AI Inspection Market

AI Inspection Market by Service Type (Testing, Inspection, Certification), Technology (Computer Vision, ML, NLP), Service Delivery Mode, Application, Sourcing Type (In-house, Outsourced), End-use Industry, and Region – Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global AI inspection market is estimated at USD 33.07 billion in 2025 and is projected to reach USD 102.42 billion by 2032, growing at a CAGR of 17.5% during the forecast period. Growth is driven by the shift from manual, periodic assurance to AI-enabled testing, inspection, and certification delivered via remote and hybrid models. Demand is strongest for quality and process assurance, regulatory and compliance management, asset integrity management, cybersecurity and data assurance, and sustainability and ESG auditing. Adoption is led by computer vision, ML and analytics, and NLP to automate evidence, reporting, and decision-making.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is the largest region, with a 37.5% market share in 2024.

-

BY SERVICE TYPEAI-powered certification services form the fastest-growing service type with a 20.9% CAGR (2025–2032).

-

BY SOURCING TYPEOutsourced TIC services are the fastest-growing sourcing model, with a CAGR of 2.96% during 2025–2030.

-

BY END-USE INDUSTRYOutsourced delivery grows faster than in-house at 18.6% CAGR (2025–2032), indicating accelerating reliance on third-party AI-powered TIC providers.

-

COMPETITIVE LANDSCAPEGlobal TIC majors (SGS SA, Bureau Veritas, DEKRA, TÜV SÜD, TÜV Rheinland, Intertek Group plc, DNV, UL) are leading AI-powered TIC services through AI-enabled inspection, remote audits, and digital compliance platforms.

-

COMPETITIVE LANDSCAPEAI inspection specialists and data-platform enablers (Gecko Robotics, Percepto, Zeitview, SkySpecs, Instrumental, Landing AI) intensify competition by accelerating automation and audit-ready evidence workflows via partnerships.

The AI inspection market is expanding rapidly as enterprises move from manual, periodic checks to continuous, data-driven assurance across quality, safety, and compliance. Adoption is rising in manufacturing, energy and utilities, healthcare and life sciences, construction, and consumer supply chains, where faster inspections and audit-ready evidence materially reduce risk and downtime. Computer vision is scaling defect detection and condition monitoring, ML analytics improves anomaly detection and risk scoring, and NLP accelerates documentation and reporting. Remote and hybrid delivery models are gaining share, supported by tighter ESG expectations and stricter regulatory scrutiny globally.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ businesses in the AI inspection market stems from shifting assurance needs, rising compliance expectations, and rapid digital disruption across industries. Manufacturing, energy and utilities, healthcare and life sciences, construction and infrastructure, and consumer supply chains are the primary adopters, with a focus on quality assurance, asset integrity, and regulatory compliance as core areas of emphasis. AI-enabled inspection, remote audits, automated reporting, cybersecurity and data assurance, and ESG verification increasingly influence operational performance and risk management for end users. These shifts are accelerating demand for scalable testing, inspection, and certification services delivered through remote and hybrid models, reshaping the market’s revenue mix and long-term growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising regulatory complexity and compliance intensity across industries

-

Pressure to reduce inspection turnaround time and operational costs

Level

-

High upfront investment and long validation cycles within accredited TIC frameworks

-

Integration complexity with legacy inspection processes and client-specific compliance requirements

Level

-

Monetization of inspection data and compliance intelligence services

-

Expansion into underserved mid-market and SME compliance segments

Level

-

Shortage of qualified personnel for AI-governed inspection and regulatory interpretation

-

Ensuring regulatory trust, explainability, and cross-border acceptance of inspection outcomes

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising regulatory complexity and compliance intensity across industries

The AI inspection market is being propelled by tightening regulatory scrutiny and higher accountability for product safety, process integrity, cybersecurity, and sustainability claims. As standards evolve and audits become more evidence-driven, enterprises are increasing spending on AI-enabled testing, inspection, and certification to accelerate compliance, improve repeatability, and create auditable digital trails. This is especially visible in regulated and high-risk environments where verification frequency and documentation quality directly affect approvals, market access, and operational continuity.

