosting fan engagement, and streamlining operations. Tools like Second Spectrum and Hudl deliver real-time performance insights and tactical adjustments, while systems from Catapult Sports monitor player health and fitness to reduce injury risks. AI solutions such as IBM Watson personalize fan experiences with interactive stats, and broadcast platforms automate content delivery to improve viewer engagement. Additionally, AI supports ticket pricing, sponsorship analytics, and talent scouting, enabling smarter decision-making. Complementary services, including consulting, system integration, maintenance, and outsourced management, ensure seamless adoption and effective use of AI technologies. Together, these solutions and services are revolutionizing sports by driving efficiency, improving strategy, and elevating the overall fan experience.

AI in Sports Market, By Type

AI technologies are revolutionizing the sports industry through advancements in generative AI and other technologies like machine learning, natural language processing (NLP), computer vision, and predictive analytics. Generative AI drives innovation in game content creation, player training simulations, and fan engagement. For instance, AI models like ChatGPT and DALL·E are being adapted to create personalized fan experiences. At the same time, advanced training simulations mimic real-game scenarios for athletes to refine their skills. In machine learning, predictive models analyze vast amounts of player and game data to uncover patterns, optimize strategies, and forecast outcomes. NLP tools enhance communication and fan interaction by providing real-time multilingual commentary and automated match summaries. Similarly, computer vision enables precise tracking of player movements, ball trajectories, and referee decisions, as seen in sports like tennis with Hawk-Eye systems or in soccer with VAR technology. Predictive analytics enhances decision-making for coaches and management by forecasting injury risks, game results, and player performance based on historical data.

AI in Sports Market, By Sports Type

AI is revolutionizing sports by enhancing performance, strategy, and fan engagement across individual, team, and e-sports. In athletics, wearables monitor biomechanics for optimized training, while tools like Hawk-Eye in tennis and telemetry in motorsports refine strategies and performance. In boxing, AI analyzes sparring sessions to identify weaknesses and improve techniques. Team sports such as cricket, soccer, basketball, and hockey leverage AI for player monitoring, tactical adjustments, and performance analytics, with cricket and soccer teams using AI for real-time game strategies, basketball teams applying AI-powered video analysis for shooting and defense, and hockey employing wearables to track fatigue and prevent injuries. In e-sports, AI enhances gameplay analysis, predicts outcomes, and enriches fan experiences through interactive dashboards and live insights. Collectively, AI has become a driver of innovation in sports, improving athletic performance, team coordination, and the overall spectator experience.

AI in Sports Market, By End Use

In the sports industry, AI is leveraged by various end users, each utilizing the technology for distinct purposes. Sports associations such as FIFA, the International Olympic Committee (IOC), and the National Basketball Association (NBA) utilize AI to improve operational efficiency, enhance decision-making, and ensure fairness in gameplay. For instance, FIFA uses AI for video assistant referee (VAR) technology to analyze real-time footage, aiding in accurate decision-making during critical moments of matches. Similarly, sports teams at both professional and grassroots levels use AI-driven tools for performance monitoring, injury prediction, and recruitment strategies. Premier League clubs like Manchester City employ AI-powered platforms to analyze player statistics and optimize training regimens, while smaller teams use data analytics to scout potential talent more effectively. Sports media & broadcasting companies, such as ESPN and NBC Sports, leverage AI to enhance the fan experience by providing instant replays, generating highlights, and even predicting match outcomes, making broadcasts more interactive. AI also helps deliver personalized content, allowing fans to engage with their preferred teams, players, and events.

REGION

North America is estimated to account for the largest market share during the forecast period

North America holds the largest share in the AI-driven sports industry, fueled by technological advancements and a strong focus on data-driven decision-making. The region benefits from a well-established technological infrastructure and increasing demand for real-time analytics in player performance, fan engagement, and operational efficiency. In the US, major sports leagues such as the NFL, NBA, and MLB are pioneering the use of AI to enhance game strategies and transform fan experiences. Canada is leveraging AI to improve athlete training and foster grassroots sports development. Prominent companies like IBM, Microsoft, and Oracle dominate the market with offerings that include predictive analytics, automated broadcasting, and immersive fan engagement solutions. Despite its growth, challenges such as high implementation costs and data privacy concerns pose obstacles. Ongoing collaborations and technological advancements are expected to drive further innovation in the region.

AI in Sports Market: COMPANY EVALUATION MATRIX

In the AI in sports market, the competitive landscape is defined by the high-growth trend toward data-driven performance optimization and immersive fan experiences. Microsoft (Star) secures its leadership position by pioneering cloud-based AI solutions, such as Azure AI and Copilot, which are transforming athlete training and spectator engagement by automating complex tasks such as real-time game analysis and personalized content delivery for major leagues, including the NFL and Premier League. Conversely, Intel (Emerging Leader) is gaining momentum with its hardware-accelerated AI platforms, focusing on enabling edge computing for accessible sports analytics. Intel powers innovative "talent scouting" applications and Olympic broadcast enhancements, leveraging its processor technologies and partnerships to provide the scalable computational backbone necessary for the entire ecosystem's advancement.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.03 Billion |

| Market Forecast in 2030 (value) | USD 2.61 Billion |

| Growth Rate | CAGR of 16.7% from 2024 to 2030 |

| Years Considered | 2019–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By offering, type, sports type, end user, and region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: AI in Sports Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) |

|

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- November 2024 : IBM partnered with UFC to launch AI-powered solutions, utilizing IBM Watson for real-time athlete performance analysis. This collaboration enhances fan engagement by providing personalized experiences, including tailored content and insights, to improve athlete training and fan interaction during UFC events.

