AI in Telehealth & Telemedicine Market: Growth, Size, Share, and Trends

AI in Telehealth & Telemedicine Market by Component (Software, Service), Function (Virtual Care, Chatbot, RPM, Admin, Patient Engagement), Application (Teleneurology, TeleICU, Teleradiology), End User (Provider, Payer, Patient) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI in telehealth and telemedicine market size is projected to reach USD 27.14 billion by 2030 from USD 6.17 billion in 2025, at a CAGR of 36.4% during the forecast period. The market has experienced significant growth primarily driven by the growing geriatric and medically underserved (predominantly rural) population, the increasing prevalence of chronic conditions, the shortage of physicians and care personnel, advancements in telecommunication technologies, and the expansion of RPM systems.

KEY TAKEAWAYS

- North America is estimated to dominate the AI in telehealth & telemedicine market with a share of 50.4% in 2024.

- By component, the software segment accounted for a share of 70.4% in terms of value in 2024.

- By function, the remote patient monitoring segment is projected to grow at a CAGR of 38.4% during the forecast period.

- By application, the primary care segment is expected to hold the largest shar for the AI in telehealth & telemedicine market in 2024.

- By end user, the healthcare providers segment accounted for the largest market size in 2024.

- Medtronic, GE Healthcare, Oracle, and Koninklijke Philips N.V. were identified as Star players in the AI in telehealth & telemedicine market, given their broad industry coverage and strong operational & financial strength.

- K Health, Andor Health, and BioIntelliSense, Inc. have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolio

The AI in telehealth & telemedicine market is projected to reach USD 27.14 billion by 2030 from USD 4.22 billion in 2024, at a CAGR of 36.4% from 2024 to 2030

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the AI in telehealth and telemedicine market, the impact on consumers’ businesses results from evolving customer trends and technological disruptions. Hot prospects include healthcare providers, payers, and enterprises that are adopting AI-enabled telehealth platforms. Target applications encompass virtual care delivery, remote patient monitoring (RPM), AI-driven diagnostics, clinical decision support, and workflow automation tools. Shifts such as AI integration, cloud-based telehealth expansion, evolving reimbursement policies, interoperability requirements, and the transition toward value-based care models influence the revenues of end users like hospitals, clinics, and home care providers. These changes in end-user revenues directly affect the revenue of hot prospects, ultimately impacting the performance of AI in telehealth and telemedicine vendors such as GE Healthcare, Epic Systems, Medtronic, Oracle, and Philips.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing adoption of virtual assistant chatbots

-

Rising popularity of e-prescriptions

Level

-

Regulatory variations across regions

-

Lack of advanced telemedicine infrastructure in emerging economies

Level

-

Growing popularity of virtual healthcare solutions

-

Emergence of AI and ML.

Level

-

Increasing data breaches and medical identity theft cases

-

Complexities of big data in healthcare

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing adoption of virtual assistant chatbots

The adoption of virtual assistant chatbots for Al-based telemedicine solutions has a significant share due to an increased demand for accessible healthcare and operational efficiency. Chatbots in telemedicine leverage Al technologies such as NLP and ML to provide personalized and efficient healthcare services. They offer 24/7 support, answering patient queries and guiding them to appropriate medical resources. Chatbots assess symptoms based on extensive medical databases, determining whether patients need urgent care or can manage their conditions independently. For instance, in January 2023, Northwell Health Solutions (US) implemented Northwell Health Pregnancy Health Chats, an Al-driven pregnancy chatbot for obstetrics practices. Furthermore, Boston Children Hospital employs a KidsMD chatbot that assists parents in making an appointment by analyzing their child's symptoms and determining whether one is required.

Restraint: Regulatory variations across regions

The regulatory landscape for AI-based telemedicine presents significant obstacles that limit its market expansion. Different regions adopt varied approaches to regulating AI within healthcare, reflecting diverse strategies for integrating AI technologies. In Australia, the Therapeutic Goods Administration (TGA) oversees AI-driven medical devices, focusing on risk-based classification and patient safety concerns. China's NMPA has issued guidelines for AI-assisted software, prioritizing classification, safety, and efficacy standards to create uniform regulations domestically and globally. Southeast Asian nations like India and Indonesia have their own telemedicine regulations that cover consent, data security, and platform requirements; for example, India's rules mandate registered medical practitioners and grievance procedures. Meanwhile, in Europe and the US, regulatory frameworks like GDPR and HIPAA are continually evolving to protect patient data privacy and security.