Restraint: High upfront investment and long validation cycles within accredited TIC frameworks

Despite strong demand, adoption is constrained by the cost and time required to deploy AI at scale under accredited TIC practices. Enterprises and TIC providers must invest in data capture, model training, system integration, and secure evidence management, while also validating performance across sites, materials, and operating conditions. In regulated use cases, AI outputs often require extensive qualification, change control, and documented traceability, which slows rollout, delays ROI, and limits rapid substitution of established inspection methods.

Opportunity: Monetization of inspection data and compliance intelligence services

The AI inspection market is creating a new value pool beyond traditional inspection events by turning inspection outputs into reusable enterprise intelligence. Providers can monetize continuous defect analytics, predictive risk scoring, supplier quality benchmarking, and compliance dashboards that integrate into QMS and enterprise systems. This enables subscription and managed-service models, supports remote-first service delivery, and strengthens customer lock-in by positioning providers as ongoing assurance intelligence partners rather than point-in-time inspectors.

Challenge: Shortage of qualified personnel for AI-governed inspection and regulatory interpretation

Market scaling is challenged by the limited availability of talent that can bridge domain inspection expertise, AI model governance, and regulatory interpretation. Effective deployment requires professionals who can define acceptance criteria, validate model behavior, manage drift and exceptions, and translate findings into audit-ready documentation aligned with standards. Talent gaps increase execution risk, raise delivery costs, and can slow enterprise adoption, particularly for multi-site programs that require consistent governance and repeatable assurance outcomes.

AI INSPECTION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizes autonomous drone-based remote inspection and AI analytics to monitor upstream and midstream facilities, capture high-frequency visual evidence, and flag anomalies across critical assets without continuous on-site presence. | Improves inspection frequency and coverage, reduces field travel and safety exposure, and accelerates identification of maintenance priorities across dispersed assets. |

|

Engages AI-powered inspection services using drones and centralized visual data management to standardize inspection evidence, streamline reporting, and enable consistent inspection execution across multiple sites and projects. | Improves inspection consistency at scale, reduces manual documentation effort, strengthens traceability of findings, and supports faster maintenance and project decisions. |

|

Leverages AI-assisted remote survey and inspection methods to capture 3D asset condition data, automate anomaly detection and corrosion mapping, and improve planning for targeted inspection and repair activities. | Reduces high-risk manual access, improves accuracy of condition assessment, optimizes maintenance planning, and lowers inspection-related downtime and cost. |

|

Adopts third-party AI management system certification to verify governance controls for AI development and deployment, including lifecycle risk management, accountability, and continuous monitoring processes. | Improves enterprise and client trust, supports audit and procurement requirements, reduces regulatory and reputational risk, and standardizes AI governance across teams. |

|

Uses AI-enabled autonomous inspection routines during plant operations and maintenance windows to collect structured visual evidence, track asset condition changes, and enable remote expert review workflows. | Reduces inspection turnaround time, improves safety by limiting manual access, increases consistency of findings, and supports better maintenance planning and uptime. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI inspection market ecosystem is structured around four tightly linked layers that convert AI capability into auditable assurance outcomes. AI technology and infrastructure enablers provide the cloud, compute, data platforms, and edge/vision toolkits that power model training, deployment, and scalable evidence management. AI-powered TIC service providers operationalize these technologies into commercial services by combining domain inspectors, certified methods, and digital workflows to deliver AI-enabled testing, inspection, and certification through on-site, remote, and hybrid models. Regulatory, standards, and accreditation bodies set the rules for conformity, traceability, and acceptance, shaping how AI outputs must be validated, documented, and governed. Finally, vertical end users (manufacturing, energy, transportation, retail, and other regulated industries) drive demand by seeking faster decisions, higher repeatability, and audit-ready compliance across quality assurance, asset integrity, cybersecurity/data assurance, and ESG verification.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI Inspection Market, By Service Type