- May 2024 : Intel introduced AI solutions for the Paris 2024 Olympics to enhance athlete performance, optimize training, and boost fan engagement. The technology provides real-time performance data for coaches to improve training and reduce injuries while offering fans personalized content and immersive experiences.

- March 2024 : AWS and DFL expanded their partnership to implement AI-driven solutions in football analytics. This collaboration enhances player performance analysis, team strategies, and match predictions through AI tools like machine learning and data analytics. It also aims to improve fan engagement with real-time data, while aiding in injury prevention and optimizing overall game tactics.

Table of Contents

Methodology

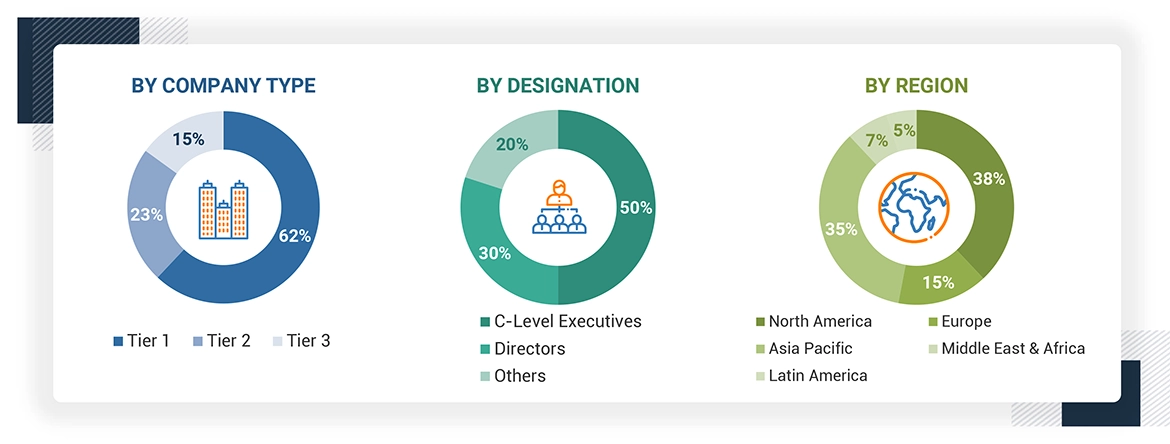

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the AI in Sports market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and associations, such as Artificial Intelligence in Sport Programme 2024, AI for Sport Conference 2nd Edition, were also referred to. Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the AI in Sports market. The primary sources from the demand side included AI in Sports end users, consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

*Others include sales managers, marketing managers, and product managers.

Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies ‘revenue ranges between

USD 500 million to 1 billion; and Tier 3 companies’ revenue ranges in between USD 100 million

and USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

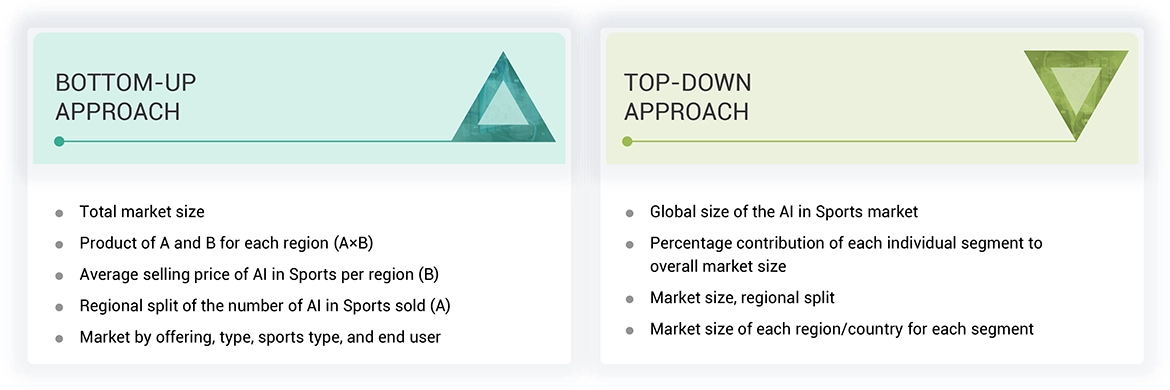

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the AI in Sports market. The first approach involves estimating market size by summing up the revenue companies generate by selling AI solutions for Sports.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

AI in Sports Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

AI in Sports refers to the integration and application of artificial intelligence technologies to enhance various aspects of the sports industry. This includes improving athletic performance, optimizing game strategies, enriching fan experiences, and managing operations efficiently. AI-powered solutions in sports leverage data analytics, machine learning, computer vision, and natural language processing to analyze vast amounts of data and deliver actionable insights.

Additionally, AI automates broadcasting, generates real-time analytics, and improves operations such as ticketing, crowd management, and scheduling, transforming the way sports are played, managed, and consumed.

Stakeholders

- Sports Teams and Athletes

- Coaches and Managers

- Sports Data Providers

- Technology Providers

- Sports Broadcast Networks

- Sports Organizations

- Fans and Consumers

- Sponsors and Advertisers

- Health and Fitness Professionals

- Sports Medicine Specialists

- Sports Analytics Firms

- Sports Betting Companies

- Media and Content Creators

- Equipment Manufacturers

- Regulatory Bodies

- Esports Organizations

- Academic Institutions and Researchers

- AI Startups and Innovators

Report Objectives

- To determine, segment, and forecast the AI in Sports market based on offering (solutions and services), technology (Generative AI and Other AI), sport type (Individual Sports, Team Sports, E-Sports), end user (Sports Associations, Sports Teams, Sports Media and Broadcasting,and Other), and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI in Sports Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI in Sports Market