Opportunity: Emergence of AI and ML

The integration of AI and ML is a key driver in the telehealth and telemedicine market, transforming healthcare and improving patient outcomes. AI allows remote patient monitoring (RPM), enabling providers to track vital signs and health metrics continuously without frequent visits. AI-powered devices collect real-time data on heart rate, blood pressure, and glucose, allowing proactive care and early detection of issues, enhancing efficiency, safety, and satisfaction. For example, in December 2024, NHS Lothian launched the UK's first AI-powered physiotherapy clinic, Flok Health, to address high musculoskeletal waitlists. The platform provides same-day automated video appointments with an AI physiotherapist via a smartphone app. These advances in AI and ML drive market growth.

Challenge: Increasing data breaches and medical identity theft cases

In healthcare, approximately one-third of data breaches result in medical identity theft mainly due to a lack of internal control over patient information, a lack of top management support, outdated policies and procedures or non-adherence to existing ones, and inadequate personnel training, all of which contribute to the rise in data breaches and medical identity theft cases in the industry, making patient confidentiality a significant challenge in the healthcare industry. Patient data contains personal, private, or confidential information requiring strict safeguards to prevent misuse. The growing use of automated technologies (such as EHRs and medical claims processing) and the shifting trend toward health information exchanges (HIEs) have altered the healthcare privacy and security landscape. The electronic exchange of patient data offers greater reach and efficiency in healthcare delivery. Still, it involves greater data risk and liability due to broader access and can result in data breaches.

AI in Telehealth & Telemedicine Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deploys AI-enabled remote diagnostics and imaging-as-a-service platforms that help healthcare enterprises and clinics access advanced imaging analytics. | Enables faster, more accurate diagnostic decisions while reducing dependence on in-person imaging specialists and optimizing resource use |

|

Offers end-to-end telehealth platforms and connected monitoring devices for hospitals and home care settings to support hybrid care delivery | Expands patient access to care, boosts engagement and adherence, and reduces hospital burden through remote service delivery |

|

Provides a cloud-based clinical and claims data platform to enable virtual care management, payer analytics, and telehealth integration | Streamlines reimbursement, improves interoperability, and accelerates data-driven decisions across payers and providers |

|

Uses connected medical devices and AI analytics for continuous remote patient monitoring across cardiac, diabetic, and respiratory conditions | Enhances chronic disease management, reduces emergency visits, and enables proactive care through predictive insights |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Al in telehealth & telemedicine has revolutionized healthcare by facilitating remote consultations and increasing care access in remote areas. This ecosystem includes the telemedicine platform, the telemedicine service using providers, and firms developing software and devices related to telemedicine. Interoperability and secure data exchange from EHRs with telehealth systems are key to its success. Data privacy, regulatory standards, and reimbursement models significantly influence telemedicine effectiveness and growth. Effective collaboration among healthcare providers, technology developers, and regulators helps overcome the challenges of adoption and ethics, allowing telemedicine solutions to be widely accepted.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI in telehealth & telemedicine market , By Application

The AI in telehealth market is segmented into primary care, specialty care, teleICU, and others, with primary care holding the largest share. Remote primary care enhances convenience, reduces the need for in-person visits, overcomes geographic barriers, and tackles shortages by allowing at-home healthcare. These advances manage chronic illnesses with prompt interventions and monitoring. Many companies, like K Health and Andor Health, offer telehealth platforms for primary care. In January 2023, Teladoc launched a comprehensive whole-person care app that combines primary care, mental health, and chronic disease management. CVS offers virtual primary care services, including 24/7 on-demand care and scheduled mental health support.