In 2024, AI-powered testing services held the largest share of the AI inspection market. They are expected to remain the dominant revenue pool through 2032, as enterprises scale AI-enabled validation for product safety, reliability, and compliance across high-volume operations. Testing continues to lead because it is embedded upstream in product qualification and ongoing quality assurance programs, creating recurring demand and wider adoption across industries.

AI Inspection Market, By Technology

Computer Vision held the largest share of the AI inspection market, reflecting its direct fit with high-volume visual checks such as defect detection, dimensional verification, labeling/packaging integrity, and asset condition monitoring. Computer vision remains the primary adoption entry point because it delivers fast ROI, integrates well with cameras and edge systems, and scales across factories and field assets with repeatable outcomes.

AI Inspection Market, By Application

The quality & process assurance segment holds the largest share of the AI inspection market, with enterprises prioritizing defect prevention, yield improvement, and consistent inspection outcomes across high-throughput operations. This segment leads because it ties AI deployment directly to measurable production KPIs such as scrap reduction, rework avoidance, and faster quality decision cycles, making it the most scalable entry point for adoption.

AI Inspection Market, By Service Delivery Mode

As of 2024, on-site services hold the largest share of the AI inspection market, as many inspections and verification activities still require physical presence for access, safety protocols, sampling, and compliance procedures—particularly in regulated and asset-intensive environments. On-site delivery remains dominant as enterprises build confidence in AI outputs alongside traditional inspection controls and accredited workflows.

AI Inspection Market, By Sourcing Type

In 2024, manufacturing held the largest share of the market. It is expected to remain the primary demand center through 2032 as factories scale AI-enabled quality and process assurance to reduce defects, improve yield, and standardize inspection outcomes across high-throughput production lines. Manufacturing leads because it has the highest frequency of repeatable inspection events and the clearest ROI linkage to scrap, rework, and warranty reduction.

AI Inspection Market, By End-use Industry

In-house delivery holds the largest share of the AI inspection market, reflecting that many enterprises continue to keep core quality, compliance, and operational assurance activities internal to retain process control, protect sensitive data, and align inspections tightly with production and maintenance KPIs. In-house remains the default starting model as organizations build AI maturity, validate performance, and integrate outputs into QMS and operational systems.

REGION

Asia Pacific is projected to be the fastest-growing region in the AI inspection market during the forecast period.

Asia Pacific is expected to register the highest CAGR in the AI inspection market as the region combines the world’s densest manufacturing base with rapidly expanding digital infrastructure and export-driven compliance needs. High-frequency inspection environments in automotive, electronics and semiconductors, heavy machinery, and consumer goods are accelerating the adoption of computer vision and ML-enabled quality and process assurance to reduce defects, improve yield, and standardize outcomes across multi-plant networks. Growth is further amplified by large-scale capacity additions, rising regional supply-chain complexity, and increasing customer requirements for traceability and audit-ready documentation, which pull demand for AI-enabled certification and automated compliance workflows. The region also benefits from faster deployment economics and scaling effects—large sites, high inspection volumes, and growing acceptance of remote and hybrid delivery—making AI inspection investments easier to justify and expand over the forecast period.

AI INSPECTION MARKET: COMPANY EVALUATION MATRIX

In the AI inspection market matrix, SGS (Star) leads with strong market traction and a broad service footprint, supported by its ability to scale AI-enabled inspection, remote audits, and digital compliance workflows across multiple industries and regions. DEKRA (Star) also shows high visibility with a robust footprint, benefiting from deep capabilities in safety, industrial assurance, and digitally enabled inspection programs that translate well into scalable AI-driven delivery. While these leaders combine reach with credibility in accredited TIC frameworks, several players in the adjacent quadrants have clear headroom to move upward by expanding multi-site deployments, strengthening audit-ready evidence platforms, and deepening vertical specialization where AI-enabled testing, inspection, and certification demand is accelerating.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- SGS SA (Switzerland)

- DEKRA (Germany)

- Bureau Veritas (France)

- TÜV SÜD (Germany)

- TÜV Rheinland (Germany)

- Intertek Group plc (UK)

- DNV (Norway)

- UL LLC (US)

- Applus+ (Spain)

- Eurofins Scientific (Luxembourg)

- Element Materials Technology (UK)

- TÜV NORD GROUP (Germany)

- ALS (Australia)

- Kiwa (Netherlands)

- MISTRAS Group (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 18.92 Billion |

| Market Forecast in 2032 (Value) | USD 102.42 Billion |

| Growth Rate | CAGR of 17.5% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: AI INSPECTION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global TIC Major / AI-powered TIC Service Provider |

|

|

| Manufacturing Enterprise (Automotive/Electronics/Industrial) |

|

|

| Energy & Utilities Asset Owner (Oil & Gas/Power/Renewables) |

|

|

RECENT DEVELOPMENTS

- December 2025 : TÜV Rheinland launched Advanced SmartRBI Services (AI-enabled Risk-based Inspection/Asset Integrity Management). Advanced SmartRBI expands TÜV Rheinland’s AI-enabled risk-based inspection delivery into a more structured, end-to-end asset integrity offering. The service utilizes intelligent algorithms and data models to transition customers from fixed inspection cycles to risk-aligned inspection plans, incorporating automated risk screening, targeted inspection planning, and continuous revalidation.

- November 2025 : SGS signed an agreement to acquire Information Quality (IQ), adding digital engineering, asset data, information management systems, and reliability engineering capabilities that strengthen the data backbone for data-driven assurance and advanced digital asset integrity programs. Information Quality (IQ) is an Australia-based specialist in asset data/information management and reliability engineering for industrial operators.

- September 2025 : Intertek launched AURS as a global service solution that combines unmanned robotics (drones and remotely operated vehicles) with artificial intelligence and data science to execute inspections, surveys, 3D imaging, and non-destructive testing in hazardous, inaccessible, or high-risk environments. AI is used to convert high-volume visual and sensor data into decision-ready, quality-controlled inspection evidence, supporting faster condition assessment, corrosion mapping, weld inspection, and integrity prioritization while reducing human exposure and downtime.

- July 2025 : DEKRA acquired a majority stake (50.1%) in Spearhead AG, strengthening its AI-enabled digital claims management capability for vehicle damage assessment and settlement workflows. The deal expands DEKRA’s ability to scale remote, data-driven inspection evidence capture (FNOL), automated triage, and faster decision-making for insurers and fleet operators. Spearhead AG specializes in digital claims management systems that support end-to-end digital processing of vehicle damage claims.

- May 2025 : TÜV Rheinland signed an MoU with Quantified Energy to collaborate on drone-based electroluminescence (EL) inspection for solar PV systems, combining autonomous drone capture with AI-driven defect detection and geospatial mapping to deliver faster, higher-coverage PV inspections with third-party inspection documentation and decision-ready outputs for owners and investors. Quantified Energy is a Singapore-based solar inspection technology company focused on AI-enabled, drone-led PV inspection and analytics.