AI in telehealth & telemedicine market , By End User

End users include healthcare providers, payers, patients, pharma & biotech, medTech, and others. The patient segment is expected to grow the fastest due to increased demand for remote healthcare, particularly for chronic disease management, and the rising use of smartphones and wearable devices. Advances in wearable tech have boosted telemedicine, especially in remote monitoring and personalized care. For elderly patients, telehealth offers a convenient alternative to in-person visits, reducing travel and enabling home-based care. AI technologies, such as chatbots, virtual consultations, and remote monitoring, help patients manage their health proactively, increasing adoption across all ages and regions. In August 2024, Pfizer launched ‘PfizerForAll’ for appointment booking via telehealth, while US Medicare focuses on connecting patients to remote specialists and integrating telehealth into care.

AI in telehealth & telemedicine market , By Function

The remote patient monitoring (RPM) segment is projected to be the fastest-growing part of AI in telehealth, driven by the rise in chronic diseases like diabetes, hypertension, and CVDs that require constant management. RPM systems continuously track patient health data, reducing hospital visits and improving outcomes. Healthcare facilities, such as the Mayo Clinic (US), use RPM to reduce readmissions. In January 2025, Taiwan's ITRI introduced AI-based RPM devices developed with StreamTeck to monitor vitals like body temperature, heart rate, and blood pressure.

REGION

The Asia Pacific region is expected to be the fastest-growing region in the AI in telehealth and telemedicine market in 2024.

The AI in telehealth market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific became the fastest-growing market, driven by rapid advancements in digital health, increased government spending on telemedicine infrastructure, and rising smartphone and internet usage. Countries such as China, India, Japan, and Australia are actively adopting AI-powered telehealth solutions to enhance healthcare access and address doctor shortages. For example, in March 2024, India's Ministry of Health worked with NITI Aayog and various AI startups to introduce smart teleconsultation systems into rural health programs. Likewise, Ping An Good Doctor (China) and Doctor Anywhere (Singapore) expanded their AI-based virtual care platforms to boost patient engagement and enable remote diagnostics. These efforts, along with supportive regulations and growing public-private partnerships, are likely to speed up AI adoption and drive market growth across the Asia Pacific.

AI in Telehealth & Telemedicine Market: COMPANY EVALUATION MATRIX

Philips (Star) leads with a strong market share and an extensive product footprint, driven by its comprehensive AI-powered telehealth solutions, advanced remote diagnostic tools, and robust interoperability capabilities that are widely adopted across hospitals, clinics, and virtual care networks. Walgreens (Emerging Leader) is gaining visibility with its scalable AI-enabled telehealth platforms and virtual care services, strengthening its position through innovation, ease of integration, and targeted offerings for retail health clinics and community-based healthcare providers. While Philips dominates through scale and a diverse portfolio, Walgreens shows significant potential to move toward the leaders' quadrant as demand for interoperable, cloud-enabled, and AI-driven telehealth solutions continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.22 Billion |

| Market Forecast in 2030 (Value) | USD 27.14 Billion |

| Growth Rate | CAGR of 36.4% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: AI in Telehealth & Telemedicine Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Client requested insights on the AI in Telehealth and Telemedicine Market in Middle East, focusing on growth drivers, regional trends, and market dynamics. | Provided a detailed analysis highlighting AI-driven virtual care expansion, government-backed digital health initiatives, and integration of AI triage and diagnostic tools improving healthcare access and efficiency across Middle East (GCC Countries). | Included custom growth driver, regional adoption examples (e.g., UAE’s Telehealth Guidelines, Saudi Arabia’s National eHealth Strategy), and strategic insights on AI’s role in improving healthcare accessibility and clinical efficiency. |

RECENT DEVELOPMENTS

- October 2024 : Zoom Communications Inc. (US) partnered with Suki AI, Inc. (US), a developer of AI-powered healthcare voice tools, to integrate advanced AI features into their telehealth services. Suki's AI engine, the Suki Platform, enables clinical documentation capabilities for in-person and virtual telehealth visits conducted through Zoom; this collaboration marks a significant step in leveraging AI to improve healthcare delivery

- May 2024 : Baptist Health (US) and Caregility (US) partnered to improve patient care across the Arkansas-based healthcare organization. Baptist Health has doubled its inpatient telehealth services by increasing the use of Caregility’s intelligent telehealth devices to over 700 bedsides.