Table of Contents

Methodology

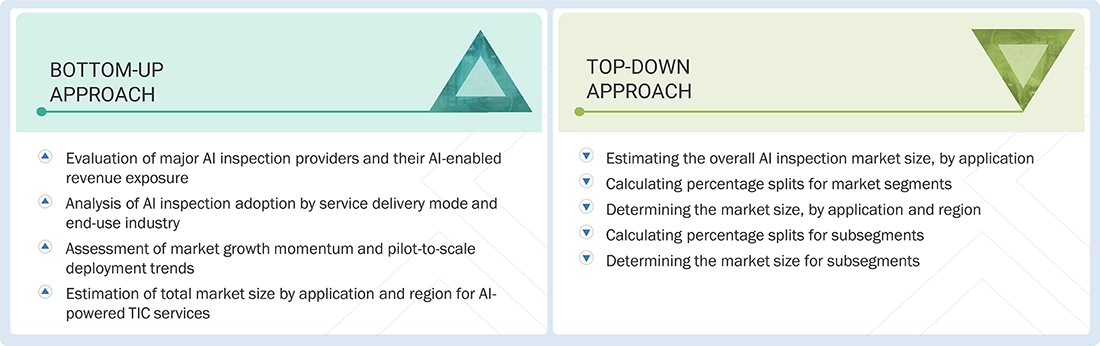

The study involved major activities in estimating the current market size for the AI inspection market. Extensive secondary research was conducted to collect information on AI-enabled testing, inspection, and certification services, including technology adoption trends, end-use demand patterns, regulatory and accreditation frameworks, and competitive developments across key regions. The next step was to validate findings, assumptions, and market sizing through primary research with stakeholders across the value chain, including TIC service providers, technology enablers, and end users. Both top-down and bottom-up approaches were used to estimate the overall market size, supported by multiple cross-checks across segmentation views such as service type, technology, delivery mode, application, sourcing type, end-use industry, and region. After this, market breakup and data triangulation procedures were applied to derive segment and subsegment estimates and ensure consistency of totals across all cuts.

Secondary Research

Secondary research for this study involved gathering information from credible sources such as company annual reports and investor presentations, official company websites, press releases, regulatory and accreditation bodies, standards organizations, industry journals, and relevant conference and association publications. This process helped map the AI inspection value chain, identify key service providers and technology enablers, assess market segmentation and regional trends, and track major service, technology, and partnership developments. The insights and datasets compiled through secondary research were used to build the initial market size estimates and segment allocations, which were subsequently validated through primary research.

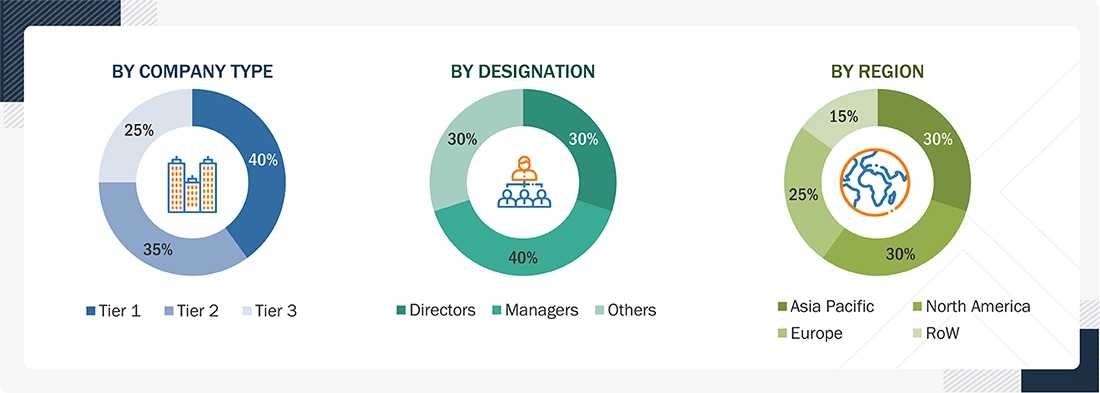

Primary Research

Extensive primary research was conducted after establishing the market context through secondary findings for the AI inspection market. Multiple interviews were carried out with stakeholders across both the supply and demand sides, including global and regional TIC service providers, AI and digital platform enablers, and end users across priority industries. Primary inputs were collected across major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, using structured questionnaires, email interactions, and telephonic interviews. These discussions were used to validate assumptions on adoption drivers, delivery models, sourcing preferences, and growth hotspots, and to refine market sizing and segmentation outputs.