- September 2024 : Oracle(US) and AvaSure (US) collaborated to develop an AI-powered virtual concierge solution for hospitals. Built on AvaSure's Intelligent Virtual Care Platform, OCI's AI capabilities, and NVIDIA's advanced computing infrastructure, the solution enhances patient care and streamlines workflows, delivering seamless smart room experiences across departments.

Table of Contents

Methodology

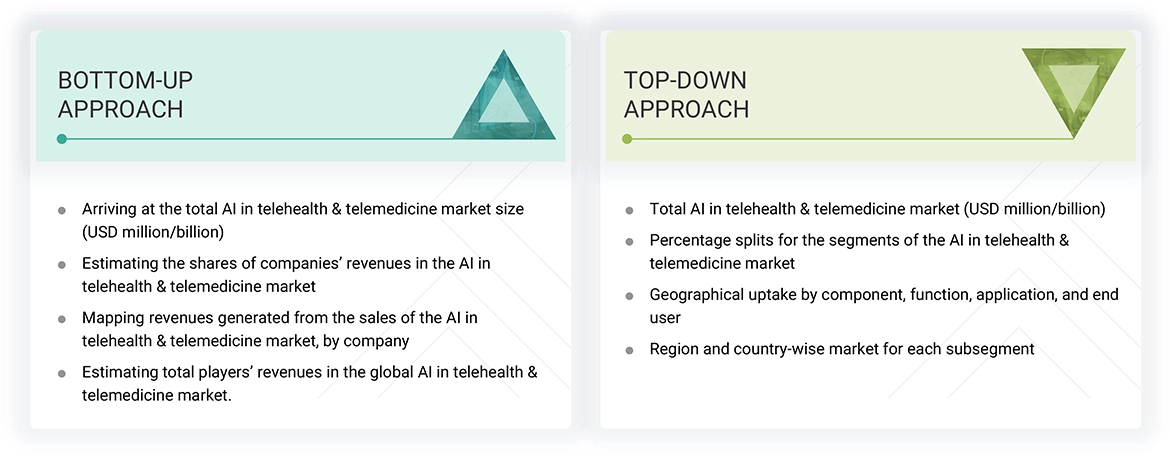

The study involved significant activities to estimate the current size of the AI in telehealth & telemedicine market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the AI in telehealth & telemedicine market.

Secondary Research

This research study used secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The companies offering AI-based telehealth & telemedicine solutions were determined at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

The secondary research process referred to various secondary sources to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of AI in telehealth & telemedicine vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the AI in telehealth market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of AI-based telemedicine solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

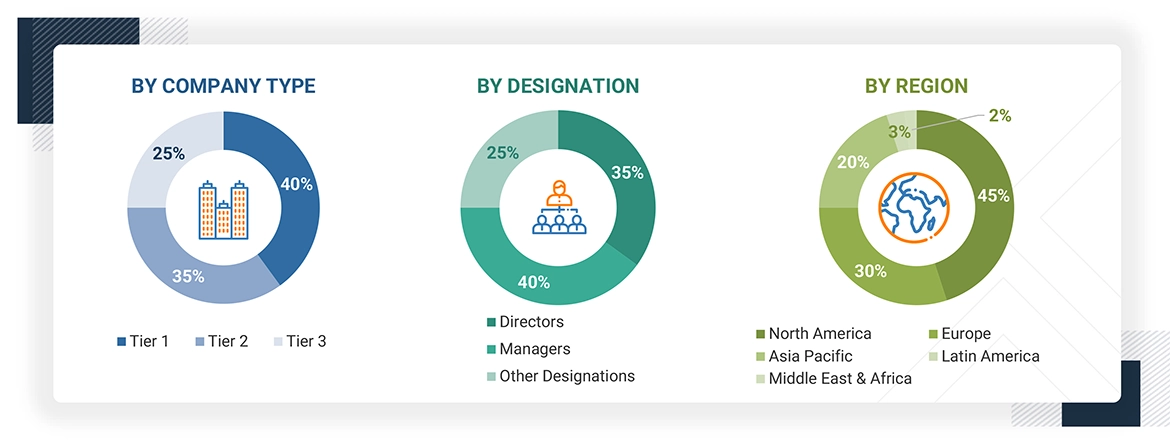

Breakdown Of Primary Participants

Note 1: Other designations include sales, marketing, and product managers.