Breakdown of Primary Interviews

Notes: Other designations include product managers, sales managers, and marketing managers.

Tier 1 companies include market players with revenues above USD 500 million; tier 2 companies earn revenues between USD 100 million and USD 500 million; and tier 3 companies earn up to USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AI inspection market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The bottom-up procedure has been employed to arrive at the overall size of the AI inspection market.

- Identifying stakeholders in the AI inspection market that influences the entire market, along with participants across the value chain

- Analyzing major AI-powered TIC service providers in the ecosystem

- Analyzing trends related to the adoption of AI-powered TIC services

- Tracking the recent developments in the market that include investments, R&D activities, AI-powered solutions/services launches, collaborations, acquisitions, expansions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of AI-powered TIC services

- Segmenting the overall market into various other market subsegments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operations managers, and finally with the domain experts at MarketsandMarkets

The top-down approach has been used to estimate and validate the total size of the AI inspection market.

- Start with the Global AI Inspection Market total for each year as the single control number.

- Split the global total into top-level cuts by service delivery mode, organization type, and application.

- Allocate the global total by country, then roll up countries to regions, and reconcile back to the global total.

- Within each country, split further by end-use industry and sourcing type, ensuring country totals remain consistent.

- In parallel, derive the global cut by service type, then segment each service type by technology.

- Transpose the service type × technology view to obtain the technology market totals and validate all cuts through triangulation to match the global total.

AI Inspection Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size for the AI inspection market using the estimation approaches described above, the market was split into key segments and subsegments. Data triangulation and market breakdown procedures were then applied to complete the market engineering process and derive consistent estimates for each segment and subsegment. The data was triangulated by comparing insights from both the demand and supply sides, including adoption patterns by end-use industries, technology penetration trends, service delivery preferences, sourcing behavior, and competitive developments across regions. This triangulation ensured that all segment totals reconcile with the overall market size and that assumptions remain consistent across multiple market views.

Market Definition

The AI inspection market, as defined in this study, refers exclusively to AI-powered testing, inspection, and certification (TIC) services, encompassing both in-house (captive) and outsourced TIC activities. It covers inspection, testing, audit, and certification services where artificial intelligence is embedded into service workflows to improve defect detection, data interpretation, inspection prioritization, and compliance accuracy. The scope encompasses AI-enabled visual, remote, and automated inspections, intelligent analysis of test and sensor data, predictive and condition-based inspection models, as well as AI-assisted audit and certification processes across regulated and industrial environments. The market excludes standalone AI software, inspection hardware sold without service delivery, factory automation systems, internal quality control activities outside TIC functions, and traditional TIC services where AI does not materially influence service outcomes.

Key Stakeholders

- Government Bodies, Venture Capitalists, and Private Equity Firms

- AI-enabled TIC Service Providers

- In-house (Captive) TIC Units

- TIC Industry Associations

- Professional Service & Solution Providers

- Research Institutions & Organizations

- Standards Organizations & Regulatory Authorities Related to the AI Inspection Market

- System Integrators

- Technology Consultants

Report Objectives

- To define, describe, and forecast the AI inspection market based on service type, technology, service delivery mode, application, sourcing type, and end-use industry in terms of value

- To forecast the market size for five main regions—Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa, along with respective countries, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the AI inspection supply chain

- To strategically analyze micromarkets1 with regard to individual market trends, growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze competitive developments and major growth strategies, such as service launches, acquisitions, collaborations, expansions, and partnerships, in the AI inspection market

- To describe macroeconomic factors impacting market growth in each region

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, and US tariff impact, key conferences & events, Porter’s Five Forces analysis, and regulations pertaining to the market under study

Available customizations:

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI Inspection Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI Inspection Market