Note 2: Tiers of companies are defined based on their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AI in telehealth & telemedicine market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Telehealth:Telehealth represents a broad group of healthcare services, including care, education, and other services, made possible through various digital communication technologies; these services are facilitated by telecommunications equipment such as video conferencing, mobile applications, RPM devices, and wearable health technologies. Telehealth offers various services, including preventive care, chronic disease management, mental health support, and virtual consultations. The integration of AI in telehealth enhances remote care by enabling real-time monitoring, virtual assistants, diagnostics, personalized treatment, and predictive analytics.

Telemedicine: Telemedicine is a specific subset of telehealth focused exclusively on remote clinical services. It involves using electronic communications to diagnose, treat, and manage patients without requiring in-person visits. Telemedicine includes real-time video consultations, remote health data monitoring, and the store-and-forward method, where medical information is collected and sent to specialists for evaluation. NLP automates medical documentation and supports AI-powered virtual consultations, reducing administrative burdens on healthcare professionals.

Stakeholders

- Pharmaceutical & Biotechnology Companies

- CROs

- Technology & AI Companies

- Regulatory Authorities

- Hospitals & Healthcare Providers

- Patients & Patient Advocacy Groups

- Clinical Trial Investigators & Site Coordinators

- Data Management & Analytics Firms

- Academic Institutions & Research Organizations

- Investors & Venture Capital Firms

- Clinical Trial Software Providers

- Ethics Committees and Institutional Review Boards (IRBs)

- Insurance Companies

- Telehealth Software Providers

- RPM Solutions

- Healthcare IT Service Providers

Report Objectives

- To define, describe, and forecast the AI in telehealth & telemedicine market based on component, function, application, end user, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the market growth

- To analyze opportunities for stakeholders by identifying the high-growth market segments

- To forecast the size of the market segments with respect to the five main regions: North America, Europe, the Asia Pacific, the Middle East & Africa, and Latin America

- To analyze subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the key players and comprehensively analyze their market sizes and core competencies.

- To track and analyze competitive developments such as acquisitions, collaborations, agreements, mergers, product approvals, product launches & updates, partnerships, expansions, and other recent developments in the global market.

Frequently Asked Questions (FAQ)

What are the major market players covered in the reports?

The key players in the AI in telehealth and telemedicine market are Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), GE Healthcare (US), Epic Systems Corporation (US), Oracle (US), Doximity, Inc. (US), and Teladoc Health, Inc. (US), among others.

Define AI in telehealth & telemedicine market.

Telehealth refers to a broad group of healthcare services, including care, education, and other services delivered through digital communication technologies such as video conferencing, mobile applications, remote patient monitoring devices, and wearable health technologies. The integration of AI in telehealth enhances remote care with real-time monitoring, virtual assistants, diagnostics, personalized treatment, and predictive analytics. Telemedicine is a subset of telehealth focused on remote clinical services. It uses electronic communications for diagnosis, treatment, and patient management without requiring in-person visits. Telemedicine includes real-time video consultations, remote health data monitoring, and store-and-forward methods. AI technologies such as natural language processing assist with medical documentation and enable AI-powered virtual consultations, helping reduce the administrative burden on healthcare professionals.

Which region is expected to have the largest market share in the AI in telehealth and telemedicine market?

North America is expected to hold the largest market share in the AI in telehealth and telemedicine market during the forecast period.

Which end-user segments have been included in the AI in telehealth and telemedicine market report?

The report includes end-user segments such as healthcare providers, hospitals, ambulatory surgery centers, ambulatory care centers and other outpatient settings, long-term care and assisted living facilities, home healthcare, other healthcare providers, healthcare payers, patients, pharmaceutical and biotechnology companies, medtech companies, and other end users.

How big is the global AI in telehealth & telemedicine market today?

The global AI in telehealth and telemedicine market is projected to grow from USD 4.22 billion in 2024 to USD 27.14 billion by 2030, at a compound annual growth rate (CAGR) of 36.4% from 2024 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI in Telehealth & Telemedicine Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI in Telehealth & Telemedicine Market